The top coated direct thermal printing films market is witnessing rapid growth as the demand for durable, cost-effective, and high-performance labeling and packaging solutions is increasing. Innovation, sustainability, and automation have become the watchwords for companies to improve the efficiency of their production processes while reducing waste.

The growth in the market is attributed to the trend of using eco-friendly packaging materials, increased e-commerce activities, and stringent regulatory standards.

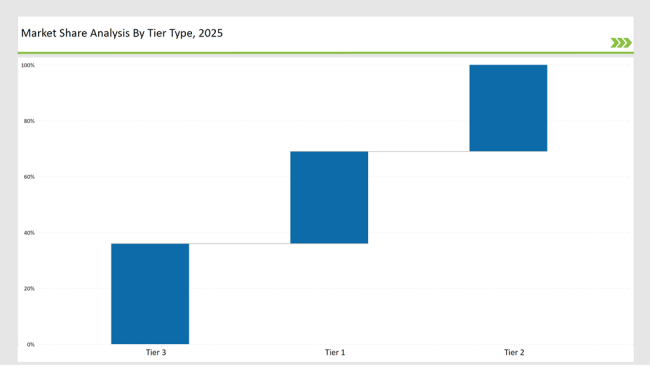

Tier 1: Market leaders include Avery Dennison, Ricoh, and Zebra Technologies, which have a market share of 33%. The three companies maintain a competitive edge with the use of advanced manufacturing techniques, wide distribution networks around the world, and continued R&D investments.

Tier 2: Companies with UPM Raflatac, Oji Imaging, and Mitsubishi Paper Mills. This provides 31% market share. These companies provide top-of-the-line solutions to medium-sized companies that are customizable and meet the stringent requirements of most industries.

Tier 3: Regional and niche manufacturers focus on logistics, pharmaceutical, and food applications, accounting for the remaining 36% in the market. These companies focus on tailored solutions, localized distribution, and cost-efficient production methods.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Avery Dennison, Ricoh, Zebra Technologies) | 16% |

| Rest of Top 5 (UPM Raflatac, Oji Imaging) | 10% |

| Next 5 of Top 10 (Mitsubishi Paper Mills, Sato Holdings, DNP Imaging, Hansol Paper, Jujo Thermal) | 7% |

The top coated direct thermal printing films market serves multiple industries by providing durable, heat-sensitive, and high-resolution printing solutions that improve efficiency and reduce operational costs. Companies are also developing next-generation coatings that enhance print contrast and increase resistance to environmental factors.

Additionally, advancements in direct thermal technology are reducing reliance on chemical developers, making the process more sustainable and cost-effective.

Manufacturers focus on high-quality print resolution, durability, and sustainability by integrating advanced coating technologies and automated production systems.

They are also investing in innovative heat-resistant coatings to enhance label longevity. Additionally, the use of advanced polymer technology is improving flexibility and adhesion properties for various substrates.

Manufacturers are investing in automation, material innovation, and AI-driven quality control to meet evolving industry standards. Key players emphasize sustainability, waste reduction, and enhanced print performance to improve efficiency and market competitiveness.

Companies are also incorporating nanotechnology to improve thermal sensitivity and durability of printed labels. Additionally, the integration of smart sensors in direct thermal printing films is enhancing tracking and authentication processes, making them more secure and efficient.

Technology providers should enhance automation, sustainability, and customization in direct thermal printing films. Partnering with manufacturers and material suppliers will drive cost efficiency and innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Avery Dennison, Ricoh, Zebra Technologies |

| Tier 2 | UPM Raflatac, Oji Imaging |

| Tier 3 | Mitsubishi Paper Mills, Sato Holdings, DNP Imaging, Hansol Paper, Jujo Thermal |

Manufacturers expand production capacity and use sustainable materials, strengthening safety features against industrial demands. They can also use AI-driven analytics to monitor production efficiency and improve quality control.

| Manufacturer | Latest Developments |

|---|---|

| Avery Dennison | March 2024: Launched a 100% recyclable direct thermal film solution. |

| Ricoh | August 2023: Developed ultra-durable, high-resolution thermal printing films. |

| Zebra Technologies | May 2024: Introduced heat-resistant thermal labels for industrial use. |

| UPM Raflatac | November 2023: Expanded pharmaceutical-grade thermal film offerings. |

| Oji Imaging | February 2024: Enhanced biodegradable direct thermal film solutions. |

| Mitsubishi Paper Mills | April 2024: Developed high-strength scratch-resistant thermal films. |

| Sato Holdings | June 2024: Launched innovative flexible direct thermal printing solutions. |

The coated direct thermal printing films market at the top remains competitive, and companies are focusing on automation, sustainability, and improved compliance measures to stay ahead in the competition. Businesses are implementing predictive analytics to maximize production and minimize operational costs. In addition, higher investment in high-performance coatings is enhancing the durability of the film and print quality.

Growth will be driven by manufacturers adopting smart printing technologies, investing in sustainable materials, and optimizing production efficiency. The growing demand in the logistics, e-commerce, and healthcare industries will further fuel the expansion of the market.

Companies are also embracing AI-driven automation to improve production accuracy and minimize material wastage. Furthermore, the development of high-resolution, heat-resistant thermal films is improving the durability and longevity of printed labels.

Expansion into emerging markets is further fueling industry growth, with companies tailoring solutions to meet region-specific regulations and requirements.

Leading players include Avery Dennison, Ricoh, Zebra Technologies, UPM Raflatac, and Oji Imaging.

The top 3 collectively control 16% of the global market.

Medium concentration, with top players holding 33%.

Sustainability, automation, material advancements, and regulatory compliance.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Ventilated FIBC Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.