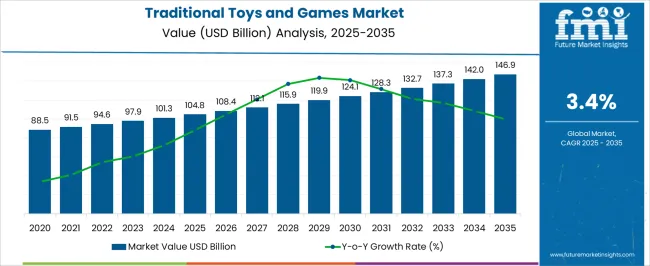

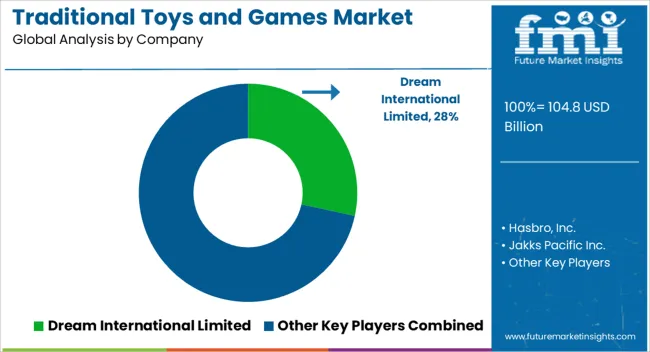

The Traditional Toys and Games Market is estimated to be valued at USD 104.8 billion in 2025 and is projected to reach USD 146.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Traditional Toys and Games Market Estimated Value in (2025 E) | USD 104.8 billion |

| Traditional Toys and Games Market Forecast Value in (2035 F) | USD 146.9 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The traditional toys and games market is witnessing sustained growth as parents and caregivers continue to prioritize educational, developmental, and entertainment value in play products. Rising awareness of the cognitive and motor skill benefits associated with traditional games and puzzles is reinforcing demand across households and educational settings.

Shifts toward sustainable materials and safe product design are reshaping manufacturing priorities, while global retail expansion and e-commerce growth have enhanced accessibility for diverse consumer groups. Regulatory standards around child safety and material quality are also driving continuous innovation and product refinement.

The outlook remains positive as manufacturers leverage branding, digital integration, and eco-conscious materials to align with consumer values while preserving the cultural and developmental importance of traditional play.

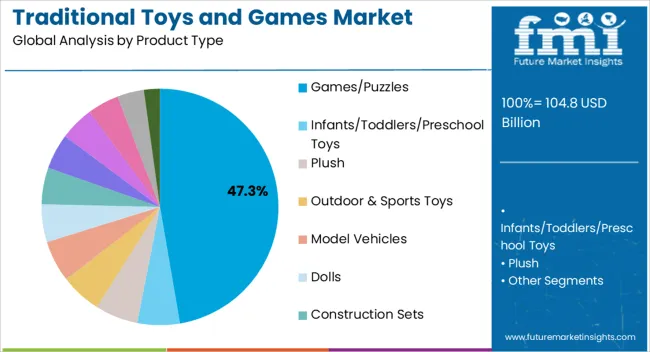

The games and puzzles segment is expected to hold 47.30% of total market revenue by 2025, establishing it as the leading product type. Its dominance is driven by rising parental preference for interactive and skill-enhancing products that improve problem-solving, memory, and concentration.

Growing demand for family-oriented activities has also supported adoption, particularly as board games and puzzles provide opportunities for collaborative and educational play.

The long shelf life and replay value of these products have further reinforced their popularity, positioning this segment as a core revenue driver within the traditional toys and games market.

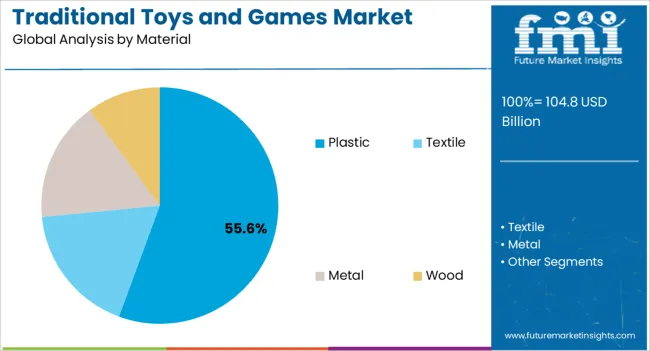

The plastic material segment is projected to account for 55.60% of the market by 2025, making it the most significant material category. This leadership is attributed to the durability, cost-effectiveness, and design versatility offered by plastic in toy production.

Manufacturers have adopted advanced molding and coloring technologies to enhance safety, aesthetics, and functionality, ensuring appeal across a wide age range. Plastic toys are also lightweight and adaptable to mass production, aligning with global retail and distribution strategies.

With rising innovation in recyclable and bio-based plastics, the segment continues to maintain its leadership while addressing sustainability concerns.

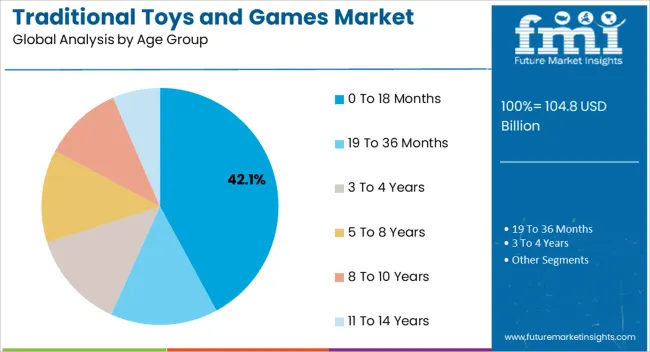

The 0 to 18 months age group is anticipated to represent 42.10% of total revenue by 2025, highlighting its dominance within the age group category. This demand is fueled by parental focus on early developmental products that promote sensory stimulation, motor skills, and cognitive growth.

Safety-certified designs, soft textures, and interactive features such as sound and movement are increasingly prioritized in toys for this age group. Growing awareness of the importance of early childhood development and the role of play in fostering foundational learning has reinforced adoption.

Consequently, the 0 to 18 months age group remains a critical growth driver in the traditional toys and games market.

Sales of traditional games and toys increased at a 3.3% CAGR between 2020 and 2025, finds FMI. Demand for traditional games and toys for at-home entertainment increased at a significant pace due to the lockdown restrictions imposed to curb the COVID-19 outbreak.

Manufacturers actively shifted towards online sales channels to keep sales of traditional toys and games afloat as physical stores were temporarily shut down. The global traditional toys and games market registered year-over-year growth by 2.3% between 2024 and 2025. Conventional toys are games are often crucial to support early childhood education in classrooms.

Teachers use traditional toys such as puzzles, construction sets, and other educational toys to stimulate play and cognitive development. These toys also help keeping children engaged and boost their curiosity and ability to explore and grasp knowledge about new shapes and elements.

Educational institutes across the globe are focusing on mental and physical learning. Educational toys are gaining traction, especially in preschools, kindergarten and middle school. This is expected to propel demand for traditional toys and games. A huge chunk of the millennial population is getting keen on obtaining traditional toys, figurines and puzzles as collectibles. This factor is encouraging manufacturers to re-launch traditional games, featuring legendary characters inspired by pop culture.

As per the traditional toys and games industry analysis, sales in the market is expected to grow at a 3.6% CAGR through 2035 on the back of the aforementioned trends.

Cognitive Benefits of Traditional Toys and Games Driving Sales

Cognitive development in children involves thinking skills, the ability to process information and a basic understanding of how the world works. Toys and games naturally offer opportunities for children to practice different thinking skills, such as cause and effect, imitation, symbolic thinking and problem solving.

For instance, when a teacher guides children how to use simple objects like pots and pans as drumming instruments, they imitate the teacher and make a sound of their own. Offering opportunities like this allows children to practice imitation, understand cause and effect and to discover new elements. Sensory play helps stimulate a child’s senses, develops hand-eye coordination and encourages interaction. Problem solving toys such as light-up mats, stackers and blocks and others help children figure out cause and effect, and boost their confidence through trial and error while promoting movement.

Themed playsets, construction sets and dolls help children develop their recognition skills. These toys also assist with language development by reinforcing the names of colors and shapes. Consumers, especially millennial parents, are widely recognizing the need for traditional toys and games for the development of their children’s cognitive abilities. These toys are being used not only in schools but also at homes, preschools, playpens, and babysitting facilities. Sales of traditional toys and games are expected to propel at a remarkably over the forecast period.

Pop Culture to Influence Spurring Demand for Traditional Toys and Games

Millennials are largely getting inclined towards purchasing figurines, puzzles and action figures of their favorite cartoon characters and superheroes. Depiction of these characters in movies, television shows, books, and comics are influencing purchasing decisions of millennials, as they want to have these unique collectibles in their collection.

Leading toy brands are capitalizing on this trend by honing in on the target audience’s memories and interests to develop stronger and emotional connections. Toy makers are realizing the significance of a visual language that connects to the experience of their past. They are offering toys and games that take the audience down the memory lane, by creating a theme around popular themes and characters from the 80s and 90s.

Millennials seek toys and games that feature pop culture references, which include Legos, Transformers, Star Wars and Strawberry Shortcake for their kids as parents who grew up in the 80s. Watching these shows and buying these toys connects millennials to their past and gives them a hint of nostalgia. These consumers also want their kids to have a similar experience as a mean to establish a shared memory.

For brands and marketers, it can lead to brand loyalty and increased sales. Apart from this, popular movies such as harry Potter, Shrek, Toy Story and Cars have rocked the box office as well as retail shelves with interesting tie-in figurines and games. In 2024, Leading pop culture consumer products and toys company Funko launched ‘Marvel Battleworld: Mystery of the Thanostones’, a micro table gaming system. The company collaborated with animation production and comics house Marvel to engage their younger fans and adults with a new range of products and animation collaboration.

Collecting such toys, puzzles and figurines is a trending hobby among millennials, young adults, and children under the age group 11 to 14. Sales of traditional toys and games are expected to soar in the forthcoming years, opines FMI.

Demand for Construction Games is Anticipated to Gain Momentum

Based on product type, sales of construction games are expected to gain traction over the assessment period, as per FMI. The construction games acquired a 17.2% market share in 2025. Construction games are popular among kids and young adults as they require creativity and decision making regarding the placement of objects and components.

Leading toy makers such as Lego and Hasbro have launched a myriad of construction games in the past that are still popular among individuals. Hasbro’s Jenga is a crowd favorite, and many similar toys and games are gaining attention of consumers as they can be played in a group or alone.

The Plastic Materials is the Most Sought-after Material Globally

In terms of material type, plastic is expected to emerge as the most preferred material for manufacturing toys and games. Plastic has been used in the toy manufacturing industry for many years due to factors such as low costs, ease of molding, and the possibility of producing complex shapes and forms.

Manufacturers operating in the traditional toys and games market are also focusing on research development to launch toys made form biodegradable plastic. Manufacturer are also using biodegradable plastics for packaging of games and toys to reduce carbon footprint.

The 3 to 4 years Age Group is likely to be More Attracted towards these Games

Sales of traditional toys and games for the age group 3 to 4 years are expected to gain traction over the assessment period, finds FMI. Demand for traditional toys and games for education purposed is increasing for children in this age group, which will continue providing tailwinds to sales of the same over the assessment period.

3 to 4 year olds are in their early stages of mental and physical development. Educational toys and games facilitate the development of cognitive abilities and decision making in children, which in turn will continue propelling sales of traditional toys and games through 2035.

The Hypermarkets/Supermarkets Sales Channel is Likely to be Highly Preferred by the Consumers

In terms of sales channels, the hypermarkets/ supermarkets is expected to expand at a steady pace over the assessment period. The hypermarket/supermarket sales gained a 25.6% market share in 2025. Growth in this segment is attributable to availability of a wide range of toys and games, along with convenience of choice, a wide array of things to choose from and payment options.

To keep themselves entertained at home, consumers were actively buying games and toys through this sales channels. This trend is predicted to continue in the forthcoming years, augmenting growth of the traditional toys and games market over the forecast period.

The Urge to Indulge the Kinds in Various Activities is Likely to Boost the Market Growth

In 2025, sales of traditional games and toys increased due to lockdown restrictions. Consumers were increasingly purchasing dolls, puzzles and model vehicles to keep their children engaged and entertained. Sales of traditional toys and games among adults also grew at a significant pace, as home-bound individuals wanted to pass time.

The United States will continue exhibiting high demand for traditional toys and games over the forecast period. The country accounted for a 16.4% market share in 2025. As per the study, sales of traditional toys and games in North America are slated to grow at a 2% CAGR through 2035.

Licensing and branding of traditional toys and games with popular franchise is also a key factor driving sales in the United States market. For instance, one of the most popular toy makers in the world, Hasbro, has licensed its toys and games with Transformers and Back to the Future that transform the DeLorean car featured in the movie just like a transformer.

Hasbro launched a unique product that grabbed the attention of kids as well as millennials by combining both of these elements from these famous movies. These developments are indicative of lucrative growth prospects for players operating in the traditional toys market in the United States.

Rising Trend towards Digitalization of Traditional Toys might Enhance Sales

Demand for traditional toys and games in the United Kingdom is expected to grow at a steady pace, on the back of growing trend of ‘home-entertainment’. As per FMI, the traditional toys and games market in Europe is forecast to expand at a 4.7% CAGR over the assessment period.

Digitalization of traditional toys and games is also expected to fuel growth of the market in the United Kingdom. Rapid adoption of smartphones, tablets, gaming consoles and other smart devices is broadening the scope for sales of toys and games through online channels. Brands are also using technologies such as virtual reality (VR) and artificial intelligence (AI) to attract consumers’ attention.

LEGO VIDIYO, for instance, is a music video making toy that enables children to star in their own music videos alongside Lego sets and mini figurines. These product developments are combining digital and physical worlds through connective technology, which is likely to gain traction in the forthcoming years. Demand for traditional toys and games is expected to remain high owing to the above-mentioned factors in the United Kingdom through 2035.

Increasing Consumer trend towards Collectibles is likely to propel Growth

Growing preference for eCommerce for purchasing traditional toys and games in China is expected to place it as an attractive market with a 7.1% CAGR during the assessment period. Even after the resumption of trade activities in China, consumers are buying essentials and non-essential commodities through online channels.

Rising trend of collectibles is also fueling sales of traditional toys and games in China. Consumers are seeking limited edition games, action figures, toys and puzzles to expand their collection, which in turn is spurring demand for the same. This trend is expected to continue over the forecast period.

The top traditional toys and games producers are focusing on expanding their product portfolio by launching new products through online sales channels. Apart from this, leading companies in the traditional toys and games market are aiming at strengthening their global footprint through mergers, strategic collaborations, and acquisitions. For instance:

The key players in this market include:

Some of the products being launched by the key players are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.4% from 2025 to 2035 |

| Market value in 2025 | USD 104.8 billion |

| Market value in 2035 | USD 146.9 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Material, Age Group, Sales Channel, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States, Canada, Mexico, Brazil, Germany, United Kingdom, France, Spain, Italy, Japan, China, Singapore, Thailand, Indonesia, Israel, GCC Countries, South Africa, Australia, New Zealand |

| Key Companies Profiled | Dream International Limited; Hasbro, Inc.; Jakks Pacific Inc.; Mattel, Inc.; Lego A/S; BANDAI NAMCO Holdings Inc.; LeapFrog Enterprises, Inc.; Spin Master Corp; Tomy Co., Ltd.; Playmates Toys Limited; Games Workshop Group PLC; Kids Ii Inc.; Madame Alexander Doll Company LLC; Mega Brands Inc.; Melissa & Doug Inc.; Funskool (India) Limited; Funko LLC; K'NEX Brands, L.P.; Ravensburger AG; MGA Entertainment, Inc. |

| Customization & Pricing | Available on Request |

The global traditional toys and games market is estimated to be valued at USD 104.8 billion in 2025.

The market size for the traditional toys and games market is projected to reach USD 146.9 billion by 2035.

The traditional toys and games market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in traditional toys and games market are games/puzzles, infants/toddlers/preschool toys, plush, outdoor & sports toys, model vehicles, dolls, construction sets, art and crafts, remote control toys, educational toys, dress up and role play and ride on vehicles.

In terms of material, plastic segment to command 55.6% share in the traditional toys and games market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Traditional Wound Management Market is segmented by product type, application and end user from 2025 to 2035

Pet Toys Market Analysis – Size, Share & Forecast 2025 to 2035

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Kids Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Male Sex Toys Market Forecast and Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Educational Toys Market Analysis and Overview by Category, End-use Sector, and Area through 2035

Eco-friendly Toys Market Size and Share Forecast Outlook 2025 to 2035

Personalized Toys Market Size and Share Forecast Outlook 2025 to 2035

Decompression Toys Market Growth - Trends & Forecast 2025 to 2035

Autonomous Robot Toys Market

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

Microwaveable Stuffed Animal Toys Market Size and Share Forecast Outlook 2025 to 2035

Board Games Market Size and Share Forecast Outlook 2025 to 2035

eSports & Games Streaming Market – Trends & Forecast 2023-2033

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA