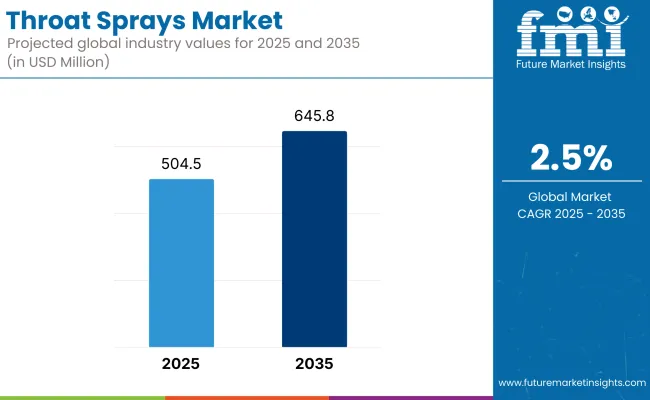

The global throat sprays market is anticipated to reach USD 504.5 million in 2025 and expand at a CAGR around 2.5%, and shall reach USD 645.8 million by 2035. Conveniently available over-the-counter (OTC) for all demographics, throat sprays can be helpful for treating sore throats, inflammation, dryness and even bacterial infections.

Because consumers are looking for less invasive, easy-to-administer solutions, pharmaceutical and personal care companies are expanding their product lineups with herbal- and anesthetic- and antiseptic-based throat sprays. Moreover, the growth of e-commerce channels and pharmacies in emerging countries is enhancing distribution and promoting product visibility. Demand in the market is also being driven by things such as seasonal flu outbreaks, increasing pollution levels, and vocal strain caused by lifestyle.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 504.5 Million |

| Market Value (2035F) | USD 645.8 Million |

| CAGR (2025 to 2035) | 2.5% |

The North America OTC Pharmaceuticals market is one of the most prominent due to an established OTC healthcare market, high consumer disease awareness, and frequent cold and flu cycles. In the USA market, medicated sprays like antiseptics, anesthetics, and herbal extracts are widely used. Strong retail and digital pharmacy distribution helps to further penetrate the market.

The European market is focused on natural and homeopathic treatments. Germany and France prefer throat sprays that are formulated with certain essential oils and herbal actives. With increased regulatory focus on clean labeling and a non-prescription formulation, innovation is escalating, especially in organic and vegan-friendly variants.

Asia-Pacific is proving to be a market hotbed due to the increase in urban pollution, adoption of more Western healthcare products, and higher awareness of personal health. Demand for throat sprays is rising in markets such as China, India and Japan, where rampant upper respiratory infections and lifestyle-related vocal fatigue are driving throat care consumption.

Regulatory Barriers and Product Standardization

Throat sprays occupy a regulatory gray zone in some markets, where they’re classified as either pharmaceuticals or consumer health products. Diverging approvals processes and labeling requirements can slow down product launches. Moreover, achieving uniform dosing and formulation stability is a technical obstacle.

Natural Ingredients and E-Commerce Expansion

Arising demand for herbal and alcohol-free formulations is a big opportunity to differentiate. Other ingredients, including honey, eucalyptus, licorice and propolis, are becoming popular among consumers looking for more natural options. In fact, digital health platforms and online pharmacies are widening the sales spectrum especially in regions with limited access to pharmaceuticals.

Throat sprays market is expected to grow steadily throughout the upcoming years of 2025 to 2035 while the increased volume of seasonal infections, allergic reactions and voice strain, growing need for fast-acting targeted relief will act as its driver.

This trend is driven by greater awareness of respiratory health, particularly in the context of global pandemics and air pollution. The industry is moving in the direction of natural, herbal and alcohol-free formulas, often bolstered by ingredients such as echinacea, honey, menthol and essential oils. The convenience of on-the-go relief and over-the-counter (OTC) availability boosts product uptake even further.

Spray delivery mechanisms, including fine-mist dispensers and long-nozzle actuators for targeted application, have become more advanced and are thus increasing efficacy and user experience. Moreover, the integration of telehealth services and e-pharmacies is making these products easily accessible to people especially in the urban and rural areas.

Market Shifts: 2020 to 2024 vs. 2025 to 2035

| Key Dimensions | 2020 to 2024 |

|---|---|

| Formulation Trends | Alcohol-based, mentholated |

| Consumer Base | Cold and flu sufferers |

| Delivery System | Standard spray pumps |

| Distribution Channels | Pharmacy chains, retail stores |

| Usage Purpose | Symptom relief (sore throat, dry throat) |

| Geographic Demand | North America, Western Europe |

| R&D Investment Focus | New actives, better flavor profiles |

| Key Dimensions | 2025 to 2035 |

|---|---|

| Formulation Trends | Herbal, sugar-free, alcohol-free, honey-based |

| Consumer Base | Broader use: singers, public speakers, allergy sufferers |

| Delivery System | Advanced mist technology, long-nozzle dispensers |

| Distribution Channels | E-commerce, telemedicine-linked pharmacies, wellness platforms |

| Usage Purpose | Preventive care, voice enhancement, allergy management |

| Geographic Demand | Asia-Pacific, Latin America, Eastern Europe |

| R&D Investment Focus | Natural actives, improved bioavailability, smart packaging |

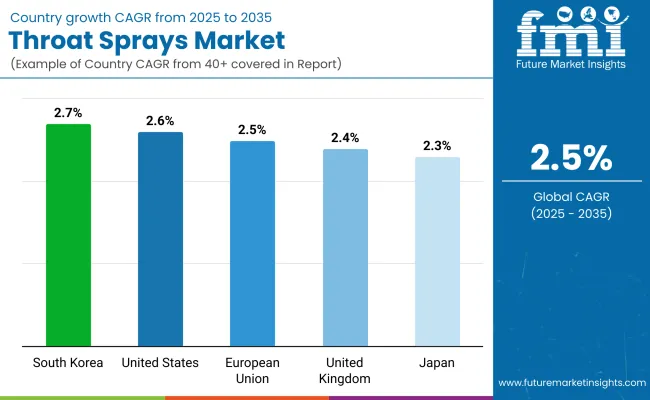

The size of the throat sprays market in the USA stands to remain sturdy, largely backed by OTC requirements for sore throat, allergy, and cold weather diseases. Demand is propelled by an aging population, rising incidence of respiratory illnesses, and high consumer awareness. Product safety, active ingredients, and labeling are regulated by the F.D.A.

Important trends that include demand for herbal and natural sprays, fast-acting innovative formulations, and seasonal retail spikes through flu-season.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.6% |

The UK sees growing demand for such throat sprays as part of a regular self-care and cold treatment routine. The MHRA works with manufacturers to ensure quality standards are adhered to while maintaining consumer safety. Notable is the movement toward natural ingredients and medicinal plants.

Top trends are OTC sales growth, online availability, and demand for sugar-free and alcohol-free formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.4% |

The EU throat sprays market is growing moderately, driven by growing awareness for personal wellness and preventive healthcare. Countries such as Germany, France and Italy see strong demand. Active compounds and formulations are governed by the EMA and national authorities.

Other factors such as Increasing Demand for Antiseptic and Analgesic Sprays and Increasing Distribution Channels by Pharmacy are anticipated to create growth opportunities for the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.5% |

The strength of Japan's market lies in consumer preference for throat sprays as part of everyday wellness products. Many key drivers for this trend include pollution concern, seasonal allergies, and cold/flu prevention. It is a competitive market with a strong orientation towards innovation versus taste.

Popular trends include natural ingredients, portable packaging, and superior flavor profiles.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.3% |

With a high level of health consciousness in South Korea combined with urban pollution affecting respiratory health, demand is uniform. The market is saturated with multifunctional throat sprays which contain a combination of antibacterial, antiviral and moisturising properties.

Drivers of growth include K-wellness trends, an increase in e-pharmacies and consumer loyalty to domestic brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.7% |

The global throat sprays market is anticipated to grow at a steady rate over the forecast period 2025 to 2035, owing to increasing incidence of seasonal infections, rising demand for over-the-counter (OTC) self-care products, and rising preference for fast-acting and localized topical treatments.

Throat sprays are employed to alleviate such symptoms as sore throat, cough, and throat irritation in all age groups. As consumers increasingly look for non-invasive, convenient, and multi-symptom relief products, throat sprays evolve, with evolving active ingredients from synthetic compounds to natural extracts. Additionally, simple packaging advancements like pump dispensers improve dosage accuracy and user experience.

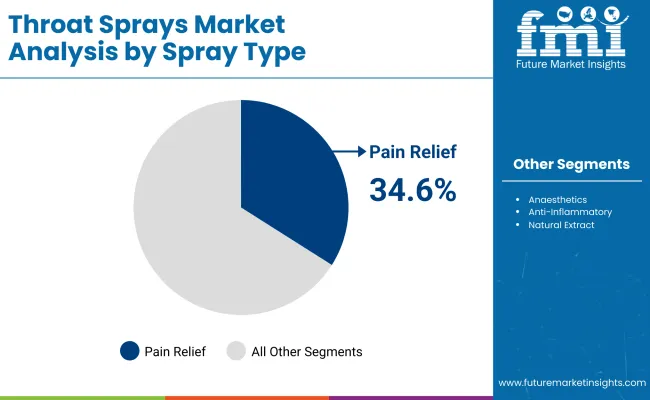

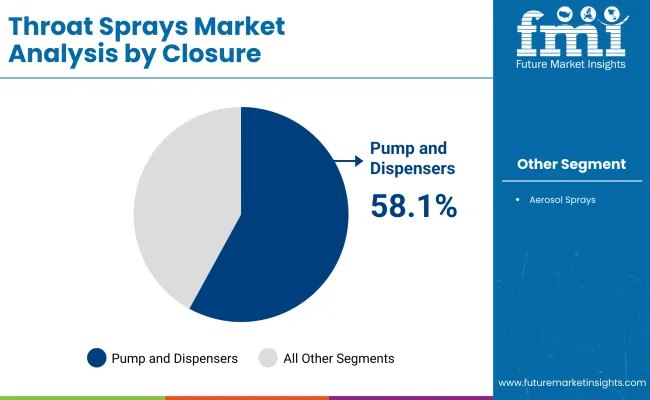

Segmentation by spray type and closure design underlines the growing popularity of pain relief formulations and pump-based delivery systems as they are expected to usher towards bite mark and pain relief formulations leading the market share in 2025.

| Spray Type | Market Share (2025) |

|---|---|

| Pain Relief | 34.6% |

Pain relief sprays are expected to figure 34.6% of overall throat sprays landscape in 2025, leading the category, as they are well-suited for treatment of different throat-related discomfort conditions. Common types contain agents like benzocaine or phenol for instant numbing effects for pain associated with infections, dryness, or irritation. Being fast-acting is one of the reasons why topical analgesics are such a popular OTC solution for consumers looking for immediate relief without the risks of systemic medication.

Throat sprays for pain relief are popular in pharmacies, travel kits and workplace wellness kits, especially around flu season or environmental allergy seasons. As the knowledge about self-management of symptoms and preference for localized drug delivery increases, this segment will continue to grow. Furthermore, segment strength is further powered by pharmaceutical companies launching dual-action sprays that have pain relief as well as anti-inflammatory or anti-bacterium activities.

| Closure Type | Market Share (2025) |

|---|---|

| Pump and Dispensers | 58.1% |

Pump and dispenser closures are projected to remain the most lucrative closures segment, accounting for 58.1% of market share in 2025. This is due to their capability in providing uniform and measured doses targeted at the throat, improving treatment effectiveness and reducing wastage. Such mechanisms are particularly preferred in clinical and household environments where sanitary, accurate, and leak-proof implementation is of utmost importance.

Pump dispensers are perceived as safer, more environmentally-friendly alternative to traditional aerosol formats in line with regulatory trends and consumer preferences for packaging sustainability. Manufacturers are also incorporating tamper-evident designs and ergonomic grips to cater to aging users and caregivers. The radical shift towards the use of pump dispensers in herbal, paediatric and travel-friendly throat spray versions shall enable this closure type to remain at the forefront in the forecast period.

The global throat sprays market is experiencing steady growth owing to the increasing prevalence of respiratory infections, the rising preference for self-medication, and the growing awareness about natural and fast-acting remedies. Demand is especially driven by seasonal flu spikes, pollutants in the environment, and lifestyle choices like vocal strain and smoking.

Major manufacturers are expanding their product lines to offer formulations of natural ingredients, quick-acting anesthetics, and sugar- or alcohol-free options. Organizations are also investing in e-commerce and digital health platforms to improve access and visibility of their services.

Regional brands and startups are emerging with herbal, ayurvedic, and homeopathic alternatives, making competition even fiercer. Market performers that lead innovation in delivery systems, prioritize consumer safety, and differentiate products by flavor, function, and formulation are anticipated to SPARCLE in market through 2035.

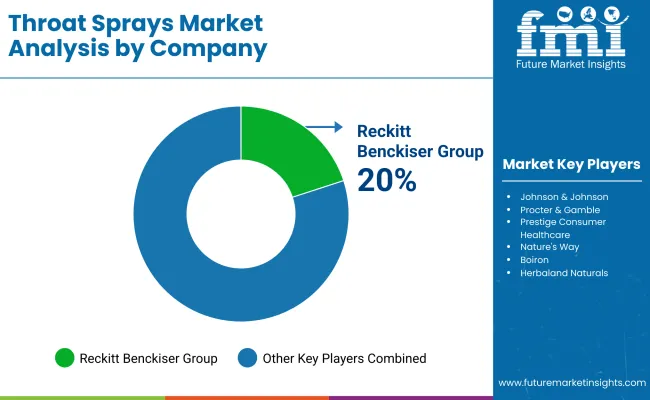

Market Share Analysis by Company (2024 Estimates)

| Company Name | Estimated Market Share (%) |

|---|---|

| Reckitt Benckiser Group | 20-24% |

| Johnson & Johnson | 14-18% |

| Procter & Gamble | 10-14% |

| Prestige Consumer Healthcare | 8-12% |

| Nature's Way | 6-10% |

| Other Companies (combined) | 26-34% |

| Company Name | Key Offerings/Activities |

|---|---|

| Reckitt Benckiser Group | In 2024, new Strepsils came out with pain relief and germ-fighting agents. In 2025, they sold these in Asia-Pacific. |

| Johnson & Johnson | In 2024, Listerine added natural extracts to its throat sprays. In 2025, eco-friendly packaging hit stores across Europe. |

| Procter & Gamble | In 2024, Vicks had new throat sprays that worked longer. In 2025, they teamed up with online health sites for product advice. |

| Prestige Consumer Healthcare | In 2024, Chloraseptic got new flavors and sizes. In 2025, it was found more in Latin American markets. |

| Nature's Way | In 2024, added elderberry and echinacea to herbal sprays. In 2025, key products were certified as organic and non-GMO. |

Key Company Insights

Reckitt Benckiser Group (20-24%)

Reckitt operates in the medicated throat spray space globally with its flagship brand being the very successful Strepsils. The company is well placed for sustaining leadership, driven by functional innovation and regional expansion.

Johnson & Johnson (14-18%)

Building on its healthcare brand portfolio, J&J’s foray into throat sprays fuses scientific credibility with consumer trust, particularly in Western markets and burgeoning wellness categories.

Procter & Gamble (10-14%)

Under the Vicks umbrella, P&G offers advanced throat relief, which emphasizes convenience, fast action, and family-safe use, particularly in North America and Southeast Asia.

Prestige Consumer Healthcare (8-12)

Chloraseptic is still a top-selling product in the North American market. The company is focused on new product formats, family-friendly products and global market penetration.

Nature's Way (6-10%)

Nature's Way is the largest throat spray in the natural and herbal niche. Its focus on clean labels, botanical ingredients, and sustainable manufacturing appeals to wellness-oriented shoppers.

Other Key Players (26-34% Combined)

Several regional and emerging players contribute to a dynamic and growing throat sprays ecosystem:

The overall market size for the throat sprays market was USD 504.5 million in 2025.

The throat sprays market is expected to reach USD 645.8 million in 2035.

Key drivers include rising incidences of respiratory infections and throat-related conditions, increasing preference for fast-acting, localized treatments, growing awareness of over-the-counter healthcare products, and product innovations with herbal and natural ingredients.

The leading regions contributing to the market include North America, Europe, and Asia-Pacific. Asia-Pacific is witnessing growing demand due to expanding healthcare access and increasing cases of seasonal flu and allergies.

The antiseptic and analgesic throat sprays segment is expected to lead, owing to its effectiveness in relieving pain and combating infections in sore throat cases.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Spray Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Spray Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Closures, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Closures, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Spray Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Spray Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Closures, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Closures, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Spray Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Spray Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Closures, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Closures, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Spray Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Spray Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Closures, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Closures, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Spray Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Spray Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Closures, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Closures, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Spray Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Spray Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Closures, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Closures, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Spray Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Spray Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Closures, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Closures, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Spray Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Spray Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Closures, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Closures, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Spray Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Closures, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Spray Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Spray Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Spray Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Spray Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Closures, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Closures, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Closures, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Closures, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Spray Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Closures, 2023 to 2033

Figure 28: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Spray Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Closures, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Spray Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Spray Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Spray Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Spray Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Closures, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Closures, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Closures, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Closures, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Spray Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Closures, 2023 to 2033

Figure 58: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Spray Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Closures, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Spray Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Spray Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Spray Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Spray Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Closures, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Closures, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Closures, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Closures, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Spray Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Closures, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Spray Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Closures, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Spray Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Spray Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Spray Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Spray Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Closures, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Closures, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Closures, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Closures, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Spray Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Closures, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Spray Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Closures, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Spray Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Spray Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Spray Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Spray Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Closures, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Closures, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Closures, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Closures, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Spray Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Closures, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Spray Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Closures, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Spray Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Spray Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Spray Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Spray Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Closures, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Closures, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Closures, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Closures, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Spray Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Closures, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Spray Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Closures, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Spray Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Spray Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Spray Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Spray Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Closures, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Closures, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Closures, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Closures, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Spray Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Closures, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Spray Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Closures, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Spray Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Spray Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Spray Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Spray Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Closures, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Closures, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Closures, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Closures, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Spray Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Closures, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Capacity, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sore Throat Lozenges Market Size and Share Forecast Outlook 2025 to 2035

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Strep Throat Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

Dermal Sprays Market Size and Share Forecast Outlook 2025 to 2035

Ayurvedic Throat Care Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Sprays Market Size and Share Forecast Outlook 2025 to 2035

Steroid-Free Nasal Sprays Market Insights - Trends & Forecast 2025 to 2035

Medical Nitroglycerin Sprays Market - Demand, Innovations & Forecast 2025 to 2035

Cold, Cough, and Sore Throat Remedy Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA