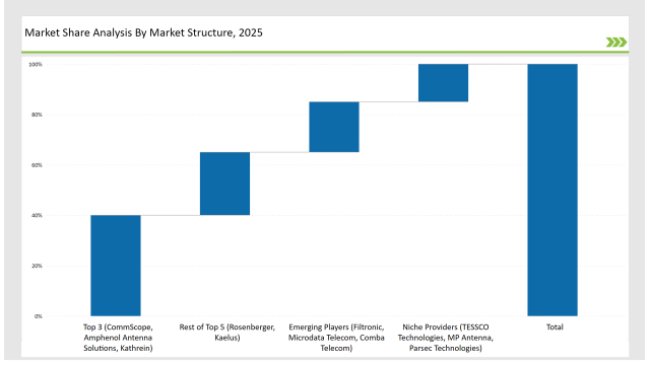

Telecom operators and network providers are increasingly adopting advanced amplification solutions, including Tower Mounted Amplifiers, to improve signal strength, reduce noise, and achieve optimal network performance, contributing to rapid growth in the Tower Mounted Amplifier (TMA) market. The leading three players-CommScope, Amphenol Antenna Solutions and Kathrein-together account for 50% of the market, capitalizing on advanced low-noise amplifier (LNA) technology and 5G-ready solutions.

The second and third players, Rosenberger and Kaelus, comprise an additional 20% of the market, providing energy-efficient, frequency-agnostic amplifiers. There are 20% part of Emerging players like Filtronic, Microdata Telecom and Comba Telecom with more strength in small-cell deployments and low-cost network expansion. Niche providers (TESSCO Technologies, MP Antenna, Parsec Technologies, etc.) capture 10%-focused on remote area coverage and mission-critical communication applications.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (CommScope, Amphenol Antenna Solutions, Kathrein) | 40% |

| Rest of Top 5 (Rosenberger, Kaelus) | 25% |

| Emerging Players (Filtronic, Microdata Telecom, Comba Telecom) | 20% |

| Niche Providers (TESSCO Technologies, MP Antenna, Parsec Technologies) | 15% |

| Market Concentration | Assessment |

|---|---|

| High (> 60% by top 10 players) | Medium |

| Medium (40-60%) | High |

| Low (< 40%) | Low |

The Single Band TMA segment leads the market with a 55% share, enhancing signal transmission in dedicated frequency bands. These TMAs provide superior noise reduction and signal clarity, making them a top choice for telecom providers.

The Multi-Band TMA segment is expanding quickly, holding 45% of the market. As network operators demand flexibility and efficiency, multi-band TMAs enhance performance by supporting multiple frequency bands simultaneously, reducing infrastructure complexity and deployment costs.

The Analog TMA segment holds a 60% market share, remaining popular due to its cost-effectiveness and reliable performance in traditional network architectures. Many regions still deploy these amplifiers where LTE and legacy networks dominate.

The Digital TMA segment is gaining momentum, comprising 40% of the market as demand for next-generation 5G networks increases. Digital TMAs offer superior interference management, real-time monitoring, and adaptability for complex network environments.

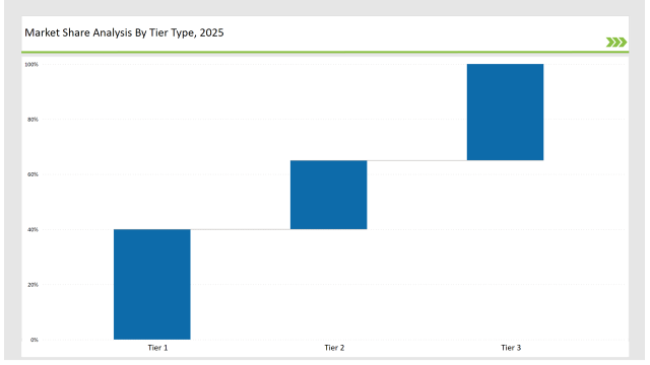

| Tier | Tier 1 |

|---|---|

| Vendors | CommScope, Amphenol Antenna Solutions, Kathrein |

| Consolidated Market Share (%) | 40% |

| Tier | Tier 2 |

|---|---|

| Vendors | Rosenberger, Kaelus, Filtronic |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Microdata Telecom, Comba Telecom, TESSCO Technologies, MP Antenna, Parsec Technologies |

| Consolidated Market Share (%) | 35% |

| Vendor | Key Focus |

|---|---|

| CommScope | Advances AI-driven TMA solutions for 5G applications. |

| Amphenol Antenna Solutions | Integrates beamforming technology for enhanced signal transmission. |

| Kathrein | Strengthens smart antenna and IoT-enabled TMA offerings. |

| Rosenberger | Develops energy-efficient, multi-band TMAs. |

| Kaelus | Innovates interference-resistant and lightweight TMAs. |

Telecoms must evolve AI-driven network monitoring that will allow them to make quality adjustments immediately and more efficiently. The layered structures of neural networks will be used to develop machine learning based self-optimizing networks to improve coverage while minimizing manual intervention, facilitating the smooth transition to 5G networks.

TMAs the supporting elements of 5G and a widely expanded IoT environment will be indispensable components for the high-speed data exchange and ultra-low latency applications. Vendors are also encouraged to consider employing blockchain-enabled network security solutions capable of ensuring data integrity and preventing breaches of network infrastructure access.

The volume of telecom infrastructure investments in burgeoning markets is also significant. To Drive Adoption Rates:Pay Attention to Multi-language Interfaces and Regional Compliance Standards

Cloud-based TMA remote management solutions would offer a competitive advantage for telecom operators enabling them to optimize performance in real-time with no physical maintenance required till required. To achieve a long-term success in this emerging market, vendors must form strategic alliances with telecoms giants and regulatory agencies.

Leading vendors CommScope, Amphenol Antenna Solutions, and Kathrein hold 50% of the market.

Emerging players Filtronic, Microdata Telecom, and Comba Telecom hold 20% of the market.

Niche providers TESSCO Technologies, MP Antenna, and Parsec Technologies hold 10% of the market.

The top 5 vendors (CommScope, Amphenol, Kathrein, Rosenberger, and Kaelus) control 70% of the market.

Market concentration in 2025 is categorized as medium, with the top 10 players controlling 80% of the market.

Electric Switches Market Insights – Growth & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Eddy Current Testing Market Growth – Size, Demand & Forecast 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

IP PBX Market Analysis by Type and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.