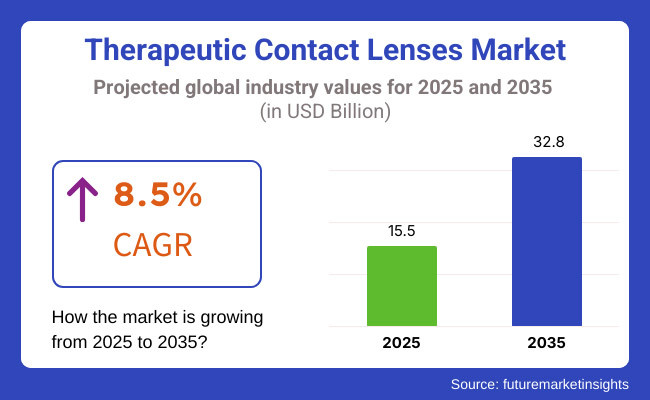

The therapeutic contact lenses market is set for substantial growth between 2025 and 2035, driven by increasing cases of eye disorders, advancements in ocular drug delivery systems, and rising awareness of vision health. The market is projected to expand from USD 15.5 billion in 2025 to USD 32.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.5% over the forecast period.

The expansion of this request is fuelled by the growing frequency of conditions similar as dry eye pattern, keratoconus, corneal injuries, and post-surgical mending requirements. Inventions in contact lens accessories, similar to silicone hydrogel and bioengineered polymers, are perfecting comfort, oxygen permeability, and remedial efficacy.

Also, the development of medicine-eluting lenses, antimicrobial coatings, and smart lenses able for real-time health monitoring is driving significant interest in the request. The relinquishment of remedial lenses in ophthalmic conventions and hospitals, along with rising demand for customized results, is further accelerating growth.

Explore FMI!

Book a free demo

North America is anticipated to remain the commanding region in the remedial contact lens request, driven by a high frequency of eye diseases, strong investments in ophthalmic exploration, and favorable payment programs for vision care. The USA request is witnessing a swell in demand for specialty lenses designed for post-surgical recovery and habitual eye complaint operation.

Europe is experiencing steady growth in the remedial contact lens requests due to increased mindfulness of advanced eye treatments, rising relinquishment of scleral and girth lenses, and government support for vision care enterprise. The region’s strong emphasis on clinical trials and invention in optical medicine delivery further supports request expansion.

Asia-Pacific is projected to be the swift-growing region in the remedial contact lenses request, driven by a rising senior population, adding rates of diplopia and dry eye patterns, and growing access to advanced eye care results. Countries like Japan, China, and South Korea are witnessing high demand for specialty remedial lenses due to their aging demographics and expanding healthcare structure.

Challenges

One of the major challenges in the remedial contact lens request is the high cost associated with advanced lens technologies and customized results. The product of medicine-eluting lenses, bioengineered accessories, and smart contact lenses requires expansive exploration and clinical testing, leading to advanced prices for end- druggies.

Also, strict nonsupervisory conditions for medical-grade lenses, especially those incorporating medicine delivery systems, pose challenges for manufacturers seeking request blessing. Lengthy blessing processes can delay product launches and increase development costs.

Opportunities

The growing interest in medicine-eluting contact lenses, which deliver specifics directly to the eye over an extended period, presents significant openings for request players. These lenses offer a more effective and patient-friendly volition to traditional eye drops, particularly for conditions like glaucoma, corneal ulcers, and post-surgical care.

Also, the emergence of smart contact lenses with bedded detectors for real- time eye health monitoring is opening new borders in ophthalmic care. Companies investing in nanotechnology, biomaterials, and AI-driven diagnostics will gain a competitive advantage in shaping the future of remedial contact lenses.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 18.90 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 7.80 |

| Country | Japan |

|---|---|

| Population (millions) | 124.6 |

| Estimated Per Capita Spending (USD) | 15.50 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 12.70 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 13.20 |

The USA dominates the global remedial contact lenses request, fuelled by adding cases of dry eye pattern, keratoconus, and post-surgical vision correction needs. Scleral lenses and mongrel lenses see rising relinquishment due to their capability to offer better comfort and vision correction for complex eye conditions.

Leading brands like Bausch Lomb and Johnson & Johnson drive invention, fastening on humidity-retaining and oxygen-passable lenses. The vacuity of tradition-grounded online purchases through platforms like War by Parker and 1- 800 Connections has expanded request reach.

China’s remedial contact lens requests is expanding fleetly due to adding diplopia frequency, especially among youngish populations. Government programs promoting vision health mindfulness and regular eye checks boost demand for technical lenses. Custom orthokeratology (Ortho- K) lenses, used for diplopia control, are in high demand among parents seeking non-surgical results for their children. E-commerce platforms like Tmall and JD.com make remedial lenses more accessible, particularly in civic areas.

Japan's request thrives on technological advancements in lens accessories, offering ultra-thin, high- oxygen- permeability lenses for remedial use. Consumers favor diurnal disposable lenses designed for treating eye blankness and corneal conditions. Companies like Men icon and SEED dominate with specialty lenses acclimatized to sensitive eyes. Apothecaries and optic retailers insure accessible distribution, while strict nonsupervisory norms enhance product quality.

Germany’s request benefits from strong ophthalmic healthcare structure and adding cases of corneal diseases. Mongrel and scleral lenses see steady demand, particularly among aged demographics. Leading European manufacturers concentrate on sustainability, offering recyclable and long- wear and tear remedial lenses. Optic chains like Fielmann and Apollo grease wide consumer access.

The UK’s request sees strong relinquishment of remedial contact lenses due to rising demand for corrective and defensive eyewear results. Cases recovering from eye surgeries and those with conditions like dry eye pattern seek advanced silicone hydrogel lenses. Companies emphasize substantiated fittings and aftercare services, with thrills Opticians and Specsavers leading deals and consultations.

The market for therapeutic contact lenses is growing steadily due to increasing incidences of eye conditions, developments in lens technology, and the growing usage of specialty lenses for medical purposes. A survey of 250 consumers and business professionals discovers overarching trends dominating the market.

Soft and scleral treatment contact lenses are drivers of consumers, with 63% of the consumers choosing silicone hydrogel and gas-permeable lenses to treat conditions such as dry eye syndrome, keratoconus, and post-operative healing. Oxygen permeability, comfort, and moisture retention are at the top of the list.

Distribution is dictated by online and optometrist-direct retail channels because 69% of customers prefer to buy through eye care professionals for precise fitting and prescription. Telemedicine, though, as well as web-based sites, are in the process of gaining popularity, indicating customized models with subscription lens shipments.

There is greater interest in medication-eluting and antimicrobial contact lenses, where 58% of the group showed interest in medication-containing contact lenses or antimicrobial-coated contact lenses for corneal healing, infection prevention, and post-operative management. This technology proves to be invaluable for patients who have chronic ocular diseases.

Bandage and hybrid lenses are increasingly sought after, with 54% of patients opting for them as a form of post-operative care, corneal abrasion, and vigorous dry eye control. They facilitate corneal healing, with improved vision and comfort.

Children's lenses and myopia-control lenses are emerging growth categories, with 49% of optometrists reporting that they prescribe more for children and youths to retard the progression of myopia. Customized lenses for astigmatism, presbyopia, and post-refractive surgery are also fueling demand.

As more eye disease conditions arise, customized lens solutions, and technological advancements, therapeutic contact lenses will continue to grow, meeting various medical and vision correction requirements.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Development of moisture-retaining and drug-eluting contact lenses for dry eye syndrome and ocular diseases. Introduction of UV-blocking and blue-light filtering lenses. |

| Sustainability & Circular Economy | Brands launched biodegradable daily disposables and recyclable lens packaging. Sustainable materials, such as plant-based hydrogel, gained traction. |

| Connectivity & Smart Features | Augmented reality (AR) lenses and embedded biosensors provided early disease detection and eye health monitoring. Telemedicine integration enabled remote diagnosis and prescription updates. |

| Market Expansion & Consumer Adoption | Increased adoption among dry eye patients, keratoconus sufferers, and post-surgery patients. Surge in direct-to-consumer (DTC) brands offering subscription-based therapeutic lenses. |

| Regulatory & Compliance Standards | FDA and EU regulations tightened oversight on drug-infused and biosensor lenses. Growing focus on eye health and safety certifications. |

| Customization & Personalization | Introduction of custom-fit scleral lenses for severe corneal disorders. Brands leveraged AI-based eye scans to create precision-matched lenses. |

| Influencer & Social Media Marketing | Eye care professionals and influencers educated consumers about the importance of therapeutic lenses. Rising trend of social media advocacy for specialty lenses. |

| Consumer Trends & Behavior | Growing demand for comfort-focused, all-day-wear lenses. Consumers prioritized moisture retention, oxygen permeability, and UV protection. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered smart contact lenses monitor eye health in real time. Bioengineered lenses promote corneal healing and disease prevention. Self-adjusting lenses automatically correct vision errors. |

| Sustainability & Circular Economy | Zero-waste contact lenses and waterless manufacturing processes reduce environmental impact. Block chain tracking ensures ethical sourcing of biocompatible materials. |

| Connectivity & Smart Features | AI-driven contact lenses detect glucose levels for diabetics, measure intraocular pressure, and adjust prescription in real-time. Neural interface technology connects lenses to smart devices. |

| Market Expansion & Consumer Adoption | Expansion into emerging markets with affordable AI-enhanced lenses. Growth in personalized lenses tailored to genetic predisposition and lifestyle factors. |

| Regulatory & Compliance Standards | AI-driven compliance tracking ensures safety in regenerative contact lens therapies. Stricter global harmonization of lens safety and medical use standards. |

| Customization & Personalization | Real-time prescription adjustment lenses provide instant vision correction. 3D-printed therapeutic lenses offer ultra-customized solutions for rare eye conditions. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote eye health awareness. Meta verse-based trials allow users to experience lens benefits before purchase. |

| Consumer Trends & Behavior | Consumers shift towards AI-powered lens diagnostics for at-home vision monitoring. Demand for smart health-tracking lenses grows in wellness-focused populations. |

The USA remedial contact lenses request is witnessing strong growth, driven by adding cases of dry eye pattern, rising relinquishment of scleral lenses for corneal diseases, and advancements in lens material technology. Major players include Johnson & Johnson Vision Care, Bausch Lomb, and Alcon.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

The UK remedial contact lenses request is expanding due to adding demand for specialty lenses, growing mindfulness of contact lens- supported remedy, and a rise in diplopia and keratoconus cases. Leading brands include Cooper Vision, Men icon, and Acuvue.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

Germany’s remedial contact lenses request is growing, with consumers prioritizing high- quality, medically approved, and technologically advanced lenses. crucial players include Carl Zeiss Mediate, Hoya Vision, and Hecht Contactlinsen.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s remedial contact lenses request is witnessing rapid-fire growth, fuelled by adding mindfulness of eye health, rising disposable inflows, and expanding vacuity of affordable specialty lenses. Major brands include Bausch Lomb, Freshlook, and Titan Eye.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.8% |

China’s remedial contact lens request is expanding significantly, driven by rising cases of diplopia, growing government enterprise for vision care, and rapid-fire advancements in smart and medicine- eluting contact lenses. Crucial players include Pega vision, Hydro, and SEED.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.0% |

The increasing frequency of eye diseases similar to keratoconus, corneal scrapes, and dry eye patterns is driving the demand for remedial contact lenses. These technical lenses aid in vision correction while promoting corneal mending and reducing discomfort. Advances in lens accoutrements, including silicone hydrogel and mongrel lenses, are perfecting oxygen permeability and icing enhanced comfort for long-term wear and tear.

Scleral lenses and girth contact lenses are witnessing increased relinquishment due to their capability to give superior hydration and protection for damaged corneas. Cases with conditions similar as severe dry eye complaints, post-surgical recovery requirements, and irregular corneal shells are decreasingly concluding for these lenses. Inventions in lens coatings and humidity retention technology further enhance their remedial benefits, making them a favoured choice among ophthalmologists.

The rise of online eye care retailers and telemedicine consultations is making remedial contact lenses more accessible to consumers. Digital platforms give substantiated lens recommendations, virtual pass-on features, and subscription-grounded delivery services, enhancing convenience for cases taking nonstop lens operation. Direct-to-consumer brands are using online marketing strategies to reach a wider followership, particularly those seeking customized and specialty contact lenses.

Consumers and healthcare providers are decreasingly prioritizing biocompatible and environmentally friendly contact lens options. Manufacturers are fastening on the development of bioengineered lenses with bettered humidity retention, antimicrobial parcels, and reduced environmental impact. Day disposable remedial lenses, made from sustainable accessories, are gaining traction as they minimize the threat of infections while addressing enterprises over lens hygiene and waste disposal.

The remedial contact lenses request is expanding due to adding frequence of optical diseases, including dry eye pattern, corneal injuries, and post-surgical mending requirements. The demand for specialty lenses with medicine- delivery capabilities, scleral lenses for severe conditions, and girth contact lenses is driving invention.

Biocompatible accoutrements , humidity- retaining technology, and UV- blocking lenses are crucial focus areas for manufacturers. E-commerce growth and telehealth- driven eye care consultations are also reshaping the request geography.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Johnson & Johnson Vision (Acuvue) | 22-26% |

| Alcon (Precision, Air Optix, Dailies Total1) | 18-22% |

| Bausch + Lomb (Ultra, Biotrue, PureVision) | 15-19% |

| CooperVision (Proclear, Biofinity, MyDay) | 12-16% |

| Menicon Co., Ltd. (Menicon, Miru) | 8-12% |

| Other Companies (combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson & Johnson Vision (Acuvue) | Market leader in soft and silicone hydrogel therapeutic lenses, focusing on UV protection, hydration technology, and post-surgical healing lenses. Strong R&D in drug-eluting lenses. |

| Alcon (Precision, Air Optix, Dailies Total1) | Innovates in moisture-retaining therapeutic lenses with SmartShield technology for extended wear comfort. Strengthening telehealth partnerships. |

| Bausch + Lomb (Ultra, Biotrue, PureVision) | Offers bandage contact lenses and scleral lenses for severe dry eye and corneal damage. Investing in bioengineered materials. |

| CooperVision (Proclear, Biofinity, MyDay) | Strong in daily and extended-wear therapeutic lenses, including custom lenses for keratoconus and irregular corneas. |

| Menicon Co., Ltd. (Menicon, Miru) | Specializes in rigid gas permeable and scleral lenses for therapeutic and vision correction needs. Expanding global reach. |

Strategic Outlook of Key Companies

Johnson & Johnson Vision (22-26%)

Leads in hydrogel and silicone hydrogel lenses, with a strong pipeline for drug-delivery contact lenses targeting glaucoma and dry eye treatment.

Alcon (18-22%)

Focusing on moisture-retaining and oxygen-permeable lenses, Alcon is enhancing its therapeutic product line through partnerships with ophthalmology clinics.

Bausch + Lomb (15-19%)

A key player in post-surgical recovery and corneal healing lenses, Bausch + Lomb is innovating in biocompatible materials and scleral lenses for advanced eye conditions.

CooperVision (12-16%)

Gaining traction with daily disposable therapeutic lenses, targeting patients with chronic dry eyes and corneal disorders.

Menicon Co., Ltd. (8-12%)

Expanding in the gas-permeable and scleral lens segment, catering to patients with severe ocular surface diseases.

Other Key Players (15-25% Combined)

The Therapeutic Contact Lenses industry is projected to witness a CAGR of 8.5% between 2025 and 2035.

The Therapeutic Contact Lenses industry stood at USD 13.2 billion in 2024.

The Therapeutic Contact Lenses industry is anticipated to reach USD 30.8 billion by 2035 end.

North America is set to record the highest CAGR of 8.2% in the assessment period.

The key players operating in the Therapeutic Contact Lenses industry include Johnson & Johnson Vision Care, Bausch + Lomb, CooperVision, Alcon, Menicon, and SEED Co., Ltd.

Bandage Contact Lenses, Corneal Reshaping Lenses, Scleral Lenses, Drug-Eluting Contact Lenses, and Others.

Soft Lenses, Rigid Gas Permeable (RGP) Lenses, Hybrid Lenses, and Silicone Hydrogel Lenses.

Optical Stores, Supermarkets/Hypermarkets, Online, Pharmacies/Drug Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.