The global thermoplastic tape market is projected to witness steady growth through 2035, driven by increasing demand for lightweight, high-strength, and corrosion-resistant materials across industries such as aerospace, automotive, construction, and sports equipment.

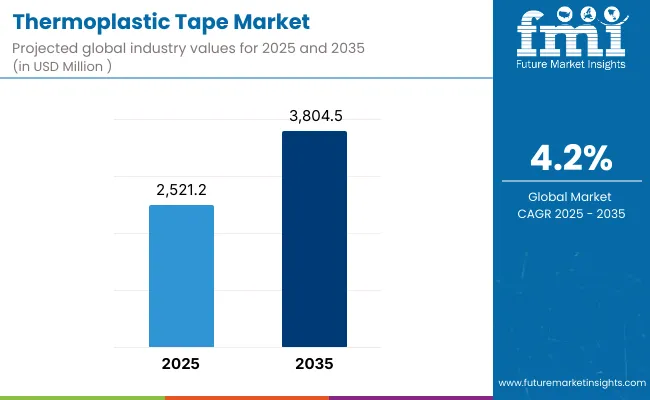

Thermoplastic tapes, typically composed of continuous fibers embedded in thermoplastic resin matrices, offer advantages such as recyclability, rapid processing, and high impact resistance. In 2025, the global thermoplastic tape market is estimated to be valued at approximately USD 2,521.2 Million. By 2035, it is projected to grow to around USD 3,804.5 Million, reflecting a compound annual growth rate (CAGR) of 4.2%.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2,521.2 Million |

| Projected Market Size in 2035 | USD 3,804.5 Million |

| CAGR (2025 to 2035) | 4.2% |

These tapes are increasingly used in composite manufacturing for structural reinforcements, their durability and ease of molding. As industries seek more sustainable and cost-effective alternatives to traditional materials, the adoption of thermoplastic tape is expected to grow, supported by advancements in automation and processing technologies.

North America continues to be a key region, driven by robust demand within its aerospace and automotive sectors. Specifically, the United States increasing usage of thermoplastic tapes in aircraft structural components and lightweight automotive parts are few of the major drivers owing to the composite manufacturing innovations.

Another significant market is Europe, where sustainability goals, stringent emission regulations, and growing use of thermoplastic composites in automotive and wind energy applications are the drivers behind this forecast. Countries like Germany, France, and the Netherlands are leading the integration of thermoplastic tapes into high-performance engineering solutions.

The Asia-Pacific region is the fastest-growing market, fueled by rapid industrialization, expanding manufacturing sectors, and rising investments in transportation and infrastructure. Countries like China, Japan, and South Korea are witnessing increased demand for thermoplastic tapes in automotive, rail, and consumer electronics applications, driven by light weighting and durability needs.

High Processing Temperature, Material Compatibility, and Cost Constraints

The thermoplastic tape market is held back by multiple factors including high processing temperatures and compatibility with existing equipment. Thermal plastics composite materials like polyether ether ketone (PEEK), polyamide (PA), and polypropylene (PP), require precise temperature control and advanced winding or stamping machines, making it challenging for small and mid-sized manufacturers to adopt them.

Matrix resin-compatibility with common reinforcing fibers (e.g. carbon, glass, aramid) also deters their widespread inter-industry integration. Moreover, raw material and machinery costs are still a concern compared to thermoset tapes and conventional reinforcement techniques thus inhibiting the adoption in the cost-sensitive automotive and construction industries.

Light weighting Demand, Aerospace & Automotive Growth, and Circular Manufacturing

Despite the challenges, The Thermoplastic Tape Market is well-positioned to capitalize on the trends aiming for growth and Breno material for aerospace, automotive and industrial use sectors. Thermoplastic tapes also work well with over-molding, automated tape placement (ATP), and thermally welded composites for fast cycle times and reprocess ability.

Compared with thermosets, they also have better fatigue resistance, moisture tolerance, and impact strength. In addition, the increased focus on sustainability and circular economy frameworks are driving demand for thermoplastic composites that can be easily recycled and repurposed, particularly in the manufacturing of electric vehicles, wind energy and sports equipment.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with lightweight standards and material performance certifications (ASTM, ISO). |

| Consumer Trends | Demand for lightweight alternatives to metals and thermosets. |

| Industry Adoption | Used in aerospace brackets, automotive body panels, and pipe reinforcements. |

| Supply Chain and Sourcing | Relies on carbon fiber, glass fiber, and high-performance thermoplastic resins. |

| Market Competition | Dominated by Solvay, Toray, Evonik, Sabic, and Teijin. |

| Market Growth Drivers | Boosted by fuel efficiency goals, composite part standardization, and high-strength material demand. |

| Sustainability and Environmental Impact | Focused on lower VOCs and reprocessability vs. thermoset composites. |

| Integration of Smart Technologies | Early-stage use of in-line thickness control and surface defect sensors. |

| Advancements in Processing Technology | Use of automated tape laying (ATL) and press forming. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Integration of eco-design regulations, carbon footprint metrics, and recyclable content mandates. |

| Consumer Trends | Shift toward smart composites, multi-functional tapes, and energy-absorbing structural components. |

| Industry Adoption | Expanded use in EV battery casings, wind turbine blades, and medical equipment components. |

| Supply Chain and Sourcing | Movement toward natural fiber reinforcements, closed-loop sourcing, and regional compounding. |

| Market Competition | Entry of bio-composite startups, automation-focused tape fabricators, and circular economy material firms. |

| Market Growth Drivers | Driven by sustainability mandates, automated production lines, and functionalized material development. |

| Sustainability and Environmental Impact | Transition to bio-based thermoplastics, reusable scrap strategies, and net-zero manufacturing models. |

| Integration of Smart Technologies | Growth in embedded sensors, digital twin simulations, and thermoplastic part traceability systems. |

| Advancements in Processing Technology | Evolution toward robotic tape winding, hybrid molding, and 3D-integrated thermoplastic printing systems. |

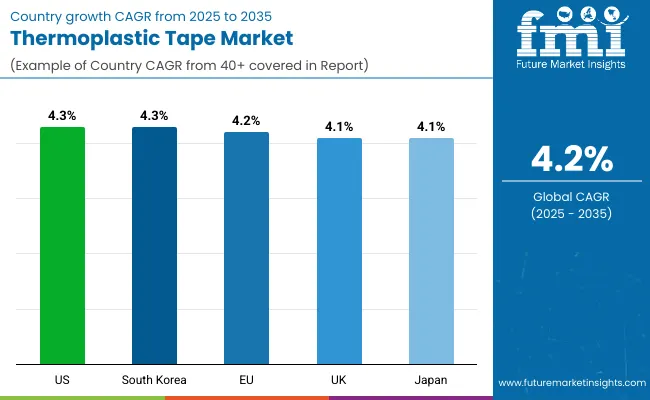

In USA, demand for lightweight, high-strength materials in automotive and aerospace industries, coupled with their growing use in electrical insulation and structural reinforcement applications, is which is contributing to the growth of thermoplastic tape market. Thermoplastic tapes are being evermore used towards composite manufacturing to assist fuel efficiency and structural stiffness in components for EVs and aircraft.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

The UK market growth benefits from the development of composite material design, government initiatives towards low-carbon transportation, and growing demand within wind energy and industrial applications. Due to its durability and recyclability, thermoplastic tapes are increasingly being used in retrofitting and modular construction.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

Used in automotive light weighting, rail infrastructure, and building panels, recyclable composite materials are driving the growth of the market in the European Union backed by environmental regulations. High-performance thermoplastic composites adoption for manufacturing and repair applications is being led by countries like Germany, France, and the Netherlands.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Japan thermoplastic tape market will be moderately growing due to developments in precision composite engineering, increasing demand in consumer electronics, sporting goods and industrial components, and a growing focus on sustainable thermoplastic matrix systems with low weight and high impact resistance.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The market is growing in South Korea on account of the country’s lead in manufacturing electronics, battery casings, and automotive components, where the use of thermoplastic tapes provides high performance-to-weight ratio and thermal stability. While local firms are also committing to thermoplastic composites for hydrogen vehicles and structural battery enclosures.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The growth of the thermoplastic tape market is driven by its growing applications in aerospace, automotive, sports equipment, and industrial sectors, where high strength-to-weight ratio, corrosion resistance, and faster processing times are necessary.

Reinforced thermoplastic continuous-fiber-dominated thermoplastic tapes embedded in resins are a sustainable substitute for conventional thermoset composites in terms of excellent formability, recyclability, and mechanical performance.

With the emphasis on process automation and component integration among manufacturers, the advanced thermoplastic tape demand is expected to grow. The segmentation criteria in the market include Thickness (0.20 mm, 0.21-0.40 mm, More Than 0.40 mm), Material Type (Fiber (Carbon, Glass, Others) and Resin (PAEK, PC, PA, PET, TPU, PP, Others).

| Thickness | Market Share (2025) |

|---|---|

| 0.21-0.40 mm | 46.3% |

By 2025, the 0.21-0.40 mm thickness segment is expected to dominate the thermoplastic tape market with a share of 46.3%. Such an alloy range provides a relatively perfect balance of formability and strength for the automotive form of the returns and other parts welded before and thus many range of applications from automotive paneling to aerospace strongholds to sports goods.

It provides support for automated fiber placement (AFP) and thermoforming processes that are key in high-throughput manufacturing. This thickness also allows for multi-layer stacking for structural parts, alongside superior compatibility with over-molding and hybrid composite techniques, propelling its dominance across performance-driven sectors.

| Fiber Material | Market Share (2025) |

|---|---|

| Carbon Fiber | 52.1% |

Carbon fiber thermoplastic tapes dominate the type of material segment and are likely to account for 52.1% of market share in 2025. These tapes provide high mechanical strength, stiffness, and fatigue resistance under extreme temperature conditions which are critical in aerospace, defense, automotive, and wind energy applications.

The growing requirement of light weighting technologies imposes extreme charges on utilizing such materials to achieve a higher fuel efficiency and reduce emissions, which is one of the primary factors for the growing acceptance of carbon fiber-reinforced tapes. Furthermore, their compatibility with high performance resins such as PAEK, PPS and PEKK makes them ideal for harsh environments and long service life demands.

The thermoplastic tape market shows signs of massive growth. The carbon or glass fiber multilayer tapes, reinforced with PPA, PA, or PEEK resins, enhance mechanical performance, recyclability as well as increased speeds on automated lay-up and over molding systems. To broaden applications, manufacturers are developing continuous fiber-reinforced systems, sustainable thermoplastics, and thermoforming-compatible tapes.

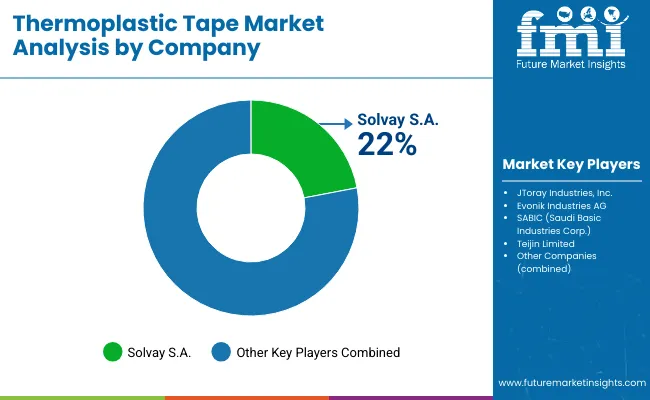

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Solvay S.A. | 18-22% |

| Toray Industries, Inc. | 14-18% |

| Evonik Industries AG | 10-14% |

| SABIC (Saudi Basic Industries Corp.) | 8-12% |

| Teijin Limited | 6-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Solvay S.A. | In 2024, launched PEEK- and PPS-based thermoplastic composite tapes for aerospace structures. In 2025, partnered with OEMs on automated tape laying (ATL) process optimization for structural parts. |

| Toray Industries | In 2024, expanded production of Toray Cetex® thermoplastic tapes with carbon fiber reinforcement. In 2025, introduced recyclable PA-based tapes for automotive crash structures and interiors. |

| Evonik Industries AG | In 2024, rolled out continuous fiber-reinforced PA12 tapes for lightweight pressure vessels. In 2025, developed co-extruded thermoplastic tapes with customizable fiber/resin interfaces. |

| SABIC | In 2024, introduced glass fiber-reinforced PP and PEI tapes for consumer electronics and EV batteries. In 2025, advanced low-cost, high-flow tape grades for injection over molding. |

| Teijin Limited | In 2024, unveiled thermoplastic CFRTP tapes for aircraft interior panels and EV applications. In 2025, launched bio-based resin systems for sustainable tape production. |

Key Company Insights

Solvay S.A. (18-22%)

Solvay leads with high-performance thermoplastic composites, focusing on aerospace, energy, and structural automotive parts. It offers PEEK- and PPS-based tapes compatible with ATL/AFP manufacturing, enabling significant weight savings and cycle time reductions.

Toray Industries (14-18%)

Toray’s Cetex® product line covers a wide range of carbon- and glass-fiber tapes, designed for high-volume automotive production, aerospace, and sporting goods. The company emphasizes material recyclability and hybrid laminates.

Evonik Industries (10-14%)

Evonik is known for lightweight, ductile thermoplastic tapes, especially in gas storage, filtration, and industrial applications. Its focus on custom formulations and interface engineering boosts adhesion and performance in overmolded systems.

SABIC (8-12%)

SABIC supplies cost-effective thermoplastic tapes for electrical insulation, battery components, and structural housing, leveraging its expertise in polyolefins and high-heat polymers like PEI and PC.

Teijin Limited (6-9%)

Teijin focuses on green chemistry and thermoplastic composites with a strong presence in transportation and building materials, offering bio-derived matrices and glass/carbon fiber reinforcement systems.

Other Key Players (25-30% Combined)

The overall market size for the thermoplastic tape market was USD 2,521.2 Million in 2025.

The thermoplastic tape market is expected to reach USD 3,804.5 Million in 2035.

Growth is driven by the increasing demand for lightweight and high-strength materials in aerospace, automotive, and sporting goods industries, growing preference for recyclable and sustainable composites, and advancements in continuous fiber-reinforced thermoplastic tape technology.

The top 5 countries driving the development of the thermoplastic tape market are the USA, Germany, China, Japan, and France.

0.21-0.40 mm Thickness and Carbon Fiber-Based Tapes are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Square Meter) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 4: Global Market Volume (Square Meter) Forecast by Thickness, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material type, 2018 to 2033

Table 6: Global Market Volume (Square Meter) Forecast by Material type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End use, 2018 to 2033

Table 8: Global Market Volume (Square Meter) Forecast by End use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Square Meter) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 12: North America Market Volume (Square Meter) Forecast by Thickness, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material type, 2018 to 2033

Table 14: North America Market Volume (Square Meter) Forecast by Material type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End use, 2018 to 2033

Table 16: North America Market Volume (Square Meter) Forecast by End use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Square Meter) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 20: Latin America Market Volume (Square Meter) Forecast by Thickness, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material type, 2018 to 2033

Table 22: Latin America Market Volume (Square Meter) Forecast by Material type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End use, 2018 to 2033

Table 24: Latin America Market Volume (Square Meter) Forecast by End use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Square Meter) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 28: Western Europe Market Volume (Square Meter) Forecast by Thickness, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Material type, 2018 to 2033

Table 30: Western Europe Market Volume (Square Meter) Forecast by Material type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End use, 2018 to 2033

Table 32: Western Europe Market Volume (Square Meter) Forecast by End use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Square Meter) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 36: Eastern Europe Market Volume (Square Meter) Forecast by Thickness, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Material type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Square Meter) Forecast by Material type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Square Meter) Forecast by End use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Square Meter) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Square Meter) Forecast by Thickness, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Material type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Square Meter) Forecast by Material type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Square Meter) Forecast by End use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Square Meter) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 52: East Asia Market Volume (Square Meter) Forecast by Thickness, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Material type, 2018 to 2033

Table 54: East Asia Market Volume (Square Meter) Forecast by Material type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End use, 2018 to 2033

Table 56: East Asia Market Volume (Square Meter) Forecast by End use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Square Meter) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Square Meter) Forecast by Thickness, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Material type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Square Meter) Forecast by Material type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Square Meter) Forecast by End use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Square Meter) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 10: Global Market Volume (Square Meter) Analysis by Thickness, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material type, 2018 to 2033

Figure 14: Global Market Volume (Square Meter) Analysis by Material type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End use, 2018 to 2033

Figure 18: Global Market Volume (Square Meter) Analysis by End use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End use, 2023 to 2033

Figure 21: Global Market Attractiveness by Thickness, 2023 to 2033

Figure 22: Global Market Attractiveness by Material type, 2023 to 2033

Figure 23: Global Market Attractiveness by End use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Square Meter) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 34: North America Market Volume (Square Meter) Analysis by Thickness, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material type, 2018 to 2033

Figure 38: North America Market Volume (Square Meter) Analysis by Material type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End use, 2018 to 2033

Figure 42: North America Market Volume (Square Meter) Analysis by End use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End use, 2023 to 2033

Figure 45: North America Market Attractiveness by Thickness, 2023 to 2033

Figure 46: North America Market Attractiveness by Material type, 2023 to 2033

Figure 47: North America Market Attractiveness by End use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Square Meter) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 58: Latin America Market Volume (Square Meter) Analysis by Thickness, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material type, 2018 to 2033

Figure 62: Latin America Market Volume (Square Meter) Analysis by Material type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End use, 2018 to 2033

Figure 66: Latin America Market Volume (Square Meter) Analysis by End use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Thickness, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Material type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Square Meter) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 82: Western Europe Market Volume (Square Meter) Analysis by Thickness, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Material type, 2018 to 2033

Figure 86: Western Europe Market Volume (Square Meter) Analysis by Material type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Material type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Material type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End use, 2018 to 2033

Figure 90: Western Europe Market Volume (Square Meter) Analysis by End use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Material type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Material type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Square Meter) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Square Meter) Analysis by Thickness, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Material type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Square Meter) Analysis by Material type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Material type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Material type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Square Meter) Analysis by End use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Material type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Material type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Square Meter) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Square Meter) Analysis by Thickness, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Material type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Square Meter) Analysis by Material type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Square Meter) Analysis by End use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Thickness, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Material type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Material type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Square Meter) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 154: East Asia Market Volume (Square Meter) Analysis by Thickness, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Material type, 2018 to 2033

Figure 158: East Asia Market Volume (Square Meter) Analysis by Material type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Material type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Material type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End use, 2018 to 2033

Figure 162: East Asia Market Volume (Square Meter) Analysis by End use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Thickness, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Material type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Material type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Square Meter) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Square Meter) Analysis by Thickness, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Material type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Square Meter) Analysis by Material type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Material type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Square Meter) Analysis by End use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Thickness, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Material type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermoplastic Adhesive Films Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Thermoplastic Ester Elastomer (TPEE) Market Growth - Trends & Forecast 2025 to 2035

Thermoplastic Pipe Market Growth – Trends & Forecast 2025 to 2035

C9 Thermoplastic Resin Market Size and Share Forecast Outlook 2025 to 2035

Recycled Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Olefinic Thermoplastic Elastomers Market

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Ultrasoft Thermoplastic Elastomer Market

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA