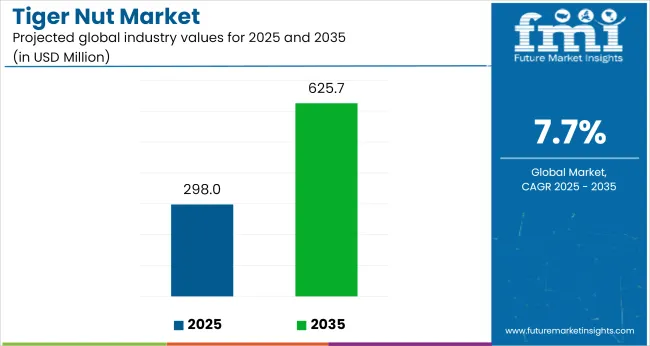

The global tiger nut market is projected to grow from USD 298 million in 2025 to USD 626 million by 2035, registering a CAGR of 7.7%. The market expansion is being driven by rising consumer focus on natural superfoods, increasing vegan and lactose-intolerant populations, and greater demand for tiger nut-based beverages, flours, and oils.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 298 million |

| Industry Value (2035F) | USD 626 million |

| CAGR (2025 to 2035) | 7.7% |

The nuts’ benefits in digestive health, heart health, and as a nutrient-dense snack fuel their incorporation into food products, beverages, bakery, and health supplements.

The market holds an estimated 100% share of the tiger nut products market, reflecting its core role in this segment. Within the edible nuts market, it commands 3.5%, emphasizing its niche but growing importance as a superfood. It contributes around 1.4% to the global plant-based milk market and nearly 0.02% to the overall food and beverage market.

Government regulations impacting the market focus on food safety standards, organic certifications, and novel food approvals in regions such as Europe and North America. In the EU, tiger nuts (chufa) are regulated under novel food guidelines, while the USA FDA governs its safety standards for human consumption. These regulations ensure quality, drive market credibility, and encourage wider consumer adoption globally.

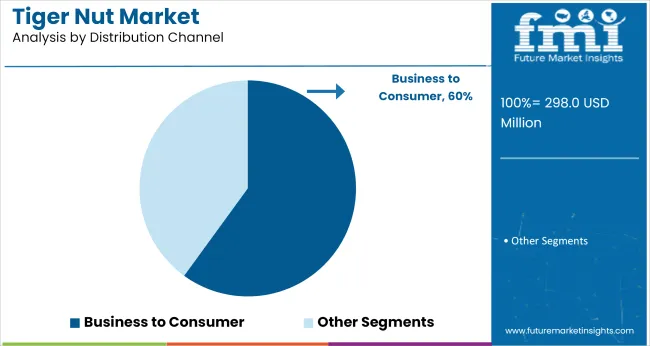

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 9.4% from 2025 to 2035. By distribution channel, business to consumer will lead with a 60% market share, while by type, powder tiger nuts will hold a 57% share. The USA market is expected to grow at a CAGR of 8.2%, while France is projected to expand at 8% CAGR during the same period.

The market is segmented by type, application, distribution channels, and region. By type, the market is divided into powder, granules, and others (tiger nut flour, tiger nut milk, tiger nut oil capsules, and roasted tiger nuts). Based on application, the market is segmented into food & oil industry, cosmetic industry, pharmaceutical industry, and others (animal feed, dietary supplements, biodiesel exploration, and fish bait).

By distribution channels, the market is bifurcated into business to business and business to consumer (hypermarkets/supermarkets, convenience stores, online retail, and others (Independent health stores, specialty organic stores, pharmacy retail, and direct farmer sales)). Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

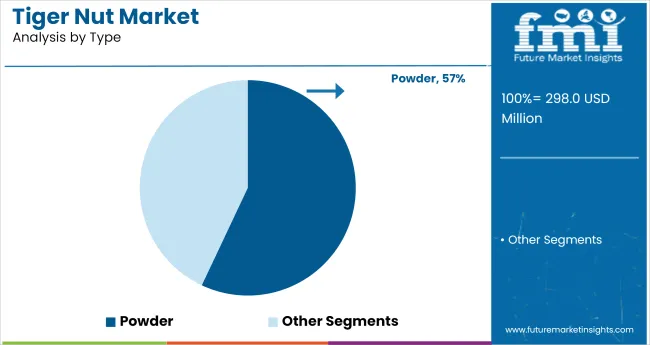

Powder is projected to lead the type segment, capturing 57% of the market share by 2025. These are widely used in bakery, beverages, and home cooking applications.

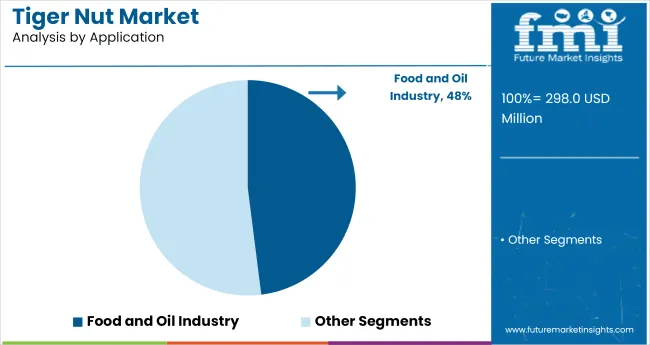

The food and oil industry is projected to capture 48% of the market share in 2025.

Business to consumer sales channels are expected to dominate the distribution channel segment, accounting for 60% of the global market share by 2025.

The global tiger nut market is experiencing steady growth, driven by the increasing demand for plant-based, nutritious, and versatile food ingredients across sectors. Tiger nuts play a crucial role in enhancing product formulations with their health benefits and clean-label positioning.

Recent Trends in the Tiger Nut Market

Challenges in the Tiger Nut Market

Japan leads the tiger nut market with the highest CAGR at 9.4%, driven by premium health-focused snacks, functional foods, and cosmetics. The UK follows with 9% CAGR, supported by traditional use as fishing bait and growing healthy snacking trends. The USA market grows at 8.1% CAGR, underpinned by demand for healthy baked goods and gluten-free alternatives.

Germany records an estimated 8.5% CAGR, driven by baking, confectionery, and functional food applications. France shows 8% CAGR, supported by bakery, confectionery, and plant-based dairy substitute demand. Europe remains dominant, with Japan significantly exceeding the global average in tiger nut adoption and market expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan tiger nut revenue is growing at a CAGR of 9.4% from 2025 to 2035. Growth is driven by strong demand in premium health-focused snacks, functional foods, and cosmetics. As a technology-driven OECD economy, Japan prioritizes high-value, allergen-free, and fortified natural ingredients.

The sales of tiger nuts in Germany are expected to expand at an 8.5% CAGR during the forecast period, driven by strong demand in baking and confectionery applications. Growth is supported by clean label trends and gluten-free dietary preferences in the EU market.

The French tiger nut market is projected to grow at 8% CAGR during the forecast period, supported by rising consumer interest in plant-based and allergen-free ingredients. Growth is driven by bakery and confectionery applications as well as emerging demand in premium food formulations.

The USA tiger nut market is projected to grow at 8.1% CAGR from 2025 to 2035. USA demand is driven by health and wellness trends, rising obesity concerns, and preference for gluten-free, non-GMO food ingredients.

The UK tiger nut revenue is projected to grow at a CAGR of 9% from 2025 to 2035. Growth is supported by traditional use as fishing bait alongside increasing incorporation in gluten-free and allergen-free bakery products.

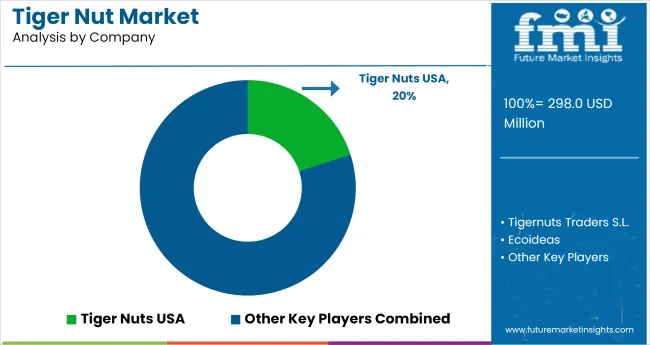

The market is moderately fragmented, with leading players like Tiger Nuts USA, Tigernuts Traders, S.L., Ecoideas, Henry Lamotte Services GmbH, and KCB International dominating the industry. These companies provide a diverse range of tiger nut products catering to applications in food and beverage, bakery, snacks, dietary supplements, and cosmetics. Tiger Nuts USA focuses on raw, flour, and oil products with strong domestic distribution, while Tigernuts Traders, S.L. specializes in exporting premium chufa products primarily for horchata and bakery applications.

Ecoideas delivers organic-certified tiger nuts, flour, and oil targeting the health food and functional ingredient sectors. Henry Lamotte Services GmbH offers bulk sourcing, processing, and trading solutions for European markets, and KCB International is known for importing African tiger nuts with rigorous cleaning and safety standards.

Other key players like Kofi Vinyo and Company Limited (KVCL), Levantex Bocairent S.L., Organic Gemini, Pamela’s Products, Rapunzel Naturkost, and The Chufa Original Company contribute by providing innovative, high-quality tiger nut products for various regional markets and niche applications.

Recent Tiger Nut Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 298 million |

| Projected Market Size (2035) | USD 626 million |

| CAGR (2025 to 2035) | 7.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/Volume in Metric Tons |

| Type Analyzed | Powder, Granules, and Others (Tiger Nut Flour, Tiger Nut Milk, Tiger Nut Oil Capsules, Roasted Tiger Nuts) |

| Application Analyzed | Food and Oil Industry, Cosmetic Industry, Pharmaceutical Industry, and Others (Animal Feed, Dietary Supplements, Biodiesel Exploration, and Fish Bait) |

| Distribution Channel Analyzed | Business to Business, Business to Consumer (Hypermarkets/Supermarkets, Convenience stores, Online retail, and Others (Independent Health Stores, Specialty Organic Stores, Pharmacy Retail, and Direct Farmer Sales)) |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Tiger Nuts USA, Tigernuts Traders S.L., Ecoideas, Henry Lamotte Services GmbH, KCB International, Kofi Vinyo and Company Limited (KVCL), Levantex Bocairent S.L., Organic Gemini, Pamela’s Products, Rapunzel Naturkost, and The Chufa Original Company |

| Additional Attributes | Dollar sales by type, share by application, regional demand growth, regulatory influence, emerging trends, competitive benchmarking |

Based on the type, the tiger nut market is divided into powder, granules, and others.

Based on the distribution channel, the sector is segmented into business to business and business to consumer. In addition, the business to consumer segment has been subdivided into hypermarkets/supermarkets, convenience stores, online retail, and others.

Based on the application, the tiger nut sector is categorized into food and oil industry, cosmetic industry, pharmaceutical industry, and others.

The sector has been analyzed with the following regions covered: North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The market is valued at USD 298 million in 2025.

The market is forecasted to reach USD 626 million by 2035, reflecting a CAGR of 7.8%.

Powder tiger nuts will lead the type segment, accounting for 57% of the global market share in 2025.

The food and oil industry will dominate the application segment with a 48% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 9.4% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutritive Sweetener Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Nutragenomics Market Size and Share Forecast Outlook 2025 to 2035

Nuts Market Size, Growth, and Forecast for 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Rigid Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Nutrient Dense Food Products Market Analysis by Application, Ingredients, Sales Channel and Region Through 2035

Nut Butters Market Insights - Premium Spreads & Consumer Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA