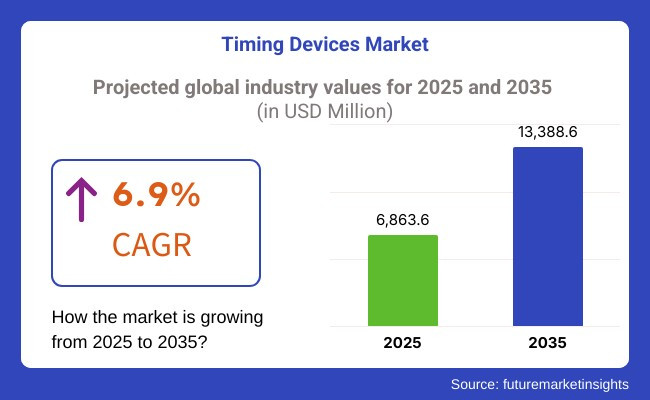

The timing devices market is estimated to be worth USD 6.86 billion in 2025 and anticipated to reach a value of USD 13.38 billion by 2035. Sales are projected to rise at a CAGR of 6.9% over the forecast period between 2025 and 2035.

The industry is witnessing significant growth due to various factors. The rising demand for smartwatches and wearable devices is a key driver. Customers like multifunctional smartwatches with fitness-tracking capabilities, GPS, and connectivity, thus making them vital accessories. It is driving producers to innovate and enhance functionality.

Advances in quartz and atomic clock technology, along with integration of AI and IoT, are enhancing timekeeping devices accuracy and functionality. Also, increasing demand for high-end watches among luxury brands, particularly in emerging economies, is driving the industry. High-net-worth individuals are purchasing high-end brands, making high-end watches gain more demand.

The growing application of time devices in industrial, aerospace, and defense has also increased the industry. These sectors make use of precise time synchronization for various operations. In addition, growing disposable income and urbanization in Asia-Pacific and Latin America has contributed to increased consumers' expenditure on both smart watches and conventional watches.

While the industry holds potential, there are limitations to growth. The strongest among these is mobile phone competition, which now capture the majority of checking time use. This lowers the demand for personal wristwatches and clocks. Another difficulty is the costliness of luxury and smartwatches, keeping most price-conscious consumers out.

The industry also presents a few growth opportunities. The industry for hybrid watches, which combine the analog look and feel with intelligent features, is increasing. Gaining entry in emerging markets offers another growth opportunity for watch companies. The shift towards sustainable and environmentally friendly material usage, for example, solar-powered and recycled-material watches, is also directing future product innovations.

Smartwatch integration of 5G, AI, and sensors is a growth opportunity that further enhances the functionality of tracking health, being connected, and performance. At the same time, atomic clocks and quantum clocks are gaining larger roles in science, aerospace, and telecommunications markets, which open up the reach of the industry for time devices even further.

Additionally, there are a number of trends influencing the industry such as wearable healthcare technology is going mainstream, with smartwatches providing ECG monitoring, SpO2 monitoring, and fitness analysis. Consumers are increasingly interested in minimalist and retro watch designs, which indicate a move away from fussy digital displays towards classic styling.

Explore FMI!

Book a free demo

Shifting industry is exemplified through the rate of penetration of AI-equipped time-monitoring network solutions, super-intelligent watches, and the installation of highly accurate synchronizing software tools. Customers attach greater priority on business prestige, fashion, and intelligent features, while the suppliers prioritize precision, reliability, and simple implementation of industrial applications in their processes.

Dealers on the one hand stress the importance of pricing strategies, brand diversity, and demand forecasting obligations and manufacturers on the other hand allocate funds to R&D for innovation and cost-cutting processes. The orientation to eco-friendly raw materials and digital transformation remains the backbone of the industry with innovations like biometric authentication, quantum timekeeping, and blockchain-based timestamping technologies gaining more traction.

The anticipated increase in the use of GPS-enabled and AI-accomplished timekeeping devices with the goal of strengthening precision and efficiency across diverse areas is due to the highly synchronized systems that are required in the different sectors.

| Company/Entity | Contract Value (USD Million) |

|---|---|

| SiTime Corporation | Approximately USD 50 |

| Microchip Technology Inc. | Approximately USD 75 |

| TXC Corporation | Approximately USD 40 |

| Abracon LLC | Approximately USD 60 |

Strategic partnerships and technological advancements have brought significant growth in the industry during 2024 and early 2025. The collaboration of SiTime Corporation with an automaker to supply MEMS-based timing solutions for ADAS highlights the increasing convergence of precise timing in vehicle safety features.

Again, Microchip Technology Inc. to develop telecommunication infrastructure through accurate timing through its recent contract to enhance the service from the cloud displays the effective use of precise timing in increasing reliability within the network. Providing crystal oscillators for wearable technology is the driving force behind TXC Corporation's partnership to enhance performance for consumer electronics, fueled by the demand for better performance in consumer electronics.

Emphasizing the importance of precise performance in operational efficiency as well is the partnership formed by Abracon LLC to integrate timing solutions into industrial automation. The innovations reflect that the strong and growing timing devices has indeed helped to contribute to allow innovations in several field.

During the period 2020 to 2024, the industry witnessed strong growth with rising demand for accurate timekeeping in telecommunication, consumer electronics, automotive, and industrial markets. The advent of 5G networks demanded ultra-high precision timing solutions to facilitate untroubled data transmission and network synchronization.

Growing demand for high-precision timing in navigation and sensor fusion in autonomous vehicles and advanced driver-assistance systems (ADAS) further propelled growth. Smartphones, wearables, and IoT devices depended upon miniature and power-friendly timing solutions to support increased performance and battery life. Despite integration difficulties and miniaturization needs, vendors were interested in developing MEMS-based and quartz-based oscillators that would be more accurate with less power consumption.

AI-based synchronization, quantum timing, and edge computing from 2025 to 2035 will drive industry growth. AI-powered timing equipment will enable real-time tuning of performance and predictive maintenance in industrial automation and telecommunication. Quantum clocks will deliver unparalleled accuracy for defense, satellite navigation, and scientific research high-precision application.

Edge computing and IoT will require very tight timing requirements for edge processing and communication. 6G network creation will require ultra-low latency and synchronized timing infrastructure. Automotive technology, including autonomous vehicles, will continue to drive the requirement for real-time sensor synchronization and navigation accuracy. Green products and energy-efficient buildings will become more aligned with environmental goals.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gradual improvements in quartz-based and atomic clocks enhanced precision for consumer and industrial applications. | Adoption of ultra-high precision next-generation atomic and optical clocks for scientific research, defense, and aerospace. |

| Smartwatches and wearables with health monitoring, GPS, and mobile connectivity growing. | Biometric authentication-enabled AI wearables with real-time health diagnostics and automatic IoT synchronization. |

| High-precision timekeeping became critical for financial trading, telecommunications, and navigation systems. | Quantum technology-enabled timekeeping systems go mainstream to provide highly accurate synchronization for space exploration, deep-sea navigation, and high-frequency trading. |

| Time devices increasingly integrated into smart homes, IoT-enabled factories, and vehicle connectivity. | Complete automation with 6G networks, AI-based scheduling systems, and cloud-based time synchronization across sectors. |

| Chip designers investigated low-power chip designs to provide longer battery life in wearables and industrial time devices. | Widespread use of energy-harvesting technologies, including solar and kinetic charging, in consumer and industrial time devices. |

| North America and Europe dominated the industry, with Asia-Pacific experiencing growing adoption with fast-paced digitization and increasing electronics production. | Asia-Pacific leads other markets in terms of industry share due to semiconductor technology and government investment driving innovation in precision timekeeping. |

| Industry growth was driven by demand from telecommunications, GPS, defense, and consumer electronics. | Growing applications in AI-driven automation, quantum computing, and decentralized digital identity systems drive industry growth. |

Risks involved in the industry are in the supply chain such as the lack of microchips and the key parts that are necessary to produce items can sometimes lead to unwanted consequences, for instance, detaining production and thus, increasing the cost. Always on the lookout for quality suppliers besides exploring additional sourcing avenues are the prime aspects companies should concentrate on to ensure continued manufacturing as well as distribution.

The strict regulations surrounding battery usage, electronic waste disposal, and environmental sustainability have a negative effect on the industry. The sector is required to deal with this issue by utilizing green materials, making energy-conserving products, and adhering to international standards. Packaging that is biodegradable and components that are recyclable will be the two factors dominating the competitive edge in the industry.

Despite the fact that the situation in the world is difficult and companies are striving to escape cyber threats, the level of concern for the industry to do IoT and the cloud connection is increasing. The risks of hacking, data breaches, and unauthorized third-party access threaten the privacy of users and the integrity of the system.

Adopting cutting-edge security protocols, continual software upgrades, and encrypted communication channels are some of the means that businesses should consider to find the route through these obstacles for being trusted by consumers.

The financial risks manufacturers face come from the fluctuation of raw materials such as metals and electronic components. What is more, the ongoing geopolitical tensions and trade embargoes could be a reason behind the supply chain interruptions. However, using different suppliers for raw materials, establishing local production units, and forthcoming strategic pricing policies are some of the actions to take in overcoming the problem and keeping the business prospering.

| Type | Share (2025) |

|---|---|

| Oscillators | 27.8% |

Oscillators Dominates the Market Share in the Timing Devices Industry

Oscillators command the largest industry share in the industry because they are universally used in various industries, such as telecommunications, aerospace, automotive, and consumer electronics.

They help maintain frequency and time in electronic circuits in an accurate manner, facilitating error-free communication and synchronization. Increasing usage of 5G networks has increased demand for highly accurate quartz and MEMS oscillators to provide reliable timing solutions. Increases in the industry share due to growth of autonomous cars, IoT devices, and industrial automation also secured oscillator leadership in the marketplace.

Increasing popularity of low-power miniaturized oscillators among wearable devices and smart devices has also been driving their dominance. Supported by ongoing technological advancements and incorporation of MEMS-based technology, oscillators will remain at the top spot in the future as well.

| Application | CAGR (2025 to 2035) |

|---|---|

| Consumer Electronics | 7.5% |

Consumer Electronics Segment is Growing at the Highest CAGR During the Forecasted Years.

The consumer electronics sector is growing at the highest CAGR due to the rising use of smart devices, wearables, and IoT-enabled devices. The increasing penetration of smartphones, tablets, smartwatches, and fitness trackers has significantly driven the need for high-accuracy timing solutions. MEMS oscillators and real-time clocks (RTCs) also become extremely important in providing accurate timekeeping and synchronization within these devices.

Additionally, increased demand for smart home systems, including connected appliances and home automation systems, further fueled industry growth. With consumers ever more focused on smaller, power-saving, and high-performance electronics, manufacturers increasingly produce timing solutions that increase the reliability of devices. Increased interest in AI-powered applications and augmented reality (AR) devices will increasingly drive demand for consumer electronics timing devices.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| France | 5.7% |

| UK | 6.2% |

| China | 7.2% |

| India | 7.8% |

The USA is among the leading players in the Industrybecause of its defense, aerospace, and 5G technology sectors. The fast rollout of 5G networks requires ultra-high precision timing solutions to synchronize the networks, which places a huge onus on the demand for high-performance oscillators and atomic clocks. The strong defense sector is dependent on cutting-edge timing solutions for GPS-reliant military missions, secure communications, and missile guidance systems.

Financial industries, especially high-frequency trading, rely on nanosecond-scale precision, hence fueling the need for precision timing instruments even more. Government efforts towards improving satellite-based navigation and cybersecurity further increase the industry strength, and industry leaders like Microchip Technology and SiTime Corporation are still at the forefront of developing precision timing devices.

FMI is of the opinion that the USA industry is slated to grow at 6.8% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| 5G Rollout | Rollout of 5G networks across the country needs high-precision timing solutions to ensure seamless transfer of data. |

| Defense Sector | Military missions need GPS-based navigation and reliable atomic clock-backed communication. |

| Financial Market | High-precision timekeeping is necessitated by high-frequency trade to enable fast execution of trades. |

| Space & Navigation | NASA and industry dictate satellite navigation solutions on the need for strong timing solutions. |

| IoT & Automation | Smart infrastructure and autonomous vehicle initiatives drive the need for the right synchronization solutions. |

The UK is also witnessing high growth in the industryas a result of the exponential rise in 5G, industrial automation, and advancements in space technology. The telecommunication industry needs accurate timing for a stable 5G network, whereas the nation's focus on Industrial IoT (IIoT) and smart manufacturing necessitates demand for synchronized automated systems.

The UK's participation in satellite navigation projects, such as those of the UK Space Agency, is in need of high-atomic clocks and frequency control equipment. The London financial industry, a hub for high-frequency trades globally, relies on high-accuracy time coordination to ensure smooth transactions.

FMI is of the opinion that the UK industry is slated to grow at 6.2% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| 5G Network Installation | Installation of 5G technology necessitates high-precision timing to ensure stability within the network. |

| Industrial IoT | Smart manufacturing and automation are based on synchronized timing systems. |

| Space & Navigation | Atomic clocks are needed for satellite missions to make accurate navigation and location possible. |

| Financial Sector | The trading centers in London depend on precise timekeeping for algorithmic trading. |

| National Security | Secure communications and cybersecurity programs need strong timing solutions. |

India's industryis expanding with high velocity, fueled by ubiquitous 5G rollout, smart city development, and growing defense modernization programs. The deployment of 5G networks necessitates precision in time solutions to allow for smooth connectivity. Smart city initiatives supported by the government have IoT-based real-time monitoring networks that need suitable time synchronization.

The defense department supports satellite-based navigation networks, such as NavIC, using advanced atomic clocks and frequency control devices. Fintech businesses based on speedy digital transactions also need accurate time-stamping tools. With record foreign investment and government-sponsored manufacturing plans under "Make in India," India is well-positioned to be the world's destination for time devices.

FMI is of the opinion that the Indian industry is slated to grow at 7.8% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| 5G Rollout | The mass-scale rollout of 5G throughout the country enhances the demand for high-accuracy timing solutions. |

| Smart Cities | Real-time IoT-based monitoring requires precise synchronization. |

| Defense Sector | NavIC satellite navigation system relies on high-performance atomic clocks. |

| Fintech & Digital Payments | The introduction of electronic transactions necessitates precise time-stamping solutions. |

| Manufacturing & R&D | Government policies promote indigenous manufacturing of high-precision timing devices. |

Technological development and infrastructure expansion at a rapid pace in China is driving the growth of the industry. The country's dominance in 5G and telecommunication is fueling the need for high-accuracy timing solutions. The trend of smart cities and intelligent transportation systems is on the rise, and synchronized networks are needed to enhance efficiency.

Defense and aerospace industries apply atomic clocks to secure navigation and military use. China's involvement in space exploration and satellite-based navigation systems also increases the demand for high-performance timing equipment. The nation's financial sector, particularly in high-frequency trading, also relies on accurate time synchronization.

FMI is of the opinion that the Chinese industry is slated to grow at 7.2% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| 5G & Telecom Growth | Reliable telecommunications require high-precision timing equipment. |

| Smart Cities & IoT | IoT requires accurate time synchronization in urbanization. |

| Aerospace & Defense | Military uses and navigation systems require highly developed atomic clocks. |

| Space Exploration | Chinese satellite programs require good timing to position correctly. |

| Financial Market | The stock industry depends upon good time-stamping for algorithmic trading. |

France is becoming a significant industry player through its robust aerospace industry, 5G infrastructure deployment, and industrial automation focus. The nation's leadership in aerospace and space exploration requires state-of-the-art timing solutions for safe navigation and communications systems.

5G network deployment and industry digitalization require excellent time synchronization. The nation's financial industries, such as high-frequency trading operations, also depend on nanosecond accuracy. With rising research and development spending, France is poised to increase its share in the global marketplace for Time Devices.

FMI is of the opinion that the French industrie is slated to grow at 5.7% CAGR during the study period.

Growth Factors in France

| Key Drivers | Details |

|---|---|

| Aerospace & Aviation | Airborne systems need to have high-accuracy timing solutions to operate safely. |

| 5G Deployment | Deployment of the 5G network increases the need for communication synchronization. |

| Industrial Automation | Smart manufacturing utilizes accuracy in timekeeping. |

| Space Programs | Satellite navigation systems need atomic clocks. |

| Financial Services | High-frequency trading relies on synchronized time. |

The industryis on a fast track for growth as it has been making use of advances in miniaturization, low power consumption, and high-precision timing solutions for applications in telecommunications, IoT, aerospace, and industrial automation. End users are becoming increasingly demanding in terms of high-stability oscillators, atomic clocks, and MEMS-based timing solutions with the adoption of 5G technology, AI-driven systems, and edge computing.

The players who lead the industry are Seiko Epson Corporation, Microchip Technology Inc., and SiTime Corporation, with a strong investment in R&D and a superior range of products specifically related to MEMS oscillators, real-time clocks (RTC), and temperature-compensated crystal oscillators (TCXO). Nihon Dempa Kogyo (NDK) and Rakon Limited provide niche applications in areas such as aerospace, industrial automation, and high-frequency telecommunication.

Emerging competition from cheaper, cost-effective quartz oscillators and RTCs produces large-scale manufacturing in countries such as China and Taiwan. The future shaping innovations has included many more, especially low power consumption, and ultra-precision timing devices to cater to next-gen connectivity, autonomous systems, and smart grids.

Strategic space includes Timer synchronization with AI, increased demand for Timing solutions in robust 5G infrastructure, and consolidation with mergers and acquisitions. This highly hot and fast-evolving industry favors timing related to ultra-low jitter oscillators, ruggedized timing solutions, and application-specific timing modules.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Seiko Epson Corporation | 18-23% |

| Microchip Technology Inc. | 15-20% |

| SiTime Corporation | 10-15% |

| Nihon Dempa Kogyo (NDK) | 8-12% |

| Rakon Limited | 5-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Seiko Epson Corporation | Leader in quartz crystal oscillators, RTCs, and high-precision timing solutions for industrial and automotive applications. |

| Microchip Technology Inc. | Offers atomic clocks, MEMS oscillators, and ultra-stable frequency references for telecommunications, defense, and aerospace sectors. |

| SiTime Corporation | Specializes in MEMS-based timing devices, low-power oscillators, and 5G-compatible timing solutions. |

| Nihon Dempa Kogyo (NDK) | Focuses on high-stability quartz oscillators and frequency control solutions for telecom and industrial automation. |

| Rakon Limited | Provides high-precision timing solutions for space, defense, and navigation applications. |

Key Company Insights

Seiko Epson Corporation (18-23%)

Epson dominates the industry when it comes to quartz-based oscillators and RTC devices that are provided for automotive, industrial, and consumer applications.

Microchip Technology Inc. (15-20%)

Microchip is a top company in atomic clocks and MEMS solutions for timing, focusing on application markets including 5G, aerospace, and very high reliability in general.

SiTime Corporation (10-15%)

SiTime is the industry leader in MEMS-based oscillators, helping to grow innovation on ultra-compact, low-power, and high-stability timing solutions.

Nihon Dempa Kogyo (NDK) (8-12%)

NDK manufactures high-precision frequency control components for the fields of telecommunications, industrial automation, and medical devices.

Rakon Limited (5-10%)

Rakon is a key supplier of high-reliability oscillators and frequency control devices used in applications such as space-driven, defense, and GPS.

Other Key Players (30-40% Combined)

The industry is estimated to generate USD 6.86 billion in 2025.

The market is projected to reach USD 13.38 billion by 2035, growing at a CAGR of 6.9%.

Key manufacturers include Seiko Epson Corporation, IQD Frequency Products Ltd., Nihon Dempa Kogyo Co. Ltd., TXC Corporation, Microchip Technology, Inc., Texas Instruments, Infineon Technologies AG, Kyocera Corporation, Murata Manufacturing Co. Ltd., and Rakon Limited.

Asia-Pacific, particularly Japan and China, due to strong demand in consumer electronics, telecommunications, and automotive sectors.

Quartz-based timing devices dominate due to their high precision, reliability, and widespread use in consumer electronics and industrial applications.

By type, the segment is categorized into Oscillators, Resonators, Semiconductor Clocks, Jitter Attenuator, and Clock Buffers.

By application, the segment is classified into Computing Tools, Consumer Electronics, Automotive Sector, Telecommunications, and Industrial Sector.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.