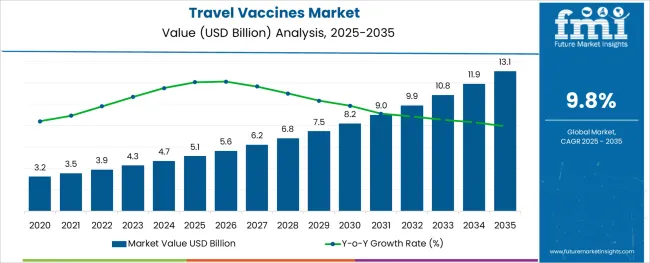

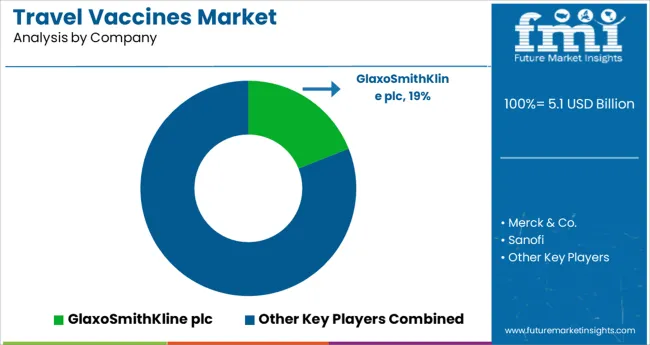

The Travel Vaccines Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 13.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.8% over the forecast period.

The webbing cutting machine market is witnessing notable growth as industries including automotive, apparel, military, and packaging increasingly depend on precision fabric cutting technologies to improve productivity and reduce material waste. Automation has become central to the evolution of these machines, as manufacturers seek to enhance output consistency, minimize human error, and meet diverse order specifications with minimal downtime.

The demand for faster changeovers, smart control systems, and digitally calibrated feed mechanisms is accelerating, particularly in high-mix production environments. Additionally, integration with vision systems and programmable logic controls is enabling manufacturers to achieve tighter tolerances across various textile and synthetic materials.

Emerging application areas such as wearable technology and smart textiles are also encouraging investment in highly adaptable cutting equipment. As global supply chains become more reliant on efficiency and precision, future growth will be shaped by machines that offer high throughput, minimal material degradation, and compatibility with sustainable production practices.

The market is segmented by Disease Type, Booking Channel, Tourist Type, Tour Type, and Age Group and region. By Disease Type, the market is divided into Covid-19, Ebola, Influenza, Hepatitis, and Others. In terms of Booking Channel, the market is classified into Online Booking and In Person Booking.

Based on Tourist Type, the market is segmented into International and Domestic. By Tour Type, the market is divided into Independent Traveler, Tour Group, and Package Traveller. By Age Group, the market is segmented into 26-35 Years, 0-14 Years, 15-25 Years, 36-45 Years, 46-55 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic segment is projected to command 63.50% of the total market revenue in 2025, establishing it as the dominant category within the automation segment. This leadership is driven by increasing demand for machines that offer continuous operation with minimal manual intervention.

Automatic webbing cutting machines are equipped with features such as digital length setting, heat sealing, and tension control, which enhance cutting accuracy and reduce edge fraying. These machines are particularly valued for their role in streamlining operations in mass production environments, where high repeatability and reduced setup time are critical.

With rising labor costs and the need for lean manufacturing, adoption of automatic systems has accelerated across both established and emerging economies. Furthermore, their ability to integrate into larger production lines and support smart factory initiatives has reinforced their position as the preferred automation type in the webbing cutting machine market.

The 50 to 100 meter per minute capacity range is anticipated to hold 42.70% of market revenue in 2025, making it the leading segment by capacity. This range has emerged as the optimal balance between operational speed and control, particularly in industries requiring mid-volume production with high dimensional accuracy.

Machines in this capacity bracket are favored for their versatility, enabling manufacturers to process a wide variety of webbings such as nylon, polyester, and cotton with consistent quality. Their compatibility with both manual and automated feeding systems has further expanded their utility across small and medium-sized enterprises.

Additionally, lower energy consumption and compact machine footprints make them suitable for space-constrained production floors. These characteristics have led to widespread adoption, particularly in textile and accessories manufacturing, positioning this capacity range as the most commercially viable in the segment.

In the application segment, tapes are expected to account for 24.60% of total market revenue in 2025, making it the leading application area for webbing cutting machines. This growth is being propelled by the expanding use of woven and non-woven tapes in sectors such as automotive interiors, safety equipment, apparel reinforcement, and packaging. Precision and clean-edge cutting are critical in tape production, especially when dealing with specialty adhesives, heat-sensitive fabrics, and reflective materials.

Webbing cutting machines designed for tape applications often feature hot knife or ultrasonic options to meet these requirements. The increasing demand for customized widths, batch production flexibility, and high-speed order fulfillment has driven adoption in this segment.

Moreover, advancements in coating and lamination techniques have created new performance expectations, which these machines are being designed to meet. As tape usage diversifies across industries, its status as a core application for webbing cutters is expected to remain strong.

Vaccines are made up of deceased microbes, living attenuated organisms, or living fully pathogenic organisms that are tested with the purpose of artificially enhancing or generating immunity to a certain disease.

The first step towards safe and healthy travel is to get a travel vaccine. Travel vaccine shots, in addition to a passport, are now required before embarking on overseas travel. Travel vaccines give immunisation by lowering the likelihood of becoming ill while travelling overseas.

The growth in the number of travellers and the frequency with which they travel have had medical, epidemiological, and medico-legal effects in addition to economic, cultural, and social ramifications. While travel can be entertaining and thrilling, as well as beneficial to one's mental and physical well-being, it can also be destructive to one's health.

Every year, almost 900 million foreign journeys are made. This kind of global travel exposes many people to a variety of health hazards. The growth in worldwide travel has resulted in more frequent illnesses while travelling as well as cases of the disease being imported back to the nation of origin.

This has increased the awareness among several nations and their travellers too. More travellers are getting vaccinated before their trips which proves to be beneficial for the Travel Vaccines Market.

There are several government bodies in different countries, making it mandatory for travelers to be vaccinated before their travel. These countries aim to prevent the entry of diseases from other parts of the world to ensure the safety and well-being of their residents.

They provide complete information about the vaccines associated with the diseases and the destinations as well.

These organizations also provide free vaccines for some diseases which are aided by government programs and schemes. This has resulted in increased use of vaccinations by travelers, hence growth in the travel vaccines market.

There has been a rapid increase in travel and tourism since the regulations of the pandemic have eased up. People are getting out to explore new places and experiences. Every sector of tourism is getting back to normal and is set to break previous travel records.

This has given rise to more people getting vaccinated before their travel as most countries have made vaccinations compulsory for their visitors as well as their residents. As a result, there is an increased demand for vaccines which is expected to boost the Travel Vaccines Market.

Since the pandemic, people all over the world are getting more and more concerned about their health. They are finding new ways to stay immune to diseases and ensure safety during their travel. Government bodies and pharmaceutical companies are taking combined efforts to make different travel vaccines available to travelers.

The players are also engaged in research and development to provide vaccines with lesser side effects and minimum dosages. This has helped the travel vaccines market to grow to a large extent. Travelers are getting inclined toward the use of vaccines which will aid the growth of the market.

Indonesia found a new vaccine for dengue

Takeda's dengue fever vaccine received its long-awaited initial approval after more than a decade of development. After years of testing in Asia and Latin America, authorities in Indonesia approved the vaccination for people aged 6 to 45.

A few processes must be accomplished before the company can distribute the shot. Takeda's contract manufacturer in Germany has a ready-to-ship inventory. Takeda anticipates receiving further clearances in the near future.

The corporation is pursuing simultaneous approvals in numerous endemic nations as part of an ambitious regulatory approach. At the same time, European Medicines Agency authorities are reviewing the shot.

Europe invented a novel vaccine to treat multiple diseases

Marketing Authorization was granted by the European Commission (EC) for HEPLISAV B, a vaccine created for the immunization of the infection caused by hepatitis B virus and other varieties of hepatitis B virus in people of age 18 and more, according to Dyanavax, a biopharmaceutical company focused on developing and commercializing novel vaccines.

The mandate was granted following the positive judgment of the European Medicines Agency's (EMA) Committee for Medicinal Products for Human Use (CHMP) on the company's Marketing Authorization Application. The mandate and CHMP recommendation were decided on the good benefit-risk profile of HEPLISAV B, as proven by the findings of three clinical trials of three phases on safety and immunogenicity.

India and China are leading producers of Covid-19 Vaccines

In China and India, two COVID-19 vaccinations given orally or through the nasal cavity have been provided with a green light for use. China's new vaccine is inhaled as an aerosolized mist through the nose and mouth, whereas India's is administered as nasal drops.

These mucosal vaccinations are designed to attack the thin membranes that are inside the nose, mouth, and lungs. Mucosal vaccines, by inducing immune responses where the virus enters the body’s system, could prevent even mild episodes of sickness and prevent transmission to others. Some covid doses were proven to be incompetent. Vaccines that produce sterilizing immunity could change the course of the epidemic.

Online Booking is More Preferred by Tourists

Most travelers prefer booking their vaccination slots in person as visiting the place gives a more clear idea about the vaccines needed as per the travel destination. Travelers are able to choose the vaccinations according to their needs and preferences.

Children and Old people are more susceptible to diseases

Generally, children and senior citizens are more susceptible to getting ill during travel due to the changing climatic and environmental conditions. Hence, the age group 0-14 Years, 56-65 Years, and 66-75 Years are more likely to get vaccinated before their travel.

Several large pharmaceutical companies are conducting research and development for travel vaccines. Travel vaccinations for region-specific diseases are being developed by companies. As the world moves toward free trade and globalization, the number of international tourists is expected to grow year after year.

The companies are trying to innovate the vaccines, either by combinations of different vaccines or by reducing the dosages. This will aid in minimizing the side effects caused by the vaccinations and provide immunity against a variety of diseases.

For Instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & MEA |

| Key Countries Covered | United States of America, Canada, Brazil, Mexico, Argentina, Colombia Germany, UK, France, Italy, Russia, South Africa, Turkey, UAE, Egypt, Jordan China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Philippines, Cambodia, Vietnam Australia & New Zealand. |

| Key Segments Covered | Disease Type, Booking channel, tourist type, tour type, and Region. |

| Key Companies Profiled |

GlaxoSmithKline plc; Merck & Co.; Sanofi; Novartis AG; Pfizer Inc.; Dynavax Technologies; Emergent BioSolutions Inc.; Abbott; Bharat Biotech; Serum Institute of India; Takeda; Chiron; BioNTech; Astra Zeneka; GSK Vaccines; Moderna |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global travel vaccines market is estimated to be valued at USD 5.1 USD billion in 2025.

It is projected to reach USD 13.1 USD billion by 2035.

The market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types are covid-19, ebola, influenza, hepatitis and others.

online booking segment is expected to dominate with a 52.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Travel Advertising Market Size and Share Forecast Outlook 2025 to 2035

Travel Pouches Market Size and Share Forecast Outlook 2025 to 2035

Travel Trailer Market Size and Share Forecast Outlook 2025 to 2035

Travel & Tourism User Generated Content Market Size and Share Forecast Outlook 2025 to 2035

Travel Bags Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Travel Expenses Processing Market Analysis By Type, By End User, By Booking Channel, By Region Forecast: 2025 to 2035

Travel SIM MVNO Market by MVNO Type, Coverage, End User & Region Forecast till 2035

Understanding Market Share Trends in Travelers Identity Protection

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Travelport GDS Systems Market Trends - Growth & Forecast 2025 to 2035

Travel Intermediaries Business Market Analysis - Growth & Forecast 2025 to 2035

Market Share Distribution Among Travel Agency Services Providers

Travel Agency Services Market Analysis by Services Provided, by Tourist Type, by Tour Type, by Demography, by Age Group and by Region– Forecast for 2025-2035

Travel Management Software Market

Travel Toiletry Market Report – Demand & Industry Growth 2024-2034

Travel and Expense Management Software Market

UK Travel Agency Services Market Report – Trends, Demand & Outlook 2025-2035

B2B Travel Market Size and Share Forecast Outlook 2025 to 2035

USA Travel Agency Services Market Analysis – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA