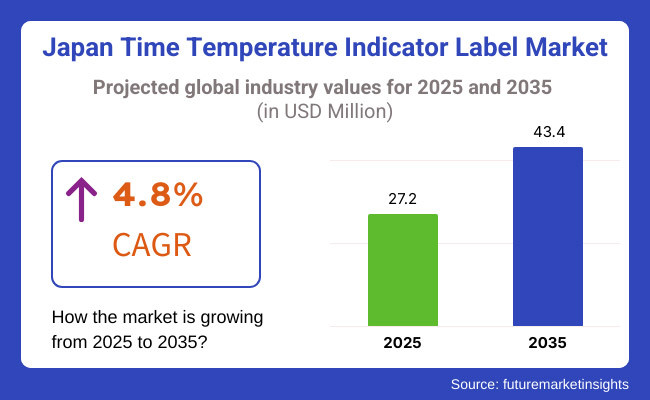

The Japan time temperature indicator label industry is estimated to account for USD 27.2 million in 2025. It is anticipated to grow at a CAGR of 4.8% during the assessment period and reach a value of USD 43.4 million by 2035.

Industry Outlook

As per FMI analysis, the Japanese time temperature indicator label market will grow steadily, with increasing demand for real-time temperature monitoring in food, pharmaceutical, and logistics sectors. Increasing regulatory requirements and consumer awareness of product safety by 2025 will drive adoption, with technological innovations like IoT-based sensors and enzymatic indicators improving accuracy.

Forward to 2035, the market will feature such innovations as smart labeling based on artificial intelligence, blockchain-transparency in the supply chain, and sustainable biodegradable materials to meet the world's environmental needs. Growth in the biotechnology, precision medicine, and high-value perishable export markets will create further demand.

As Japan builds its cold chain infrastructure and waste reduction becomes a priority, the industry will be a key player in product integrity and safety and solidify its position as part of temperature-sensitive logistics.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Adoption was largely limited to basic chemical and enzymatic indicators, with early experimentation in smart labels and RFID-based tracking systems. | Widespread AI-driven smart labeling, blockchain for supply chain transparency, and IoT-enabled real-time tracking will become standard, improving efficiency and accuracy. |

| Stricter food safety regulations and pharmaceutical cold chain requirements influenced industry growth. The pandemic led to heightened emphasis on vaccine storage and temperature monitoring. | Regulatory compliance will become more stringent, with international cold chain standards driving demand for high-precision indicators, particularly in biotech and biologics. |

| Primarily used in food and pharmaceuticals, with adoption limited to essential cold chain sectors like vaccines and dairy products. E-commerce grocery deliveries saw a rise in demand. | The industry will expand into biotechnology, precision medicine, cosmetics, and specialty chemicals, ensuring broader applications in high-value perishable goods. |

| Awareness about temperature-sensitive storage increased during the pandemic, but mass adoption was still in its early stages, mainly driven by food safety concerns. | Consumers will demand more transparency and sustainability, leading to eco-friendly, digital, and reusable indicator labels that provide real-time monitoring via mobile apps. |

| Labels were mostly single-use and chemical-based, with limited focus on environmental impact. Recycling efforts were minimal. | The industry will shift toward biodegradable, reusable, and energy-efficient indicator labels, aligning with Japan’s carbon neutrality goals and waste reduction policies. |

| Japan invested in improving cold storage facilities, but logistical inefficiencies and gaps in monitoring persisted. The industry relied on manual checks and basic tracking systems. | The future will see fully automated cold chain networks, AI-driven logistics management, and real-time tracking systems, reducing product spoilage and waste. |

| Growth was pandemic-driven, with demand for vaccine storage, food safety, and online grocery deliveries boosting the market. Government initiatives promoted cold chain improvements. | Growth will be fueled by technological advancements, expanding biotech and pharma sectors, rising global trade, and stricter regulatory frameworks, ensuring long-term demand. |

Growing Demand for Real-Time Temperature Monitoring

Japanese consumers are increasingly demanding real-time visibility into the status of perishable products, particularly in food and pharmaceuticals. As health awareness increases, consumers expect time temperature indicator labels to give them instant temperature readings through smartphone apps and IoT connectivity. This is driving businesses to implement digital sensors and AI-based indicators that provide real-time monitoring and automatic notifications.

Expansion of E-Commerce and Home Deliveries

The expansion of online food ordering and delivery of meal kits has sped up the demand for accurate temperature monitoring. Fresh and safe food at delivery is required by Japanese consumers, and grocery store shopping and logistics operators who shop every day have been compelled to integrate smart temperature labels into product packaging. The labels provide customers with confidence that products like seafood, dairy products, and frozen foods have been kept within safe temperatures along the supply chain.

Green and sustainable product preference

Environmental concerns are influencing the buying decision since consumers increasingly choose biodegradable, recyclable, or reusable temperature indication labels. Consumers increasingly seek alternatives that are plastic-, chemical-, and power-free because these are associated with Japan's sustainability initiatives. This is prompting companies towards green ink-based and enzyme-based labels that biodegrade innocuously without affecting the environment whatsoever.

Higher Consciousness in Pharmaceuticals and Biotech

The need for temperature-sensitive biologics, specialty pharmaceuticals, and vaccines is spurring consumers' demands for high-accuracy monitoring. Doctors and patients need intelligent labels to provide drug integrity, specifically for drugs that need strict cold chain management. Japan's demographic shift of aging and the growth in personalized medicine fit with this trend since precise temperature monitoring is a facet of healthcare.

Based on product type, the market is categorized into color-based and barcode-based. Color-changing temperature indicator labels are more common in Japan due to their simplicity, lower cost, and instantaneous visual feedback.

They color-change upon exposure of the product to outside temperature variations from the acceptable limits, making them suitable for use in food, pharmaceutical, and logistics industries. Their simplicity of application, with no need for any specialized scanning gear, has positioned them as widely desired by shoppers, retailers, and supply chain personnel requiring on-the-spot, real-time guarantee of product authenticity.

Depending on label information, the market is segmented into Time Temperature Indicators (TTI), Critical Temperature Indicators (CTI), and Critical Time Temperature Indicators (CTTI). Among Out of Time Temperature Indicators (TTI), Critical Temperature Indicators (CTI), and Critical Time Temperature Indicators (CTTI), Time Temperature Indicators (TTI) are utilized most in Japan. TTIs are more because they provide continuous temperature exposure over time monitoring, which is a superior measure of product safety compared to that provided by CTIs and CTTIs.

Where cold chain integrity is required in foods, drugs, and logistics, TTIs help track cumulative temperature exposure to guarantee products remain safe along their supply chains. Perishable foods, vaccines, and biologics are examples where small temperature fluctuations over the shelf life reduce quality and potency.

Based on technology, the market is divided into microbiological, diffusion, polymer-based, photochemical, and enzymatic. Enzymatic TTIs are widely used because they provide high accuracy, low cost, and their capability to simulate food spoilage or pharmaceutical degradation over a period. Enzymatic TTIs work through initiating a color change by enzymatic reactions that map to cumulative temperature exposure, rendering them extremely dependable for food safety, pharmaceuticals, and cold chain logistics.

Japan's stringent food safety laws and increased demand for minimally processed, fresh foods prompted the use of enzymatic TTIs, since they are ideal in showing that a product remains fresh. Also, the drug industry gains through enzymatic markers for monitoring cold-sensitive vaccines, biologics, and pharmaceuticals to satisfy international cold chain requirements.

Based on end-use industry, the market is divided into pharmaceutical, food & beverage, and chemical & fertilizers. Within Pharmaceutical, Food & Beverage, and Chemical & Fertilizers, the Food & Beverage industry is the largest adopter of time temperature indicator (TTI) labels in Japan.

The reason for this dominance is caused by stringent food safety laws, demand from consumers for fresh and perishable produce, and the expanding e-commerce grocery home delivery market. Japan's food business greatly depends on cold chain logistics to preserve the quality of seafood, dairy, meat, sushi, ready-to-eat food, and frozen foods, for which TTIs are critical in guaranteeing that products stay within safe temperatures along the distribution channel.

There are a few major players in Japan's time temperature indicator (TTI) label market, with top manufacturers and technology companies leading the trend and market growth. Major firms concentrate on high-end smart labeling solutions, IoT connectivity, and sustainability, responding to increasing demand for temperature-sensitive logistics in food, pharma, and biotech.

Japanese producers emphasize high-quality, reliable, and regulatory-compliant TTI solutions, and as such, the market is strongly specialized. The sector is characterized by close collaborations among TTI producers, food distributors, pharmaceuticals, and logistics companies to ensure extensive adoption. Local innovation and strict conformity with safety rules further reinforce the leadership of established domestic and foreign brands.

Despite intense competition, entry barriers are high because of the requirement for technological skills, regulatory clearances, and wide distribution channels. Small companies and startups find it difficult to enter the market unless they provide niche, low-cost, or green solutions. Big players still have the upper hand, determining the future of the industry with smart, advanced, and sustainable TTIs.

Major Developments

Key domestic and foreign players battle in Japan's time temperature indicator (TTI) label market with emphasis on technological advancement, regulatory adherence, and supply chain alliances. Top players lead by investing in R&D, creating intelligent TTIs, IoT-supported tracking, and blockchain implementation to provide consistent temperature monitoring for the food, pharma, and logistics industries.

Japanese producers emphasize high-precision, environmentally friendly solutions that are in line with the nation's stringent safety standards and green objectives. Domestic firms use cutting-edge chemical, enzymatic, and polymer-based indicators to increase precision and longevity. International companies compete by bringing in AI-based, RFID, and digital TTIs, meeting the increasing need for real-time, automated cold chain monitoring.

Alliances and associations consolidate market control, with TTI manufacturers in close coordination with food distributors, pharma businesses, and logistics companies. Industry leaders embed intelligent labels within packaging solutions, promoting extensive use. Government regulations pertaining to cold chain safety and reducing food wastage also fuel the market, urging companies to enhance TTI efficiency.

In spite of competition, entry barriers are still high, as new firms find technology expenses, regulatory clearances, and industry standardization costs to be hurdles. Branded players rule with patented TTI technologies, supply chain dominance, and channels. But startups targeting affordable, biodegradable, or tailor-made TTIs make inroads, providing specialty solutions in a crowded market.

The market is anticipated to reach USD 27.2 million in 2025.

What is the outlook on the time temperature indicator label industry sales?

Prominent players include Insignia Technologies Ltd., Evigence Sensors, Phase IV Engineering, Inc., and others.

With respect to product type, the market is classified into colour-based and barcode-based

In terms of label information, the market is segmented into Time Temperature Indicators (TTI), Critical Temperature Indicators (CTI), and Critical Time Temperature Indicators (CTTI).

In terms of technology, the market is divided into microbiological, diffusion, polymer-based, photochemical, and enzymatic.

In terms of end-use industry, the market is divided into pharmaceutical, food & beverage, and chemical & fertilizers.

In terms of province, the market is segmented into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and Rest of Japan.

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Neoprene Coffee Sleeves Market Growth - Demand & Forecast 2025 to 2035

Mailer Boxes Market Growth – Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.