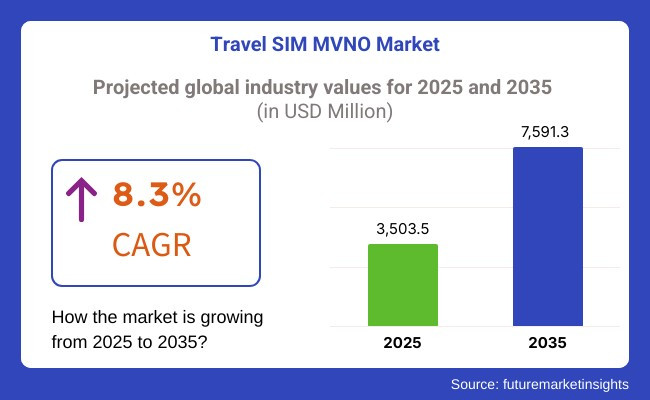

The global travel SIM MVNO market is projected to grow significantly, from USD 3,503.5 Million in 2025 to USD 7,591.3 Million by 2035 an it is reflecting a strong CAGR of 8.3%.

The travel SIM MVNO market is expanding as travelers and businesses increasingly rely on external telecom providers for uninterrupted global connectivity. Individuals seek cost-effective roaming solutions, while enterprises need reliable cross-border communication. The demand for multi-network compatibility and affordable data plans is driving market growth.

Telecom regulations such as the EU Roaming Regulations and FCC guidelines require MVNOs to maintain transparency in pricing and fair usage policies. To ensure compliance, providers are adopting automated regulatory management tools that help them meet evolving mandates efficiently while avoiding penalties.

The shift towards cloud-based telecom solutions and digital transformation has led businesses and travelers to depend on third-party network operators. However, this reliance also introduces risks such as poor connectivity, data security concerns, and fraudulent roaming charges, necessitating advanced monitoring and risk mitigation solutions.

With MVNOs handling sensitive user data, cybersecurity risks such as SIM cloning, unauthorized access, and billing fraud are increasing. To combat these threats, providers are integrating real-time monitoring and fraud detection tools that enhance security and ensure a seamless user experience.

North America dominates the market due to stringent telecom regulations, high traveler volume, and strong MVNO presence. Meanwhile, Asia-Pacific, including India and Australia, is experiencing rapid growth driven by rising cross-border travel and an expanding digital economy, increasing the need for secure and cost-effective travel SIM solutions.

The market is experiencing an impressive growth momentum owing to the growing number of international travelers, mobile workforces, and the necessity for the connected devices to utilize the services of seamless global connectivity.

Travelers and tourists are found to be the ones that look for roaming plans that are budget-friendly, multi-country SIMs as well as the options that can be activated without much hassle. Business travelers, in contrast, depend on high-speed data, secure networks, and premium customer support in order to be productive away from home.

In digital nomads' view, flexibility in the form of eSIM support and long-term options as well as good coverage of different areas are among the chief requests that they look for. IoT and connected devices with the use of MVNO travel SIMs are capable of tracking the fleet, managing logistics, and being in real-time communications.

The airline and hospitality industry are the one that uses travel SIM services to facilitate customer experiences, digital in-flight connectivity, and through that gain loyalty. Some of the newly upcoming trends in the area of telecommunication territory will be related to the launch of 5G travel SIMs, AI data management for better connectivity, improved security through blockchain.

| Company | Contract/Development Details |

|---|---|

| Vodafone | Entered into a long-term agreement with AST SpaceMobile to offer space-based cellular broadband connectivity in Europe and Africa, enhancing roaming services for travelers. |

| Truphone | Partnered with several airlines to provide in-flight travel SIM services, enabling passengers to stay connected during flights without incurring roaming charges. |

During the period 2020 to 2024, the Travel SIM MVNO market evolved well, powered by a return of international travel after COVID-19 and growth in demand for low-cost global roaming solutions. Budget-conscious travelers sought cheaper data and voice offerings, and accordingly, MVNOs providing multi-country SIMs and eSIM-based solutions were in vogue.

Travel SIM MVNOs partnered with large telecom carriers to provide seamless coverage over multiple territories, at affordable rates and real-time data usage monitoring. eSIM technology reduced tourism activity and plan switching. Operators tried to enhance coverage, user experience, and multi-currency payments in the face of disruption in the form of volatility in international roaming agreements and network affinity.

Market growth from 2025 to 2035 will be fueled by AI-driven roaming management, 6G-based connectivity, and blockchain-based billing. Dynamic roaming rate management, data allocation forecasting, and instant customer support will be enabled with AI-based platforms. 6G networks will enable ultra-high-speed data and low-latency connectivity to travelers with advanced streaming and communications.

Blockchain billing will authenticate payments and prevent fraud, enabling transparent pay-as-you-go business. Multi-network virtual SIMs will allow tourists to switch automatically between networks according to signal strength and local tariffs. Interoperability with travel platforms and smart city infrastructure will allow user convenience and location-based offer of services.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Roam-like-home policies and fair use policies characterized the travel SIM market. | AI compliance systems ensure low-cost international connectivity. |

| Physical SIMs moved to eSIM-based solutions at a faster rate. | AI-driven dynamic network switching with end-to-end digital SIM provisioning. |

| Competitive pricing models changed for heavy international roamers. | AI-driven real-time cost optimization to allow trouble-free international data consumption. |

| Emerging markets growth drove travel SIM adoption. | AI-driven network aggregation offers uninterrupted global coverage. |

| Increased cross-border travel and remote working stimulated demand. | AI-powered multi-network SIM solutions merge IoT and smart devices. |

The global travel SIM MVNO market is faced with many potential threats such as the difficult regulatory environment, unstable roaming contracts, and changing connectivity options. The regulatory risks arise from the uneven telecom legislation that applies in different nations which means that the violations brought by the MVNO and service restrictions or fines imposed may hinder the company in its operations and development plans.

One of the critical issues is the shifting of roaming agreements \negotiations. Travel SIM MVNOs are heavily reliant on the partnerships they have established with a variety of Mobile Network Operators (MNOs) to be able to offer customers easy international access. The consequences of any negative control, price increases, or reduction of contracts on the level of the quality and margins will be significant.

Transitioning to a different technology also creates problems. With the introduction and spread of eSIM technology and global roaming plans by MNOs, the need for the old travel SIM cards will be diminished. For example, the tourists will go for embedded solutions rather than requesting MVNOs to stock physical SIM cards that must be altered quickly.

The competition among the travel sim card MVN is characterized by the gigabytes of free Wi-Fi spots and services such as WhatsApp along with the global roaming bundles that main carriers are pushing, has grown to be very intensive. The need for selling themselves through the pricing, coverage, and complementary services is more crucial than ever.

In the end, the fluctuations of currencies also affect the prices and operational costs of the service providers. Travel SIM MVNOs are present in all parts of the world, which is why they tend to be vulnerable to the changing exchange rates, which are a source of possible profit losses if issues are not well dealt with.

Tier 1 vendors are leading organizations with a vast international presence, large customer bases, and extensive service offerings. These companies typically have deep pockets, allowing them to invest in cutting-edge technology and infrastructure and provide a range of services to address voice, data, SMS, and roaming needs for both the leisure and corporate markets.

They have extensive brand recognition and partnerships with many Mobile Network Operators (MNOs), enabling them to offer seamless connectivity in many countries. A leading travel SIM company such as Airalo provides cutting-edge eSIM solutions that span a magnanimous number of destinations around the world.

Tier 2: Mid-sized, solidly established vendors with a growing customer base. They usually target some specific area or demographic group, customizing their offerings based on the particular requirements of such markets. Although they lack the widespread global reach of Tier 1 vendors, they deliver specialized services, competitive pricing, and personalized customer support.

Such vendors partner with local MNOs to guarantee continuous connectivity and can also offer unique services like unlimited data plans or SIM packages tailored for that particular region. This agility makes them capable of adapting to changing markets and new customer needs, helping them to play a better game of chess in a competitive market.

Tier 3 vendors are smaller, typically niche players that focus on targeted market segments or regional areas. They might run in a handful of countries or cater to certain types of travelers, like students, expats, or budget tourists.

These vendors usually separate themselves through their value proposition - providing niche customer support, community-based services, or extremely competitive prices on certain routes. Their market share may not be big, but their knowledge of their audience helps them to keep their customers. However, they may have limitations when it comes to resources, scale, and negotiating power with the big MNOs.

| Countries | CAGR (%) |

|---|---|

| India | 11.2% |

| China | 9.8% |

| Germany | 7.2% |

| Japan | 8.2% |

| The USA | 8.0% |

China's outbound tourism industry is booming, driving demand for Travel SIM MVNO services. Chinese tourists took about 87.63 million outbound trips in 2023, indicating robust post-pandemic recovery. As international travel becomes popular again, more and more Chinese tourists need affordable but hassle-free mobile coverage to prevent roaming fees. Increased use of digital payment platforms, social media websites, and map apps increases demand for reliable and affordable SIM options.

The Chinese government has been pursuing this trend by streamlining visa policies, removing travel restrictions, and introducing new international flight routes. Bilateral travel arrangements between China and European countries, as well as Asian nations, have also favored cross-border travel. With the increasing economic and diplomatic presence of China around the world, the requirement for travel connect solutions will persist.

FMI is of the opinion that the Chinese market is slated to grow at 9.8% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Increasing Outbound Tourism | The increase in outbound travel with 87.63 million trips taken in 2023, requiring low-cost SIM solutions. |

| Use of Digital Payments & Social Media | The huge adoption of WeChat Pay, Alipay, and social media apps has generated the need for secure international mobile connectivity. |

| Government Support | Facilitation of visas and additional flight routes are encouraging international travel. |

Rising smartphone penetration in India is driving the growth in Travel SIM MVNO services. Mobile internet reaches more than 95% of villages, and digital connectivity has become a way of life. Pushed by indigenous manufacturing policies and programs such as Digital India, affordability has grown smartphone penetration. As a result, Indian visitors abroad are taking to mobile data services more to remain connected at affordable rates instead of incurring high roaming rates.

Government initiatives to improve digital infrastructure and internet penetration have been a major force behind this trend. Low-cost smartphone production, enhanced 5G coverage, and international telecom partnerships have cemented India's position in the mobile connectivity arena.

FMI is of the opinion that the Indian market is slated to grow at 11.2% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Growing Smartphone Penetration | More than 95% of the villages have gone online, with demand rising for international mobile connectivity. |

| Affordable Mobile Handsets | State subsidies and indigenous manufacturing have put affordable smartphones in hands. |

| Development of Digital Infrastructure | Rollouts of 5G networks and international telecom tie-ups are expanding connectivity worldwide. |

America is also experiencing the rise of e-commerce, which is hugely impacting the distribution channel for Travel SIM MVNO services. Total combined revenues for e-commerce were over USD 1 trillion by 2024, and growing numbers of buyers were purchasing travel goods, like SIM cards, on the internet. Tourists would love the ease of procuring SIM cards beforehand in order to avoid prohibitive roaming expenses and get appropriately linked up on their destination lands.

The USA government has also facilitated this revolution of the digital kind by investing in broadband facilities, passing data protection legislations, and ensuring safe online transactions. With website e-commerce becoming increasingly sophisticated, consumers will increasingly turn to digital buys and, therefore, increasingly adopt Travel SIM MVNOs.

FMI is of the opinion that the USA market is slated to grow at 8.0% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| E-commerce Growth | Internet sales exceeded USD 1 trillion in 2024, increasing the market for travel SIM cards. |

| Digital Commerce Growth | Consumer confidence in online shopping and secure payments are driving online purchases. |

| Government Support | Cybersecurity policy and investment in broadband are facilitating online transactions. |

Germany, being the biggest European economy, is witnessing an upsurge in business travel abroad that creates demand for Travel SIM MVNO services. The German business community depends on uninterrupted mobile connectivity for global business communication, conferences, and cross-border transactions. The central positioning of Germany in Europe means that it is a hotspot for multinational corporations, which contributes to the need for connectivity for traveling.

The government of Germany has supported mobile connectivity with policies that promote network infrastructure development and minimize roaming charges for enterprises and frequent business commuters.

FMI is of the opinion that the German market is slated to grow at 7.2% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Increased Number of Business Travel | Germany is a global hub for multinational companies, and the demand for business travel is increasing. |

| Roaming Cost Rules | Rules are intended to cut the cost to businesses and frequent business travelers. |

| Solid Network Infrastructure | 5G and mobile network investment in high speeds is enhancing global connectivity. |

Japan's growing tourism sector is fueling demand for Travel SIM MVNO services. Japan hosts more than 30 million overseas tourists each year, and travelers are looking for cost-effective and dependable mobile solutions for navigation, cashless payments, and communications.

The government has encouraged tourism by easing visa policies and boosting digital infrastructure to address connectivity demands. With Japan remaining an attractive destination for tourists as well as business travelers, the demand for Travel SIM MVNO service will rise.

FMI is of the opinion that the Japanese market is slated to grow at 8.2% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Tourist Boom | Japan welcomes over 30 million tourists per year, which is additionally driving mobile connectivity demands. |

| Visa & Travel Policy | Easy visa policies enable higher inbound and outbound travel. |

| Investment in Digital Infrastructure | Increased mobile network coverage raises the tourists' level of connectivity. |

| MVNO Type | Value Share (2025) |

|---|---|

| Light MVNO | 38.2% |

The full MVNO model is coming to dominate the MVNO market, becoming the largest segment in terms of subscriber counts, with a 38.2% share of the total MVNO market in 2025, as it has more control over operations, including PCN card management, billing, and customer experience.

Unlike Light MVNOs, Full MVNOs have complete control over their operations, enabling them to establish wholesale agreements with multiple mobile carriers and provide customized data plans directly to customers with superior service quality and greater pricing freedom.

Using the Full MVNO model, leading players, including Tracfone (USA), Lebara (Europe), and Poste Mobile (Italy), have demonstrated the ability to successfully differentiate their services away from host MNOs. Certain operators are moving towards full MVNO structures with the increase of 5G networks as this allows them to take autonomy over their network features, retain customers better, and deploy value-added services such as IoT connectivity and enterprise solutions.

The Light MVNO segment is projected to be 33.7% by 2025, contributing to kuat in Travel SIM, eSIM, and budget mobile markets. They lease the infrastructure from MNOs but operate in particular in terms of branding, pricing strategies, and customer service, presenting themselves as cost-effective alternatives.

Due to these develoments, there is now a large consumer demand for affordable data plans, and we indeed saw a rise in Light MVNOs like Airalo. Flexiroam, and Lycamobile, who offer cheap eSIMs or local access with data plans to foreign visitors/overseas residents, providing them with more cost-effective way of staying connected.

Regulatory incentives such as lower licensing fees and MVNO-friendly frameworks across select geographies have also aided market expansion, while new entrants and the accompanying competition within the enterprise and telecom space make up the next layer of this expansive multi-pronged approach to capturing the emerging market.

| Subscriber | Value Share (2025) |

|---|---|

| Consumer | 67.2% |

In terms of subscriber share, the Travel SIM MVNO market is expected to be led by the Consumer segment, which is projected to hold a share of 67.2% in 2025. The global tourism boom, rise of remote work and growth of digital nomadism have greatly increased demand for flexible, prepaid international roaming options. Many consumers prefer eSIM-enabled instant connectivity across multiple countries, as provided by companies like Airalo, Flexiroam, and Lycamobile, which are available on a pay-as-you-go or short-term basis.

The Business segment, which accounts for 32.8% market share, is also increasing due to corporate travel and mobility of the global workforce. To lower international roaming expenses, enterprises are implementing Travel SIM solutions in corporate expense management. Businesses, especially large companies and SMEs, are increasingly choosing MVNOs that are tailored to businesses (for example, Truphone and GigSky), which offer the ability to connect across multiple countries, pool data, and receive a centralized bill.

Both segments are being influenced by government regulations. However, tighter roaming transparency legislation in North America and the EU is challenging businesses to find more economical MVNO solutions, whereas 'open' Asian and Middle Eastern government policies are pushing businesses and consumer users to take e-SIM with digital onboarding.

The growth engine for the next phase of the Travel SIM MVNO market is the consumer and business subscribers with the ongoing market evolution witnessed in network coverage, artificial intelligence-driven roaming management, and corporate mobile solutions.

The travel SIM MVNO market is expanding as global travelers are concerned about getting effective roaming solutions at lower costs. Evolving competitiveness is brought about by the introduction of eSIM technology's multi-region capability and smooth activation features. There are personalized pricing options by companies on account of several network operators turned into significant partners and user experience improvement, especially through digital platforms.

Players in this category provide global coverage, competitive data packages, and app-based management. New entrants will typically take up exciting eSIM developments, AI-driven optimization of data usage, or real-time customer assistance to win over the so-called 'digital-first' traveler.’

While 5G rollouts continue to grow, the market has changed due to direct carrier partnerships and embedded travel solutions in both fintech and hospitality platforms. Well-established firms with significant compliance capabilities and strong infrastructure are favored in the spectrum-limited and regulatory walls.

Competitive strategic factors include digitization for the scalable delivery of services coupled with an integration of travel and fintech ecosystems. Society can build convenience over instant activation, transparent pricing, and AI-influenced connectivity management, which makes it more competitive in the emerging travel SIM MVNO market.

Recent Industry Developments

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Airalo | 18-22% |

| Ubigi | 12-16% |

| Mint Mobile | 10-14% |

| Google Fi | 8-12% |

| Visible | 6-10% |

| Other Players | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Airalo | Global eSIM provider offering affordable regional and worldwide data plans via app-based activation. |

| Ubigi | Focuses on IoT connectivity, travel eSIM solutions, and 5G roaming services. |

| Mint Mobile | USA-based MVNO providing low-cost prepaid plans, expanding into international roaming. |

| Google Fi | Offers flexible data plans, eSIM activation, and seamless international coverage across 200+ countries. |

| Visible | Verizon-backed MVNO with unlimited data plans, Wi-Fi calling, and USA-to-international roaming. |

Key Company Insights

Airalo (18-22%)

The market leader when it comes to digital-first eSIM solutions, along with very affordable multi-region data plans and seamless app-based activation.

Ubigi (12-16%)

Companies expanded in IoT, travel eSIMs, and enterprise connectivity, primarily focusing on Europe and Asia.

Mint Mobile (10-14%)

Advantageous in terms of raw prices and pure and simple prepaid models, slowly gaining customer traction in the USA and worldwide stalking sectors.

Google Fi (8-12%)

Strong technical integration through a variety of Google services offers a flexible and very clear roaming solution for international travelers.

Visible (6-10%)

Competes primarily based on unlimited data plans coupled with international coverage to target cost-conscious travelers.

Other Key Players (30-40% Combined)

In terms of MVNO type, the segment is segregated into Light MVNO and Full MVNO.

In terms of Coverage, the segment is segregated into Domestic and International.

In terms of End User, it is distributed into Individuals and Business Users.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The industry is projected to witness CAGR of 8.3% between 2025 and 2035.

The industry stood at USD 3,503.5 million in 2025.

The industry is anticipated to reach USD 7,591.3 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 9.7% in the assessment period.

The key players operating in the Global Travel SIM MVNO Industry Airalo, Ubigi, Mint Mobile, Google Fi Wireless, Visible, Cricket Wireless, USA Mobile, Lycamobile, Lebara, and Red Pocket Mobile.

Table 1: Global Market Value (US$ Million) Analysis (2018 to 2022) By Operational Model

Table 2: Global Market Value (US$ Million) Forecast (2023 to 2033) By Operational Model

Table 3: Global Market Value (US$ Million) Analysis (2018 to 2022) By Usage Type

Table 4: Global Market Value (US$ Million) Forecast (2023 to 2033) By Usage Type

Table 7: Global Market Value (US$ Million) Analysis (2018 to 2022) By Subscriber

Table 8: Global Market Value (US$ Million) Forecast (2023 to 2033) By Subscriber

Table 9: Global Market Value (US$ Million) Analysis (2018 to 2022) By Region

Table 10: Global Market Value (US$ Million) Forecast (2023 to 2033) By Region

Table 11: North America Market Value (US$ Million) Analysis (2018 to 2022) By Operational Model

Table 12: North America Market Value (US$ Million) Forecast (2023 to 2033) By Operational Model

Table 13: North America Market Value (US$ Million) Analysis (2018 to 2022) By Usage Type

Table 14: North America Market Value (US$ Million) Forecast (2023 to 2033) By Usage Type

Table 17: North America Market Value (US$ Million) Analysis (2018 to 2022) By Subscriber

Table 18: North America Market Value (US$ Million) Forecast (2023 to 2033) By Subscriber

Table 19: North America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 20: North America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 21: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Operational Model

Table 22: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Operational Model

Table 23: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Usage Type

Table 24: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Usage Type

Table 27: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Subscriber

Table 28: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Subscriber

Table 29: Latin America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 30: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 31: Western Europe Market Value (US$ Million) Analysis (2018 to 2022) By Operational Model

Table 32: Western Europe Market Value (US$ Million) Forecast (2023 to 2033) By Operational Model

Table 33: Western Europe Market Value (US$ Million) Analysis (2018 to 2022) By Usage Type

Table 34: Western Europe Market Value (US$ Million) Forecast (2023 to 2033) By Usage Type

Table 36: Western Europe Market Value (US$ Million) Analysis (2018 to 2022) By Subscriber

Table 37: Western Europe Market Value (US$ Million) Forecast (2023 to 2033) By Subscriber

Table 38: Western Europe Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 39: Western Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 40: Eastern Europe Market Value (US$ Million) Analysis (2018 to 2022) By Operational Model

Table 41: Eastern Europe Market Value (US$ Million) Forecast (2023 to 2033) By Operational Model

Table 42: Eastern Europe Market Value (US$ Million) Analysis (2018 to 2022) By Usage Type

Table 43: Eastern Europe Market Value (US$ Million) Forecast (2023 to 2033) By Usage Type

Table 44: Eastern Europe Market Value (US$ Million) Analysis (2018 to 2022) By Subscriber

Table 45: Eastern Europe Market Value (US$ Million) Forecast (2023 to 2033) By Subscriber

Table 46: Eastern Europe Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 47: Eastern Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 48: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Operational Model

Table 49: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Operational Model

Table 50: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Usage Type

Table 51: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Usage Type

Table 52: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Subscriber

Table 53: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Subscriber

Table 54: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 55: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 56: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Operational Model

Table 57: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Operational Model

Table 58: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Usage Type

Table 59: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Usage Type

Table 60: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Subscriber

Table 61: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Subscriber

Table 62: East Asia Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 63: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 64: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Operational Model

Table 65: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Operational Model

Table 66: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Usage Type

Table 67: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Usage Type

Table 68: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Subscriber

Table 69: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Subscriber

Table 70: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 71: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) by Country

Figure 1: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ Million), 2018 to 2022

Figure 4: Global Market Value (US$ Million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Operational Model

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operational Model

Figure 7: Global Market Attractiveness By Operational Model

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Usage Type

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Usage Type

Figure 10: Global Market Attractiveness By Usage Type

Figure 11: Global Market Value Share Analysis (2023 to 2033) By End User

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 13: Global Market Attractiveness By End User

Figure 14: Global Market Value Share Analysis (2023 to 2033) By Subscriber

Figure 15: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Subscriber

Figure 16: Global Market Attractiveness By Subscriber

Figure 17: Global Market Value Share Analysis (2023 to 2033) By Region

Figure 18: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Region

Figure 19: Global Market Attractiveness By Region

Figure 20: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 22: Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ Million), 2018- 2033

Figure 24: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 25: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 26: North America Market Value (US$ Million), 2018 to 2022

Figure 27: North America Market Value (US$ Million), 2023 to 2033

Figure 28: North America Market Value Share Analysis (2023 to 2033) By Operational Model

Figure 29: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operational Model

Figure 30: North America Market Attractiveness By Operational Model

Figure 31: North America Market Value Share Analysis (2023 to 2033) By Usage Type

Figure 32: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Usage Type

Figure 33: North America Market Attractiveness By Usage Type

Figure 34: North America Market Value Share Analysis (2023 to 2033) By End User

Figure 35: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 36: North America Market Attractiveness By End User

Figure 37: North America Market Value Share Analysis (2023 to 2033) By Subscriber

Figure 38: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Subscriber

Figure 39: North America Market Attractiveness By Subscriber

Figure 40: North America Market Value Share Analysis (2023 to 2033) by Country

Figure 41: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 42: North America Market Attractiveness by Country

Figure 43: U.S. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 44: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 45: Latin America Market Value (US$ Million), 2018 to 2022

Figure 46: Latin America Market Value (US$ Million), 2023 to 2033

Figure 47: Latin America Market Value Share Analysis (2023 to 2033) By Operational Model

Figure 48: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operational Model

Figure 49: Latin America Market Attractiveness By Operational Model

Figure 50: Latin America Market Value Share Analysis (2023 to 2033) By Usage Type

Figure 51: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Usage Type

Figure 52: Latin America Market Attractiveness By Usage Type

Figure 53: Latin America Market Value Share Analysis (2023 to 2033) By End User

Figure 54: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 55: Latin America Market Attractiveness By End User

Figure 56: Latin America Market Value Share Analysis (2023 to 2033) By Subscriber

Figure 57: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Subscriber

Figure 58: Latin America Market Attractiveness By Subscriber

Figure 59: Latin America Market Value Share Analysis (2023 to 2033) by Country

Figure 60: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 61: Latin America Market Attractiveness by Country

Figure 62: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 63: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 64: Rest of Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 65: Western Europe Market Value (US$ Million), 2018 to 2022

Figure 66: Western Europe Market Value (US$ Million), 2023 to 2033

Figure 67: Western Europe Market Share Analysis, by Operational Model – 2023 & 2033

Figure 68: Western Europe Market Y-o-Y Growth Comparison, by Operational Model, 2023 to 2033

Figure 69: Western Europe Market Attractiveness, by Operational Model

Figure 70: Western Europe Market Share Analysis, by Usage Type– 2023 & 2033

Figure 71: Western Europe Market Y-o-Y Growth Comparison, by Usage Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness, by Usage Type

Figure 73: Western Europe Market Share Analysis, by Country – 2023 & 2033

Figure 74: Western Europe Market Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 75: Western Europe Market Attractiveness, by Country

Figure 76: Germany Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 77: Italy Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 78: France Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 79: U.K. Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 80: Spain Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 81: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 82: Nordics Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 83: Rest of Western Europe Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 84: Eastern Europe Market Value (US$ Million), 2018 to 2022

Figure 85: Eastern Europe Market Value (US$ Million), 2023 to 2033

Figure 86: Eastern Europe Market Share Analysis, by Operational Model – 2023 & 2033

Figure 87: Eastern Europe Market Y-o-Y Growth Comparison, by Operational Model, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness, by Operational Model

Figure 89: Eastern Europe Market Share Analysis, by Usage Type– 2023 & 2033

Figure 90: Eastern Europe Market Y-o-Y Growth Comparison, by Usage Type, 2023 to 2033

Figure 91: Eastern Europe Market Attractiveness, by Usage Type

Figure 92: Eastern Europe Market Share Analysis, by Country – 2023 & 2033

Figure 93: Eastern Europe Market Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 94: Eastern Europe Market Attractiveness, by Country

Figure 95: Poland Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 96: Hungary Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 97: Romania Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 98: Czech Republic Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 99: Rest of Eastern Europe Market Absolute $ Opportunity (US$ Million), 2018 – 2033

Figure 100: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 101: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 102: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Operational Model

Figure 103: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operational Model

Figure 104: South Asia & Pacific Market Attractiveness By Operational Model

Figure 105: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Usage Type

Figure 106: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Usage Type

Figure 107: South Asia & Pacific Market Attractiveness By Usage Type

Figure 108: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By End User

Figure 109: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 110: South Asia & Pacific Market Attractiveness By End User

Figure 111: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Subscriber

Figure 112: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Subscriber

Figure 113: South Asia & Pacific Market Attractiveness By Subscriber

Figure 114: South Asia & Pacific Market Value Share Analysis (2023 to 2033) by Country

Figure 115: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 116: South Asia & Pacific Market Attractiveness by Country

Figure 117: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 118: Indonesia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 119: Malaysia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 120: Singapore Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 121: Australia& New Zealand Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 122: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 123: East Asia Market Value (US$ Million), 2018 to 2022

Figure 124: East Asia Market Value (US$ Million), 2023 to 2033

Figure 125: East Asia Market Value Share Analysis (2023 to 2033) By Operational Model

Figure 126: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operational Model

Figure 127: East Asia Market Attractiveness By Operational Model

Figure 128: East Asia Market Value Share Analysis (2023 to 2033) By Usage Type

Figure 129: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Usage Type

Figure 130: East Asia Market Attractiveness By Usage Type

Figure 131: East Asia Market Value Share Analysis (2023 to 2033) By End User

Figure 132: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 133: East Asia Market Attractiveness By End User

Figure 134: East Asia Market Value Share Analysis (2023 to 2033) By Subscriber

Figure 135: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Subscriber

Figure 136: East Asia Market Attractiveness By Subscriber

Figure 137: East Asia Market Value Share Analysis (2023 to 2033) by Country

Figure 138: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 139: East Asia Market Attractiveness by Country

Figure 140: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 141: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 142: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million), 2018 to 2022

Figure 144: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 145: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Operational Model

Figure 146: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operational Model

Figure 147: Middle East and Africa Market Attractiveness By Operational Model

Figure 148: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Usage Type

Figure 149: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Usage Type

Figure 150: Middle East and Africa Market Attractiveness By Usage Type

Figure 151: Middle East and Africa Market Value Share Analysis (2023 to 2033) By End User

Figure 142: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By End User

Figure 143: Middle East and Africa Market Attractiveness By End User

Figure 144: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Subscriber

Figure 145: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Subscriber

Figure 146: Middle East and Africa Market Attractiveness By Subscriber

Figure 147: Middle East and Africa Market Value Share Analysis (2023 to 2033) by Country

Figure 148: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 149: Middle East and Africa Market Attractiveness by Country

Figure 150: GCC Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 151: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 152: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 153: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Travel Advertising Market Size and Share Forecast Outlook 2025 to 2035

Travel Pouches Market Size and Share Forecast Outlook 2025 to 2035

Travel Trailer Market Size and Share Forecast Outlook 2025 to 2035

Travel & Tourism User Generated Content Market Size and Share Forecast Outlook 2025 to 2035

Travel Bags Market Size and Share Forecast Outlook 2025 to 2035

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Travel Expenses Processing Market Analysis By Type, By End User, By Booking Channel, By Region Forecast: 2025 to 2035

Understanding Market Share Trends in Travelers Identity Protection

Travelport GDS Systems Market Trends - Growth & Forecast 2025 to 2035

Travel Intermediaries Business Market Analysis - Growth & Forecast 2025 to 2035

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Market Share Distribution Among Travel Agency Services Providers

Travel Agency Services Market Analysis by Services Provided, by Tourist Type, by Tour Type, by Demography, by Age Group and by Region– Forecast for 2025-2035

Travel Management Software Market

Travel Toiletry Market Report – Demand & Industry Growth 2024-2034

Travel and Expense Management Software Market

UK Travel Agency Services Market Report – Trends, Demand & Outlook 2025-2035

B2B Travel Market Size and Share Forecast Outlook 2025 to 2035

USA Travel Agency Services Market Analysis – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA