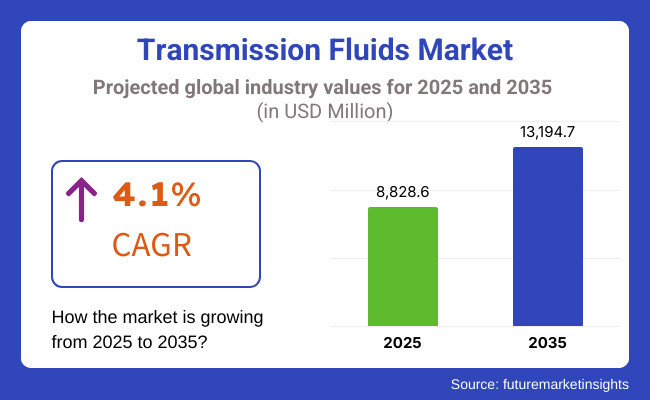

The global transmission fluids market is poised for steady growth over the forecast period, with market size expected to increase from USD 8,828.6 million in 2025 to USD 13,194.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.1%.

Growing automotive production, increased vehicle demand, demand for fuel-efficient vehicles, and technological advancements in transmissions (notably in the realms of automatic and electric transmissions) are factors driving market growth. This transformation can be clearly observed in the transmission fluids market as well, which is gradually moving towards battery-powered automobiles (EVs) and hybrid powertrains that offer optimal efficiency and durability.

The growing exchange of technology between vehicle drivetrain technologies and material technology has significantly been favourable for the growth of the transmission fluids market. The personalized oils that improve the performance and fuel usage of vehicles with automatic transmissions, dual-clutch transmissions (DCTs) and continuously variable transmissions (CVTs) are highly specialized. Moreover, the rise of electric vehicles is contributing to heightened demand for transmission fluids designed for new powertrain architectures like e-axles and direct-drive systems.

The transmission fluids market is expected to have steady growth due to technological developments and changing automotive trends. Over the next decade, the OEMs will focus towards successive range of increasing fuel-efficient and eco-friendly lubricants. With the growing trend towards electric vehicles, transmission fluid formulations will need to change even more, as manufacturers adjust to a changing industry.

Since most of the users are now preferring automatic and semi-automatic gear system, hence automatic transmission fluids would account for the largest market share. One key factor fuelling demand for EV Transmissions fluids is the growing adoption of EVs across the globe, with the segment expected to show a fast growth as compared to other segments.

Explore FMI!

Book a free demo

The North American automotive transmission fluids market is mainly influenced by strict emission regulation and rising adoption for automatic and electric vehicles. Increasing environmental regulations are being imposed on vehicle manufacturers to enhance fuel economy and limit carbon emissions, which is driving the demand for advanced transmission fluids. Same investments to grow the market as Ford, General Motors, and Tesla themselves are doing innovative production.

Another contributing element is the availability of synthetic transmission fluids which enable better performance and longevity. Moreover, the increasing demand for automatic transmissions offering higher levels of convenience and ease of operation is propelling the overall market for transmission fluids. In conjunction with the relatively high vehicle ownership rates and technological advancement, these factors are creating a positive growth outlook for the North American market.

Europe’s automotive transmission fluids market is experiencing steady growth due to a growing focus on fuel efficiency and sustainability. Stricter rules in Europe on vehicle emissions have forced the industry to adopt new technologies that make cars work better while treading more lightly on the environment. Accordingly, trend challenges are also leading to the emergence of marketable products like specialized transmission fluids that are made to improve fuel efficiency, minimize friction, and promote the path towards electric mobility.

One of the most significant trends in recent years has been the decarburization of transportation, which is primarily fueled by the transition from conventional vehicles to electric vehicles (aka EVs), resulting in an increased demand for transmission fluids suitable for electric powertrains that typically require alternative formulations than do ICE-powered vehicles.

The European commitment towards carbon reduction, along with the continued proliferation of hybrid and electric vehicles, is predicted to help fuel demand for high-end transmission fluids that enhance energy efficiency and reduce emissions.

The Asia-Pacific (APAC) region is witnessing rapid growth in the automotive transmission fluids market, driven by countries like China, Japan, and India, which are key players in the global automotive industry. Driving this growth due to rising demand in regions for auto production and rates of vehicle ownership. Various regions such as China and India are moving towards urbanization, enhancing automotive demand, on the grounds that these trends create demand for high-quality transmission fluids.

Moreover, the accelerated electrification of the vehicle fleet in the APAC region is a key factor to support the growth of the market. For electric vehicles (EVs) and hybrid vehicles, the transmission fluids are different cases from conventional vehicles, which will bring new opportunities for specific products.

APAC market growth is definitely driven by strong economic growth, increasingly high consumer purchasing power, and the increasing regional focus on sustainability, which is further advancing the demand for advanced, nature-friendly transmission fluids.

In the Rest of the World (RoW) markets, including Latin America, the Middle East, and Africa, the automotive transmission fluids market is showing moderate growth. In regions such as Latin America, economic development, increasing disposable incomes, and blooming automotive production are contributing to the demand of vehicles, and subsequently, the requirement of transmission fluids.

With an expanding automotive sector and vehicle fleet, the demand for high-end transmission fluids is also rising in the Middle East, particularly for luxury and high-performance vehicles. Additionally, an emerging middle class as well as developing urbanization in Africa is fueling the growth of the automotive sector in the continent, thus propelling the demand for traditional and synthetic transmission fluids.

Although such regions have not yet experienced the same exponential growth as Asia-Pacific or North America, still hold significant potential as garnering attention on vehicle maintenance, fuel efficiency, and technological advances in different formulations of transmission fluid has turned their attention.

Challenges

Increasing Complexity of Environmental Regulations

One of the major challenges in the automotive transmission fluids market is the increasing complexity of environmental regulations. With governments and regulatory agencies across the globe implementing increasingly stringent vehicle emissions and fuel efficiency standards, every single player in the industry including those that produce car transmission fluids will have to step up and follow evolving legislation.

Significantly, such regulations usually require a lot of testing and reformulation of products, which consuming and expensive for producers. Moreover, such regulations are frequently region specific, which causes the enterprises to tread a multifaceted landscape of legal compliance in different markets.

This increases operational cost as well as the risk of non-compliance leading to fines or product recalls. From a regulatory perspective, manufacturers will be pushed to innovate continuously in order to remain compliant, while balancing performance and price in product offerings.

Shift Toward Electric Vehicles (EVs)

Another significant challenge is the shift towards electric vehicles (EVs). The automotive industry is undergoing an electrification shift and will no longer dealing with the internal combustion engine (ICE) vehicles needing complex transmission fluids, changing the way lubrication works for electric powertrains. Development for transmission fluid, since electric vehicles usually do not require traditional transmission systems.

This shift puts on fluid manufacturers to adapt by creating new types of fluids better suited for EVs. Electric cars also work in different conditions than ICEs, which means the fluids that work for electric drivetrains are different. While these creates another challenge and opportunity for corporations, companies with substantial business units in legacy transmission fluids face a serious battle to protect their market share.

Opportunities

Growing Demand for Electric Vehicle (EV) Transmission Fluids

A significant opportunity in the automotive transmission fluids market is the growing demand for electric vehicle (EV) transmission fluids. However, with OEMs quickly moving to electric vehicles, there is a drive for fluids to meet the specialized requirements of electric drivetrains. EVs need fluids that improve efficiency while also providing reduced friction and wear in powertrains that work at speed and torque levels significantly higher than those of hydrocarbon engines.

This creates a new opportunity for manufacturers to develop specialized transmission fluids for the electric vehicle market. With the continued expansion of EV adoption, there is tremendous opportunity for companies to create cutting-edge fluid solutions that improve performance, energy efficiency, and life of electric vehicles, helping manufacturers keep pace with the growing demand for this segment.

Advancements in Synthetic Transmission Fluids

Another promising opportunity lies in the continued advancements in synthetic transmission fluids. Reputed quality high-performance fluids are formulated that provide numerous benefits over more conventional polyalolefins and mineral oils which are such as they are more efficient, serves longer service life, and can provide additional protection to components in a vehicle. With an increasing emphasis on fuel efficiency and sustainable environmental practices, the market for advanced synthetic fluids is likely to grow.

These fluids are designed to work better at extreme temperatures and resist friction better than traditional fluids, which results in improved economy and lower emissions. This trend is also an opportunity for the fluid manufacturers to develop new innovative products that can meet the needs of consumers as well as regulatory standards. Advancing performance and sustainability, synthetic transmission fluids are set to emerge as a leading market segment, representing substantial development opportunities for innovators delivering these solutions.

The transmission fluids market experienced steady growth from 2020 to 2024, driven by more or less growing due to rising vehicle production, technological progress in automotive transmission systems, and tougher rules on fuel economy. Increasing adoption of automatic transmissions, which need winding to function, further enhanced demand for the market.

Regulatory pressure for fuel economy and emissions improvements pushed manufacturers to create more efficient and environmentally sustainable fluids. The proliferation of electric vehicles (EVs) has challenged and opened opportunities around traditional transmission fluid use. However, it became a vital space for innovation to formulate new fluids for hybrid and electric drivetrains, which do not utilize traditional transmissions.

Looking ahead to 2025 to 2035, the market is expected to undergo significant transformation. The continued shift towards fully electric powertrains will reduce the demand for conventional transmission fluids, but will create a need for specialized lubricants for electric drivetrains. Furthermore, advancements made in automatic and continuously variable transmissions (CVTs) will require high-performance lubrication solutions to address increasing operational pressures and temperatures.

Moreover, growing regulatory inclination to lower carbon footprints would drive the manufacturer to further develop bio-based environmentally sustainable low viscosity transmission fluids further complying with sustainable objectives, as well as addressing the changing paradigm of the automotive industry.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tighter fuel efficiency & emissions norms leading to better lubricant formulations. |

| Technological Advancements | Design of synthetic and low viscosity oils for improved fuel economy. |

| Industry-Specific Demand | ICE vehicles still have majority of share , along with a growing segment of hybrid applications. |

| Sustainability & Circular Economy | Initial efforts toward bio-based and recyclable formulations. |

| Production & Supply Chain | Geopolitical factors causing disruptions in raw material availability. |

| Market Growth Drivers | Expanding automotive sector, demand for efficient transmission systems, and regulatory compliance. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Greater emphasis on the sustainability mandates, propelling bio-based and recyclable transmission fluids. |

| Technological Advancements | Next-gen fluid technologies designed for EV applications such as dielectric and thermal management fluids. |

| Industry-Specific Demand | Declining ICE vehicle production, increasing demand for new generation transmission fluids suitable for EVs. |

| Sustainability & Circular Economy | Full-scale adoption of environmentally friendly alternatives with extended service life. |

| Production & Supply Chain | More localized production and AI-assisted supply chain R&D for efficiency. |

| Market Growth Drivers | Electrification, more demanding sustainability standards and advances in lubricant chemistry. |

The USA transmission fluids market is driven by a strong automotive and industrial sector. Increased production of vehicles is also expected to drive the demand for high-performance lubricants. Evolution of automatic and hybrid transmission systems in vehicles, the fluid is not only required but also has very low-friction and synthetic fluid. Strict regulatory requirements, especially CAFE fuel economy regulations, are forcing manufacturers to adopt eco-friendly and low-viscosity lubricants.

Heavy-duty transmission fluid content in the industrial sector, encompassing industries such as construction and manufacturing. The expanding electric vehicle (EV) market also plays a role in targeting specialized lubricants for e-transmissions and hybrid systems. The lubricant industry's quest for innovation in efficient, high performance transmission fluid. Major players including ExxonMobil, Chevron and Valvoline are funding R&D.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The European Union transmission fluids market is influenced by automotive regulations, technological advancements, and sustainability trends. Carmakers are adopting e-transmission fluids that offer low-energy losses for the transition to electric and hybrid vehicles, influencing lubricant needs. The strict EU emissions regulations, including Euro 7 standards, are triggering a transition to bio-based and low viscosity lubricants.

Countries like Germany, France, and Italy will still be key markets, given their strong presence in automotive manufacturing. The demand for synthetic transmission fluids in heavy machinery is also being driven by industrial automation and smart manufacturing.

Recyclable and biodegradable fluids are already gaining prominence within the European lubricant industry, as it invests in circular economy initiatives. Major oil and lubricant makers like Shell, BP and Total Energies are developing environmentally friendly transmission fluids.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

China's transmission fluids market is the fastest-growing globally, fueled by automotive expansion and rapid industrialization. The EV sector, which some government incentives and local automakers largely drove, has increased demand for EV-compatible transmission fluids. Furthermore, rising vehicle ownership and solid domestic automotive manufacturing presence leads to higher lubricant consumption.

Construction and manufacturing, major segments of the industrial sector, need high-performance transmission fluids for heavy machinery and automation systems. China’s stringent emission regulations are driving the adoption of low-friction and energy-efficient lubricants. Sinopec, PetroChina, and other domestic brands are in a competition against Mobil, Shell, and others for synthetic and environmental lubricant developments. The government’s drive for self-reliance in lubricant production also fuels growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.2% |

Japan’s transmission fluids market is shaped by high-tech automotive advancements and hybrid vehicle dominance. Toyota, Honda, and Nissan spearhead hybrid cars, a growing demand has emerged for specialty low-friction lubricants. Japan’s commitment to fuel efficiency and sustainability is paving the way for bio-based and synthetic fluids, too.

Stringency in vehicle emission laws is also driving the automakers to manufacture ultra-low-viscosity lubricants. Demand for high-end transmission fluids is also driven by the country’s industrial section such as precision machinery and robotics. Japan’s automotive R&D scene is focused on the development of long-life, durable transmission fluids to improve vehicle efficiency. Market research on low-friction and thermal-resistant lubricants from key players such as Idemitsu Kosan, Eneos, and Castrol Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

India’s transmission fluids market is expanding due to growing vehicle ownership, infrastructure projects, and government-led industrial growth. Higher demand for lubricants for automotive production driven by increasing middle class. This trend toward low emission, high performance transmission fluids has been accelerated with the implementation of the BS-VI emission standards.

Government incentives further support India’s electric vehicle (EV) push, generating demand for e-transmission lubricants. The currently booming construction sector additionally aids in industrial-grade lubricants growth. Moreover, foreign investments in the Indian automotive and lubricant sector propel the market rivalry. Leading domestic and multinational corporations such as Indian Oil Corporation, Castrol, and Shell India, Emplon and Jotun in developing synthetic, high-durability, and eco-friendly transmission fluids.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Automatic transmission fluids (ATF) are critical for maintaining the optimal performance of a vehicle, allowing smooth shifting and fuel consumption. The demand for these ATF formulations has elevated due to the ever-increasing preference towards automatic transmissions in newer vehicles, particularly in urban regions which experience high traffic.

These fluids need to evolve to the increasing and varying demands on automatic transmission systems for better performance, higher durability and efficiency. Continuous developments in ATF technology supporting higher torque and lower friction in hybrid and electric vehicles is further fuelling the demand for ATF formulations that are highly localized to these propulsion types. This transition also makes necessitating and ensuring the compatibility and development of high-quality ATF for OEMs as challenge.

Manual transmission fluids are vital in vehicles with manual transmission systems to ensure smooth functionality by lubricating the moving parts and minimizing friction when shifting gears. Manuals still hold some degree of popularity in the vehicle segments where driving precision is important, like performance vehicles and off-roaders both of which still rely on manual transmissions for increased control.

Manual transmission fluids from reputable sources provide smooth transmogrification, prevent component wear, and improve vehicle longevity. The operating pressures and temperature of these fluids must be larger than the fluid in automatic systems. With the continuing demand for manual transmissions, especially for performance and off-road vehicles, the development of specialty fluids that meet these needs is necessary.

In the automotive industry, transmission fluid is a very important part that helps to improve vehicle powertrain efficiency, performance, and improves life. Increasing number of automatic and continuously variable transmissions (CVT) in passenger vehicles is influencing demand for advanced transmission fluids. Automotive transmission fluids must deliver in terms of increasing performance, while accommodating a lower emissions mandate, focusing on fuel economy.

Rising use of hybrid and electric vehicles contributes to changes in the types of fluids required for new powertrains. Driven by changing consumer preferences, manufacturers are working on creating transmission fluids that cater to the performance, sustainability, and regulatory compliance requirements of the automotive industry.

Specialized transmission fluids are needed for many off-highway vehicles operated in severe duty applications including construction, agriculture, and recreational vehicles. By design, these vehicles work in punishing conditions of extreme heat, rough terrain, and heavy payloads that put the transmissions under constant stress.

High performance transmission fluids, are irreversible loss of performance due to friction and wear. They also need to be resistant to contamination from dirt and debris, which are commonplace in off-road situations. With the rise in off-road vehicle uses in such industries as mining and agriculture, so arises a need for specific and toughened transmission fluids that can withstand such conditions.

The global Transmission Fluids market is shining with opportunity and are expected to grow at a healthy CAGR in the forecast period owing to its high performance as a lubricant in automotive as well as industrial applications. One of the significant growth drivers is the periodic maintenance of the fluids in the vehicle greenfield vehicle production and the automotive aftermarket services.

Sales of more expensive "premium" fluids such as automatic transmission fluids, continuously variable transmission (CVT) fluids, and double-clutch transmission (DCT) fluids are also forecasted to rise as automatic and CVT transmissions penetrate deeper into the marketplace.

Sustainability and eco-friendly formulations are also not only becoming an industry-wide concern, but also are driving the development of synthetic and bio-based transmission fluids. Rising focus on fuel efficiency and reduced carbon footprint, is prompting manufacturers to offer fluids that meet stringent environmental rules.

Moreover, industrial machinery and heavy equipment sectors are booming, which is also driving the growth of performance fluid. Huge competition market among multiple global chemical companies as well as regional lubricant manufacturers for market share, for performance and durability of the products but also for sustainability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ExxonMobil Corporation | 12-17% |

| Royal Dutch Shell | 10-14% |

| Chevron Corporation | 8-12% |

| BP Plc (Castrol) | 5-9% |

| TotalEnergies | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| ExxonMobil Corporation | Produces synthetic transmission fluids optimized for high-performance vehicles and heavy-duty applications. Strong focus on R&D and fuel efficiency. |

| Royal Dutch Shell | Offers Premium ATF (Automatic Transmission Fluid) with high wear protection using green lubricants. |

| Chevron Corporation | Produces industrial and automotive transmission fluids with an emphasis on thermal stability and extended drain intervals. |

| BP Plc (Castrol) | Covers transmission fluids for CVT and dual-clutch transmissions. Shifting focus to electric vehicle applications. |

| TotalEnergies | Provides extended life and improved oxidation resistance for automatic transmission fluids. Broader footprint within Asia-Pacific. |

Key Company Insights

ExxonMobil Corporation

ExxonMobil is a prominent leader in the transmission fluids market, offering a wide range of synthetic and mineral-based lubricants designed to enhance vehicle performance. The company is committed to improve fuel savings and reduce emissions that drives the company to develop better and better transmission fluid technology. With a robust global supply network, ExxonMobil is able to provide reliable access to products in major markets across the globe.

The company also works closely with original equipment manufacturers (OEMs) to create next-generation transmission fluids that will keep pace with changing industry performance requirements. This long-term commitment to innovation keeps ExxonMobil in the middle of the market in providing top-of-the-line, advanced lubricates for automotive and industrial applications.

Royal Dutch Shell

Royal Dutch Shell is a leading company in the global transmission fluids market and its presence is dominating Europe and North America. It focuses on low-viscosity/transmission fluids aimed at boosting performance and wear resistance. A collective effort to advance bio-based and low-carbon alternatives is underway as demand for them grows in response to tighter environmental regulations and sustainability advocacy.

Their ATF have extended service life and superior wear protection, which is very popular in both automotive and industrial fields. With an increasing focus on sustainability in recent times, Shell’s focus on eco-friendly and high-performance solutions puts them firmly in one of the leading positions.

Chevron Corporation

Chevron Corporation, maker of the well-known Delo brand and Havoline transmission fluids, is noted for offering incredible thermal stability and long drain periods, making them appropriate for car and overwhelming gear applications. Designed for extreme durability and performance, and made with advanced additive technology to help maximize fluid lifespan and minimize wear.

Chevron has a firm foothold in the market and is aggressively moving into emerging markets with a particular focus on growing the automotive and heavy equipment markets. The company's quality-focused and long-lasting transmission fluids drive its success across a competitive transmission fluids market through reliable solutions for performance under significant strain.

BP Plc (Castrol)

BP’s Castrol brand is a key player in the transmission fluids market, particularly in the development of CVT and dual-clutch transmission fluids. Castrol partners with automakers on next-gen lubricants that will be used in new transmission designs in response to the surge in the electric vehicle (EV) market. Sustainability goes hand in hand with corporate responsibility, and Castrol invests a huge amount of funds into developing carve neutral and other eco-friendly products to meet these environmental demands.

As a leading source for functional fluids ranging from engine oils to industrial lubricants, the company's investment in transmission fluid technology and dedication to sustainable solutions position it as a trusted partner for automotive and industrial applications alike, ensuring ongoing growth in the evolving market.

TotalEnergies

TotalEnergies is a leading provider in the worldwide commercial vehicles hydraulic and transmission lubricants business. Automotive need high-quality fluids meet modern automotive standards and they are investing heavily on R&D. TotalEnergies captures significant market share in a region of the world with strong energy demands by providing cost-effective, environmentally conscious alternatives that dovetail with growing trends toward sustainability.

TotalEnergies is also investing in the development of advanced lubricants that offer both durability and superior performance and is therefore a strong competitor in the transmission fluids market, especially in commercial vehicle applications.

The global Transmission Fluids Market is projected to reach USD 8,828.6million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.1% over the assessment period.

By 2035, the Transmission Fluids Market is expected to reach USD 13,194.7million.

The automotive industry represents a substantial and continuously growing consumer base for transmission fluids, with vehicles requiring regular maintenance and fluid changes.

Major companies operating in the Transmission Fluids Market Fuchs Petrolub SE, Valvoline Inc., Phillips 66, Amsoil Inc., Petro-Canada Lubricants, Idemitsu Kosan Co., Ltd.

In terms of Type, the industry is divided into Automatic, Manual, Other Types.

In terms of End Use, the industry is divided into Automotive, Off-Road Vehicles.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.