The demand for the thermoforming films market is on an increase with a growing requirement for robust, flexible, and sustainable packaging solutions in various industries. Companies focus on product innovation, sustainability, and advanced manufacturing techniques to ensure efficiency and reduction of waste. Some of the other drivers are regulatory compliance, an increasing demand for extended shelf-life packaging, and consumer preference for lightweight materials.

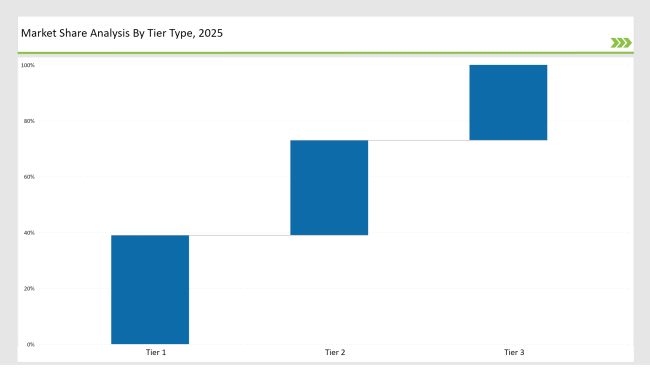

Tier 1: The market leaders include Amcor, Berry Global, and Sealed Air Corporation that account for 32% of the market. These companies have managed to stay at the forefront by adopting high-tech production technologies, global distribution networks, and consistent R&D investments.

Tier 2: Mondi Group, Winpak, and Coveris have the remaining 31% market share. They cater to medium-sized companies that demand high-performance products that are tailored to specific requirements and meet regulations.

Tier 3: Regional and niche manufacturers are also specialized to food, pharmaceuticals, and industrial applications and account for 37% of the market. They focus on specific packaging designs, localized distribution, and low-cost production.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Berry Global, Sealed Air Corporation) | 16% |

| Rest of Top 5 (Mondi Group, Winpak) | 10% |

| Next 5 of Top 10 (Coveris, FlexPak, Klöckner Pentaplast, Wipak, Sonoco) | 6% |

The thermoforming films market serves a wide array of industries, supporting multiple product lines through hardy, light-weight, flexible packaging that allows for increased shelf life and ensures enhanced product protection. High performance barrier films have gained increasing traction from manufacturers for better protection from moisture and oxygen. Customized packaging formats in increasing demand give companies the liberty to tailor solution products to accommodate specific applications.

Manufacturers are developing high-performance materials and automated production systems to focus on improving material efficiency, sustainability, and user convenience. Manufacturers are also considering nanotechnology for the improvement of barrier properties and durability. The companies are adopting real-time data analytics to optimize the production processes and minimize the waste of material.

Manufacturers invest in automation and material innovation and also in AI-driven quality control; an effort to abide by changing standards of the industry. Key players focus on sustainability, waste reduction, and enhanced protective properties as part of efforts to better packaging efficiencies and performance.

They adopt machine learning algorithms to predict material performances and optimize film formulations. Companies also invest in advanced antimicrobial coatings to enhance food safety and extend product shelf life.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Technology providers should enhance automation, sustainability, and customization in thermoforming film solutions. Partnering with manufacturers and material suppliers will drive cost efficiency and innovation.

Manufacturers are increasing their production capacity and adopting sustainable materials for integration. Improving safety features, adopting predictive maintenance technologies for enhanced equipment efficiency and low down times, and embedding investments in smart packaging innovations allow for the real-time monitoring of products for improved traceability.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | March 2024: Launched a 100% recyclable thermoforming film solution. |

| Berry Global | August 2023: Developed ultra-lightweight, high-barrier thermoforming films. |

| Sealed Air | May 2024: Introduced tamper-proof films for medical and food applications. |

| Mondi Group | November 2023: Expanded compostable thermoforming film offerings. |

| Winpak | February 2024: Enhanced tamper-evident films for pharmaceutical applications. |

| Coveris | April 2024: Developed high-strength recyclable thermoforming films. |

| FlexPak | June 2024: Launched innovative flexible packaging solutions. |

The thermoforming films market is competitive, and companies are focusing on automation, sustainability, and improved compliance measures to stay ahead of the game. Businesses are increasingly using AI-powered quality control systems to ensure consistency and reduce defects.

Manufacturers will drive growth by adopting smart packaging technologies, investing in sustainable materials, and optimizing production efficiency. The increasing demand in food, healthcare, and industrial applications will further accelerate market expansion.

Companies are integrating AI-driven automation to enhance precision in production and reduce material wastage. Additionally, innovations in high-barrier coatings are improving the protective properties of thermoforming films. The expansion of biodegradable alternatives is also reshaping the industry, aligning with global sustainability regulations.

Leading players include Amcor, Berry Global, Sealed Air Corporation, Mondi Group, and Winpak.

The top 3 collectively control 16% of the global market.

Medium concentration, with top players holding 32%.

Sustainability, automation, material advancements, and regulatory compliance.

Explore Function-driven Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.