The track and trace packaging industry is rapidly evolving as firms concentrate on supply chain transparency, anti-counterfeiting, and regulatory compliance. With industries digitizing, firms are integrating intelligent tracking technologies such as RFID, QR codes, blockchain authentication, and tamper-proof serialization. Companies are adopting cloud-based technology, AI-driven tracking analytics, and smart sensors to enhance traceability and prevent fraudulent activities.

They are reaching out for high-speed digital printing, intelligent barcoding, and Internet of Things-enabled track-and-trace solutions to increase end-to-end real-time monitoring and product protection. The trend is shifting towards environmentally friendly, economical, and precision track and trace packaging that responds to tough regulatory requirements in the pharma, food safety, and high-value commodity markets.

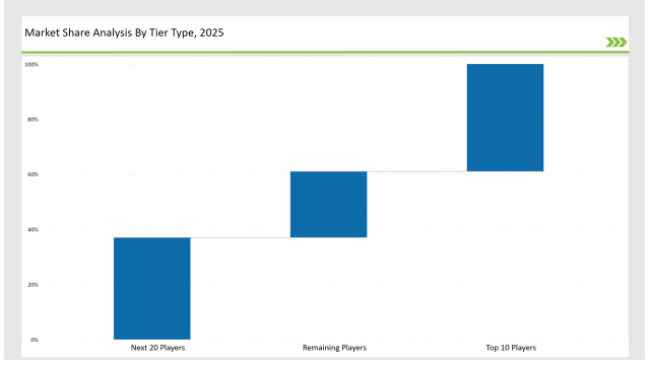

Tier 1 companies such as 3M, Avery Dennison, and CCL Industries hold 39% of the market share through their superiority in security labeling, RFID technologies, and vigorous global distribution network.

Tier 2 competitors like Zebra Technologies, UPM Raflatac, and Tesa SE account for 37% of the market share by enabling scalable, digital serialization, and high-performance track-and-trace labels that apply to logistics, pharma, and e-commerce jobs.

These Tier-3 simply consists of pure local and niche competitors with anti-counterfeit expertise, blockchain knowledge, and eco-friendly solutions, with the rest 24% under their belt. They focus on localized production, tailored security features, and AI-driven monitoring systems.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Avery Dennison, CCL Industries) | 19% |

| Rest of Top 5 (Zebra Technologies, UPM Raflatac) | 12% |

| Next 5 of Top 10 (Tesa SE, Lintec Corporation, SATO Holdings, Honeywell, Schreiner Group) | 8% |

The track and trace packaging industry serves multiple sectors where security, visibility, and compliance are critical. Companies are integrating advanced tracking technologies to meet regulatory requirements and improve supply chain efficiency.

Manufacturers are refining track and trace packaging solutions with real-time tracking, serialization, and anti-counterfeit features. They are incorporating AI-driven anomaly detection to alert anomalies in supply chains. Companies are also refining encrypted barcode technology to avoid tampering and unauthorized access. Companies are also creating interactive packaging that enables consumers to authenticate product authenticity using smartphone apps.

Automation and security are transforming the track and trace packaging market. Companies are adopting cloud-based tracking, forensic-level security print, and smart packaging solutions for improved authentication. Businesses are authenticating consumers by utilizing intelligent packaging with onboard NFC tags. Industry players are equipping manufacturers with real-time monitoring systems through AI-powered predictive analytics. Additionally, companies are adopting tamper-resistant, hologram, and encrypted track-and-trace labels for improving security and regulatory compliance.

Year-on-Year Leaders

Technology suppliers should focus on automation, AI-driven analytics, and advanced authentication solutions to support the evolving track and trace packaging market. Partnering with pharmaceuticals, logistics, and high-value consumer goods industries will accelerate adoption and innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Avery Dennison, CCL Industries |

| Tier 2 | Zebra Technologies, UPM Raflatac, Tesa SE |

| Tier 3 | Lintec Corporation, SATO Holdings, Honeywell, Schreiner Group |

Leading manufacturers are advancing track and trace packaging with AI-powered monitoring, sustainable materials, and advanced authentication solutions. They are enhancing tamper-proof packaging with encrypted serialization codes for greater security. Additionally, companies are adopting real-time tracking analytics to provide instant supply chain visibility and prevent unauthorized diversions.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched blockchain-integrated tracking labels in March 2024. |

| Avery Dennison | Developed RFID smart packaging for global supply chains in April 2024. |

| CCL Industries | Expanded high-security barcode serialization for compliance in May 2024. |

| Zebra Technologies | Released AI-driven tracking solutions for logistics in June 2024. |

| UPM Raflatac | Strengthened cloud authentication for tamper-proof packaging in July 2024. |

| Tesa SE | Introduced encrypted NFC-enabled track and trace labels in August 2024. |

| Schreiner Group | Pioneered smart QR codes for luxury goods in September 2024. |

The track and trace packaging market is evolving as companies invest in cloud-based monitoring, real-time authentication, and AI-driven tracking solutions. They are integrating blockchain-backed verification to enhance data security and prevent counterfeiting. Additionally, manufacturers are optimizing machine learning algorithms to predict and prevent supply chain disruptions. Companies are also incorporating temperature-sensitive tracking labels to monitor storage conditions and ensure product integrity.

Manufacturers will continue to use AI-driven monitoring, blockchain-based authentication, and encrypted security packaging. Companies will develop forensic-level printing for enhanced traceability. Businesses will expand predictive analytics and IoT-driven packaging solutions to optimize logistics. Smart packaging will enable real-time consumer authentication. In addition, AI-driven quality control will optimize production efficiency and sustainability. Companies will develop ultra-secure serialization techniques to enhance product authentication. Additionally, manufacturers will add real-time shipment tracking with dynamic QR codes to optimize logistics efficiency.

Leading players include 3M, Avery Dennison, CCL Industries, Zebra Technologies, UPM Raflatac, Tesa SE, and Schreiner Group.

The top 3 players collectively hold 19% of the global market.

The market shows medium concentration, with the top players holding 39% of the industry share.

Key innovation drivers include blockchain authentication, AI-powered tracking analytics, IoT-enabled real-time monitoring, and sustainable packaging solutions. Companies are focusing on smart labeling, encrypted barcodes, and predictive analytics to enhance security and supply chain visibility.

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Pails Market Analysis - Growth & Forecast 2025 to 2035

Needlecraft Patterns Market Analysis - Growth & Demand 2025 to 2035

Plastic Corrugated Sheets Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.