The tool presetters industry is valued at USD 1.43 billion in 2025. According to FMI's analysis, the tool presetters market will grow at a CAGR of 6.4% and reach USD 2.66 billion by 2035.

Tool presetters have become a vital asset in many industries because they substantially minimize mistakes and idle time. These systems are creating an environment of greater efficiency and optimization by eradicating errors and solidifying their industry stance.

In 2024, the tool presetters industry witnessed substantial progress, led by the incorporation of advanced technologies and an increased focus on precision manufacturing. Tool presetters with artificial intelligence (AI) and Internet of Things (IoT) capabilities were launched by manufacturers, making real-time monitoring and predictive maintenance possible.

Moving forward to 2025, the tool presetters sector will continue to grow. The continued development of Industry 4.0 practices and the accelerating need for automation in manufacturing will continue to spur the use of advanced tool presetting technologies. Businesses will be expected to increase investment in intelligent manufacturing technologies, incorporating machine learning algorithms into tool presetters to enhance cutting parameters and tool selection using real-time data.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 1.43 Billion |

| Industry Value (2035F) | USD 2.66 Billion |

| CAGR (2025 to 2035) | 6.4% |

Explore FMI!

Book a free demo

The tool presetter industry is experiencing strong growth, fueled by the increasing need for precision engineering and manufacturing automation. Companies adopting AI-based and IoT-driven presetting solutions will be in a better position to compete by improving efficiency and minimizing downtime.

At the same time, the slow adopters stand to be marginalized by inefficiencies and rising operating expenses. As Industry 4.0 gathers momentum, tool presetters will be the key to maximizing machining accuracy and rationalizing production processes.

Ramp Up AI-Based Precision Production

Firms should invest in AI-based tool presetters in order to make machining precision and operations more optimal. Real-time data analytics and predictive maintenance will cut downtime, increase productivity, and future-proof production capabilities.

Further Digital Integration to Seamless Workflow Optimisation

Stakeholders must ride Industry 4.0 with tool presetters plugged into cloud computing, digital twin, and intelligent factory networks. This will help monitor the processes in real-time, reduce the need for human intervention, and improve cross-plant interoperability.

Grow Global Footprint Via Strategic Partnerships

Building relationships with CNC machine producers, automation companies, and software companies will lead to innovation and industry growth. Building out distribution channels and investing in localized production plants will further establish industry position in high-growth sectors.

| Risk Factor | Probability & Impact |

|---|---|

| Supply Chain Volatility: Raw material availability interruptions, logistics restrictions, and geopolitics instability can cause delays in production and cost escalations. | High Probability, High Impact |

| Operational Inefficiencies Caused by Legacy Systems: Poor integration of AI-based and IoT-based tool presetters with legacy infrastructure can decrease productivity and hinder the benefits of automation. | Medium Probability, High Impact |

| Strict and Disjointed Regulatory Environment: Consistently differing standards of safety and compliance by regions can escalate certification expenses, extend sector introduction periods, and hinder global expansion processes. | High Probability, Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Accelerate Smart Automation Adoption | Perform feasibility tests on AI-based tool presetters to increase machining precision and minimize downtime. |

| Strengthen Supplier Resilience | Diversify the sourcing approaches of key components to reduce supply chain disruption and ensure a seamless production process. |

| Expand Sector Reach Through Strategic Alliances | Form alliances with OEMs and CNC manufacturers to promote product adoption and enhance distribution channels. |

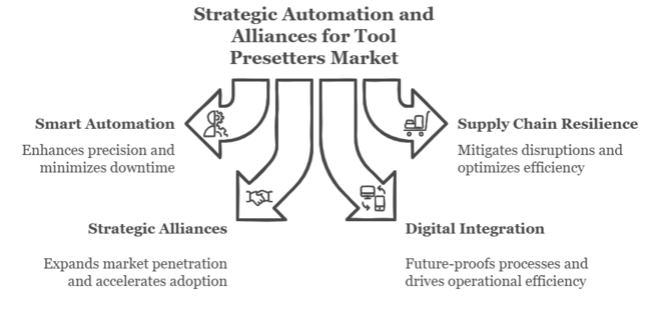

To stay ahead, companies must prioritize smart automation, optimize supply chain resilience, and forge strategic industry alliances. Adopting AI-driven tool presetters will improve accuracy, reduce downtime, and increase operational efficiency.

Early investment in digitalization and predictive maintenance will future-proof manufacturing operations, while diversified sourcing approaches will reduce disruptions. Bolstering collaboration with OEMs and CNC producers will deepen industry penetration and increase adoption. This insight reinforces the imperative of keeping pace with Industry 4.0 developments to ensure long-term competitive edge.

Contact tool presetters will remain a pivotal component in machining operations, being highly precise and economical. Solutions of this kind are still the first choice when tactile measurement assures greater accuracy for the best calibration of tools. The evolution in sensor technology as well as the use of automation will make them even more dependable and efficient. On the other hand, non-contact-based presetters are increasingly being adopted because they can measure without physical contact, which minimizes wear and tear on tools.

With instant adoption in precision-driven sectors like aerospace and electronics, this market segment is expected to see robust growth. FMI research forecasts that between 2025 and 2035, the product type segment as a whole will grow at a CAGR of 6.4%, with non-contact-based solutions leading conventional systems.

Portable tool presetters are becoming increasingly popular because they offer flexibility for operators to make tool measurements near machining stations. They are conducive to efficiency and reduce downtime, hence beneficial for dynamic manufacturing environments. Standalone tool presetters, on the other hand, continue to be the central component in high-precision manufacturing facilities, with enhanced features, automation, and integration with CNC machines.

Industries with high accuracy and high-volume production needs will continue to spend money on standalone equipment. With a growing emphasis on smart factories, FMI projects that between 2025 and 2035, the category segment will have a CAGR of 6.3% while portable presetters will take a stronger hold.

The automotive and aerospace industries are among the first to adopt tool presetters, motivated by high precision demands and the necessity of fast production cycles. Semiconductor and electronics production is quickly embracing sophisticated presetting technologies to address the miniaturization and high-precision needs of contemporary components. Metal fabrication is a traditional application that uses tool presetters to increase productivity in milling and machining processes.

General manufacturing sectors are adopting these solutions to optimize production processes, while training centers and workshops are using them for machine optimization and skill development. The healthcare sector is also becoming a rising user, using precision tools for the manufacturing of medical devices. FMI analysis projects that between 2025 and 2035, the end-use segment will witness a CAGR of 6.5%, with semiconductor and electronics driving the growth.

The American presetter industry is rapidly evolving due to the convergence of AI, IoT, and predictive analytics in manufacturing. The nation's effort towards reshoring and local semiconductor production self-reliance is fueling the demand for high-accuracy tool presetting technologies. Adaptive presetting technologies are being invested in by defense and aerospace sectors more and more to improve the machining accuracy for complex parts.

Additionally, the surge for multi-axis machining is driving demand for next-generation tool presetters that optimize spindle performance and tool life. With a strong focus on lean manufacturing, USA industries are adopting cloud-connected presetters for real-time monitoring and automated calibration. FMI forecasts that the CAGR of the United States will be 6.6% from 2025 to 2035.

The Indian industry for presetters is gaining from its rapidly developing MSME sector, which is slowly adopting CNC-based machining solutions. The growing government spending on indigenous defense production by the Indian government is fueling the use of tool presetters with sophisticated calibration features. The electronics sector is also investing in ultra-precision presetting technologies to aid local chip manufacturing and printed circuit board (PCB) production.

The growth in the railway industry, with massive modernization initiatives, is also driving demand for extremely precise tool measurement solutions. With the growing pace of automation, local players are collaborating with multinational companies to bring in affordable, high-accuracy presetting solutions. FMI opines that India's CAGR will be 7.1% from 2025 to 2035.

China's high-value manufacturing trend is driving demand for AI-empowered tool presetting systems. With the government promoting leading-edge robotics and intelligent factories, producers are embracing automated presetting technologies to raise precision and cut downtime.

The country’s dominance in consumer electronics and electric vehicle manufacturing is spurring advances in high-speed contactless presetting technologies. Further, China's assertive expansion in the aerospace industry is opening up opportunities for ultra-precision presetters used in turbine and composite machining. With domestic companies trying to minimize dependence on foreign CNC machines, the domestic production of advanced tool presetters is rising. FMI projects that the CAGR of China will be 7.0% from 2025 to 2035.

The UK's commitment to future-proof manufacturing is pushing the use of hybrid tool presetters, which feature both optical and tactile measuring abilities. Increased activity in electric aviation projects is stimulating demand for ultra-accurate presetting solutions for lightweight material machining. The nation's shipbuilding sector is also tapping into automated presetting to make complex structural component production more efficient.

With sustainability as their prime agenda, UK manufacturers are incorporating energy-efficient presetting technologies that minimize carbon footprints. The use of digital twins and virtual machining simulations is also revolutionizing presetting accuracy and workflow optimization. FMI forecasts that the CAGR of the United Kingdom will be 6.2% from 2025 to 2035.

Germany's tool presetting industry is transforming with the advent of AI-driven error correction technology that raises presetting accuracy. The automotive sector's shift towards hydrogen and hybrid fuel technologies is requiring more customized presetting solutions for next-generation materials. Moreover, Germany's focus on modular automation is compelling manufacturers to embrace scalable presetting solutions that easily fit into intelligent production lines.

As nanotechnology gains wider use in industrial machining, the demand for ultra-high precision tool presetters is on the rise. High-performance CNC tooling expertise in the country is driving partnerships between conventional manufacturers and AI-based software firms to create next-generation presetting solutions. FMI opines that the CAGR of Germany will be 6.5% from 2025 to 2035.

South Korea's semiconductor and electronics industry is pioneering the adoption of cloud-based tool presetters for remote diagnostics and automated calibration. The adoption of precision robotics for medical device manufacturing, at a fast pace, is driving demand for high-precision presetting systems. As development in 5G infrastructure is accelerating, the telecom equipment sector is focusing on micromachining presetters designed for miniaturized components.

In addition, the South Korean government's drive for advanced naval defense initiatives is promoting the demand for smart presetters in metal fabrication in the marine environment. The growth of AI-based production control systems continues to revolutionize tool presetting effectiveness across industries. FMI projects that the CAGR of South Korea will be 6.8% from 2025 to 2035.

Japan's push towards hyper-precision manufacturing is resulting in the implementation of atomic-scale tool presetters in machining advanced materials. The nation's increasing space exploration activities are generating interest in ultra-precise presetting technologies for aerospace component manufacturing. Moreover, the advent of autonomous CNC machining is compelling manufacturers to implement AI-based presetting solutions with self-learning and real-time adaptation capabilities.

The focus of medical technology on nanofabrication is pushing compact presetting tool development with regard to micro-surgical instruments faster. As sustainability takes the central stage in production in Japan, industries are resorting to efficient presetters incorporating smart power control systems. FMI forecasts that Japan's CAGR will be 6.3% from 2025 to 2035.

France's aerospace sector is leading the adoption of AI-based tool presetters with real-time data analysis to improve component manufacturing. France's increasing investment in renewable energy equipment is fueling demand for presetting solutions suitable for precision machining in wind turbine and solar panel manufacturing.

The shift in the automotive industry towards lightweight technologies is driving higher usage of innovative presetting systems specific to machining composites. As industrial automation continues to grow, French industries are utilizing AI-driven calibration solutions to maximize production efficiency. FMI opines that the CAGR of France will be 6.2% from 2025 to 2035.

Italy's precision engineering industry is driving innovation in high-speed tool presetters optimized for complex metalworking applications. Investments in the country's smart glass and ceramic production are generating a need for advanced presetting systems with higher thermal stability. Italy's tradition in high-fashion and jewelry production is also generating prospects for micro-tool presetters employed in complex detailing operations.

The demand for robotics-based machining in industrial automation is resulting in the integration of AI-based presetting systems that increase machining repeatability. With a high focus on quality control, Italian industries are implementing automated presetting verification systems to eradicate deviations in high-precision components. FMI projects that the CAGR of Italy will be 6.4% from 2025 to 2035.

Australia and New Zealand's drive towards self-sufficiency in advanced manufacturing is driving investment in a local production of tool presetters. The defense sector's emphasis on next-generation submarine and aerospace programs is generating demand for high-tolerance presetting solutions. Furthermore, the mining industry's requirement for ultra-high wear-resistant machining tools is driving the adoption of presetters engineered for extreme wear situations.

With the growing use of 3D printing in industrial uses, tailored presetting solutions optimized for additive manufacturing are becoming more popular. As regulations for sustainability become stricter, companies are installing energy-efficient presetters to adapt to environmentally friendly manufacturing processes. FMI forecasts that the CAGR of Australia & New Zealand will be 6.1% from 2025 to 2035.

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, and end-users in the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance

Convergent and Divergent Views on ROI

USA stakeholders found 73% of the automation "worth the investment," while 40% of Japanese manufacturers still maintained a preference for semi-manual presetters.

Agreement

Hardened Steel & Ceramic: Chosen by 67% worldwide because it is durable and resistant to tool wear.

Deviation

Shared Challenges

86% mentioned increasing material prices (steel +28%, aluminum +16%) as a significant industry issue.

Regional Differences

Manufacturers

Distributors

End-Users (Machining & Manufacturing Facilities)

Alignment

76% of worldwide manufacturers intend to invest in AI-driven tool presetting and predictive analytics.

Divergence

High Consensus: Precision accuracy, demand for automation, and cost pressures are issues across the board.

Key Variances

Strategic Insight

One-size-fits-all will not work. Regional adaptation (e.g., steel in the USA, aluminum in Europe, compact presetters in Asia) is key to industry penetration.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | Compliance with NIST precision standards and OSHA is compulsory. Import tariffs affect pricing, and ANSI/ASME B5.54 regulates CNC tool presetters. |

| India | "Make in India" stimulates local manufacturing through tax incentives. BIS certification is mandatory, and import bans promote local R&D. |

| China | GB/T precision standards and Made in China 2025 promote local automation. Foreign companies are scrutinized under cybersecurity regulations for cloud-based equipment. |

| United Kingdom | UKCA marking replaces CE post-Brexit. British Standards (BS) and strict energy efficiency laws cover metrology tools. |

| Germany | DIN precision standards and CE marking are compulsory. TÜV certification increases the cost of compliance, but Industry 4.0 incentives encourage automation. |

| South Korea | KCS certification is compulsory for importation. Government support for AI-integrated presetters, but intricate approval holds up industry entry. |

| Japan | JIS standards guarantee ultra-precision compliance. Government drives automation but necessitates strict accuracy verification. |

| France | CE marking is obligatory. Energy-efficient equipment is encouraged by tax credits for sustainability. AFNOR regulations enhance safety requirements. |

| Italy | CE and UNI requirements are applicable. "Transition 4.0" incentives benefit digital presetters, with rigorous documentation necessary for tax advantages. |

| Australia-NZ | AS/NZS metrology requirements are applicable. Import-dependent sectors experience holdups due to rigorous biosecurity and energy efficiency requirements. |

The industry for tool presetting systems is fairly fragmented, with a lot of regional and international players competing for sector share. Although some major players with superior technological solutions and established brand equity lead with dominance, small companies survive by meeting niche requirements and offering price-friendly solutions.

Industry leaders are adopting various strategies to sustain their competitive advantage. Innovation continues to be a priority, with producers incorporating automation, IoT functionality, and Industry 4.0 technologies into their tool presetting products.

In 2024, there were a number of significant developments that influenced the competitive environment. In January 2024, Superior Drilling Products Inc. (SDPI) acquired Drilling Tools International Corp. (DTI), enhancing its product offerings and international industry presence.

March 2024 witnessed the release of an advanced digital tool presetter with increased automation capabilities, aimed at maximizing efficiency in today's production environments. In June 2024, a renowned manufacturer established a strategic alliance with a software company to incorporate data analytics into tool presetting solutions for improved accuracy and predictive maintenance features.

Market Share Analysis

Automation is enhancing precision, reducing setup times, and integrating seamlessly with smart manufacturing systems, driving widespread adoption.

Industry 4.0 is enabling real-time data analytics, remote monitoring, and predictive maintenance, improving operational efficiency across industries.

Yes, manufacturers are prioritizing energy-efficient designs, recyclable materials, and eco-friendly production processes to align with global sustainability goals.

Stringent quality control and safety regulations, especially in aerospace and automotive sectors, are accelerating the demand for high-precision tool presetting solutions.

High initial investment costs, integration complexities with legacy systems, and the need for skilled operators remain key adoption challenges.

Contact-Based, Non-Contact Based

Portable, Standalone

Automotive and Aviation, Semi-Conductor & Electronics, Metal Fabrication, General Manufacturing, Workshops & Training Centres, Healthcare, Others

North America, Latin America, Western Europe, Eastern Europe, Middle East and Africa (MEA)East Asia, South Asia and Pacific

Power Tool Gears Market - Growth & Demand 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

External Combustion Engine Market Growth & Demand 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.