World tortilla mix market will be experiencing growth with growing popularity of convenience food, growing popularity of Mexican food, and well-being trend toward alternative bread. Tortilla mix is a hassle-free, easy-to-apply product to produce your own tortillas and keep the natural flavor and texture.

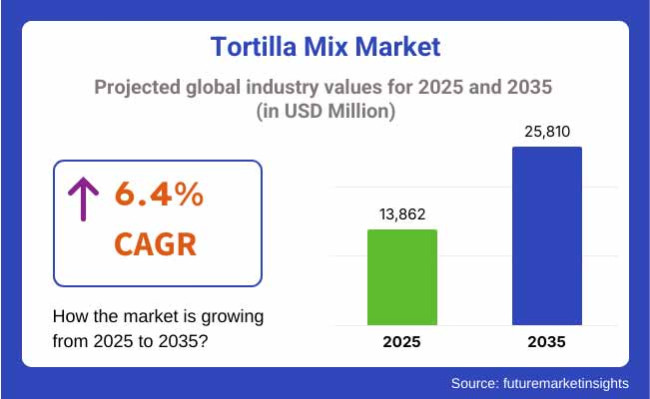

Organic, gluten-free, the consumers' turn toward them has spurred the next generation of product forms. Market value of tortilla mix is expected to be around USD 13,862 million in 2025. It will be around USD 25,810 million at a compound annual growth rate of 6.4% by 2035.

The market is building momentum with continued product development of gluten-free, whole wheat, and organic tortilla mix options. The market for tortilla mix will increase steadily during 2035 with rising demand from home bakers, restaurants, and foodservice outlets.

North America is leading the market for tortilla mix by virtue of having very high popularity for Mexican food, which has created a strong base of large tortilla brands, and growing consumer inclination toward convenience meal options.

The United States is specifically leading the market growth, wherein chain stores and specialty stores are augmenting their volumes of products for tortilla mix to cater to health-conscious and convenience-demanding consumers.

The European tortilla mix market has seen increased demand for the product, particularly in nations like the United Kingdom, Germany, and Spain. Increased consumption of plant-based foods and organic and gluten-free demand for tortilla mix drive the growth of the market in the region. Tortilla mix private-label products are increasingly being stocked by European supermarkets, hence increasingly becoming increasingly available to an increasingly large number of customers.

Asia-Pacific is the most rapidly expanding market for tortilla mix, led by worldwide food awareness, urbanization, and eating pattern shift. Japan, South Korea, and Australia are all experiencing rising trends of Mexican-style restaurants and native cuisine with tortillas. Growing demand fueled by the trend towards healthy and preservative-free tortilla mixes is also propelling innovation and growth in demand in the region.

Challenges

Ingredient Sourcing, Price Fluctuations, and Consumer Awareness

One of the largest market issues for tortilla mix is volatile raw material prices like corn and wheat that affect manufacturing costs and profitability. Procuring non-GMO, organic, or specialty ingredients might also be difficult for manufacturers to address changing consumer demand. Consumer awareness of tortilla mix products is low in emerging markets versus traditional flatbreads and regional competition.

Opportunities

Healthy Choices, Growth in Developing Markets, and Internet Expansion

Despite such constraints, the market for tortilla mix is replete with opportunities. Due to the increasing consumer trend towards healthier consumption, enriched and high-protein tortilla mixes have been launched.

Companies are entering growth markets with increased outreach through strategic alliances with supermarkets and online stores. Web sites proliferate exponentially, enabling brands to reach consumers directly through subscription models and web-only products.

There was a surge in demand for tortilla mix in 2020 to 2024 as well as the growing trend of cooking at home during the pandemic lockdown. Convenient food was required by the population, and hence, companies launched new, flavored, and gluten-free tortilla mix offerings. Sudden price variations in basic materials like corn flour resulted in supply chain irregularities.

From 2025 to 2035, tortilla mix food will expand and diversify in response to new niche diet niches like keto, protein-fortified, and organic. Local sourcing of package material and sustainable package protocols will gain visibility as companies seek out eco-friendly manufacturing processes. On the docket, too, is broader use of AI-powered personal recommendation on e-commerce platforms, driving customer behavior through purchase and consumption-driven product recommendation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adherence to food safety regulations, GMO labeling regulations, and local flour fortification requirements. |

| Consumer Trends | Demand for heritage corn and flour tortilla mixes in foodservice and home cooking. |

| Industry Adoption | Heavy usage by Mexican restaurants, QSRs, and retail bakery market segments. |

| Supply Chain and Sourcing | Dependent on locally sourced corn and wheat suppliers, with weather and trade policy variability. |

| Market Competition | Controlled by brands such as Maseca , Bob's Red Mill, and King Arthur Baking. |

| Market Growth Drivers | Spurred by Mexican food popularity, home cooking growth, and demand for clean-label products. |

| Sustainability and Environmental Impact | Early initiatives towards recyclable packaging and minimizing food waste during manufacturing. |

| Integration of Smart Technologies | Implementation of quality control sensors in flour milling and ingredient mixing. |

| Advancements in Product Formulation | Emphasis on shelf-stable dry mixes with little or no preservatives. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increase in organic and non-GMO certification standards, as well as more stringent allergen labeling laws. |

| Consumer Trends | Increased demand for gluten-free, whole grain, and plant-based tortilla mix varieties due to health-oriented consumers. |

| Industry Adoption | Expansion into meal kit operations, convenience store products, and private-label tortilla mix brands. |

| Supply Chain and Sourcing | Implementation of regenerative agriculture practices and diversified sourcing to offset climate-related supply chain disruptions. |

| Market Competition | Entry by niche artisanal tortilla mix manufacturers emphasizing heirloom grains and sustainable packaging. |

| Market Growth Drivers | Spurred by global growth, fusion food trends, and protein-rich tortilla substitutes. |

| Sustainability and Environmental Impact | Complete shift to biodegradable packaging, water-saving milling operations, and carbon-free supply chains. |

| Integration of Smart Technologies | Increased use of AI-optimized production, blockchain -based supply chain visibility, and real-time inventory monitoring. |

| Advancements in Product Formulation | Creation of fortified tortilla blends with supplemental fiber, protein, and functional ingredients such as probiotics. |

The USA tortilla mix market is robust and is driven by a number of key factors. Rising popularity of Mexican food among US consumers has fueled demand for tortillas and tortilla foods, including tortilla mixes.

Demand also is growing for organic, gluten-free, and non-GMO versions as health-conscious shoppers look for cleaner, more natural ingredients. With America's increasing Hispanic population comes America's increasing demand, as well, and since tortillas are such a ubiquitous home staple, grocery stores and websites are piling up increasingly more varieties of tortilla mixes, from specialty to diet tortillas, in order to make them available to more individuals.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

In the UK, increasing popularity of overseas foods, especially Tex-Mex food and Mexican food, has propelled the market for tortilla mix. British consumers are increasingly experimenting with foreign flavors, and food prepared from tortillas is becoming mainstream home cooking.

Dominance of premium, high-quality tortilla mixes in supermarkets and specialist food shops has encouraged the growth of the market. In addition, the partnerships of off-shore suppliers with local companies have increased the number of tortilla mixes offered, which both consumers who are interested in traditional or health-oriented products are attracted to. Moreover, convenience brought through web-based food shopping has increased the ability to try new products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

European tortilla mix market is growing as consumers choose increasingly more clean-label, organic, and minimally processed foods. Healthy trends fuel trendy whole-grain and gluten-free tortilla solutions in Germany, France, and Spain.

The change in regulations supporting plant-based diets and natural food products also fuels the trend. Shopper demand still encourages supermarket expansion of offer for baking mixes that offer ingredients for the type of food a shopper can and wishes to make. Expanded flexitarian and vegetarian consumption across Europe also spurs demand for tortilla mixes based on alternative grains and healthier ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6 .1% |

The Japanese tortilla mix market is increasingly picking up steam as Mexican and Western food become increasingly popular, particularly in urban cities such as Tokyo and Osaka. As more Japanese citizens move towards global food trends, demand for foods based on tortillas continues to grow.

Whole wheat and low-carb tortilla mixes, as they focus on nutrition and wellness, are particularly in demand because consumers in Japan prefer to focus on wellness and nutrition. Supermarkets and specialty food stores are developing business to stock not only imported, but domestic tortilla mix as well. Also, foodservice chains, restaurants, and coffeehouses are incorporating tortillas into menu items, generating further market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The South Korean tortilla mix market is growing at a phenomenal pace spearheaded by the Korean-Mexican fusion food demand. Bulgogi tacos and kimchi quesadillas have put tortillas in the limelight of Korean cuisine, creating growing demand for tortilla mixes.

Online meal kit and grocery shopping has also fueled the market boom as consumers seek convenient, high-quality ingredients to cook at home. Specialty and premium tortilla mixes such as gluten-free and organic are favored by health-conscious consumers. Foreign food companies also make inroads in South Korea, which makes market diversification simpler.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

| By Product Type | Market Share (2025) |

|---|---|

| Corn Tortilla Mix | 46 % |

Corn tortilla mix will lead the market for tortilla mix with 46% of total demand until 2025. Increased use of authentic Mexican flavor and inclination towards gluten-free food has stimulated growth in the segment. Industry leaders Bob's Red Mill and Maseca have created a brand image of being dependable with quality stone-ground corn mixes offering better texture for consumers to make fresh tortillas at home.

In addition, increasing needs for organic and non-GMO corn tortilla mix, especially in North America and Europe, further propel market expansion. The convenience of use of corn tortilla mix in applications for enchiladas, tacos, and tostadas further solidifies its status as the most desired among consumers and foodservice operators.

| By Distribution Channel | Market Share (2025) |

|---|---|

| Offline | 58 % |

Offline distribution channels, such as grocery stores, specialty food stores, and local food store chains, will capture 58% of the market for tortilla mix in 2025. Customers want to visit offline stores to buy tortilla mix in bulk packages so that it remains fresh and they have the opportunity to examine the quality of the product prior to buying it. Mass box retailers such as Walmart, Kroger, and Costco still lead in sales with their complete range of corn and flour tortilla mixes in every size.

Ethnic foodstores and Latin American specialty stores also have high sales, especially for gourmet and artisanal tortilla mixes. Despite online purchases growing by the minute, the need for ready availability in stock and individual choice places traditional channels still strongly in the leadership role in the marketplace.

Growing demand from consumers for easy-to-consume, clean-label, and gluten-free tortilla mixes is driving market growth of tortilla mixes. Manufacturers are producing organic, whole grain, and high-protein products to serve health-conscious customers.

Major companies are also spending on sophisticated milling and processing technologies to provide enhanced texture and flavor. Private label and artisanal companies are also emerging, adding to the level of competition in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Gruma S.A.B. de C.V. | 28-32% |

| Archer Daniels Midland (ADM) | 18-22% |

| General Mills, Inc. | 14-18% |

| Cargill, Incorporated | 10-14% |

| Bob’s Red Mill Natural Foods | 6-10% |

| Other Companies (combined) | 12-16% |

| Company Name | Key Offerings/Activities |

|---|---|

| Gruma S.A.B. de C.V. | In 2024, launched an organic whole-wheat tortilla mix line under its Mission brand. In 2025, expanded production capacity in North America to meet rising demand for gluten-free and non-GMO mixes. |

| Archer Daniels Midland | In 2024, developed a high-protein tortilla mix using pea protein for plant-based diets. In 2025, introduced AI-driven quality control in its flour mills to improve consistency. |

| General Mills, Inc. | In 2024, rolled out a limited-edition tortilla mix infused with ancient grains. In 2025, partnered with restaurant chains to supply custom tortilla mix formulations. |

| Cargill, Incorporated | In 2024, invested in sustainable sourcing for its corn-based tortilla mixes. In 2025, introduced a reduced-sodium tortilla mix line for the health-conscious segment. |

| Bob’s Red Mill Natural Foods | In 2024, expanded its distribution of organic and sprouted grain tortilla mixes. In 2025, launched an e-commerce subscription service for direct-to-consumer sales. |

Key Company Insights

Gruma S.A.B. de C.V. (28-32%)

Gruma dominates the global tortilla mix market due to its large portfolio of Mission-branded products. It enjoys positive positioning in Latin America and North America by using its gigantic factories and R&D to churn out clean-label and organic mixes.

Archer Daniels Midland (18-22%)

ADM is one of the leading grain processing companies, with new protein blends and sustainable sourcing in its tortilla mix. The company is building its base in the plant-based category with high-fiber and protein products.

General Mills, Inc. (14-18%)

General Mills is building its base with premium and artisanal forms of tortilla mix, using ancient grains and functional ingredients to reach health-oriented consumers. Its foodservice partnerships contribute to building its market base.

Cargill, Incorporated (10-14%)

Cargill boasts a strong corn and wheat flour tortilla mix supply chain, with health-focused innovations and sustainable sourcing being the highlight. Introducing new lower-sodium items is in reaction to shifting consumer behavior towards reduced-sodium eating.

Bob's Red Mill Natural Foods (6-10%)

Bob's Red Mill is a top organic and natural foods firm with a range of non-GMO and whole grain tortilla mixes. It is using direct-to-consumer sales and the internet to extend its market reach.

Other Key Players (12-16% Combined)

The overall market size for the tortilla mix market was USD 13,862 million in 2025.

The tortilla mix market is expected to reach USD 25,810 million in 2035.

The increasing demand for convenient and ready-to-use food products, growing popularity of Mexican cuisine, and rising consumer preference for clean-label and organic ingredients fuel the tortilla mix market during the forecast period.

The top 5 countries which drive the development of the tortilla mix market are USA, Mexico, Canada, Spain, and Brazil.

On the basis of application, the food service sector to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Claim, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Claim, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Claim, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Claim, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Claim, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Claim, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Claim, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Claim, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Claim, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Claim, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Claim, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Claim, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Claim, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Claim, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Claim, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Claim, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Claim, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Source, 2023 to 2033

Figure 28: Global Market Attractiveness by Claim, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Claim, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Claim, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Claim, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Claim, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Claim, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Source, 2023 to 2033

Figure 58: North America Market Attractiveness by Claim, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Claim, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Claim, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Claim, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Claim, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Claim, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Claim, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Claim, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Claim, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Claim, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Claim, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Claim, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Source, 2023 to 2033

Figure 118: Europe Market Attractiveness by Claim, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Claim, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Claim, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Claim, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Claim, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Claim, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Claim, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Claim, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Claim, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Claim, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Claim, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Claim, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Source, 2023 to 2033

Figure 178: MEA Market Attractiveness by Claim, 2023 to 2033

Figure 179: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tortilla Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tortilla Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Tortilla Bread Industry

USA Tortilla Market Report – Growth, Demand & Forecast 2025-2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Korea Tortilla Market Analysis by Product Type, Nature, Source Type, Process Type, Sales Channel, and Region Through 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Gluten-Free Tortilla Market Trends – Free-From Foods & Market Growth 2024-2034

Western Europe Tortilla Market Analysis by Product Type, Nature, Source, Process, Sales Channel, and Country through 2025 to 2035

Mixed Reality Surgery Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Mixed Signal IC Market Size and Share Forecast Outlook 2025 to 2035

Mixed Xylene Market Trends - Demand, Innovations & Forecast 2025 to 2035

Mixing Console Market by Type, Sales Channel, Application & Region Forecast till 2025 to 2035

Mixers & Attachments Market

Mixers Market

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Premix Bottled Cocktails Market Trends - Growth & Consumer Shifts 2025 to 2035

Premix Bread Flour Market Growth - Trends & Applications 2025 to 2035

Premixed Cocktail Shots Market Growth - Consumer Trends 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA