The global travel intermediaries market will be Enhance even more during coming decades, with the help of the most recent trends Statistics on the market size and market share of individual segments, along with their growth rate. One of the most significant contributors to this growth is the continuing digital transformation of the travel space. With online travel agencies (OTAs) and other digital platforms improving their user experience, travellers are turning to intermediaries more and more for flights, hotels, car rentals and more unique travel experiences.

The ease of access, combined with the selection is aided also by the rise of mobile apps and the ongoing demand of global internet penetration rates, giving consumers easy access to a comparison across travel services when they want it, wherever they are in the world. Aside from digitalization, changing consumer needs are redefining the services offered by these intermediaries in travel. Today’s traveller wants solutions that are personalized, and integrated from beginning to end.

This has forced intermediaries to embrace the artificial intelligence (AI) and machine learning technologies for analysing customer taste, anticipating demand trends and driving customised travel packages. In addition, the increasing demand for sustainable and responsible travel options has led intermediaries to offer eco-conscious stays, carbon-offset programs, and tours that support destination communities.

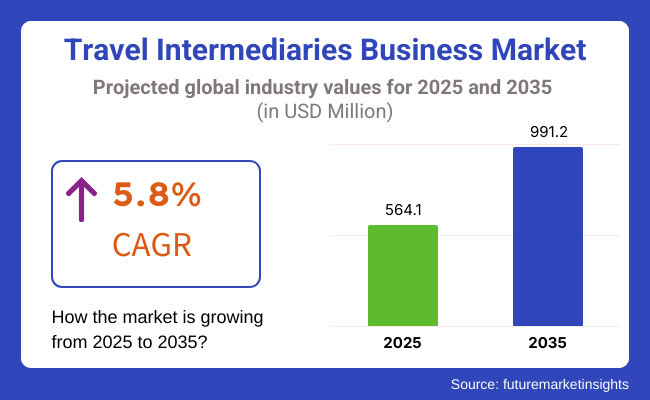

The size of the market is anticipated to expand at a compound annual growth rate (CAGR) of 5.8% over the forecast period of 2025 to 2035, which should have a market size of USD 564.1 Million in 2025 and USD 991.2 Million in 2035. As the industry continues to evolve, innovative travel intermediaries that focus on innovation, sustainability, and consumer-driven models will be best placed to provide tailored experiences in this dynamic environment.

Explore FMI!

Book a free demo

The travel intermediaries market in North America rakes in profits due to wide usage of OTAs (online travel agencies) as well as widespread adoption of advanced travel management software from corporates. With established infrastructure for domestic and international travel and strong representation of larger travel companies, travel is easily arranged and customized. Leisure travel and business travel have grown steadily, particularly in the USA and Canada, with consistent demand for intermediaries.

Furthermore, the introduction of niche travel agencies that emphasize luxury holidays, adventure tourism and environmental-friendly packages, is growing the market. Given this, and a consumer risk appetite for more personalized and curated experiences, the market is likely to maintain a strong growth trajectory.

Europe's travel intermediaries market is among the biggest in the world, characterized by an extended history of organized travel agency networks, ongoing emphasis on outbound and inbound tourism. Germany, the United Kingdom, and France head the headlines among European nations turning to digital travel solutions as more and more travellers are searching for online resources to compare prices, read reviews, and book their own travels.

Additionally, the emergence of budget airlines the development of train services, and the increasing demand for eco-friendly travel alternatives have compelled intermediaries to broaden their services and include carbon-offset travel solutions. Along with this cultural and historical diversification, itself a pull factor to international travellers, Airbnb can simply profit from further systemic acceleration in travel arrangements and new concepts in travel packages.

The Asia-Pacific leads market growth for travel intermediaries due to rising middle-class incomes, a soaring millennial traveller population and increased interest in cross-border tourism. China, India and Southeast Asian countries are enjoying an explosion of outbound and domestic travel. Competition might still be inward, but the growth of local OTAs, as well as international companies bringing activity to the region is increasing competition and ingenuity.

Moreover, the growth of Asia-Pacific’s digital economy and the increasing participation of the region in internet usage is driving more travellers to use mobile booking platforms, customer-friendly apps and social media channels for trip planning. The region’s growth is also bolstered by efforts from its governments to boost tourism, as well as the regular construction of infrastructure (airports, high-speed trains, and modern lodges)

Challenge

Fierce Competition and Digital Disruption

Justifications for the Travel Intermediaries Business Market Report by gaining insights on the market by analysing dynamics, dollar trends, and price trends of the market. As direct to consumer booking platforms gain popularity, travel intermediaries now have to provide value and differentiate by offering personalized suggestions, packaged experiences and better service. The proliferation of AI, block chain, and real-time data analytics, meanwhile is transforming the travel landscape and forcing travel intermediaries to upgrade their platforms.

The regulatory landscape, which requires compliance with evolving consumer protection and data privacy laws, adds additional complexity. To counter these findings, intermediaries further need to pursue advanced automation undertaken and AI-endorsed client insights such as Intermediary, seamless multi-channel booking integrations.

Opportunity

Growth of AI-Driven Travel Solutions and Digital Transformation

The travel intermediaries business market is expected to witness significant growth as the advent of seamless travel experiences powered by technology continues to drive demand. This is why travellers want personalized, hassle-free booking experiences, that use AI to customize their itinerary, use dynamic pricing and predictive analytics. Share The use of block chain for secure transactions, digital concierge services for real-time support, and AI chatbots for improved customer service is revolutionizing the role of intermediaries.

In addition, collaborations with airlines, hotels, and experience suppliers allow consumers to combine all travel in a single product offered by intermediaries. Digital transformation, AI-based personalization, and block chain-secured transactions are just three areas in which innovative travel companies can define and chart the course towards becoming leaders in travel’s new ecosystem.

The world went through a bunch of in-between brown and greasy slime puddles, and the Travel Intermediaries Business Market adopted some digital-first solutions, automated customer support, and sharper loyalty programs from 2020 to 2024.

Innovations such as mobile booking platforms, AI-driven virtual assistants, and dynamic pricing models enhanced efficiency and user interaction. While direct booking platforms, variable commission structures, and shifting travel regulations posed operational challenges. Businesses quickly pivoted by implementing predictive analytics solutions, tailored marketing models, and intelligent travel recommendation tools.

As we venture into the future (2025 to 2035), hyper-personalized travel planning will be revolutionized along with voice-activated booking systems and decentralized travel distribution models. AI among them, will be empowered to change what came before, consumer-facing travel intermediaries - the men and women who help build smart itineraries and encrypted travel previews that fit within integrated, metaverse-like environments, and the digital avatars used for booking that would be secured through biometric measures.

Additionally, the implementation of predictive pricing engines, real-time risk-assessment tools, and sustainable travel offerings will define the next generation of intermediary services. Next-gen automation, block chain backed travel security and AI based itinerary customization will be the in-thing in a future travel intermediary’s business market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with consumer protection laws and data privacy regulations |

| Technological Advancements | Growth in AI-powered virtual assistants, dynamic pricing, and mobile bookings |

| Industry Adoption | Increased reliance on online travel agencies and dynamic pricing engines |

| Supply Chain and Sourcing | Dependence on airline and hotel partnerships for commissions |

| Market Competition | Competition with direct airline and hotel booking platforms |

| Market Growth Drivers | Demand for price comparison, flexible booking options, and bundled experiences |

| Sustainability and Energy Efficiency | Early-stage implementation of carbon offset options and eco-friendly travel packages |

| Integration of Smart Monitoring | Limited predictive analytics for traveller behaviour and booking patterns |

| Advancements in Travel Technology | Use of mobile apps, AI chatbots, and dynamic pricing tools |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of block chain-secured bookings, AI-driven compliance automation, and real-time fraud detection. |

| Technological Advancements | Widespread adoption of predictive AI-based trip planning, biometric-secured transactions, and met averse-based travel previews. |

| Industry Adoption | Expansion into AI-personalized travel concierge services, automated itinerary customization, and smart booking platforms. |

| Supply Chain and Sourcing | Shift toward decentralized travel distribution networks, block chain-backed transactions, and real-time supplier integrations. |

| Market Competition | Rise of AI-native travel platforms, autonomous booking systems, and frictionless smart travel solutions. |

| Market Growth Drivers | Increased investment in AI-powered recommendation engines, block chain-secured transactions, and real-time risk assessment tools. |

| Sustainability and Energy Efficiency | Large-scale adoption of AI-optimized sustainable travel recommendations, zero-carbon travel platforms, and energy-efficient booking solutions. |

| Integration of Smart Monitoring | AI-enhanced behavioural analytics, real-time demand forecasting, and hyper-personalized travel planning. |

| Advancements in Travel Technology | Evolution of met averse travel experiences, AI-driven voice booking systems, and digital concierge automation. |

The travel intermediary/agency market in the USA is gradually growing owing to adoption of online travel agencies (OTAs), demand for personalized travel experiences, and use of AI based booking systems. Power users such as Expedia, Booking Holdings, and American Express Travel have been able to maintain their market share due to the incorporation of big data drove insights, AI led personalization, and real-time dynamic pricing.

End-to-end booking solutions offered by corporates travel agencies further stimulate the growth of business travel and luxury tourism. Another relevant trend is the emergence of mobile-based travel planning applications and metasearch engines that are reshaping the way in which travellers go through intermediate companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

The UK travel intermediaries market is undergoing a transformation fuelled by rising demand for personalized travel arrangements, an increase in digital distribution channels, and rising preference towards sustainable travel options. Travel management companies (TMCs), including Hays Travel, Flight Centre and Trail finders, are investing in their digital capabilities to enhance the customer journey.

Corporate travel is also an area where transparency and demand is high as companies are looking for AI-based expense management and tools to book in adherence to their policy. In addition, increasing multi-destination holiday packages and luxury travel concierge services are opening new business opportunities for the travel intermediaries.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

The market is like a combination of the factors that helps in driving the continuous growth. Germany, France and Spain lead the way on the rise in inbound and outbound tourism, generating high demand for aggregated booking alongside AI-based itinerary planning.

The single market of the EU is emphasizing sustainable tourism and is leading to the incorporation of eco-friendly travel products by travel agencies and intermediaries. Additionally, automated booking platforms and virtual travel assistants enable increased customer engagement and allow for real-time flexibility of bookings.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

Japan's travel intermediaries market is expanding, due to an increase in outbound tourism, the use of digital travel platforms, and the deployment of AI-based customer service solutions. Intensive micro-led bookings are offered by Japanese travellers resulting in the high demand for tailor-made tours and premium travel middlemen.

Online Travel Agencies (OTAs) and Metasearch such as Rakuten Travel and Jalan. Net are leading to an additional change in the market. In addition,Japan’s drive for smart tourism is driving the adoption of AI-powered travel assistants, automatic guest support, and seamless digital booking experiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

Strong growth in Travel Intermediaries in South Korea is driven by various demand drivers such as increasing outbound tourism demand, growth in digital penetration and AI to provide personalized travel experiences. This is quickly driving the mobile-based travel bookings as well as real-time price comparison tools which can be supported by the digital ecosystem of the country and the high penetration rate of mobile.

And it is the next generation travel agencies and OTAs like InterparkYanolja, MyRealTrip that are now investing heavily in building AI-powered travel suggestions and automated bookers. Furthermore, the increase in the demand for such travel experiences as luxury and K-pop tourism, adventure travel seem to shape the new great opportunities for travel intercessors as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

Holiday packages and travel services comprise a considerable share in the travel intermediary's business market as modern-day tourists are increasingly relying on easy, bundled traveling options and customized guidance by travel agencies, tour operators, and web booking websites. They occupy a middle ground in facilitating trip planning to advance, acquiring cut-rate bargains at low costs, and augmenting the ease of travelers and thus become a requirement of leisure travelers, business travelers, and group tour travelers.

Holiday packages are among the most in-demand services today, providing tourists with one-stop-shop traveling that has flights, hotels, guided tours, and activities all at affordable prices. Holiday packages are easy to book, economical, and provide professionally designed travel experiences compared to do-it-yourself vacations.

The increase in demand for customized and full-package holiday packages with pre-booked travel itineraries, offers, and customized service has encouraged holiday package consumption, as consumers look for convenient trip planning and no-frills booking. Based on research, more than 65% of leisure tourists opt for packaged tour packages instead of making separate bookings, thus guaranteeing high demand for the segment.

Emergence of AI-driven dynamic holiday packaging, including real-time personalization, preference-based trip planning, and price automation, has increased market demand, allowing for greater utilization of vacation packages across various categories of travelers.

Integration of green travel arrangements, including eco-tourism packages, carbon-neutral flights, and sustainable tourism practices, has also driven adoption, allowing for closer alignment with worldwide sustainability movements.

Introduction of holiday packages with premium membership, such as loyalty rewards, VIP concierge bonuses, and travel privileges, has optimized market growth, ensuring higher customer loyalty and tailored experience delivery.

Introduction of experience-based holiday packages, such as immersive cultural experiences, adventure travels, and tailor-made luxury vacations, has established market growth, ensuring greater interaction and segmentation within a competitive travel agency market.

While it enjoys the benefits of convenience, cost-effectiveness, and professionally crafted holiday experience, the vacation packages segment is exposed to fluctuating demand, changing traveler sentiments, and rate wars from direct service providers. But new technologies in AI-based trip planning, blockchain travel booking, and dynamic real-time pricing models are enhancing efficiency, transparency, and customer experience, driving vacation package service market growth.

Travel services have gained total market acceptance, most notably air booking, visa service, and travel consultancy for certain needs, because travel intermediaries provide niche services to create more convenience, security, and efficiency for the consumers. Travel intermediary services provide value addition to direct bookings due to the expertise advice, protection from fraud, and flexible book management.

The increasing demand for customized travel assistance, including multi-destination trip planning, last-minute rebooking, and AI-based customer support, has fueled the consumption of travel services, as business travelers, luxury travelers, and group travelers look for easy and convenient travel bookings. More than 50% of international travelers use travel intermediaries to look for help in visa procurement, insurance, and air ticket booking, making this industry highly demanded.

AI-driven chatbot support and voice booking of travel, with 24/7 customer care, live travel intelligence, and dynamic re-ordering of travel plans, has further accelerated market demand, ensuring increased utilization of travel services by business and leisure travelers.

Emergency travel assistance and risk management, including instant crisis alerting, inclusion of travel insurance, and facilitation of medical support, have also spurred adoption, allowing greater security and confidence for consumers to avail intermediary services.

Travel advisory subscription packages, including unlimited travel planning, offers, and concierge-level service, have also driven market expansion, with increased loyalty and repeat patronage for frequent travelers.

Usage of blockchain-secured travel transactions, including fraud-proof booking confirmations, smart contract-based payment settlements, and decentralized travel identity verification, has solidified market growth with greater transparency and credibility in the travel intermediary market.

Though it excels in specialized advice, tailor-made service, and augmented security, the industry of travel services is threatened by increasing competition from direct travel vendors, increasing demand for customer self-service web bookings, and regulatory complexity across multiple nations. Still, innovative technologies in AI-powered trip planning optimization, biometric travel authentication, and sustainable travel service integrations are enhancing efficiency, security, and customer experience, ensuring increased growth for world travel intermediary services.

The transport segments, including air and others, are two principal market drivers since travel intermediaries add more integrated booking, flexible ticketing, and multimodal transport solutions to their offerings in order to support increased traveler mobility and efficiency.

Air Travel Segment Drives Market Demand as Digital Ticketing and Personalized Booking Solutions Redefine Airline Services

Aviation air travel industry has expanded to be one of the most used modes of transport, with clients being provided with a wide range of domestic and foreign flight schedules by intermediaries for trips, web travel agencies, and business travel service providers. In relation to traditional ticketing, contemporary air travel intermediaries provide dynamic prices, rebooking options, and AI-based flight recommendations.

The growth in demand for personalized airline reservation services, such as real-time comparison of fares, AI-driven seat selection, and predictive delay warnings, has fueled adoption of air travel services, as customers seek value-for-money, efficient, and flexible flights. Studies indicate that over 75% of bookings in flights are influenced by travel intermediaries, which assures positive demand in the segment.

Expansion of direct air carrier collaborations with travel agencies and OTAs, including commission-based price structures, API-integrated flight consolidations, and loyalty program affiliations, has driven greater market demand, enabling higher levels of adoption of air carrier intermediary services.

Despite convenience, cost advantage, and ease of access to good quality flight deals, the aviation travel sector is also intensely competitive with concerns such as uncertain airline prices, volatile fuel costs, and online airline website competition. However, future developments in AI-based travel guidance, blockchain-secured flight reservations, and self-service refund processing are boosting efficiency, security, and consumer satisfaction, hence releasing future market expansion opportunities for air travel middleman services.

Even other modes of transport, including cruises, rail, buses, and car hire, have experienced notable market adoption, particularly in multimodal travel options, integrated mobility, and sustainable transport, as travel intermediaries provide full-service transportation booking options. In contrast to individual transport bookings, intermediary-based transport solutions provide bundled, cross-platform, and adaptable travel planning, providing greater connectivity for the traveler.

Increased usage for multimodal journey planning, involving combined train, bus, and car rental bookings on a single booking website, has driven uptake of other types of transport services, as passengers value flexibility and convenience in planning their trips.

Though it begins with flexibility, accessibility, and affordability, other transport segment too has regional regulatory constraints, biased pricing models, and differential service availability by geography. However, new technologies in AI-based travel route optimization, decentralized ride-sharing platforms, and contactless transport ticketing solutions are improving efficiency, accessibility, and traveler convenience, ensuring sustained growth for other transport intermediary services.

The increasing demand for online travel booking, AI-powered itinerary planning, and dynamic pricing solutions leads to the growth of the travel intermediaries’ business market. Personalized travel experiences, blockchain-based secure transactions, and enhanced customer insights with the help of artificial intelligence (AI) are among products focused on maximizing convenience, saving on costs, and facilitating real-time booking flexibility.

It encompasses online travel agencies (OTAs), global distribution systems (GDS) providers, enterprise-level travel management companies, and travel aggregators, all of which drive technological innovation in smart travel booking, predictive insights, and AI-embedded consumer service.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Booking Holdings (Booking.com, Priceline, Agoda, Kayak, OpenTable) | 20-25% |

| Expedia Group (Expedia, Hotels.com, Vrbo, Orbitz, Travelocity, Trivago) | 15-20% |

| Amadeus IT Group (GDS & travel tech solutions provider) | 12-16% |

| Sabre Corporation (GDS & travel marketplace solutions) | 8-12% |

| Ctrip (Trip.com Group, Skyscanner, Qunar) | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Booking Holdings | Operates global OTAs with AI-powered hotel and flight booking, predictive pricing, and digital itinerary planning tools. |

| Expedia Group | Specializes in comprehensive travel solutions, dynamic travel packaging, and loyalty-driven digital booking platforms. |

| Amadeus IT Group | Provides GDS-based real-time inventory management, AI-driven travel analytics, and blockchain-secured transactions. |

| Sabre Corporation | Offers cloud-based airline and hotel distribution systems, digital travel booking solutions, and corporate travel management tools. |

| Ctrip (Trip.com Group) | Focuses on Asia-Pacific online travel aggregation, AI-driven flight pricing, and mobile-first personalized travel recommendations. |

Key Company Insights

Booking Holdings (20-25%)

Booking Holdings leads the travel intermediaries business market, offering comprehensive digital travel services, AI-driven hotel recommendations, and seamless multi-platform booking experiences.

Expedia Group (15-20%)

Expedia specializes in bundled travel solutions, ensuring real-time price comparisons, loyalty-driven perks, and AI-enhanced travel assistance.

Amadeus IT Group (12-16%)

Amadeus provides enterprise-level travel distribution services, optimizing GDS-enabled global travel bookings, AI-powered travel insights, and blockchain-based security.

Sabre Corporation (8-12%)

Sabre develops next-generation smart travel software, ensuring predictive analytics for travel management and enhanced digital booking systems.

Ctrip (Trip.com Group) (5-9%)

Ctrip dominates the Asia-Pacific OTA market, integrating mobile-first travel experiences, AI-based flight deals, and digital travel concierge services.

Other Key Players (30-40% Combined)

Several travel intermediaries, aggregators, and corporate travel platforms contribute to next-generation smart travel innovations, AI-driven itinerary planning, and digital-first travel assistance. These include:

The overall market size for travel intermediaries business market was USD 564.1 Million in 2025.

The travel intermediaries business market expected to reach USD 991.2 Million in 2035.

The demand for the travel intermediaries business market will be driven by the growing preference for online booking platforms, increased global tourism, demand for customized travel packages, the rise of mobile apps, and advancements in AI-driven travel recommendations for seamless planning and convenience.

The top 5 countries which drives the development of travel intermediaries business market are USA, UK, Europe Union, Japan and South Korea.

Vacation Packages and Travel Services to command significant share over the assessment period.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Spa Resorts Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.