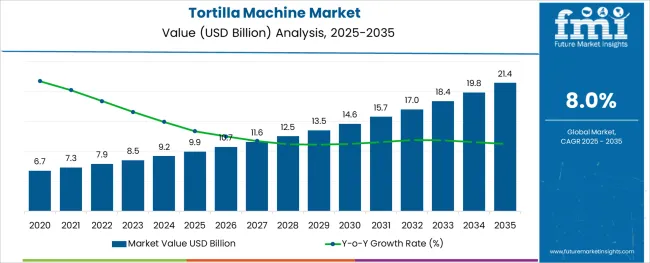

The Tortilla Machine Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 21.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The tortilla machine market is undergoing notable growth as demand for efficient, high-volume production aligns with the rising global popularity of tortillas in both traditional and fusion cuisines. Manufacturers are increasingly investing in advanced machinery to meet stringent quality standards while optimizing output and reducing labor costs.

Growth is being shaped by the dual forces of modernization in food manufacturing and the expanding footprint of quick service restaurants and packaged food brands that require consistent, scalable production solutions. Innovations in energy efficiency, hygienic design, and material handling are further enhancing adoption among large and mid-sized food processors.

Future opportunities are expected to emerge from the integration of smart controls, improved automation, and modular designs that allow customization, making it easier for enterprises to adapt to changing consumer tastes and regulatory expectations.

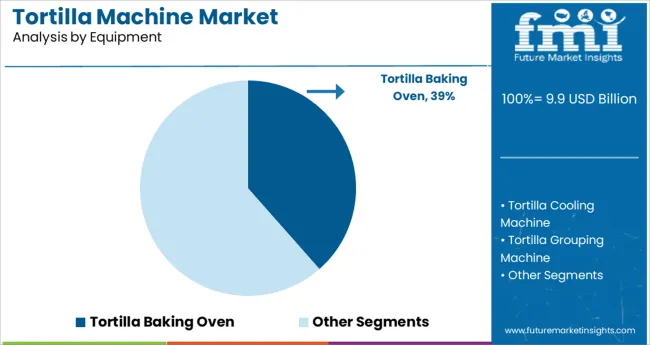

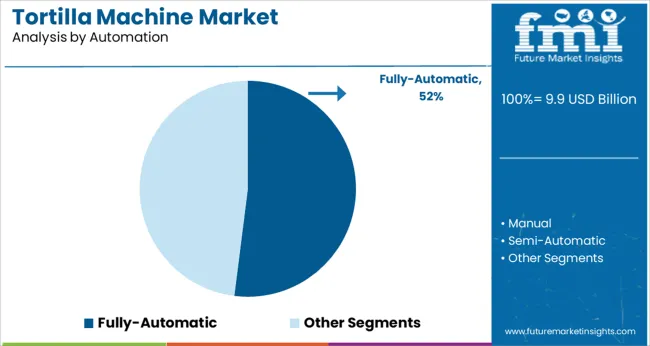

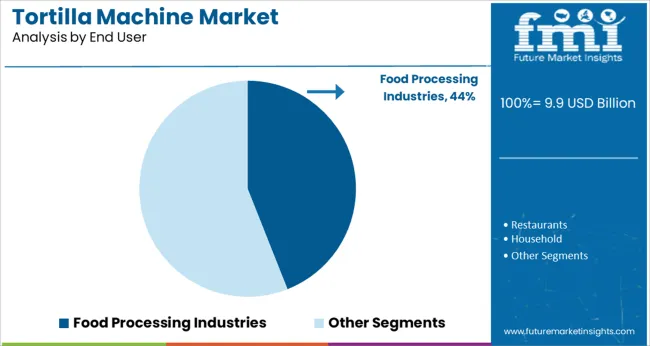

The market is segmented by Equipment, Automation, and End User and region. By Equipment, the market is divided into Tortilla Baking Oven, Tortilla Cooling Machine, and Tortilla Grouping Machine. In terms of Automation, the market is classified into Fully-Automatic, Manual, and Semi-Automatic. Based on End User, the market is segmented into Food Processing Industries, Restaurants, Household, and Caterers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Within the equipment segment, the tortilla baking oven is expected to account for 38.5% of the total market revenue in 2025, securing its position as the leading equipment subsegment. This dominance is attributed to its critical role in delivering uniform cooking, texture consistency, and the traditional taste profile required by both artisanal and industrial producers.

The ability of baking ovens to maintain precise temperature and humidity control has enhanced product quality while minimizing waste. These ovens have been favored for their durability and compatibility with upstream and downstream automation, enabling seamless integration into larger production lines.

Efficiency gains through improved heat distribution, energy savings, and easier maintenance have also strengthened the appeal of this segment in high-volume production environments.

The fully automatic subsegment within the automation category is projected to contribute 52.0% of market revenue in 2025, reflecting its leadership in driving operational efficiency and scalability. This segment’s prominence has been reinforced by the increasing necessity to reduce manual intervention, improve hygiene standards, and meet rising production targets.

Fully automatic machines have enabled manufacturers to minimize labor dependency while achieving consistent product specifications at higher throughput rates. The incorporation of programmable logic controls, real-time monitoring systems, and self-adjusting mechanisms has elevated productivity and reduced downtime.

Enhanced safety features and user-friendly interfaces have further supported widespread adoption, particularly among enterprises seeking to balance speed with quality assurance and regulatory compliance.

Segmenting by end user reveals that food processing industries are anticipated to command 44.0% of market revenue in 2025, maintaining their position as the foremost end user segment. This dominance has been driven by the industrial sector’s scale of operations and its focus on delivering standardized, high-quality products to meet both domestic and international demand.

Food processors have prioritized investments in tortilla machines to enhance efficiency, comply with food safety requirements, and achieve economies of scale. The ability to integrate advanced machinery with existing production systems has allowed these enterprises to respond swiftly to market trends while maintaining profitability.

Continuous innovation in product development and packaging within food processing industries has further fueled the uptake of high-performance tortilla machines, reinforcing their leadership in the market.

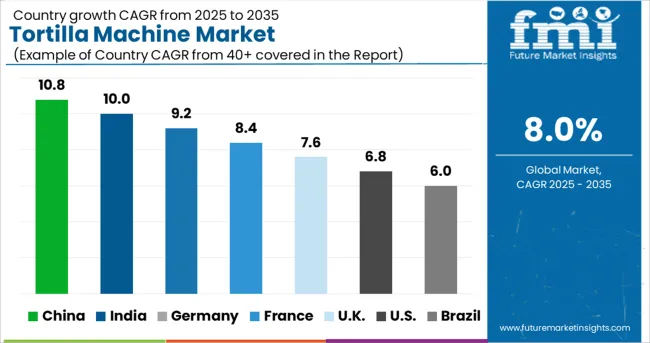

The global demand for tortilla machines is projected to grow at 8.8% CAGR between 2025 and 2035 in comparison to the 10.4% CAGR registered during the historical period of 2020 to 2024.

Rising consumption of tortillas and growing adoption of tortilla machines across food processing industries, households, restaurants, catering companies, and several other end-use sectors are key factors driving growth in the global tortilla machine market.

Similarly, increasing usage of tortillas for making a wide range of dishes due to their numerous health benefits is projected to push the demand for tortilla machines during the forecast period.

In addition to this, technological advancements in tortilla-making machines along with the growing popularity of fully-automatic machinery will generate growth prospects within the global market over the next ten years.

Growing Awareness About Health Benefits of Tortillas to Boost Market Over the Projected Period

In recent years, increasing consumer awareness about the health benefits of tortillas has generated high demand for this product, and the trend is likely to continue during the forecast period.

Tortillas are generally made from corn or wheat and are thus rich in proteins, vitamins, minerals, and other essential nutrients. Further, they contain low-fat content which makes them an ideal alternative to bread made from refined flour.

Growing demand for gluten-free products, the high nutritional benefits of tortillas, and rising health consciousness among consumers are expected to propel the tortilla machine market forward during the next ten years.

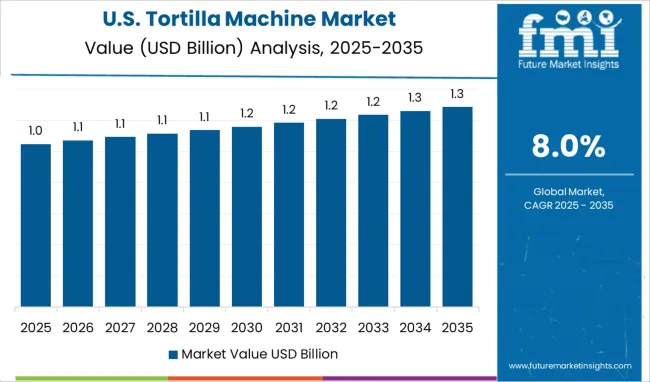

Increasing Production and Consumption of Tortilla Pushing Demand in the USA

As per FMI, the USA will continue to dominate the global tortilla machine market during the forecast period owing to the rising consumption of tortillas and the rapid growth of the food processing industry.

Similarly, the presence of leading tortilla machine manufacturers along with continuous new product launches is expected to boost the market during the next ten years.

One of the fastest-expanding baked manufacturing industries in the USA is tortilla production. This is due to the growing Hispanic population, which has increased demand for the product over the last five years.

Many tortilla manufacturers have added nutrients to their goods, such as flax and fiber, and improved their tortilla equipment to appeal to a wider range of customers. These enhancements have piqued the interest of health-conscious customers who see tortillas as a better alternative to bread. As a result of the increased demand for tortillas, sales of tortilla machines are expected to grow at a robust pace across the USA during the projected period.

Rising Popularity of Tortilla Boosting Market in India

The tortilla market in India is predicted to grow at a healthy CAGR during the forecast period owing to the rapidly growing population, increasing adoption of tortilla machines across households, and increasing popularity of automatic machines.

With increasing urbanization, the country's youth live a busy and chaotic lifestyle, necessitating the constant demand for quick food items. Tortillas serve this role as well as provide an unusual snack alternative. The Indian snack industry is seeing a rise in cross-cultural cuisine consumption.

Tortillas are a well-known Mexican cuisine that has piqued the interest of Indian foodies. Thus, the growing popularity of tortillas across the country will continue to propel sales of tortilla machines during the forecast period.

Similarly, increasing the adoption of semi-automatic and fully-automatic tortilla machines to reduce costs and improve productivity is expected to propel growth in the Indian tortilla machine market.

Increasing Consumption of Tortilla-based Dishes Generating Demand in Mexico

According to Future Market Insights, the Mexican tortilla machine market is likely to expand at a robust pace during the next ten years, owing to the growing usage of tortillas for various cuisines, the increasing adoption of fully automatic machines, and booming food tourism.

Corn tortillas, whole wheat tortillas, and tortilla chips are all sweeping the food sector across Mexica. The popularity of Mexican food is growing, and tortillas are becoming more and more well-liked among younger people due to their better nutritional profile.

Tortillas, tacos, and enchiladas are all made with tortillas, a thin flatbread that is high in protein, vitamins, and minerals. They are an essential component of Mexican cuisine and a common staple in the Hispanic population. Because of this progressive increase in demand for tortillas in Mexico, it is anticipated that the demand for tortilla machines will increase in the future.

Demand Likely to Remain High for Tortilla Baking Oven

Based on equipment, the tortilla machine market is segmented into tortilla baking ovens, tortilla cooling machines, and tortilla grouping machines.

Among these, the tortilla baking oven segment is likely to lead the global tortilla machine market during the forecast period. This can be attributed to the rising adoption of tortilla baking ovens across various food processing industries, restaurants, and households.

Tortilla baking ovens are machines designed for baking flat bread (tortilla, pitta, chapatti, lavash, etc.). As a result, they are being increasingly used by various end users.

Need for Reducing Human Intervention Fuelling Adoption of Automatic Tortilla Machines

Based on automation, the fully automatic segment is expected to grow at a higher pace during the forecast period. This can be attributed to the rising end-user preference for automatic machines to reduce human intervention, improve overall productivity, and reduce labor costs.

Besides this, the growing need for improving product quality and safety is expected to encourage the adoption of fully automatic tortilla machines during the forecast period.

The quickly changing technical environment is compelling tortilla machine manufacturers to refresh their product portfolio regularly. Hence, they are investing in research and development activities to develop advanced tortilla machines with user-friendly features. Besides this, they are adopting strategies such as partnerships, mergers, acquisitions, and collaborations to expand their global footprint. For instance,

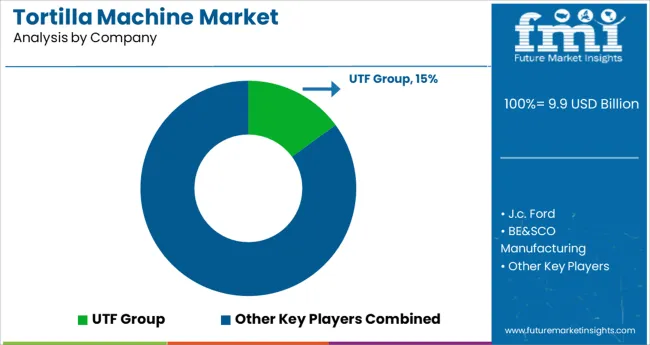

Key Tortilla Machine Makers Saving the Budget and Making the Dishes Delicious - UTF Group, BE&SCO Manufacturing, and Heisler Industries, Inc.

Leading tortilla machine manufacturers are supplying their products to improve end users’ food production process and for quality control purposes. The quality control department inspects each batch of tortillas that comes out of the machine, ensuring it’s up to code. And finally, some use these machines as a way to minimize costs. As large batches of tortillas can be produced all at once which eliminates the need for other types of machinery and equipment like flattening presses or hand-rolling stands which also saves space within their facility as well.

UTF-GROUP is one of the largest firms in Eastern Europe that manufactures industrial food processing equipment. The firm has been designing and producing high-quality machinery and production lines for various bread, wheat snacks, pasta, and confectionary items for over 25 years.

In recent years, UTF has been working to innovate its product offerings, introduce new technology, and change how tortillas are made worldwide. In 2020, UTF introduced its newest innovation - a new machine called Pro-Tekt 4000. This machine offers three advantages over traditional machines: it requires less floor space, can produce more tortillas per hour than a standard machine, and is easier to maintain. UTF group believes these innovations will help them keep up with demand for the company's products, which have increased significantly as Latin American cuisine becomes increasingly popular across North America.

Another key player, BE&SCO, is a manufacturer of tortilla machines, tamale machines, pizza machines, flatbread machines, tortilla presses, tortilla grills, tortilla ovens, electric tamale machines, electric tortilla machines, automatic tortilla presses, pizza presses, commercial tamale machines, bakery equipment, high-production machines, high-volume machines, mixers, dough dividers, rotating grills, comals, and tortilla systems.

In 2020, BE&SCO Manufacturing debuted at IFT Food Expo to showcase their recent developments after being acquired by Unitex. With a focus on innovation, they are proud to introduce four new product offerings for food manufacturing professionals. They offer machines for pre-sliced frozen dough products like bread and buns and ovens that can bake in three different flavors. There is also a machine that dispenses taco shells and tortillas, which has been popular among food service providers. A machine that rotates around products to create panini or grilled sandwiches is also available through BE&SCO Manufacturing.

Additionally, Heisler designs and produces automatic packaging and handling systems for plastic and metal containers ranging in size from pints to 55-gallon drums. The firm works with pails, jugs, cases, and trays in round, square, and F-style containers.

Heisler has been a pioneering company in food service equipment for over 50 years. One of their most recent developments is an organic line that meets USDA standards. With this new development, they're now able to offer not only gluten-free options but also more traditional products as well. For example, all ingredients are sourced locally in California and Mexico, offering the best prices and quality.

A key component of Heisler's success is innovation. Their primary focus is to design user-friendly and efficient machines with easy installation. They're constantly finding ways to improve production speed while maintaining quality. They currently have six lines of tortilla machines with eight models in each category. Every model offers different features, so it can be hard to decide which machine suits your needs best. Luckily, Heisler has developed a way for customers to see the differences between models before making a purchase decision.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 9.9 billion |

| Projected Market Size (2035) | USD 21.4 billion |

| Anticipated Growth Rate (2025 to 2035) | 8.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Key Regions Covered | North America; Europe; Asia Pacific; South America; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Mexico, UK, France, Italy, Russia, Turkey, Spain, China, Japan, Korea, India, Indonesia, Thailand, Philippines, Malaysia, Vietnam, South Korea, Australia, Brazil |

| Key Segments Covered | Equipment, End User, Automation, Region |

| Key Companies Profiled | Mexican Tortilla Machine; UTF Group; BE&SCO Manufacturing; Coperion & Coperion K-Tron; Heisler Industries, Inc.; Culinary Depot Inc.; HIX Corp.; Special Projects International, Inc; Empire Bakery Equipment; The Lanly Co.; Heat and Control, Inc.; AM Manufacturing Company; Superior Food Machinery, Inc; Lawrence Equipment, Inc; Frain Industries; Dutchess Bakers' Machinery Co., Inc.; Rotolok Ltd; J.c. Ford; Casa Herrera, Inc.; Bail-O-Matic |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global tortilla machine market is estimated to be valued at USD 9.9 billion in 2025.

It is projected to reach USD 21.4 billion by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are tortilla baking oven, tortilla cooling machine and tortilla grouping machine.

fully-automatic segment is expected to dominate with a 52.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tortilla Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tortilla Mix Market Insights - Authentic & Gluten-Free Growth 2025 to 2035

Market Leaders & Share in the Tortilla Bread Industry

USA Tortilla Market Report – Growth, Demand & Forecast 2025-2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Korea Tortilla Market Analysis by Product Type, Nature, Source Type, Process Type, Sales Channel, and Region Through 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Gluten-Free Tortilla Market Trends – Free-From Foods & Market Growth 2024-2034

Western Europe Tortilla Market Analysis by Product Type, Nature, Source, Process, Sales Channel, and Country through 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA