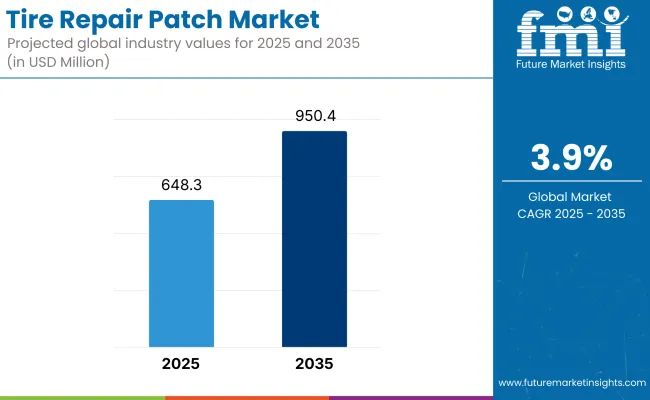

The Tire Repair Patch market is projected to reach USD 648.3 million in 2025 and is expected to grow to nearly USD 950.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.9% over the forecast period. Market expansion is being supported by increased usage of off-the-road (OTR) tires in mining and construction, alongside fleet-level strategies focused on extending tire life and minimizing downtime.

In 2023, KwikPatch confirmed an expansion in its manufacturing capabilities for OTR and earthmover tire repair patches. The new product lines were developed using high-durability rubber compounds with reinforced mesh cores. According to the company’s technical release, performance testing demonstrated enhanced abrasion resistance and longer sealing life under cyclic heavy-load conditions.

Continued adoption of repair patches in equipment maintenance protocols has been observed across mining haul trucks, port cranes, and articulated earthmovers. Full tire replacement-often costly and logistically complex-has increasingly been replaced by patch-based interventions, particularly for vehicles operating in remote or high-usage environments.

Design improvements have been introduced in patch application technologies. Self-adhesive backings and heat-curing compounds have been incorporated to support rapid repairs without reliance on external vulcanization equipment. Field repair efficiency has improved through integration of modular kits tailored for radial and steel-belted OTR tires.

Geographies with limited on-site tire service infrastructure-such as parts of Sub-Saharan Africa and Latin America-have shown increased uptake of portable repair kits. These solutions have been positioned as viable alternatives to tire replacement in remote job sites where servicing delays impact equipment utilization.

Industry service guidelines have endorsed the patch-over-plug technique for high-integrity casing repair. Major OEMs have incorporated such standards into their tire warranty protocols, with specific patch types pre-approved for retention of coverage in heavy equipment applications.

Product bundling strategies have emerged as a point of differentiation among suppliers. Kits are increasingly being offered with essential accessories such as vulcanizing tools, sealing solutions, and safety gloves. Use-case segmentation-such as casing versus sidewall repair-has been applied to standardize technician workflows and improve repair consistency.

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 648.3 million |

| Industry Projected Size in 2035 | USD 950.4 million |

| CAGR (2025 to 2035) | 3.9% |

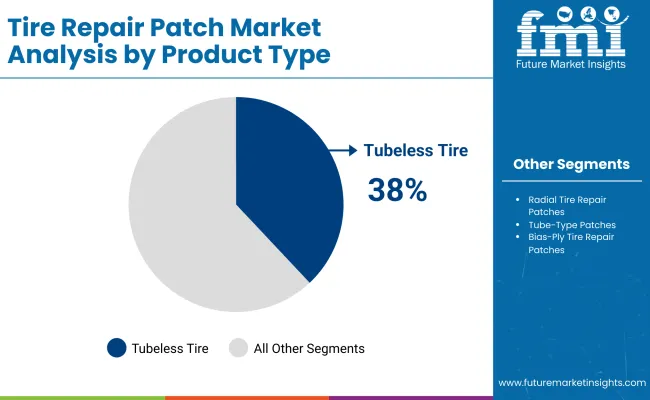

Tubeless tire patches are estimated to account for approximately 38% of the global market in 2025 and are projected to grow at a CAGR of 4.1% through 2035. This dominance is supported by the widespread shift toward tubeless tire systems in passenger vehicles, two-wheelers, and commercial fleets.

These patches offer fast, reliable sealing and require minimal tooling, making them the preferred solution for roadside assistance and tire service centers. Manufacturers continue to enhance patch adhesion, self-vulcanization properties, and compatibility with multiple tire construction types. Growth is further supported by the increasing vehicle parc fitted with tubeless tires across Southeast Asia, Latin America, and Eastern Europe, where road conditions and high puncture exposure sustain regular repair demand.

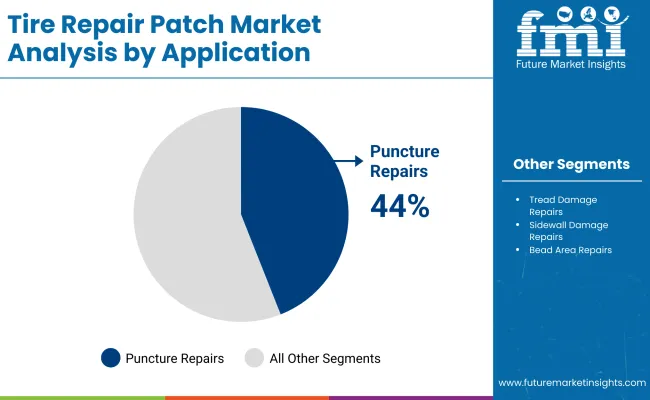

Puncture repair applications are projected to account for nearly 44% of the global tire patch market in 2025 and are expected to grow at a CAGR of 4.0% through 2035. This application leads the market due to its high frequency and cost-effective repair process for minor tire damages. Tire service shops and mobile repair operators continue to use patching kits to address common issues such as nail or debris penetration across both tube-type and tubeless systems.

Manufacturers offer a wide range of cold and hot patch formats designed for quick application and long-lasting performance. As global vehicle usage rises and infrastructure quality remains variable in many regions, puncture repair is expected to remain the core segment in tire maintenance and aftermarket services.

The market is subject to several uncertainty, and manufacturers in the tire repair patch market are faced with risks such as fluctuating raw material costs, regulatory compliance, counterfeit products and changing consumer preferences.

Raw material volatility is one of the major risks, as rubber, adhesives and synthetic polymers are exposed to price volatility caused by supply chain disruptions, geopolitical tensions and environmental legislation. Large spikes in material costs can lead to less favorable margins, forcing companies into different sourcing plans.

Another risk comes in the form of regulation, in which varying countries have differing safety standards on tire repair products. Not adhering to strict laws in areas such as North America and the EU can result in product recalls, legal fees, and brand reputation damage. Moreover, counterfeit and low-quality tire patches available in the marketplaces, especially in Asia and Africa, lead to dilution of market credibility and challenge authentic manufacturers to retain their competitive advantage.

Moreover, consumers are increasingly turning to tubeless and self-sealing tires, which will eventually diminish the need for replacement repair patches. This trend forces manufacturers to develop and upgrade to new technologies, like innovative sealants and smart tire reparation solutions. Finally, interruptions in global logistics and increased freight costs may impede timely delivery of products, while also impacting the efficiency of supply chains and customer satisfaction. To mitigate these risks and ensure long-term profitability, manufacturers should diversify their supply chains, invest in R&D, and strengthen their quality controls.

Investment Levels across Regions

| Region/Market | Investment Level |

|---|---|

| North America (USA & Canada) | High |

| European Union (EU) | High |

| China (Growing Automotive Aftermarket) | High |

| India (Expanding Two-Wheeler Market) | Medium |

| South America (Heavy-Duty Vehicle Segment) | Medium |

| Middle East & Africa (Commercial Vehicle Growth) | Low |

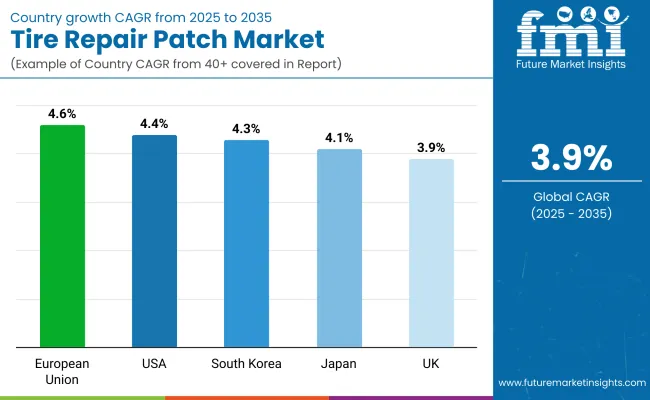

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

| UK | 3.9% |

| European Union | 4.6% |

| Japan | 4.1% |

| South Korea | 4.3% |

The USA market is showing a constant growth as it is benefitting from the increasing automotive fleet, the rise in off-road and commercial vehicle usage, and the search for cost-effective tire maintenance solutions. The USA has 275 million cars, and the tendency for tire repair and maintenance services is still high.

The commercial vehicle industry, especially the logistics and fleet, is a major reason behind the growing demand for patches. The e-commerce expansion trade boom, led by Amazon, FedEx, and UPS, is now translating to more leaked tires that need repairing in order to increase fleet efficiency.

More so, the soaring of the fuel expenses further pressed companies to become tire longevity and fuel-efficient tire management oriented, which increased the application of the heavy-duty tire patches that are well suited for the conditions.

The self-vulcanizing and chemical cure tire patches have been the real heroes in the last couple of years with their high efficiency in puncture sealing, that in turn, reduced downtime for the vehicle operators. The car manufacturers are also coming up with eco-friendly and biodegradable tire patch materials which are a positive trend considering the shifting regulations toward car sustainability.

Growth Factors in The USA

| Growth Factors | Details |

|---|---|

| High Vehicle Ownership | The substantial number of vehicles on USA roads increases the demand for tire maintenance and repair products. |

| DIY Maintenance Culture | A strong do-it-yourself ethos encourages consumers to perform their own vehicle maintenance, boosting sales of tire repair patches. |

| Technological Advancements | Innovations in tire repair technologies enhance the effectiveness and ease of use of repair patches. |

The UK market is growing with the rise in vehicle ownership costs, the increase in electric vehicles (EV) adoption, and the strong demand for tire repair solutions that are sustainable.

Gas prices are compelling businesses and shoppers to look for cost-effective tire patches to maximize tire life and efficiency.

Plus, the increased share of electric vehicles has brought systematic changes in tire maintenance.

Tires of electric vehicles are heavier than those of the traditional cars, so they suffer tire wear faster, which is a reason for more requests for special, high-durability tire repair patches. On top of that, sustainability programs drive manufacturers to come out with non-toxic, low-impact tire patch solutions in line with the targets set by the UK Society of Zero Carbon 2050.

Growth Factors in the UK

| Growth Factors | Details |

|---|---|

| Rising Vehicle Prices | An increasing number of vehicles in operation necessitates efficient tire repair solutions. |

| Emphasis on Road Safety | Strict regulations and awareness campaigns promote regular tire maintenance, driving the market for repair patches. |

| Growth of E-commerce | Online retail platforms expand consumer access to a variety of tire repair products. |

The European tire repair patch market has a rising trajectory due to the strict regulations on waste tire management, high ownership rates of cars, and the rise in cost-effective tire repairs instead of the alternative of tire replacement. The EU Circular Economy Action Plan, which is currently promoting tire sustainability and repair solutions, renders tire patching preferable to discarding it.

Countries such as Germany, France and Italy are leading the pack with their top-grade patches demand, especially in the commercial transportation and heavy-duty vehicle areas. The additional self-sealing and heat-resistant patches are now being widely adopted.

Moreover, the increase in environmental awareness has led to innovations, such as biodegradable tire repair materials, free of toxins, which would align with the EU’s goal of zero-waste automotive solutions.

Growth Factors in European Union

| Growth Factors | Details |

|---|---|

| Environmental Regulations | Policies encouraging tire repair over replacement to reduce waste support market growth. |

| Expansion of Automotive Sector | A robust automotive industry increases the demand for maintenance products, including tire repair patches. |

| Consumer Shift Towards Cost Savings | Economic considerations drive consumers to opt for repairs instead of purchasing new tires. |

The density of vehicles, advanced automotive technology, and a culture that prioritizes road safety are push factors for patches demand in Japan.

Consumers in Japan have a high tendency of following preventive measures and, for a long period now, they have been using tire repair patches for small punctures, instead of changing tires earlier.

Growth Factors in Japan

| Growth Factors | Details |

|---|---|

| Aging Vehicle Fleet | Older vehicles require more frequent maintenance, including tire repairs. |

| Technological Innovation | Advanced tire repair materials and methods are being developed to meet consumer demand for quality. |

| Urbanization | High urban density leads to increased vehicle usage, necessitating regular tire maintenance. |

The South Korean market is growing with the rise in need for affordable auto solutions and a rapidly expanding e-commerce auto parts sector. The broader landscape, where the transportation networking application ridesharing and delivery services are playing a key role, is another force behind the growing demand for quick, robust tire repair patches among drivers.

The South Korea automobile industry which is well-known for its innovation has already produced tire repair patches with nanotechnology-enabled adhesives and temperature resistant sealants, thus extending the lifetime of the repair.

Growth Factors in South Korea

| Growth Factors | Details |

|---|---|

| Growing Automotive Industry | Expansion in vehicle production and ownership boosts the need for tire repair solutions. |

| Consumer Awareness | Increased understanding of the benefits of regular tire maintenance supports market demand. |

| Availability of Advanced Products | Introduction of innovative and efficient tire repair patches appeals to tech-savvy consumers. |

The competitive marketplace for tire repair patches has all leading players of the industry coming together to give their best moves to outdo the competition in the market. Other leading names in the industry are Michelin, 3M, Hankook, Texaco, Sumitomo, Kenda, Pirelli, Continental, Toyo Tire, Trelleborg, and Yokohama, who are engaged in product innovation, quality enhancements, and widening distribution networks in line with ever-increasing demand for effective tire repair solutions.

For example, developments in self-adhesive patches and heated repair technologies have greatly improved efficiency and reduced use since they apply to all vehicles, ranging from passenger cars to commercial fleets.

The key players resort to strategic partnerships, mergers, and acquisitions to diversify their distribution, geographic reach, and technological prowess. Companies are also investing great amounts in research and development to introduce environmental-friendly and sustainable repair solutions for the increasing global shifts toward environmental consciousness.

The current energy booby trap that has been set up by electric vehicles (EVs) is prompting companies to make advancements in developing repair patches made for specific EV tires. Another typical tactic is gearing up for new market ventures in emerging nations, especially in the Asia-Pacific region whose automotive industry is developing and requiring more and more reliable tire maintenance products.

The overall market size is slated to reach USD 648.3 million in 2025.

The market is expected to reach USD 950.4 million in 2035.

The increasing demand from automotive maintenance, fleet management, and roadside assistance services is slated to fuel product demand during the forecast period.

Some of the key companies include Rhino-Rack, Perrycraft Inc., Malone Auto Racks, Atera GmbH, EGR Group, Weipa Auto Accessories, Westin Automotive Products Inc., Hapro International, Mitsuba Corporation, Thule Group, JAC Products, and Yakima Products Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord and Tire Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire & Wheel Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Tire Inspection System Market - Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Tire Cord Market

Tire Carousel Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA