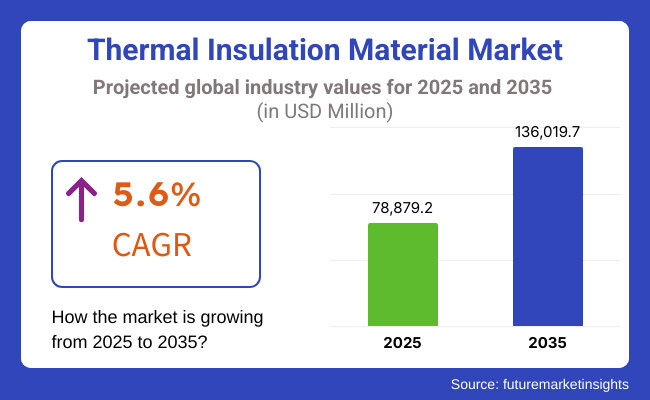

The global thermal insulation material market is expected to grow significantly, reaching USD 78,879.2 Million in 2025 and expanding at a 5.6% CAGR to USD 136,019.7 Million by 2035. This growth is driven by rising demand in the construction, industrial, and automotive sectors, along with stricter energy efficiency standards, regulatory policies, and advancements in materials science.

The global thermal insulation materials market is primarily driven by factors such as infeasible growing attention on energy practice & sustainability. The increasing construction activities around the world, particularly for commercial and residential, are propelling the demand for insulation products to enhance energy efficiency. Moreover, several industrial verticals including oil & gas, manufacturing, and HVAC systems have also been adapting high-performance insulation materials to curb energy wastage and enhance operational performance.

Advanced insulation technologies, such as aerogels, vacuum insulation panels, and phase-change materials, are changing the game for the industry. As energy codes and Green Building principles are adopted internationally, there is a further potential for market demand. In addition, rising penetration of electric vehicles (EVs) is increasing the demand for thermal insulation in batteries and vehicle parts to enhance the efficiency and safety of vehicles.

Thermal insulation material market is expected to witness a CAGR of 7-8% between 2023 and 2030, with regular data on the growth rate up to October 2023. Companies that specialize in sustainable and high-performance insulation solutions will position themselves as leaders in this competitive landscape.

With worldwide energy efficiency standards getting stricter, the need for new and economic insulation materials will be increasingly vital over the following ten years, determining the market's path.

Explore FMI!

Book a free demo

The North America region will be a significant thermal insulation market, driven by comprehensive energy efficiency regulations and the rising trend of green buildings. High-performance insulation solutions for commercial and residential sectors are increasingly becoming a norm to meet energy-saving standards. In turn, companies are able to produce modern and energy-saving materials with the advantage of cutting-edge manufacturing facilities in the region.

Moreover, several government policies supporting environmental sustainability and decreasing carbon footprints remain favorable to market growth. As a result, green insulation was widely adopted in the construction sector as an energy-efficient energy performance solution due to the need for cost-effective energy conservation measures that reduce operational costs for buildings.

Europe leads the way with sustainable insulation for buildings, having been driven by tight environmental policies and energy-saving strategies throughout the region. Germany, France, and the UK are taking the lead in developing new green and sustainable insulation materials to help meet zero-carbon building targets.

Regulatory frameworks like EU's Energy Performance of Buildings Directive, have driven industries to adopt green building concepts and energy-efficient technologies. Advanced thermal insulation technologies are an essential element to the European goal of reaching a low-carbon economy, helping to improve energy security, cut CO2 emissions, and enhance the comfort of buildings across Europe.

Rapid urbanization, industrialization and emphasis on energy-efficient buildings have led to the fastest growth in thermal insulation demand in the Asia-Pacific region. The key regions of the market are China, India and Japan, where infrastructure and sustainable technologies account for it.

Energy-efficient building codes and green building certifications continue to promote the use of advanced thermal insulation materials, among others, supported by government incentives and regulatory frameworks. With the economies in the region continuing their growth, demand for affordable insulation in residential and commercial services is on the rise, leading to additional market growth, alongside the drive for energy-efficient buildings while constructing.

Demand for thermal insulation materials is also rising globally, albeit at a differential pace, as per geographical determinants. Urbanization trends and infrastructure development in Latin America and the Middle East is driving the adoption of insulation materials in construction projects. Energy efficiency is also increasingly being enforced through new stricter building codes legislation, as well as green building certification efforts by governments in regions around the world.

In Africa however, we talk about affordable housing and energy efficiency in residential developments. Developing Regions- Increasing awareness about climate change and energy-efficient solutions acceptability is anticipated to significantly boost the energy-efficient building solutions demand in the developing regions.

Challenges

Fluctuating Raw Material Prices

The raw materials such as fiberglass, mineral wool and polystyrene used in the production of thermal insulation are subject to fluctuating prices which hamper the growth of the thermal insulation market significantly. Factors such as global supply chain disruptions, increased demand, and geopolitical tensions have caused this price fluctuation, potentially resulting in higher production costs.

Raw material prices can be one of the most challenging aspects for a manufacturer to keep profitable during unexpected lapses. Manufacturers need to adopt more flexible procurement strategies and to investigate alternative materials, but all such solutions tend to raise cost and performance issues of their own.

Regulatory Compliance Complexities

With the growing global environmental and energy efficiency regulations, insulation manufacturers are facing a challenge that is only going to grow. This is a massive investment in product development and process retraining to comply with a wide variety of often complex local, regional, and international regulations ranging from the EU’s Energy Performance of Buildings Directive to, oh, you name it.

This can get quite complicated where products are failing to meet sign off requirements across jurisdictions causing extended product launches, cost for obtaining multiple certifications as well as more rigorous testing processes. Such regulatory complexities provide a major barrier to entry for smaller companies, and large institutions often have teams dedicated to negotiating such agreements.

Opportunities

Eco-Friendly Insulation Materials

With the growing concern towards the environment, there is an increasing demand for eco-friendly and sustainable insulation materials. By creating biodegradable, recyclable or renewable resources like cellulose or cotton, manufacturers can take advantage of the emergence of this trend. Due to their minimal impact on the environment and ability to contribute to sustainable construction practices, these products are being sought after more and more.

As governments provide incentives for green building projects, the market for eco-friendly insulation is growing. Incorporating innovative usage of 3D printing will enable these companies to stand out in a saturated market by appealing to conscious consumers and staying on the right side of the emerging regulations that demand a focus on sustainable practices in construction.

Technological Advancements

The electric insulation market has a great scope in this fast pace of technological development which brings plenty of opportunities. Innovations including nanotechnology and smart insulation products (those that can adjust themselves, for example, or actively respond to variations in temperature) are ushering in entirely new technology in the field. Compared to traditional materials, these innovations offer improved energy efficiency, temperature preservation, and longevity.

The rise of these technologies opens up incredibly lucrative opportunities for manufacturers, especially considering the applications that rely on high-performance materials in areas like electric vehicles, aerospace and industrial sectors. As new smart insulation solutions are becoming more mainstream will lead to market expansion providing early adopters a competitive advantage in these advanced sectors.

Between 2020 and 2024, the thermal insulation material market has grown rapidly, due to the growing need from the construction, automotive, and industrial sectors.

Energy efficiency regulations, growing consumer awareness for sustainable building materials, and technological development have been crucial in influencing these dynamics. This trend has only accelerated the push towards advanced insulation solutions due to the global drive towards green buildings and reducing the carbon footprint.

Looking ahead to 2025 to 2035, the market is expected to be influenced by stringent energy efficiency regulations, advancements in nanotechnology technology, and rising utilization of bio-based and recyclable insulation materials. Aerogels, vacuum insulation panels (VIPs), and phase change materials (PCMs) are some of the innovations that will improve insulation performance. Furthermore, responsive insulation materials that can adjust to varying environmental factors will also contribute to the growth of this market.

The future of thermal insulation materials looks promising, with opportunities in different industry verticals. During 2020 to 2024, there would be gradual advancements in aerogels, spray foam, and recyclable materials; from the next decade onwards, trends are more likely towards self-regulating smart insulation, generative AI-led optimization, and a broad-scale adoption of bio-based alternatives. The expansion of the market to aerospace, EVs, and wearable insulation applications will open new revenue streams, and innovation will be key to their success.

With governments imposing stricter sustainability mandates and consumer preferences increasingly leaning towards greener solutions, companies investing in the next-generation thermal insulation materials will be well-positioned to gain a competitive advantage, setting them up for long-term success in an ever-evolving landscape.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter building codes and energy efficiency standards (LEED, BREEAM, etc.) are implemented. |

| Technological Advancements | Growth in aerogels, spray foam insulation, and vacuum insulation panels. |

| Industry-Specific Demand | Strong demand across construction, HVAC and industrial applications. |

| Sustainability & Circular Economy | Greater use of recycled insulation materials and low-emission manufacturing methods. |

| Production & Supply Chain | Supply chain breaks from shortages and delays of raw materials related to the pandemic. |

| Market Growth Drivers | Growth in urbanization, rising energy costs, and environmental awareness. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter international regulation on net-zero energy buildings and carbon neutrality. |

| Technological Advancements | Adoption of smart insulation, AI-driven material optimization, and next-generation phase change materials. |

| Industry-Specific Demand | Diversification into EV battery insulation, aerospace, and wearable thermal insulation. |

| Sustainability & Circular Economy | Scaling bio-based insulation, circular economy models and carbon-negative materials. |

| Production & Supply Chain | Improved local production, blockchain for supply chain visibility, AI-driven forecasting. |

| Market Growth Drivers | Government benefits for green-building construction, higher R&D spending, and consumer demand for sustainable living. |

The USA thermal insulating materials market is growing owing to strict energy efficiency, sustainability standards implemented in the construction and industrial sectors. Government incentives like Energy Star program and green buildings are driving demand for advanced insulation materials. High-performance insulation is being implemented in the commercial sector, specifically for offices, healthcare plants, and industrial facilities for effective energy conservation.

The growing number of electric vehicles (EVs) is also driving demand for lightweight, heat-resistant insulation for automotive production. Data centers and cold storage facilities where the renovation of buildings fueled the market challenges such as volatile raw material prices and a gradual shift toward sustainable alternatives in specific sectors persist.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.0% |

The thermal insulation market in the UK is experiencing growth, driven by sustainability initiatives, energy efficiency guidelines, and government subsidies for low-carbon building practices, with increasing demand for household spaces.

British immigration policy after the Brexit vote to leave the European Union reduces the window of foreign workers from being employed on construction sites since the 2020s have reduced the amount of imported insulation materials, encouraging local production.

The increasing emphasis toward passive house designs and energy efficient building retrofits further increases insulation adoption across residential and commercial spaces. Vacuum insulation panels (VIPs) and aerogels are among the most common emerging technologies.

Segmentation analysis based on end-user industry, energy companies, and manufacturing industries, oil and gas industries will need high-temperature insulation solutions. Nonetheless, the market is likely to be challenged by high energy costs and slow consumer acceptance of sustainable solutions such as green insulation materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.4% |

Thermal insulation materials are one of the largest markets in Germany, largely due to strict energy efficiency legislation, namely the EnEV (Energy Saving Ordinance), in conjunction with climate protection measures.

Where the government requires retrofitting of buildings for better insulation efficiency, mineral wool (MW), expanded polystyrene (EPS), and polyurethane foams (PUR) are in high demand. Lightweight high-performance insulation materials are being introduced into the automotive sector, such as EV battery manufacturing.

If Germany, one of the largest users of insulation, is an indication of things to come, then the trend toward circular economy solutions with a growing focus on sustainable and recyclable insulation will continue, especially for bio-based insulation products. However, the high production costs and supply chain disruptions affect the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.8% |

Japan is also driving growth in the thermal insulation material market, with high energy costs and a focus on earthquake-resistant, energy-efficient buildings. Policies such as zero-energy building (ZEB) also how scope to encourage thermal insulation improvements. Energy-efficient upgrades are being made to the country’s old infrastructure, and this will drive the use of high-performing insulation materials, such as aerogels and phenolic foams.

Advanced insulation for thermal management in EV and battery systems is needed, which boosts the automotive and electronics industries. High material costs and the shorter layers of thicker insulation are some other menacing challenge as often urban structures have space constraints.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The market for thermal insulation materials in South Korea is driven by green building regulations, rapid urbanization, and growth in industrial sectors. Zero-energy building standards are also being enforced by the government, which is driving demand for insulation in both residential and commercial construction.

The hot EV market, in particular for batteries, is also driving demand for high temperature insulation. Advancing smart manufacturing and robotics-driven insulation applications Moreover, temperature management is critical for the shipbuilding and petrochemical industries, requiring high-performance industrial insulation. Nevertheless, dependency on imported raw material and volatility of oil prices can affect pricing and stability of the supply chain.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

Stone wool, derived from volcanic rock, is a key thermal insulation material known for its fire resistance, durability, and high thermal performance. It is widely used in industrial, commercial, and residential applications, particularly in high-temperature environments.

Stone wool is a leading thermal insulation material that is derived from molten volcanic rock, boasting exceptional fire resistance, durability, and thermal performance. It is commonly utilized in industrial, commercial, and domestic applications, especially in high-temperature settings.

Fiber glass insulation, made from fine glass fibers, is still one of the most common types of insulation used in homes because it is inexpensive, light, and simple to put in. Now commonly used in many HVAC systems, residential and commercial buildings, and in industrial insulation applications.

With susceptibility to moisture absorption and health concerns related to the airborne fibers, continuous innovations in binder technologies and eco-friendly formulations are likely to enhance the market outlook of fiber glass insulation. Strong demand continues throughout North America, Europe and emerging economies in the Asia-Pacific.

Growing need for thermal insulation materials for applications such as liquefied natural gas (LNG) storage, cryogenic transportation, and industrial processing is driving the demand for thermal insulation materials in the -160°C to -50°C temperature range.

In extreme cold conditions, stone wool and certain high performance fiber glass products are used to provide temperature stability and energy efficiency. Growing demand for LNG infrastructure as well as cold storage capacity in pharmaceutical and chemical industries have driven the demand for cryogenic insulation in North and South America, the Middle East and Asia-Pacific.

The -49°C to 0°C section is important to cold storage facility, refrigerated transport, and building insulation systems in colder climates. Products such as fiber glass and stone wool are used to prevent heat loss and condensation problems and to enhance energy efficiency and the ability to maintain desired temperature conditions.

A major factor contributing to the growth of this segment is the growth of the cold chain logistics sector, which was pushed by rising demand for perishable goods and pharmaceuticals. The cold-chain infrastructure investments are primarily led by North America and Europe, while the refrigerated storage area is growing rapidly in Asia-Pacific.

The Thermal Insulation Material Market is a vital segment of the construction, industrial, and automotive industries, offering solutions that enhance energy efficiency and sustainability.

The market includes a range of materials such as fiberglass, mineral wool, polyurethane foam, and aerogels. The market is witnessing growth on account of increasing focus on energy conservation, strict building codes, and advancement in insulation technology. The industry is dominated by leading global players, while regional manufacturers focus on localized demand and niche applications.

The thermal insulation market is propelled by technological innovations as well, with things such as aerogel insulation, semi-conducting phase-change materials, and nanotechnology-based insulators becoming increasingly prominent.

These advances offer greater thermal efficiency and greater durability, which opens up opportunities for energy-efficient construction. Market is also influenced to a certain extent by sustainability trends; as such, there is a demand for eco-friendly, recyclable, recyclable, and bio-based insulation solutions. Both consumers and governments are calling for greener alternatives to traditional synthetic materials.

Additionally, the regulatory landscape is changing, with more stringent energy efficiency codes as well as government incentives promoting high-performance insulation. The competitive positioning and imitation of the market expansion through mergers, acquisitions, and strategic partnerships are also driving the growth of the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Owens Corning | 12-17% |

| Saint-Gobain | 10-15% |

| Kingspan Group | 8-12% |

| Rockwool International | 7-11% |

| BASF SE | 6-10% |

| Other Companies (Combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Owens Corning | Focus is on sustainable and high-performance materials, so we specialize in Fiberglass insulation solutions. |

| Saint-Gobain | Provides a range of solutions across mineral wool and foam-based insulation with an emphasis on energy efficiency and green building solutions. |

| Kingspan Group | High-performance building develops solution provider and significant manufacturer of rigid foam insulation panels. |

| Rockwool International | Produces stone wool insulation for fire safety, acoustic performance, and sustainability applications. |

| BASF SE | Produces polyurethane and polymer insulation materials for industrial and construction industries |

Key Company Insights

Owens Corning

Owens Corning is the largest manufacturer of fiberglass insulation for residential, commercial and industrial applications in the world. The business is committed to sustainability, having successfully incorporated recycled materials into insulation and ensured compliance with green building standards.

Owens Corning makes significant investments in R&D to expand innovation in thermal efficiency, durability, and ease of installation. The company offers insulation solutions that enhance energy efficiency and minimize ecological footprint. The company continues to lead the market with strategic acquisitions and partnerships.

Saint-Gobain

Saint-Gobain works with products like mineral wool, expanded polystyrene (EPS), and polyurethane foam products (PU). The company specializes in energy efficiency and sustainability solutions for the commercial and residential sectors and provides a variety of services.

Saint Gobain: Saint-Gobain provides innovative lunch of lightweight & durable insidious that meets out all energy code requirements across countries worldwide. The reach and network of strong distribution ensure it reaches a diverse market quickly.

Kingspan Group

Kingspan Group manufactures rigid insulation boards and high performance building envelopes to minimize thermal loss and maximize fire resistance. “To meet the growing demand for sustainable construction materials, the company is at the forefront of the development of zero-carbon insulation solutions.

Kingspan can further reduce its carbon footprint and improve the performance of its products through investment in recycling initiatives and green technology. Kingspan, having a strong market positioning in Europe, North America and APAC region, is widening its product portfolio to stay competitively relevant.

Rockwool International

Rockwool International is a world leader in stone wool - a non-combustible, soundproof, and thermal insulation that caters to a wide array of applications. Have a great practice with sustainable design generation with circular economy principles that guarantees minimal waste production.

Rockwool's insulation materials are also used extensively in the residential, commercial, and industrial building sectors, especially in applications that require fireproofing and sound absorption. It widens its manufacturing capability and global market expansion, boosting its portfolio in energy-efficient construction ventures.

BASF SE

BASF SE is a major supplier of polyurethane-based insulation materials, offering solutions for industrial, commercial, and residential buildings. Insulation technology business is focused on lightweight, high-performance, environmentally friendly insulation technologies based on deep R&D capabilities.

BASF's polymer functional materials enable energy saving and thermal comfort and are thus in line with global sustainability trends. As a leading global chemical producer, BASF is deeply committed to open the way to sustainable circular economies, and is consistently innovating recyclable and low-carbon insulation solutions.

The global Thermal Insulation Material Market is projected to reach USD 78,879.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.6% over the assessment period.

By 2035, the Thermal Insulation Material Market is expected to reach USD 136,019.7 million.

Plastic Foam dominate the market due to broadly attributed to high insulation values, ease of installation, and moisture resistance characteristics.

Major companies operating in the Thermal Insulation Material Market Huntsman Corporation, Knauf Insulation, Johns Manville, Dow Inc., Armacell International, Recticel Group.

In terms of Material Type: the industry is divided into Stone Wool, Fiber Glass, Plastic Foam, Others

In terms of Temperature Range: the industry is divided into 160°C to -50°C, -49°C to 0°C, 1°C to 100°C, 101°C to 650°C

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.