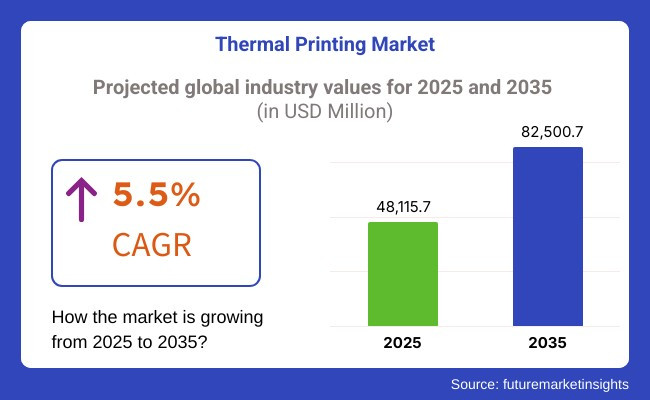

Global revenues from thermal printing are expected to hit USD 48,115.7 million by 2025 and are projected to increase significantly, with a further industry value of USD 82,500.7 million by 2035. This upturn in figures indicates that the industry will have a CAGR of 5.5% from 2025 to 2035.

The sector is undergoing a sustainable as the barcode and label printing trend develops quickly and diversely in such sectors as retail, logistics, healthcare, manufacturing and transportation. The technology has gained more and more popularity in recent years, considering its high printing speed, affordable cost, robustness, and little to no maintenance, as well as the advantages that come with it.

The segment is further divided into types: direct thermal printing and thermal transfer printing. Direct thermal printing, which is based on heat-sensitive paper, can notably be found as receipts, shipping labels, or temporary tags. Conversely, thermal transfer printing, which involves a ribbon for ink transfer onto a substrate, has started to become a trend in companies that demand high-resolution and operationally long-lasting labeling, for example, healthcare, and manufacturing.

A major factor directing the rise of the sector can be traced back to the fact that more and more label & sticker products are being printed using barcodes. In the era of rapid development of online businesses and automation of supply chains, enterprises have become heavily dependent on bar code printing to maintain accurate inventories, track materials, and operate logistics. The unique feature of the technology, which is the ability to print clear, scannable barcodes, not only simplifies operational processes but also increases industry demand for it.

Besides, the healthcare sector also plays an important role in the business. The need for barcode and label applications of patient identification, pharmaceutical labeling, and medical devices has led to the incorporation in hospitals, laboratories, and pharmacies. Additionally, upgrades in the technology, like better print resolutions, wireless connectivity, and sturdiness, have also positively influenced the growth of the industry.

Explore FMI!

Book a free demo

The industry is experiencing rapid growth as demand for high-speed, affordable, and long-lasting printing solutions increases in the industry. In the retail and e-commerce industry, companies value rapid printing, affordability, and customizable label flexibility to enhance point-of-sale processes and supply chain management.

The healthcare industry demands high-durability prints, compliance with regulations, and clear barcode labeling to ensure patient safety and monitoring of medical inventories. Logistics and transportation companies highlight high-speed and durable printing to track shipments, inventory monitoring, and warehouse labeling.

The manufacturing industry needs highly customized and extremely robust prints to maintain industrial standards, guaranteeing conformity and operational performance. In hospitality, the industry is extensively used for receipts, billing, and ticketing, with a focus on cost savings and customization. With the progress in wireless connectivity, RFID-compatible thermal printers, and environmentally friendly printing technologies, the industry is growing across diverse industries.

| Company/Entity | Contract Value (USD Million) |

|---|---|

| Zebra Technologies | Approximately USD 120 |

| Honeywell International | Approximately USD 85 |

| SATO Holdings Corporation | Approximately USD 60 |

| Toshiba TEC Corporation | Approximately USD 95 |

The industry has experienced significant growth driven by technological advancements and strategic collaborations throughout 2024 and into early 2025. The deployment of Zebra Technologies' thermal printing solutions in hundreds of stores by an international retailer signifies the technology's role in enhancing inventory management and customer service.

Honeywell International's transaction with a national logistics firm also reinforces the necessity of proper labels and expedited processing in distribution facilities. SATO Holdings Corporation partnered with a healthcare organization to implement the industry solutions for patient identification and labeling of medication, underscoring the core role of the industry in patient safety and business efficiency.

Thermal printers, on the other hand, are being used in manufacturing, as seen with Toshiba TEC Corporation's adoption of the technology on production lines, demonstrating its ability to automate labeling processes and decrease downtime. These strides reflect a broader industry trend toward leveraging advanced thermal printing solutions to improve accuracy, efficiency, and safety across an array of industries.

During 2020 to 2024, the industry grew continuously, with growing demands for barcode labels, receipts, and RFID tags for retail, logistics, health, and production businesses. Growing e-commerce business and supply chain digitization caused a need for a real-time, reliable industry for handling orders and tracking inventory.

Direct thermal and thermal transfer solutions gained popularity as they were user-friendly and had low maintenance requirements. Raw material price fluctuations and supply chain interruptions were addressed by the suppliers through enhanced print quality, print longevity in printing, and integration with cloud management systems.

Expansion of the industry between 2025 to 2035 will be spurred by AI-powered automation, sustainable printing material, and smart label adoption.AI-based print management systems will improve print quality, minimize waste, and support predictive maintenance. Rollout of recyclable and biodegradable thermal paper will meet the objective of sustainability and minimize ecological footprints.

RFID and NFC-enabled smart labels will offer real-time inventory tracking and supply chain transparency. Cloud-based print management software will allow remote monitoring and automatic resupply, enhancing operational efficiency. Color thermal printing technology will find wider uses in product branding and packaging.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased use of RFID-enabled thermal printers in logistics, retail, and healthcare to improve tracking and inventory management. | Expansion of smart labels with IoT integration, allowing real-time monitoring and automation across supply chains. Advanced RFID printing solutions become the industry standard. |

| Advanced direct thermal and thermal transfer printing technologies enhanced print quality and durability. Linerless thermal labels became a growing factor in minimizing waste. | Use of environmentally friendly materials, cloud-connected high-speed printers, and AI-based automation for predictive maintenance and error minimization. |

| Increased demand from e-commerce, healthcare labeling, and food safety legislation pushed the demand for solutions. | The emergence of sustainable packaging, pharmaceutical serialization, and digital industrialization propels the use of high-end thermal printers. |

| Early attempts at curbing waste included linerless labels and reusable thermal paper. Mass adoption challenge persisted. | Producers adapt to biodegradable thermal paper, solvent ink chemistry, and energy-saving printers as a means of responding to international sustainability law. |

| Thermal printers in independent stand-alone design were common industry-wide, though digital integration existed only in pieces. | Integration to cloud platforms, ERP systems, and predictive analysis-based AI optimizes process optimization and automated seamless printing. |

| North America and Europe spearheaded adoption, followed by the Asia-Pacific region becoming a high-growth region due to increasing retail and logistics sectors. | Increasing digital transformation initiatives in emerging economies across Latin America, Africa, and Southeast Asia fuel rapid adoption. |

| Omni-channel retail growth, medical labeling mandates, and smart packaging solutions increased the demand. | Growth in last-mile delivery, connected packaging, and industrial automation fuels continued innovation in the technologies. |

Another route that leads to an increase in demand is the widespread use in industrial operations like hospitals, retail sectors, and transportation. Nevertheless, the diversion of thermal paper and print heads in the global industry because of a lack of raw materials can result in production problems. Companies have to find alternative sourcing strategies to cover the possible impacts of manufacturing delays as well as cost surges.

The digital documentation and cloud-based solutions have assumed a new trajectory that depicts a threat to the industry. Companies increasingly go to digital paper systems, thus the management of printed receipts, labels, and invoices can be decreased. The industry manufacturers should not fall behind the competition and thus use their resources on the research of hybrid technologies that combine the digital and physical printing technologies.

Ecological responsibility, environmental regulation, and sustainability are driving the industry in a new direction. Thermal paper with BPA and other chemicals has been banned in several regions, forcing manufacturers to develop new coatings and recyclable materials. Eco-friendly printing technologies, such as direct thermal recyclable paper, are convenient for the industry; achieving both revenue and cost targets is a problem.

As thermal printers connect to cloud-based systems and IoT networks, cybersecurity worries are on the rise. The problems arising from the use of unapproved printing devices may result in data breaches and operational disturbances. It is necessary to establish strong security protocols, encrypt data, and carry out regular software updates to ensure business and customer information remains safe.

| Printing Technology | Share (2025) |

|---|---|

| Direct Thermal | 29.3% |

Direct Thermal Segment Holds a Leadership Market Share in the Thermal Printing Market.

The direct segment holds the leadership industry share because it has low cost, ease of use, and worldwide acceptance of high-print-volume operations. Direct segment, unlike thermal transfer printing, does not require the use of ink, toner, or ribbons, thus lowering the cost of operation and maintenance. This makes it the preferred option for retail, logistics, healthcare, and hospitality sectors, where label printing and short-term receipting are priorities.

Increased demand for shipping labels, price tickets, and food packaging labels also drives its dominance. Moreover, the increasing use of mobile direct thermal printers for on-demand ticketing, parking tickets, and patient wristbands also drives the dominance of the segment. Though sensitive to heat and light, industry growth is ensured by technological breakthroughs in resilient thermal paper that is BPA-free.

| Printer Type | CAGR (2025 to 2035) |

|---|---|

| Barcode Printer | 8.9% |

The barcode printer segment is expected to grow at the Steadiest Highest CAGR in the forecasted term.

The barcode printer segment is expected to grow at the highest CAGR because of the increasing demand for inventory management, supply chain tracking, and retail automation. With business trending more towards efficiency, accuracy, and traceability, barcode printer machines are rapidly becoming essential equipment in e-commerce, logistics, pharmaceutical, and manufacturing sectors.

Growing uses of RFID-enabled barcodes and increased controlled retailing and warehouse automation are mainly driving the expansion. Also, wireless and mobile barcode printing demand is on the rise, enabling easy printing in warehouses, distribution centers, and field service.

Government rules on product serialization and anti-counterfeiting activities in the pharmaceuticals and food packaging industries also increase demand. With developments taking place for high-speed, robust, and multi-format barcode printing, this industry is expected to grow strongly over the next few years.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

| France | 7.7% |

| UK | 6.8% |

| China | 9.4% |

| India | 8.2% |

The USA leads the industry because of its highly advanced e-commerce sector, sophisticated logistics infrastructure, and robust healthcare and manufacturing adoption. Thermal barcode and label printing are utilized by giants such as Amazon, Walmart, and FedEx to maximize operational efficiency and facilitate accurate order fulfillment. Hospitals and pharmaceutical firms utilize printing on patient wristband labels, prescription labels, and medical record documentation.

With increasing automation in supply chains and warehouses, the need for thermal printers equipped with RFID also increases. The USA also has strict regulatory requirements in healthcare and food labeling, forcing companies to invest in rugged, high-quality image thermal printing, and forcing the country to be a dominant force in global industry growth.

FMI is of the opinion that the USA industry is slated to grow at 7.4% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| E-Commerce Growth | Thermal printers are employed by retailers such as Amazon and Walmart to print barcodes and labels to improve logistics and delivery precision. |

| Healthcare Adoption | Hospitals and pharmacies employ these to print prescription labels, patient wristbands, and medical records. |

| Supply Chain Automation | The solutions that integrate RFID automate warehouse operations and inventory management. |

| Regulatory Compliance | Regulatory labeling for healthcare and food industries demands high-quality solutions. |

China's industry is expanding rapidly with the fast-evolving e-commerce industry, industrialization, and government encouragement towards digitalization. Top e-commerce portals like Alibaba and JD.com generate high demand for barcode and shipping label printers. Logistics and warehousing are increasing, which requires quick, automated labeling and traceability solutions.

Companies apply RFID and smart labeling technology to enhance efficiency and traceability. Moreover, the supportive government policies towards digital payments and paperless transactions have once more stimulated the adoption of thermal receipt printers in bank and retail spaces. With advancements in technology and domestic production, China remains an increasingly robust growth industry.

FMI is of the opinion that the China industry is slated to grow at 9.4% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Growing E-Commerce | Alibaba, JD.com, and other websites spur significant demand for barcode and shipping label printers. |

| Smart Labeling Adoption | Fostering industries to accept RFID and intelligent labels to drive supply chains into greater efficiency. |

| Digital Payment Growth | Government support for paperless transactions encourages thermal printer usage across retail and banking. |

| Logistics and Warehousing | Automatic identification and labeling applications enhance large-scale logistics business efficiency. |

India's industry is growing due to growing e-commerce, enhanced digitalization, and expanding retail acceptance. Online giants like Flipkart, Amazon India, and other e-players are creating demand for label and barcode printers for warehouse and logistics management.

The supermarket and quick-service restaurant businesses are gradually depending on thermal receipt printers to make billing hassle-free. Drug packaging, as well as hospital records in the pharmaceutical and drug businesses, need it. Government initiatives towards digitalization, supplemented by growing indigenous manufacturing capacity and foreign investment, make India a developing hub for thermal printing solutions.

FMI is of the opinion that the Indian industry is slated to grow at 8.2% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| E-Commerce Expansion | Amazon India and Flipkart fuel demand for barcode and shipping label printers in logistics. |

| Retail Sector Expansion | Supermarkets and QSRs use thermal receipt printers for easy transactions. |

| Healthcare and Pharmaceuticals | Hospitals and pharma companies use it for labeling and medical charts. |

| Digitalization Initiatives | Government initiatives encourage the application of it in administrative and financial services. |

The French industry grows as the retail, logistics, and manufacturing industries increasingly use automated printing. Supermarkets and chain stores apply thermal printers for billing and stock control. Logistics companies apply barcode and RFID-printers to improve package tracking and warehouse management.

Companies use smart labeling to meet traceability and environmental responsibility requirements imposed by the European Union. Its prime focus is on innovation in technology as well as premier-class printing hardware, and that is why France is a lucrative industry for innovations.

FMI is of the opinion that the French industry is slated to grow at 7.7% CAGR during the study period.

Growth Factors in France

| Key Drivers | Details |

|---|---|

| Retailing Demand | Supermarkets and chain stores use thermal printers to bill and track stock accurately. |

| Logistics Effectiveness | Firms adopt thermal printing solutions to enhance package traceability and automated warehouse operations. |

| Industrial Compliance | Compliance with European regulations stimulates intelligent labeling and RFID-tagged printing solutions. |

| Sustainability Trends | Companies are concerned with environmentally friendly technologies that fit into environmental agendas. |

The UK industry is growing steadily with growing retail use, regulatory labeling, and warehouse automation. Supermarkets and large retailers apply them to increase check-out speed and stock management.

The healthcare industry relies on pharmaceutical labeling and patient identification through thermal printing. With growing e-commerce, logistics businesses are investing in high-speed printing technology for order fulfillment. Food and drug safety legislation also increases the demand for high-resolution printing technologies.

FMI is of the opinion that the UK industry is slated to grow at 6.8% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| In-store Adoption | Large retail outlets and supermarkets use printing for invoices and stock management. |

| Logistics Expansion | Delivery networks and warehouses utilize high-speed thermal printers to label accurately. |

| Healthcare Adoption | Prescription label printing and patient wristband printing need thermal printers for hospitals and pharmacies. |

| Regulatory Norms | Food safety and pharma compliance mandates drive investments in improved printing. |

The industry is currently blossoming with features that are one of the fastest, most durable, and cost-effective printing techniques in retail, logistics, healthcare, manufacturing, etc. Industries adopt such technologies, and further investments are being made to install thermal printers with RFID technology, mobile printing, and cloud-based printing technologies to meet increasing demands for automation and traceability.

Leaders in the industry, like Zebra Technologies, Honeywell International, Seiko Epson, Toshiba Tec, and SATO Holdings, employ advanced thermal printers, barcode labeling solutions, and industrial-grade printing systems. Mid-sized and emerging players, however, aggressively compete in the industry through the provision of low-cost, region-specific thermal printing solutions.

Industry evolution stems from the introduction of eco-friendly printing technology, BPA-free thermal paper innovations, and AI-automated management in print. Smart labeling, IoT-enabled print monitoring, and sustainable packaging solutions are the dominating trends within the industry framework.

Strategic underpinnings include technology integration and regulatory conformity vis- -vis end-to-end supply chain efficiencies. With high-speed industrial printers and cloud-based print management in conjunction with environmentally conscious material choices, a player positions itself in the most favorable space in this fast-evolving the industry marketplace.

Recent Industry Developments

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Zebra Technologies | 20-25% |

| Honeywell International | 15-20% |

| Seiko Epson | 10-15% |

| Toshiba Tec | 8-12% |

| SATO Holdings | 5-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Zebra Technologies | Industry leader in RFID-enabled thermal printers, mobile label printing, and industrial barcode solutions. |

| Honeywell International | Specializes in high-speed barcode printers, POS systems, and rugged mobile thermal printing solutions. |

| Seiko Epson | Offers eco-friendly thermal receipt printers, compact mobile printers, and POS thermal solutions. |

| Toshiba Tec | Focuses on high-volume industrial label printing, RFID solutions, and retail-oriented thermal printers. |

| SATO Holdings | Provides industrial and healthcare-specific thermal printers, asset-tracking solutions, and smart labeling technology. |

Key Company Insights

Zebra Technologies (20-25%)

Zebra Technologies dominates the industry, boasting significant sales in applications that require it in the industrial field, logistics, or retail. Zebra works on innovating RFID-integrated and mobile printing systems with promises of improved futuristic productivity.

Honeywell International (15-20%)

Honeywell is one of the more well-known names in barcode and POS printing, as it manufactures ruggedized and high-performance thermal printers that are extensively applied in warehouses and transportation activities.

Seiko Epson (10-15%)

Seiko Epson is a major player in thermal receipt printing and compact POS solutions for the retail and hospitality sectors, and invests in innovative and green printing technologies.

Toshiba Tec (8-12%)

Toshiba Tec is known for providing very high-speed label printing and RFID-enabled thermal solutions, mainly targeting the industrial, healthcare, and supply chain spaces.

SATO Holdings (5-10%)

SATO provides industrial label printing and smart tracking solutions with custom barcode and RFID printing services for the manufacturing and logistics sectors.

Other Key Players (30-40% Combined)

The industry is projected to reach USD 48,115.7 million in 2025.

The industry is projected to reach USD 82,500.7 million by 2035, growing at a CAGR of 5.5%.

The key players include NCR Corporation, Honeywell International Inc., Zebra Technologies Corporation, Fujitsu Limited, HP Development Company, L.P., Seiko Epson Corporation, Toshiba Tec Corporation, Brother Industries, Ltd., Star Micronics Co., Ltd., NEC Corporation, and Advantech Co., Ltd.

North America and Asia-Pacific, driven by increasing demand in retail, healthcare, and logistics industries.

Direct thermal printing dominates due to its cost-effectiveness and extensive applications in barcode labeling, ticketing, and receipts.

By printer type, the segment is categorized into barcode printer, POS printer, kiosk & ticket printer, RFID printer, and card printer.

By printing technology, the segment is classified into direct thermal, thermal transfer, and dye diffusion thermal transfer.

By industry, the segment is categorized into retail & wholesale, transportation & logistics, healthcare, travel & hospitality, media & entertainment, manufacturing, government, and others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Border Security Technologies Market Growth - Trends & Forecast 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.