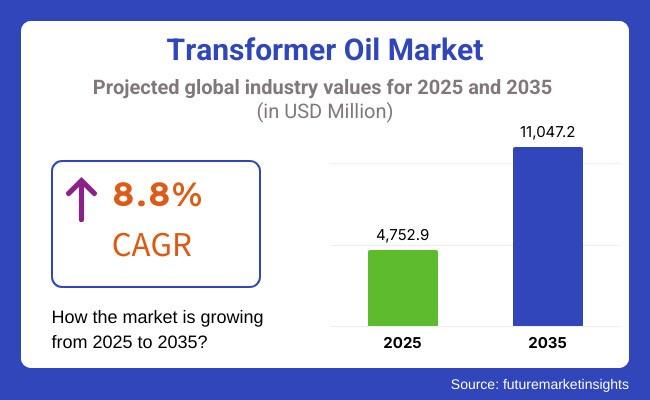

The global transformer oil market is poised for significant growth, driven by rising electricity demand and the expansion of power infrastructure. The market is projected to reach USD 4,752.9 million in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 8.8%, reaching USD 11,047.2 million by 2035. The market expansion is fueled by increasing investments in smart grids, renewable energy integration, and aging power infrastructure requiring efficient transformer maintenance.

The transformer oil market is being propelled by the increasing electricity demand and the necessity of distributing power reliably and efficiently. The utilities sector and the industrial sector are changing their transformers to boost their performance and lifetime, which, in turn, increases the usage of high-quality insulating oils. Furthermore, the introduction of bio-based and synthetic transformer oils is creating a dual opportunity of environmental sustainability and reduced ecological footprints.

Moreover, the combination of smart grids with the proliferation of high-voltage transmission systems is leading to a further increase in the transformer oil requirement. Besides, the regulatory measures propelling energy efficiency, and transformer safety are pushing most of the utilities, and manufacturers to install these innovative quenching fluids, which will positively impact the power network reliability.

The transformer oil market will continuously grow, thanks to rising energy carrying forces, grid refurbishment programs, and the progress toward council applicants of power. Companies that are innovative with regard to the use of insulating materials made from the power of nature, along with energy-saving devices, will be the leaders in the market. The necessity of meeting specific legal standards as well as technical progress encourages the promotion of high-efficiency transformer oils in the industry.

In the case of transformer oils, mineral oil-based ones are still the best choice as they are strong, cheap, and have a huge market in normal transformers. On the other hand, however, bio-based and synthetic oils are making headway thanks to their being environmentally friendly and their high thermal performance. The market for power transformers which is buoyed by the increased investment in power infrastructure and the grid upgrade is also the biggest share market of these products.

Explore FMI!

Book a free demo

The transformer oil market in North America is on a steady growth path, propelled by grid modernization and the rising share of renewable energy. The USA and Canada are making massive investments into upgrading their old transmission equipment, to boost energy efficiency and reliability. Furthermore, the region is witnessing the very first steps in the use of bio-based transformer oils driven by strict environmental regulations.

The industrial environment of the country comprises considerable transformer manufacturers' presence and horseshoe investments in research on advanced insulating materials that are also fueling the market. The expansion of the renewable energy project increases the need for excellent power transmission solutions, while the high-performance transformer oils provide space for innovation and market growth in the region.

Europe's transformer oil market keeps growing by the push of strict environmental regulations, focus on renewable energy, and a clear need for energy-efficient power transmission. Countries such as Germany, France, and the UK are investing in sustainable grid solutions, including high-voltage direct current (HVDC) transmission systems. The region's strong focus on an ecological approach has advanced the movement to bio-based transformer oils.

Besides, the spread of smart grid technologies and the rise of the renewable energy sector are pushing for more reliable, high-quality transformer oils. Manufacturers direct attention to innovation to fulfill the sustainability objectives, which now creates additional openings for market expansion, as the governments unleash initiatives for a greener economy.

The Asia-Pacific region is the market leader in transformer oil, with the highest proportion of the market driven by the establishment and expansion of power plants in, for example, China and India, as well as the growing industrial base.

As electricity demand continues to rise, investments in the construction of new transformers and the purchasing of components increase. The implementation of government-led initiatives, which aim for rural electrification and integration of smart grids, is backing up the consumption of transformer oils.

There are many challenges that occur when exploring a growing market like this. These include fluctuating raw material costs and regulatory hurdles that create obstacles for market players. Regardless of these variables, the necessity for technologically advanced and stable electricity networks guarantees the growth of the transformer oil market for a long time.

Rest of the World includes countries such as Latin America, the Middle East, and Africa where the transformer oil market is growing with the increased investments in power infrastructure. Latin America is focusing on the expansion of its transmission and distribution networks, thereby increasing the demand for transformer oils. The issue in the Middle East is a large number of power plants which causes the need for premium insulating oils for high-voltage transformers.

Africa's electrification and industrial development endeavors are also in the driver's seat, thus boosting the requirement for transformer oils. Even so, the ongoing challenges, which range from economic instability and lack of advanced manufacturing sites to the diversity of regulatory environments, could threaten market growth in those regions, though in the long-term potential always exists.

Challenges

Environmental and Regulatory Concerns:

The transformer oil market is getting harder to be survived by the super strict regulations on environmental matters, like the disposal of unused transformer oils and the environmental impact they have. A lot of countries across the globe have put on rules on waste management and emissions pertaining to hazardous substances that originate from transformer oil products.

Manufacturers have been pushed to implement sustainable solutions, as a result of these strict guidelines. These rules are of course operated from the perspective of increasing compliance costs when they really are just a way for the organizations to buy alternative insulating oils and do better environmental impact assessments.

These developments make it imperative for manufacturers to produce eco-friendly alternatives and tackle sustainability issues alongside the many liabilities that come with waste disposal, hence, bringing forth innovation in the transformer oil sector to comply with such dynamic regulatory expectations.

Fluctuating Raw Material Prices

Intermittent raw material prices affecting the costs of mineral-based transformer oils are especially the case with crude oil volatility. When the prices go up or down, manufacturers find it hard to keep their production costs stable and to manage their supply chains efficiently. Monetary instability is an issue as well since the profit margin has a correlation with the market stability.

One of the responses to this is the exploration of cost-effective alternatives whereby manufacturers are considering the use of bio-based transformer oils, which exhibit more predictable pricing. Not only is this a move towards environmental sustainability but it also means the diversification of input sources for the companies in the process to manage the raw material price instability in the transformer oil sector.

Opportunities

Growing Adoption of Bio-Based Transformer Oils

As environmental issues have been gaining more and more attention, the concept of bio-based and biodegradable transformer oils has been flourishing and largely replacing the traditional mineral oils. These oils are a great deal less toxic and generate significantly less carbon.

Thus, the strained regulatory requirements on the way to sustainable products and processes are an additional benefit for the manufacturers who are pursuing this path. Besides, it has become apparent that these oils have certain properties that they perform better at, like flame resistance and enhanced efficiency, than their counterparts.

Providing the bio-based oils is a high priority for almost all the governments and businesses who are focused on Environmental Friendly Solutions so the companies that invest in them are in the best position to ride the wave of demand for these greener and more sustainable transformer oil options.

Expansion of Renewable Energy Infrastructure

The world is attempting to transition to greener sources of energy like wind and solar. This trend pushes the need for an efficient transmission and storage system.

As more and more utilities and governments put their money into renewable energy infrastructure, they have simultaneously increased the requirement for high-performance transformer oils. Modernizing the grid that involves renewable energy integration and reliable energy storage and distribution are the main areas in which these oils find application.

As the ecosystem of green energy evolves, different manufacturers of the transformer oil have got plenty of potentials to support the renewed energy-based infrastructure with oils that are in line with. The shift not only adds to the market demand but it also results in innovations that are high-quality, energy-efficient, and designed for the needs of the renewable energy sector.

Following the pandemic, the transformer oil market has exhibited remarkable growth from 2020 to 2024 due to the surging need for electricity, grid modernization, and the renewable energy sector's growth. The sustained rise in infrastructure development and industrialization of emerging economies had also a hand in accelerating market expansion.

Furthermore, the trend has been towards natural insulating oils, which are less harmful to humans, and have been adopted more widely, contributing to the environmental benefits as well as the transformer efficiency gains.

During what we foresee as the period between 2025 and 2035, such a market will be predominantly determined by technological innovations like smart grids, alongside the wider application of bio-based transformer oils, and the imposition of rigorous environmental laws. Moreover, the paradigm shifts in the nanotechnology sector, with fluids having better cooling properties, will be the main pushers of the market development in transformer oils.

The transformer oil market is about to go through major changes mainly due to the changes in regulations, technological breakthroughs, and the need for sustainability. The period of 2020 to 2024 was marked by stable demand for both mineral and synthetic oils, whereas the next decade will be characterized by an increase in bio-based and advanced insulating fluids.

The transition to smart grids, the proliferation of renewable energy, and the construction of new generation power infrastructure all result in shifting of industry equilibrium. Companies that will venture into eco-friendly formulations, seek out nanotechnology breakthroughs, and optimize oil performance will outdo their rivals in this scenario which shall keep on changing.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emphasis on reducing toxic emissions and improving oil disposal practices. |

| Technological Advancements | Growth in high-performance mineral and synthetic transformer oils. |

| Industry-Specific Demand | High demand from power utilities, industrial applications, and renewable energy projects. |

| Sustainability & Circular Economy | Initial efforts to introduce eco-friendly alternatives and recycling initiatives. |

| Market Growth Drivers | Rising energy consumption, modernization of power grids, and industrial growth. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental regulations promoting biodegradable transformer oils. |

| Technological Advancements | Development of nanotechnology-enhanced insulating oils for better efficiency. |

| Industry-Specific Demand | Expansion into smart grids, offshore wind farms, and next-generation electrical infrastructure. |

| Sustainability & Circular Economy | Large-scale adoption of bio-based and fully recyclable transformer oils. |

| Market Growth Drivers | Increased investments in renewable energy integration and smart electrical networks. |

The rise of USA transformer oil market is dependent on the grid modernization, expansion of electricity-consuming products, and renewable energy projects. Smart grids are among the government-backed projects together with the retrofit of the old power infrastructure that will bring about energy-saving innovations.

High-Performance transformer oils reciprocally might be the most suitable lubrication for the growth of data centers and the industry. In addition, eco-friendly lifestyles are the primary drivers of the increase of the use of bio-based and biodegradable transformer oils.

Nevertheless, the supply chain interruptions and the constant fluctuation in crude oil prices are the obstacles to the expansion of the market. Another aspect is the added EV charging infrastructure, which brings the power transformers and oils sector a noticeable boost.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

The UK market for transformer oils is growing as a result of the integration of renewable energy, investment in smart grids, and industrial electrification. The government-specific carbon neutrality target and energy-efficient infrastructure program, are pushing the eco-friendly transformer oil demand up.

The increase in the offshore wind energy plants and high-voltage power transmission projects has created a requirement for transformer oils with dielectric strengths that are high. However, the market is affected by the increase in raw material prices and the post-Brexit trade uncertainty. The substitution of analog substations with digital ones and the upgrading of old power lines is the key factor that increases the need for innovative transformer oil solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

The transformer oil business in Germany is significantly influenced by the country concentration on renewable energy, the advancements in smart grid technology, and the renovation of power infrastructure. The Energiewende (energy transition) policy of the government has been responsible for driving progress in investments in wind, solar, and energy storage projects, thereby raising the bar for using advanced transformer oils.

The stringent EU regulations on carbon emissions have necessitated the migration of manufacturers towards bio-based and environmentally-friendly transformer oils. Further, the scaling of electrical vehicle technology and industrial automation fields will contribute to the development of the transformer oil market. However, the energy price increases and the import of crude oil are the major challenges the industry faces.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.5% |

The increase in household appliances and industrial machines together with the use of smart digital communication in transmission networks are the key drivers of the transformer oils sector in Japan. Also, safety measures are combined with the development of high-performance transformer installations.in the most hazardous areas including the high seismic areas. The continuous growth of renewable energy and also the put back of nuclear power since Fukushima has induced the necessity for special insulating transformer oils.

The presence of major transformer manufacturers like Toshiba and Hitachi and the adoption of high-temperature-resistant and durable transformer oils through thealmofinitive innovation imply that a long-term market for such goods exists. Nevertheless, the main challenges in this scenario are the high manufacturing costs and the fluctuation in the raw material prices.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.3% |

The transformer oil market of South Korea is on the rise owing to the rapid industrialization, the increase in the number of renewable energy projects, and the smart grid initiatives that are led by the government. The presence of the country in semiconductor manufacturing and heavy industries along with the increased electricity consumption, has created the demand for high-performance insulating oils.

The electric vehicles (EVs) being more frequently used and the plan of ultra-high-voltage transmission lines are the other factors that hold importance. The alliance of the South Korean administration with the mission to mellow carbon emissions has given birth to higher investments in bio-based and sustainable transformer oils. Thus, the sector does take a hit from the raw material dependency and the fluctuating crude oil prices.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

Mineral Oil Dominates Due to Cost-Effectiveness and Widespread Use

Mineral oil, despite the health risks of PCBs and technological advances in oil-paper insulation systems, is without doubt, the one that is still used most and is preferred by anybody for its cost, effectiveness, insulation properties, and the fact that it is widely available. With its inherent stability and potential for high thermal conductivity, it is the preferable cooling medium in most transmission and distribution networks.

Nonetheless, it has become the target for environmental concerns about it not being biodegradable and the possibility of fire hazards, thus bouncing it back to the strong attention it is getting. The relaxation of nations and the adoption of policies by agencies in different countries like North America and Europe is aimed at promoting greener options.

In spite of these shortcomings, the mineral oil-based transformer oils are still in hot demand in the Asia-Pacific region mainly because of their increases in the housing and infrastructure sectors.

The Silicone Oil's Popularity Rise with Thermal Stability

Another oil is silicone oil. It is on the rise and is considered an excellent choice as a transformer oil due to its unique ability to invest in high-performance applications. The material has outstanding thermal stability; it is also immune to oxidation and is fire resistant, so it can be safely used in transformers that are at a high risk of a fire.

Even if silicone oil is pricier than mineral, its cost is offset by the delivery of a longer service life, security, and health benefits that come with the new technologies. The use of silicone oils is particularly high in places that consider safety as a top priority, in addition, in sectors such as power production and manufacturing that need high-temperature resistance.

The silicone oils market has profitable terrain in Europe and North America with their respective commitments to improved energy efficiency and the invention of flame-retardant transformer technologies.

Transmission and Distribution Leads Market Demand

With the worldwide expansion of electricity grids and universal interest in the improvement of power reliability, the transmission and distribution (T&D) sector has become the major consumer of transformer oil. The necessity for electric grid in developing regions, especially the Asia-Pacific and Africa, has created a permanent market niche for modern and energy-efficient transformer oils.

Aging infrastructure in North America and Europe is also the reason for substitute requirement transformer oils. The integration of renewable energy and smart grids leads to a demand for the most efficient insulation solutions for transformers, partly accounting for market expansion. Transformer oils that are greener and biodegradable, have come into the bargaining as an option to follow regulatory requirements and solve a long-term problem at the same time.

Power Generation Sector Grows with Renewable Energy Development

The demand for transformer oils in the power generation sector is climbing due to the ever-increasing number of renewable energy initiatives. Wind and solar parks are in need of reliable transformer insulation to operate under variable loads and thus provide a stable transmission of electric power.

Areas actively pursuing renewable energy will locate sources of investment in the advanced transformer technologies, including the use of environmentally friendly transformer oils. Furthermore, thermal and hydroelectric power plants bring on demand, thus ensuring a steady supply of oils to all kinds of traditional and new electricity generation projects.

The Oil Sector is a smaller segment in the power and energy industry, being the key component of insulation and cooling for transformers, switchgear, and other electric devices. Oil for transformers makes sure of the superb performance of electrical grids and the excellent work of power distribution systems.

The market is propelled by the increasing requirement for energy, the upgrades to the power grid, and renewable energy project implementation. Major players are in control of the market internationally, while the regional suppliers answer to the demand in particular local territories.

The Transformer Oil Market is changing with the implementation of the principles of sustainability, energy efficiency, and grid renovation. The top players are benefactors in the industry with insulating oils of the highest performance, whereas new actors are oriented towards bio-based and cost-efficient products.

Should electricity grid investments continue to increase and integration of renewable energy accelerate, high-quality transformer oil requirements must also be met. The market regulation, invention of new technologies, and environmental factors will determine the extent of change, underlining the importance of trustworthy and ecological transformer oil.

The bio-based transformer oils trend being adopted by the companies respectively and this proves to be a strong driver of sustainability in the industry. These oils are made from renewable inputs and their life cycle products are biodegradable thus they totally eliminate the environmental balances from traditional oils.

The laws for eco-friendliness are getting tougher to handle, and at the same time, people are moving more towards being green, bio-based oils are therefore, more in demand as they have both features: they bring high efficiency, and at the same time, are not toxic. As a result, businesses are able to meet their sustainability targets while being able to produce their product effectively.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Nynas AB | 15-20% |

| Shell PLC | 12-17% |

| ExxonMobil | 10-14% |

| Sinopec Corporation | 8-12% |

| Cargill Inc. | 6-10% |

| Other Companies (Combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nynas AB | Leading supplier of naphthenic transformer oils with a strong focus on energy-efficient and sustainable solutions. |

| Shell PLC | Provides high-quality mineral-based and biodegradable transformer oils, ensuring superior insulation performance. |

| ExxonMobil | Develops premium electrical insulating oils with high oxidation stability and extended service life. |

| Sinopec Corporation | Offers cost-effective transformer oils with advanced chemical stability for global energy markets. |

| Cargill Inc. | Specializes in bio-based transformer oils, promoting environmental sustainability and enhanced fire safety. |

Key Company Insights

Nynas AB

Nynas AB is a world leader in the naphthenic transformer oils market, delivering top insulating solutions to the power and industrial sectors. The company emphasizes energy efficiency, oxidation stability, and biodegradability which guarantees the quality of electrical insulation for a long time. Nynas makes continuous investments in the development of transformer oils that are both sustainable and low-carbon. In this way, the company realizes its role as a key industry innovator.

Through the R&D initiatives of the company, new formulations are invented that increase operational efficiency and thermal performance. Nynas is a global player in transformer oils with manufacturing facilities in various countries and thus is able to meet the high demand for the insulating oils in energy distribution networks.

Shell PLC

Shell PLC takes a leading role in the transformer oil industry, offering both mineral and biodegradable insulating oils. The company supports the idea of high-performance and environmentally friendly solutions and makes them available to utilities, industrial applications, and renewable energy projects. Shell has a vast network and is a global company that guarantees reliable availability of products as it adheres to business standards.

The company is a significant player in research and development, and its products are consistently being improved in terms of thermal and oxidation stability. Shell works together with grid operators and transformer manufacturers to propose specific oil solutions which would prolong the life of electrical equipment. The focus on innovations that are sustainable and the compliance with environmental laws help the company to maintain its leadership in the market.

ExxonMobil

ExxonMobil assembles superior-grade transformer oils engineered for longer stability, oxidation resistance, and efficient cooling. The company establishes the R&D goals of improving the performance of dielectrics as well as cutting down on the maintenance costs for the grid operators. ExxonMobil, both as a brand and a company that projects technical know-how is the first choice of electrical equipment manufacturers.

The company has a strong sustainability strategy through the manufacturing of liquids for insulating fluids with innovative features of energy efficiency. The company also benefits from its huge sales network which makes it easy to deliver goods to consumers all over the world. By utilizing cutting-edge refining techniques, it guarantees that its transformer oils fulfill the highest safety and environmental criteria.

Sinopec Corporation

Sinopec Corporation is among the main suppliers of transformer oils and is known for delivering cost-effective and reliable insulating solutions. The company remains highly competitive across Asia and other developing markets with products that have remarkable oxidation resistance and thermal stability. Sinopec is on a path of both production growth and geographical diversification with the simple goal of reaching the customers.

The company has spent a considerable amount on the eco-friendly technologies of transformer oil, which are in line with the global initiative for environmental sustainability. The company R&D is centered on finding long-lasting products and cutting down the maintenance costs for utility providers. By being the low-cost provider and the supplier of quality products, Sinopec has successfully expanded in the emerging markets.

Cargill Inc.

Cargill Inc. is a trailblazer in bio-based transformer oils and actively promotes environmentally friendly and sustainable insulating solutions. Their natural ester-based oils are the safest choice in case of fires due to their high fire safety ratings and full biodegradability, which makes them a great fit for renewable energy projects and green utilities. Cargill's firm green energy approach goes alongside the growing industry trend of sustainability.

The corporation engages with regulators and utility companies to push for the introduction of industry standards in biodegradable transformer fluids. By continuously innovating, Cargill has been able to manufacture high-performance insulating materials that do not only cut back on carbon emissions but also improve the operation and safety of transformers.

The global Transformer Oil Market is projected to reach USD 4,752.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.8% over the assessment period.

By 2035, the Transformer Oil Market is expected to reach USD 11,047.2 million.

With the increasing demand for electricity worldwide, power infrastructure is continuously expanding, including the development of new transmission and distribution networks.

Major companies operating in the Transformer Oil Market Hydro-Québec, Savita Oil Technologies, Apar Industries, Valvoline Inc., Hyrax Oil Sdn Bhd, Engen Petroleum Ltd.

In terms of Oil Type: the industry is divided into Mineral Oil, (Paraffinic, Naphthenic), Silicone Oil, Bio-based Oil

In terms of End-use: the industry is divided into Transmission and Distribution, Power Generation, (Coal, Nuclear Plants, Wind Energy, Solar, Others), Railways & Metros

In terms of Application: the industry is divided into Transformer, Switchgear, Reactor

In terms of Transformer Capacities: the industry is divided into LV Transformers, (Up to 50 kva, 50 to 100 kva, 100 to 500 kva, Above 500 kva), MV Transformers, (Up to 1 Mva, 1 to 5 Mva, Above 5 Mva), HV Transformers, (Up to 10 Mva, 10 to 50 Mva, 50 to 100 Mva, 100 to 500 Mva, Above 500 Mva), Traction Transformer, (Up to 5 Mva, 5 to 10 Mva, 10 to 15 Mva)

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Polyurethane Foam Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.