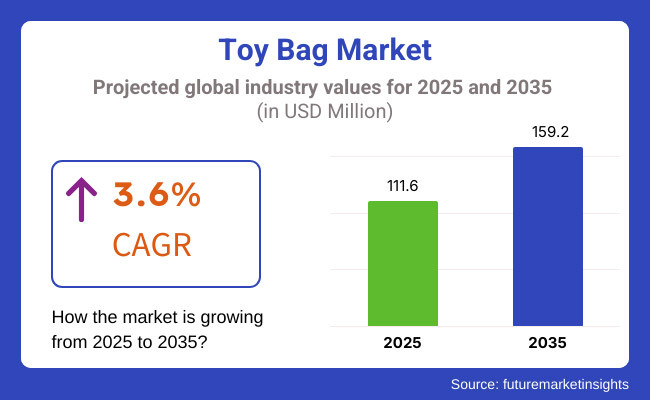

The global toy bag market will continue to grow due to increasing demand for organized and space-efficient storage solutions for children's toys. By 2025, the industry is expected to touch USD 111.6 million with a CAGR of 3.6%, driven by the increasing consumer preference for durable, kid-friendly, and elegant storage solutions.

By the conclusion of this forecast period in 2035, the value of the global toy bag segment is projected to reach around USD 159.2 million. Some of the reasons behind this trend are compact living spaces, urbanization, and consumer choice for eco-friendly materials.

Urbanization, compact living spaces, and consumer desire for sustainable materials drive these trends and helps meet the dynamic needs of parents and caretakers worldwide. This consistent growth can be attributed to growing urbanization, the increasing number of nuclear families and an upsurge in demand for sustainable and eco-friendly toy storage solutions.

E-commerce platforms offer parents a convenient shopping experience and are considered crucial for the expansion. E-commerce platforms would also promote the growth of online retail channels. Innovation in material, design, and functionality will continue to be the key growth drivers.

Explore FMI!

Book a free demo

The worldwide toy landscape underwent changes from 2020 to 2024. Companies like Lego posted record sales, bucking a widespread slowdown in the industry. Lego credited its performance to the approximately 300 new sets it released in the past year, including successful lines of products like Lego Icons, Lego City, and Lego Technic, as well as themed sets like Star Wars and Harry Potter.

Then, companies like Mattel were pivoting their supply chain in the direction of the demand, like ramping up production of the popular "Weird Barbie" doll immediately in the wake of the "Barbie" film. And these issues were further compounded by the advent of 3D printing technology that enabled consumers to produce their own versions at home of popular toys and games, resulting in complications surrounding copyright and trademark violations.

Between 2025 and 2035, one of the trends spotted at the 51st Hong Kong Toy Fair was a rise in eco-friendly toys made of sustainable materials, reflecting a global shift toward environmental consciousness. Experts predict that buyers will also prioritize educational and STEM toys, which combine play and learning to develop children's problem-solving and creative skills.

Experts anticipate that the industry will expand beyond children to include toys for teenagers, adults, and entire families, featuring stress-relief and family-bonding products. Increasing Tech Integration in Toys Advanced technology integration in the toy category is predicted to become even broader, as as technologies like AI, AR, and VR provide more immersive experiences. Rapid evolution in consumer preferences and increasing demand for interactive and educational toys will be some of the key factors driving growth of the smart toy industry.

| Key Drivers | Key Restraints |

|---|---|

| Rising demand for educational and STEM toys | High production costs for smart and tech-enabled toys |

| Increasing focus on sustainability and eco-friendly materials | Stringent safety regulations and compliance requirements |

| Expansion of e-commerce and digital sales channels | Counterfeit products and intellectual property concerns |

| Growing adult and senior toy segment | Saturation and competition from digital entertainment |

| Advancements in AI, AR, and VR-based interactive toys | Fluctuations in raw material prices affecting profitability |

| Strong brand collaborations and licensing deals | Declining birth rates in some regions impacting demand |

| Increasing parental preference for cognitive development toys | Consumer shift toward minimalism and reduced toy purchases |

Impact Assessment of Key Drivers

| Key Drivers | Impact |

|---|---|

| Rising demand for educational and STEM toys | High |

| Increasing focus on sustainability and eco-friendly materials | High |

| Expansion of e-commerce and digital sales channels | High |

| Growing adult and senior toy segment | Medium |

| Advancements in AI, AR, and VR-based interactive toys | High |

| Strong brand collaborations and licensing deals | Medium |

| Increasing parental preference for cognitive development toys | High |

Impact Assessment of Key Restraints

| Key Restraints | Impact |

|---|---|

| High production costs for smart and tech-enabled toys | High |

| Stringent safety regulations and compliance requirements | Medium |

| Counterfeit products and intellectual property concerns | High |

| Saturation and competition from digital entertainment | Medium |

| Fluctuations in raw material prices affecting profitability | High |

| Declining birth rates in some regions impacting demand | Medium |

| Consumer shift toward minimalism and reduced toy purchases | Low |

Between 2025 and 2035, preferences for toy bag materials will shift considerably. Plastic toy bags will remain a top segment as they are trendy and economical. As per our overall industry analysis, the plastic segment is estimated to contribute to almost 39.4% of the revenue generated globally.

Rising concerns regarding the environment will compel manufacturers to switch to recycled, eco-friendly plastic alternatives. These will be popular with eco-friendly consumers wanting to be sustainable in their toy storage options but will be limited across wider audiences due to durability issues. Fabric toy bags, such as cotton and canvas options, will be growing in popularity, especially since they can be reused multiple times.

Preference for bag type will shift, as functionality and convenience dictate purchase decisions. Since tote bags are easy to use and allow parents to store items on the go, they will continue to dominate sales. Families will be looking for more versatile travel and home organization options, so the duffle bags will be the best.

Drawstring bags, which are lightweight and convenient to store, are particularly well-liked by children, but they will still attract customers. Mesh bags will become more popular because of their breathable, see-through design, which makes it easy for kids and parents to find the toys inside.

Product designs and advertisement strategies will be based on consumer segmentation by gender, Boys' bags will also be very colorful and will generally have an action-oriented design theme sometimes borrowing the theme based on popular characters, vehicles or adventure. Boys usually like dark theme toys like black or white.

Girls’ toy bags will focus more on aesthetics, which is why they will tend to have pastel colors, dolls, and fashion-themed designs. Companies will also enjoy an increasing interest in gender-neutral designs as parents tend toward inclusive, unisex storage solutions.

Different innovative e-commerce strategies are shaping toy bag distribution. Warehouses stores will remain the most prominent distribution channels, offering a wide range of toys and toy bags in one location and allowing consumers to select toy bags in-store. Specialty retailers will receive generic, high-quality, customized, and themed toy bags tailored to their niche industries.

Growth will be primarily driven by online sales revenues due to the rise of e-commerce, improved price comparison capabilities, and the convenience of home delivery. Other offline sales channels, such as department stores and independent retailers, will still have a role, especially in regions where in-person shopping is a consumer preference.

The USA toy bag market is projected to register growth with the emergence of new competitors, rising demand for organized storage, and aesthetic storage solutions among consumers, leading to an anticipated CAGR of 3.8% from 2025 to 2035. Home organization and decluttering is a popular trend, and American households are investing in strong and durable toy storage solutions.

It has also pushed brands to experiment with eco-friendly materials such as recycled fabrics and biodegradable plastics to lure eco-conscious shoppers. The result includes customized storage solutions, foldable designs, and smart storage solutions with digital features.

This increased penetration of novelty toy bags and a wide product range across various e-commerce platforms, such as Amazon and Walmart, further supports progress. As the industry grows, innovation in material, design, and smart storage solutions will lead the industry, maintaining consumer curiosity.

The UK’s toy bag sector in 2035 will also mirror ongoing evolution on sustainability, functionality, and aesthetic appeal. The toy bag sector in the United Kingdom is capitalizing on a growing trend toward stylish, space-efficient, and even sustainable storage solutions. British consumers will expect the finest materials and a sleek sophistication that will fit perfectly into any contemporary home in any contemporary home.

This shift toward a more eco-friendly lifestyle has sparked increased interest in storage, specifically using recycled or biodegradable materials. Personalization is a major factor as parents increasingly seek custom-made toy bags. Home organizations, specialty stores, and online retail channels support all adjacent and extended industries.

The toy bag market in France is driven by a mix of aesthetics, functionality, and sustainability. French households favor sleek, space-saving storage solutions that complement modern interiors. There is a significant demand for eco-friendly materials such as organic cotton and natural plastics. Makers and crafters are also getting in the mix, with artisan handcrafted toy bags popping up in unique and beautiful designs.

As our cities grow and we live in smaller floor plans, the demand for economical storage solutions has resulted in the popularity of various racks for toys. The choices of consumers are heavily influenced by online retail and boutique home decor stores. By 2035, we anticipate more innovations in sustainable and customizable storage solutions in the sector.

Consumer demand for high-quality, durable, and sustainable storage solutions is expected to allow the toy bag landscape in Germany to evolve at a CAGR of 3.1% between 2025 and 2035. In Germany, families opt for functionality and durability when selecting toy bags, so they tend to favor robust and sustainable materials.

The increasing emphasis on sustainability has compelled manufacturers to prioritize biodegradable and recyclable alternatives. Especially in urban areas where space optimization matters, minimalistic and modular storage solutions are becoming more and more desired.

Particularly for online and brick-and-mortar retail stores that prioritize sustainability, and even more so for sustainable-based stores, this trend is driving segment growth. The year 2035 will mark a time when sustainable innovation and high-end premium quality are the focus of the German sector.

The toy bag market in South Korea is booming thanks to a bigger demand for compact, space-saving storage solutions in high-rise apartments. Consumers in South Korea prefer stylish, high-quality storage options that are convenient and can fit seamlessly into modern home decor. They seek products that are both high-end and sustainable.

Young parents who are fond of popular animated characters will find the customized and trendy designs appealing. The expansion in e-commerce and awareness through social media has contributed greatly to increased the penetration of the full range of innovative toy storage solutions.

Digital systems for smart storage, such as containers with QR codes for effortless organization, are on the rise. Trends driving South Korea’s toy bag sector by 2035 will increasingly orient around sustainability, digital integration, and space optimization.

In Japan, families choose streamlined, multifunctional storage compounds that help create home organization. As consumers become more conscious about sustainability, they are also opting for toy bags made from recycled fabrics as well as biodegradable materials. Foldable designs and, in one case, digital innovations like RFID tags to track what’s in storage are proving popular.

Online sales through e-commerce platforms such as Rakuten and Amazon Japan also drive most sales, presenting a wide selection of options to consumers. By 2035, Japan’s toy bag industry will likely encompass sustainable and technology-driven components.

The market for toy bags in China is projected to expand at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035, owing to urbanization, rising disposable incomes, and a growing appetite for space-saving storage formats. The combination of compact apartment living and an ambition for aesthetic appeal to toys has made functional and aesthetic toy storage solutions essential to Chinese families.

Online sales channels such as Alibaba and JD.com dominate sales, offering a wide variety of toy bags at competitive prices. Eco-responsibility is important in writing production, and more consumers choose sustainable options such as bamboo fiber and recycled plastics. Customization, foldable storage, and multifunctional designs are also gaining ground. New solutions in material, design, and digital storage will expand the Chinese industries by 2035.

The market for toy bags in India is forecasted to grow at a strong CAGR of about 5.8% in the years 2025 to 2035, due to the rising income levels of the middle class, the moving of the population from rural to urban areas, and increasing awareness about home organization. Indian customers, particularly in metros where space is at a premium, are fast adopting economical, sturdy, and space-saving storage solutions.

The growing awareness around sustainability is fueling demand for sustainable materials (like jute and organic cotton). E-commerce boom, however, has made the toy bags more accessible which helps to exnsuring a wide range of personalized toy bags through platforms like Flipkart and Amazon India By 2035, the Indian sector will continue to grow, focusing on smaller purses, sustainability, and innovative solutions for furnishing your home.

The industry for toy bags is relatively more consolidated as compared to the segment for other types of utility bags, as in the present scenario, the demand is primarily confined to a few prominent regions. These toy bags come in various designs and styles, they often match the interior decor and aesthetics of the space as well.

However, niche eco-friendly brands are gradually gaining traction through the introduction of sustainable and innovative storage solutions. A handful of major global players dominate the entire sector, ensuring uniformity in quality, design, and pricing.

Players in the toy bag market seek sustainable and innovative approaches for a competitive advantage in 2024. In the production of their products, manufacturers are using more sustainable materials such as recycled plastics and organic fabrics in the manufacturing of their offerings. These include new lines of biodegradable toy bags introduced by several large manufacturers to attract eco-minded parents.

These companies are adding smart features to their products, like modular designs and interactive components, to boost the functionality and reach the techiest children. Another method involves forming partnerships with popular media franchises, aiding in the development of exclusive licensing agreements for their stores, and creating special themed bags to entice children.

New brands are focusing on customizable toy storage options, and parents and children can select styles they prefer. Many of these startups specialize in eco-friendly materials or ethical manufacturing practices, appealing to an increasing share of consumers who anticipate the brands they follow to exercise a comparable obligation to the world and society as a whole.

These companies are doing all that while also raising brand awareness and targeting demographic groups. But on the other hand, Concerns over counterfeiting have emerged, prompting established brands to closely monitor platforms to protect their intellectual property and product safety. In response to these issues, the two platforms have enhanced their monitoring systems and removed offending listings.

In 2024, the toy bag is focusing on sustainability, technological advancements, and partnerships between brands and retailers. So, whether it's bridging the gap in consumer behavior or leveraging the opportunities offered by digital channels, leading players in the retail space are adapting to the realities of a fast-changing environment.

The growing need for organized storage, eco-friendly materials, and multifunctional designs is fueling demand for toy bags.

Online retail channels are gaining traction, general stores, and specialty stores remain important.

Yes, there is a rising preference for eco-friendly materials like fabric and biodegradable options due to increasing consumer awareness.

Which regions are leading in toy bag sales? North America, Europe, and East Asia currently dominate in sales, while South Asia and China are emerging as the fastest-growing industries due to rising disposable incomes and increasing demand for space-saving and sustainable storage solutions.

It is segmented into Plastic, Paper, Fabric, Metal, and Others.

It is segmented into Tote Bag, Duffle Bag, Drawstring Bag, and Mesh Bag.

It is segmented into Boys and Girls.

It is segmented into Supermarket and Hypermarkets, Specialty Stores, Online Retail Channels, and Other Offline Sales Channels.

It is segmented into North America, Latin America, Europe, East Asia, South Asia and Pacific, and The Middle East and Africa (MEA).

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.