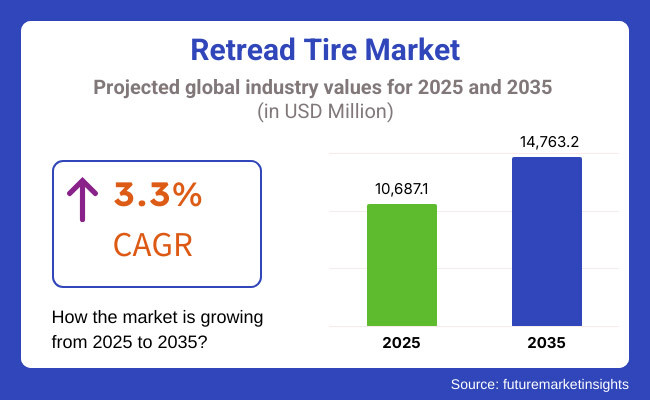

The global retread tire market is projected to witness steady growth between 2025 and 2035, driven by cost advantages, sustainability initiatives, and increasing demand for commercial vehicle maintenance solutions. The market is expected to reach USD 10,687.1 million in 2025 and expand to USD 14,763.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.3% during the forecast period.

Retreading provides a cost-effective and environmentally sustainable solution to tire replacement, enabling businesses and fleet operators to prolong the life of their tires, decrease waste, and lower overall maintenance costs. All these factors contribute to market growth, such as procurement costs for new tires, new environmental regulations on circular economy practices, and growing reliance on commercial transportation, and logistics.

Moreover, developments in retreading technologies, enhancement in rubber compounds and increasing adoption of retreaded tires in aviation, construction and agricultural vehicles are other factors impacting the market dynamics. Due to escalating efforts to minimize carbon footprints and improve fuel efficiency, demand for high-performance retread tires is anticipated to grow in several industries.

Major drivers for market growth include the increasing number of commercial trucks, buses, and aircraft, rising adoption of sustainability initiatives, and the cost-driven tendency towards tire retreading. Moreover, advancements in rubber vulcanization and tread pattern optimization during the forecast period will also drive the market demand.

Explore FMI!

Book a free demo

North America is one of the largest markets for retread tires, driven by high usage of commercial vehicles, robust regulatory frameworks supporting sustainable practices, and the presence of major retread tire manufacturers. For example, the United States and Canada are seeing growing segments in the logistics, public transportation and agricultural fields adopting retreaded tires, where cost savings and performance efficiency are core considerations.

As more sustainable replacement for new tires, both the USA Environmental Protection Agency (EPA) and the Tire Retread & Repair Information Bureau (TRIB) have been working to promote retread tire adoption. In addition, leading trucking companies and fleet operators in North America are preferring to retread to increase operational costs and at the same time reduce waste and environmental impact.

The increasing requirement for fuel-efficient, low-rolling-resistance tires is also driving growth in advanced retreading technologies such as pre-cure and mold-cure used to enhance tread durability and performance.

The tire retreading market in Europe is mainly driven by stringent environmental regulations, increasing focus on circular economy practices, and high adoption of sustainable transportation solutions. Germany, France and the UK are among the top consumers of retreads, especially in freight transport, municipal services and aviation.

The European Union (EU) sustainability strategies support the application of retreaded tires within comprehensive emission cutting policies, thus enhancing future investments in advanced retreading technologies. Moreover, road freight and logistics companies are continuously looking for cost-effective tire solutions, resulting in boosting the adoption of retreaded tires over the commercial fleet.

Electric and hybrid trucks are becoming more prevalent and demand for retreaded tires, with treads optimized for low energy consumption, is growing. Moreover, the airline operators in Europe are giving preference to retreaded aircraft tires to lower operational costs while adhering to stringent aviation safety standards.

Population growth has also boosted demand, especially in countries like India and China rising disposable incomes and the lifestyle of the high income group are expected to give a huge boost to the growth of the retread tire market in the Asia-Pacific region. Demand for retreaded tires is on the rise in commercial trucking, buses, and off-road vehicles in countries like China, India, Japan, and South Korea.

With the growing logistics industry and increasing government initiatives promoting circular economy practices in China are driving the demand for retread tire. In India, demand for retreading services is proving strong too, especially from the agricultural and mining sectors where the cost of replacing tires is high.

While Japan and South Korean are advance in rubber shaping technology and tread pattern engineering, they have promoted the aspect of high-performance and long using time retread tires, which is more popular in Japan and South Korea. As there is increasing regulatory support for sustainable vehicle maintenance, the region will continue to see its retread tire industry grow.

The Middle East & Africa (MEA) region is experiencing rising demand for retread tires, particularly in commercial transport, mining, and construction sectors. Retreaded tires are increasingly being adopted by countries including Saudi Arabia, UAE, and South Africa, where the focus is on cost-effective vehicle maintenance systems.

Moreover, increasing emphasis on sustainable transportation and tire recycling initiatives are stimulating government and private investments in retread tire manufacturing facilities. Moreover, the demanding climatic conditions and long-haul transportation needs of the region spur the demand for durable and heat-resistant retread tires.

Growing logistics market and rising awareness of cost-saving home maintenance solutions in South Africa are stimulating the market as well. Increasing adoption of retread tires in the off-road segment results in increasing construction and mining activities in the region.

Perceived Quality and Performance Concerns

Perception that retreaded tires have lower durability and reliability than new tires is one of the major challenges in retread tire market. Despite advances in retread technology, some individuals and even fleet owners are wary of the retread tire benefits; in terms of safety, wear-rate and performance in challenging conditions.

Moreover, in certain areas, inadequate regulation or low-quality retreading practices have contributed to variable product quality, perpetuating unflattering stereotypes. Challenges faces are well known and continues to be addressed through ongoing joint efforts of the entire industry to expect top retreading standards, educate consumers towards benefits of durability and demand stricter certification processes.

Competition from Low-Cost New Tires

The availability of low-cost, imported new tires, particularly from Asia, poses a competitive challenge for the retread tire industry. Most of fleet operators and individual consumers would rather buy cheap tires in millions than pay for retreading tires, hence limiting the overall growth of this market.

Interruptions in the supply chain or variations in raw material pricing, these can affect the cost efficiency of retread tire manufacturing and can hinder adoption in price-sensitive markets. Manufacturers should highlight the fact that retreaded tires provide long-term cost savings, enhanced fuel efficiency, and help protect the environment.

Technological Advancements in Retreading Processes

The development of advanced retreading technologies is creating new opportunities for market growth. Pre-cure and mold-cure developments, automated inspection systems, and AI-based tread pattern optimization are boosting retread tire performance, durability, and safety.

Furthermore, the development of new bonding agents and advanced vulcanization techniques are improving tread adhesion and tread wear resistance, to the point that retreads more than rival many new tires on the market. The implementation of automated retreading facilities and precision manufacturing enables companies to optimize the production process, minimize defects, and achieve greater consistency in terms of retread tire quality.

Rising Demand for Sustainable and Eco-Friendly Tire Solutions

This demand for retread tires, which are a more environmentally friendly option than tire disposal, is also being driven by an increased global emphasis on sustainability and limited carbon footprints. Retreading cuts raw material use, lowering CO₂ emissions and landfill waste an appealing option for eco-minded fleet operators and vehicle owners.

The market expansion is also possessed by the effort from governments and environmental agencies promoting incentives and tax advantages with retreaded tires for businesses. Although demand for retread tires is expected to be met in the long term, with increasing number of circular economy initiatives becoming popular, global retread tire market to remain promising.

Between 2020 and 2024, continued growth in the retread tires market, owing to growing fleet operator sensitivity to costs, increasing environmental impact awareness, and technological progress in retreading. Sales of retreaded tires, particularly in commercial vehicles, buses and off-road use helped increase adoption, as new tires become increasingly expensive, and there was more motion toward a sustainable solution in the automotive and transportation sector.

These innovations quickly advanced the industry, including tread compounds, automated retreading developments, and quality assurance improvements that increased the durability and performance of retreaded tires. But consumer scepticism about safety, regulatory differences among regions, and competition with budget-level new tires presented obstacles.

Looking ahead to 2025 to 2035, the retread tires market will evolve with AI-driven tire inspection, 3D-printed tread patterns, and eco-friendly retreading materials. The growing impact towards circular economy measures, smart fleet management solutions, and AI-enabled predictive maintenance will open up new avenues in the market. Also, fleets of hydrogen-powered and electric vehicles (EV) will change how retreaded tires will play a role in the future of mobility complementing these with a blockchain-based monitoring of the tires, and self-repairing tire technology.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Commercial Vehicle Fleet Optimization | Fleet operators were turning to retread tires in an effort to cut costs and get top mileage. |

| Sustainability & Circular Economy Adoption | Increasing awareness towards reducing tire wastage and carbon footprint led to growth in retreading initiatives. |

| Technological Advancements in Retreading Processes | Tire retreading with pre-cure and mold-cure technologies offered better durability and safety. |

| Electric & Hydrogen-Powered Vehicles | Retread or re-tread tires were used mainly in conventional diesel trucks, buses and off-road equipment. |

| Performance & Safety Enhancements | Some resistance remained regarding the safety of retreaded tires in high-speed applications. |

| Adoption in Emerging Markets | Retreading has been utilized more in developing economies as it is cheaper than buying new tires. |

| Market Growth Drivers | Enhanced durability and higher mileage performance of retreaded tires. |

| Market Shift | 2025 to 2035 |

|---|---|

| Commercial Vehicle Fleet Optimization | These include AI-tire predictive maintenance, smart tire wear analytics, and IoT-based fleet management systems that increase the effectiveness of retread tires. |

| Sustainability & Circular Economy Adoption | Development of fully recyclable retread compounds, bio-based tread rubber, and carbon-neutral tire retreading plants. |

| Technological Advancements in Retreading Processes | AI-facilitated retreading precision, 3D-printed tread patterns, and automated vulcanization all boost efficiency. |

| Electric & Hydrogen-Powered Vehicles | Advancing ultra-low rolling resistance EV-compatible retreaded tires with AI-optimized tread. |

| Performance & Safety Enhancements | Smart retreaded tires with embedded RFID tracking, AI-driven real-time performance monitoring, and self-sealing tread compounds. |

| Adoption in Emerging Markets | Commercial retreads demand is additionally bolstered by the expansion of e-commerce and freight transportation as trucking fleets further aim for optimal operating costs and adherence to road safety. |

| Market Growth Drivers | Market expansion driven by AI-integrated retreading processes, carbon-neutral tire plants, and fleet-wide adoption of retreaded tires in EV logistics. |

The USA retread tire market is projected to be driven by growing cost-efficiency concerns, the rising adoption of retread tires in commercial fleets, and sustainability initiatives. As new tire prices continue to trend higher, trucking companies, logistics providers and fleet operators are turning to retreads as a more cost-effective alternative.

To promote waste reduction on the whole, the USA Environmental Protection Agency (EPA) and Department of Transportation (DOT) have also backed retread tire usage, since retreading a tire helps to ensure that the tire can go the distance for its entire lifecycle a boon for keeping tires out of landfills. In addition, automated tire inspection systems and other tire automation advancements, high-performing rubber compounds are improving the longevity and reliability of retreads.

E-commerce and freight transportation boom is also driving the demand for commercial retread tires, including commercial electric and traditional-type commercial retread tires, as trucking fleets are determined to maximize operating efficiency while ensuring compliance with road safety regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.5% |

The United Kingdom retread tire market is expanding at a moderate pace, supported by government sustainability policies, cost-saving strategies in fleet management, and increased adoption of retreading in aviation and heavy-duty vehicles.

Both the UK’s Environment Agency and the Department for Transport (DfT) have highlighted the benefits of tire recycling at its best promoting retreaded tires as an environmentally sustainable solution to new tire manufacture. Moreover, the increasing cost of fuel and inflationary pressure encouraging fleet owners to use retreaded tires to lower operational cost.

Equally, the aviation sector is adopting retreaded tires as well, where retreaded aircraft tires bring with them considerable cost efficiencies, especially for commercial aircraft and military fleets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.1% |

The European Union retread tire market is witnessing steady growth, driven by strict environmental policies, expansion of logistics and commercial fleets, and rising adoption in the aviation industry. Germany, France and Italy are increasingly active regarding the adoption of retread tires, along with government incentives for environmental solutions in transportation.

The EU’s Circular Economy action plan is pushing tire manufacturers and fleet operators to invest in retreading solutions, preventing tire waste and using fewer raw materials. The rising fuel prices and overall operational costs in commercial transport is ensuring greater adoption of retread tires as a cost-effective substitute among fleet operators. Moreover, the European aerospace industry is increasingly counting on retreaded tires thanks to their leading cost advantages and environmental efficiencies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.3% |

Japan retread tire market is growing moderately, propelled by stringent environmental regulations, increasing penetration in commercial and industrial vehicle fleets and technological innovations in the retreading process. Japan’s emphasis on minimizing tire waste and encouraging circular economy initiatives is driving increased government sponsored adoption of retread tires.

Another growth sector is an expanding automotive logistics industry in Japan that is creating a growing demand for retreaded tires in the fleets of logistics companies to increase the efficiency of maintenance costs. Moreover, the adoption of advanced mechanization in retreading shops is improving the quality and endurance of retread tires, enhancing their replacement for new tires.

In Japan, the aviation sector is concentrating on the usage of retreaded aircraft tires, mainly from commercial airlines looking to reduce operational costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.0% |

The South Korea retreated tire market growth is driven by both an increase in demand from logistics companies and the expansion of sustainable transportation initiatives, combined with improvements in the quality of the retreading process. The emphasis of the South Korean government on minimizing automobile waste in the country is boosting retread tire adoption in public transport fleets and commercial vehicle sectors.

The demand for retread tires in vehicles in fleet delivery vehicles is being driven by the growth of e-commerce and last-mile delivery service causing increased need for tire replacement that is economically viable. Moreover, the South Korea solid manufacturing capabilities in tire retreading technology increase tread durability and fuel efficiency as well as overall performance. The aviation industry is also embracing retreaded aircraft tires, as airlines look to reduce maintenance costs and match sustainability objectives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.2% |

Pre-cure retreading dominates the retread tire market, owing to its cost-effectiveness, ease of application, and superior tread durability. This works by placing a pre-cured tread down on a buffed tire casing, which allows for consistent quality and performance while extending the tire's service life.

For light and heavy commercial vehicles, fleet operators and logistics companies prefer pre-cure retreading of tires, since it is cheaper than replacing tires and provides good performance. The pre-cure method offers more flexibility in the tread pattern compared to mold cure retreading, allowing it to be utilized for varied terrains and road conditions.

Moreover, improvements in rubber compounds and retreading technology have further extended the mileage and fuel efficiency of pre-cured retreaded tires, spurring its adoption amongst cost-sensitive commercial fleet owners.

Mold cure retreading is witnessing increased adoption, particularly in heavy commercial and off-road vehicles, where high durability and customized tread designs are crucial. New rubber is cured directly onto the tire casing using a mold to ensure that it is bonded seamlessly and uniformly with the existing tread pattern.

Reflecting a factory-finished and technically superior bond than pre-cure retreading, mold cure is suitable for high-load applications like long-haul trucking, mining and construction vehicles. Manufacturers are investing in advanced mold cure technology that includes heat-resistant compounds and reinforced sidewalls to cater to the increasing demand for high-performance retreaded tires in extreme conditions, which ultimately drives the market for retreaded market.

The HCV segment holds the largest share in the retread tire market as trucking fleets and transportation companies look for tire management strategies that reduce costs. The savings with retreaded tires and new tires enables fleets to ensure they have operationally fit tires from a safety and performance perspective without the additional capital costs.

As the world puts more emphasis on sustainability and the circular economy, heavy commercial fleet owners are recycling tire casings for multiple retread cycles, thereby reducing tire waste and raw material consumption. In addition, government regulations encouraging eco-friendly tire disposal and retreading practices are accelerating adoption in long-haul trucking and cargo transportation sectors.

Specialty applications for retreaded tires are gaining in popularity, particularly in construction, mining, and agriculture, where off-road vehicles and the need for down-time avoidance in extreme environments drive the demand for a durable and cost-effective solution. These industries work in rough terrain, and physical stressors, demanding tread designs that cope with extreme use and wear.

This ensures maximum traction in the roughest possible terrain and increases the durability of the tread as it is produced with tougher sidewalls installed, designed to grip dirt and rocks perfectly, while giving it more depth and a high traction pattern in off-road throughout. Retreaded tires offer substantial cost savings (up to 50% off the new tire price) while still providing excellent traction and load-bearing capabilities similar to new off-road tires.

Quarrying, forestry and off-road logistics have an ever-growing rate of construction and infrastructure, as the industries look to work more efficiently and reduce cost, increasing the demand for heavy-duty, high-performance retreaded tires.

The global demand for retread tire is on the rise owing to growing demand for affordable tires along with increasing focus on sustainable services and growing prevalence of commercial transportation and fleet management industry. The process of retreading is the same as putting new treads to the tires and helps it live a more extended period, and it is a more economical and ecologically viable option as compared to new tires and used for trucks, buses, air crafts, and offroad vehicles.

The market is being propelled by a number of trends such as the ongoing technological development with regards to tread rubber compounds, increasing adoption of automated retreading processes, and the introduction of regulations aiming towards tire recycling and waste reduction. And altitude, agriculture, and construction, catering to commercial fleets, aviation, agriculture, and construction sectors, top-tier manufacturers are also focusing on high-performance retreaded tires, enhanced tread durability, and fuel-efficient designs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bridgestone Corporation (Bandag Retreads) | 10-12% |

| Michelin (Michelin Retread Technologies) | 9-11% |

| Goodyear Tire & Rubber Company | 8-10% |

| Continental AG (ContiLifeCycle) | 6-8% |

| Marangoni S.p.A. | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bridgestone Corporation (Bandag Retreads) | A worldwide leader in retreading solutions for commercial fleets, fusing exceptional tread components and automated retread innovation. |

| Michelin (Michelin Retread Technologies) | Development advances in high-mileage retreaded tires, ensuring that all our retreads are designed for maximum durability, optimized fuel efficiency and the use of eco-friendly rubber formulations. |

| Goodyear Tire & Rubber Company | Innovation in custom tread retreading for heavy-duty applications, integrating advanced rubber compounding and wear-resistant designs. |

| Continental AG (ContiLifeCycle) | Offers premium retread solutions for trucks, buses, and off-road vehicles, ensuring cost savings and sustainability. |

| Marangoni S.p.A. | Provides innovative materials and equipment for retreading, specializing in modular tread designs and high resistance to heat. |

Key Company Insights

Bridgestone Corporation (Bandag Retreads)

Bridgestone, through its Bandag Retread Systems, is a leading provider of premium retreading solutions, offering high-performance, cost-efficient, and eco-friendly retreads for commercial fleets. The Cold and Hot Retread Processes from Bandag give you improved mileage, durability, and low rolling resistance, all tailored perfectly for trucks, buses, and heavy machinery. Bridgestone has a long history of investing in automated retreading technology, ensuring consistent tread application, durability, and longevity.

Michelin (Michelin Retread Technologies)

Michelin is a major player in the retread tire sector, offering high-mileage retreaded tires to fleets for transport, aviation and specialty vehicles. So many carriers have penalized having more than one retread, some of which surely haven’t reached end of life, but it’s sadly a misconception that needs busting, as Michelin’s own Michelin Retread Technologies (MRT) captures extend of the tire's life and how to ensure its longevity through durable rubber compounds, advanced tread patterns and optimized retreading processes to deliver fuel savings.

The new green tire initiatives are part of Michelin’s sustainable rubber sourcing initiatives and reduced CO₂ emissions in the retread production.

Goodyear Tire & Rubber Company

Goodyear specializes with custom tread retreads that are intended for heavy-duty commercial and industrial uses. The company’s solutions include Goodyear UniCircle and Precure Retreading, which enable seamless tread bonding, superior wear resistance, and improved traction. Goodyear is also working on artificial intelligence-enhanced tread wear monitoring, even getting predictive so fleets can manage better.

Continental AG (ContiLifeCycle)

Continental’s ContiLifeCycle provides best-in-class retread options for trucks, buses and specialty off-the-road vehicles, helping fleets extend tire life through Refurb, Reboot and Retreated recycling programs for cost-effective, sustainable tire solutions. As hot and cold retreading processes are spotted on scalene and incorporate continuous tread wear diagnostics and automated tread usage technology. Continental expands its smart tire initiatives, improving digital tracking of retreaded tires for ideal fleet performance.

Marangoni S.p.A.

The Marangoni product is a cutting-edge retreading technology featuring modular tread designs, higher heat resistance and superior traction control. The RINGTREAD system of the company offers uniform tread wear, fuel efficiency, and durability at high speed, due to which it is highly preferred in long-haul and off-road applications. Marangoni is developing "high-performance" rubber compounds to provide higher grip and more mileage from retreads.

The global retread tire market is projected to reach USD 10,687.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.3% over the forecast period.

By 2035, the retread tire market is expected to reach USD 14,763.2 million.

The heavy commercial vehicle segment is expected to dominate due to the high cost-effectiveness of retreaded tires for fleets, increasing sustainability concerns, and growing demand in logistics, construction, and public transportation sectors.

Key players in the retread tire market include Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company, Marangoni S.p.A., and Continental AG.

Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle, Off-road Vehicles

Pre Cure, Mold Cure

OEM, Independent Service Provider

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East & Africa

Automotive Door Latch Market Trends - Growth & Forecast 2025 to 2035

Automotive Door Hinges Market Growth - Trends & Forecast 2025 to 2035

Automotive Crash Barriers Market Growth - Trends & Forecast 2025 to 2035

Automotive Conversion Kit Market Growth - Trends & Forecast 2025 to 2035

Automotive Electronics Market Growth - Trends & Forecast 2025 to 2035

Automotive Front End Module Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.