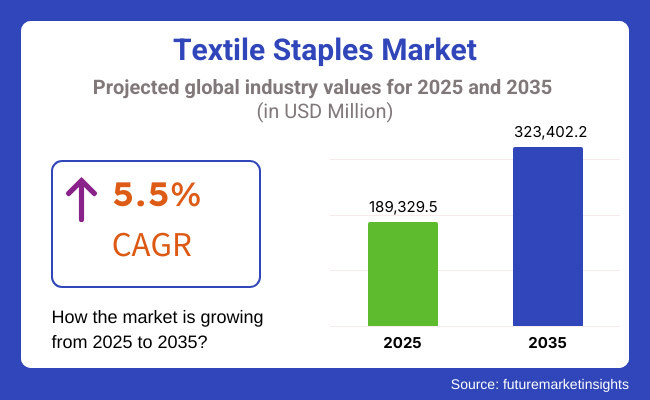

The global textile staples market is projected to grow significantly, with a market size of USD 189,329.5 million in 2025, expanding at a 5.5% CAGR to reach USD 323,402.2 million by 2035. This growth is driven by rising demand in apparel, home furnishings, and industrial sectors, along with a shift toward sustainable, high-performance textile materials and advancements in fiber production technology.

The textile staples market is all about using short fibers to produce the yarns that are used for the different fabrics in the industries. Natural fibers such as cotton, wool, and silk come with characteristics like being breathable and soft, whereas the synthetic fibers such as polyester, nylon, and acrylic, are known for their toughness, cost-effectiveness, and resistance to abrasion and tear.

These fibers are involved in various areas, such as clothing, sportswear, home textiles, medical applications, and technical textiles. The major market trend is the transition toward environmental sustainability, powered by the use of materials like organic cotton and recyclable fibers that are gaining popularity among consumers due to their environmental concerns.

The textile staples market is influenced by several factors like the higher global demand for eco-friendly fibers, increased investments in textile manufacturing, and the scientific exploration of synthetic and natural fibers in many fields.

The transition to sustainable materials, such as recycled polyester and organic cotton, has also contributed to the growth of research in textile staple fabrication. Moreover, the technological development of fiber blending has opened up the opportunity to produce high-strength and multifunctional fabrics, which cater to the needs of industries and consumers.

The regulative policies that are meant to promote the virtues of sustainability and environmental protection are also gaining a foothold and influencing the market which in turn leads to the use of bio-based fibers. Additionally, the rising adoption of technical textiles in automotive, healthcare, and construction industries is also a factor contributing to the demand. The automotive, healthcare, and construction sectors are the major forerunners in the increase of technical textiles.

The textile staples market is equipped for a solid ascent, mainly by the increasing need in various sectors and the rising urge for sustainable textile solutions. Tech breakthroughs, laws favoring green goods, and consumer choice migration to ecological products are the main factors that will affect the market framework.

Firms channeling funds into green technologies and those enlarging operations in fast-developing regions will find themselves in the best possible position to take full advantage of the surging prospects in the upcoming decade.

Explore FMI!

Book a free demo

The textile staples market in North America is being driven by the ever-increasing demand of the fashion, home furnishings, and automotive sectors. Regulatory policies that focus on sustainability promote the use of environmentally friendly materials such as organic cotton and recycled fibers and thus, the adoption of them. Progresses in the technology of synthetic fibers, in particular of performance fabrics such as moisture-wicking and stretch materials, significantly participate in the market development too.

Moreover, the growing consumer taste for organic and ethically sourced textiles is an additional driving factor for the brands and manufacturers to follow environmental trends. In spite of issue, like competition from foreign markets, the region is still able to sell high-quality and innovative textile solutions and thus continues with textile staples in global market.

Owing to the initiative of countries such as Germany, France and Italy, Europe is the leader of the sustainable textiles producers, both in high-end and technical textiles. The manufacturers are compelled to utilize bio-based recycled, low-impact fibers due to harsh environmental regulations.

Biodegradable textile raw materials and energy-low fabric manufacture are recent technologies obtaining popularity now. The consumer demand for eco-friendly products matches Europe’s concentrated motive of sustainability proving its pertinence.

Not to mention, the textile hubs that the region has which serve both the domestic and world market, assuring the offer of high-grade raw materials which are then used in car, fashion, and industrial applications. These combined with the hunger for technical and luxury textiles, are the boost that Europe needs to oversee the world's textile staples market again.

Asia-Pacific is set to be the fastest growing market for textile staples with the rise of significant players like China, India, and Bangladesh in textile manufacturing. With the cost-effects of labor, sufficient raw materials, and the large-scale production of these countries the region is in a good position. The consumer's requirement for less expensive products with eco-friendliness added, arouses the market's growth.

Indian and Chinese government programs which promote the sustainable production and use of textiles along with ecologically conducive practices are also other entities engulfing the region's dynamism. Asia-Pacific will remain a valid player in the global staples market as it continues to keep mass market and environmentally conscious textiles together even in the competition amongst nations proving their trends and innovations at the same time.

The market for textile staples in regions like Latin America, the Middle East, and Africa outside North America, Europe, and Asia-Pacific is maintaining a steady expansion in response to fast-growing urbanization and the rise of the middle-class population.

In Latin America, as Brazil and Mexico witness growth in the apparel and home textile industries, they both get there by selling to local and foreign markets. The Middle East is focusing on the high-end fabrics market of luxury textiles and has a good reputation nationally and internationally for innovation particularly in synthetic and performance textiles for fashion and automotive industries.

Ethiopia and Egypt, for example, are countries on the African continent, which witness the increase of the textile sector with the help of governmental support and affordable human labor. Although sustainability-related discussions only now start to become part of the mind-space in these regions, they are stimulating the adoption of greener materials, unlike the other regions in the world where the growth is vigorous.

Challenges

Increasing Raw Material Pricing

The fluctuation of raw material prices causes the lion's share of hurdles in the textile staples market. Natural fibers, which are very vulnerable to all kinds of circumstances like environmental situations, demand globally, and disruptions in supply chains, such as cotton and wool, etc. Along with the fluctuations of the prices of raw materials, the overall production cost also tends to be affected, which makes the companies offer less profit by either bearing the costs themselves or by raising the prices on consumers.

This degree of instability makes the entire process of outlay and future planning more difficult and stops the manufacturers from being successful. To effectively manage raw material costs, it is crucial to provide the most competitive pricing as well as guaranteeing a timely and dependable supply chain amid these unpredictable fluctuations.

Environmentally Friendly Policies and Waste Management

Environmental abuses which have pushed the textile staples market even further are now a bigger part of the worries tackled by textile producers than before. Every country is looking to cut back on carbon emissions, environmental water usage, and waste pollution through the introduction of stricter regulations.

Companies must adhere to these and go green by practices like reducing water usage and recycling waste. The switching over to drug-friendly practices often is a big deal. The upfront costs, tech changes as well as the re-engineered process of making things are some examples. On the top of that, the sorting of textile waste is a concerned topic.

The waste produced from either lost production or disposing end-of-life garments is quite burdensome. Environmental pollution from this sector is the first challenge that recyclers face before they can comply with the global standards and prosperity on their own.

Opportunities

Bio-based and Recycled Fibers

The booming market for the textile goods is making the sector a very lucrative one to invest in now as one out of every two buyers prefers eco-friendly products. Manufacturers who opt for bio-based raw materials, like organic cotton, and the ones such as PET bottles recycled from polyester, can take their pick. Subsequently, these are supplied at wholesale rates of materials which are more sustainable than the ones they use now, besides, they attract eco-conscious consumers with these products.

The rising trend of the consumer choice for respectful items has pushed the brands to put the eco-friendly textiles first on their agenda and thus this market section has become the most lucrative one for development. By the end of the day, bio-based and recycled fibers' utilization has become not only an act of protection of the environment. But, they also allow companies to generate the extra revenues by standing out in a crowded market with innovation.

Emerging Markets

The markets in Africa and Latin America that are in the initial stages of development are a source of many opportunities for textile staple manufacturers. The urbanization and a more significant part of the middle class will surely lead to a bigger market for the products of clothing, households, and industry applications.

The durability of labor and the economic advantage of the production make those markets very attractive for manufacturers to expand their global profile. The initial stages of production in these emerging markets will let the producers not just become more diverse but also obtain a more excessive market share and reduce their costs as they fulfill the requirements of both affordable and sustainable textiles.

The textile staples market has consistently expanded from 2020 to 2024, due to the increasing demand for it in the clothing, home textiles, and industrial sectors. Sustainability, recycled materials, and variable raw material prices have been the critical focus of the industry with environmental regulation determining the mode of production.

In the period from 2025 to 2035, the market will transition to the manufacturing of biodegradable fibers, advanced recycling, and AI-powered production. The Asia-Pacific region will register conspicuous development through bio-based fiber inventive solutions. Circular economy approaches coupled with tighter rules will lead the producers to turn into zero-waste and transparent supply chain operators.

The enforcement of eco-friendly regulations, the advent of new technologies, and the altered mindsets of consumers will be the factors that will transform the industry. Bio-based materials, AI incorporation, and localized operations will be the key drivers of competitiveness.

The growth will not just be catalyzed by technical textiles but even the old traditional sectors that are adopting modern ways of working. Companies that take up responsible fashion, closed-loop systems, and intelligence production will not only be the last to do so but will also contribute to such a market being shaped as more sustainable and technologically advanced.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Introduction of environmental policies promoting sustainable fiber use and limiting synthetic fiber waste. |

| Technological Advancements | Expansion of mechanical and chemical recycling for textile waste. |

| Industry-Specific Demand | High demand from the apparel, home textiles, and industrial applications. |

| Sustainability & Circular Economy | Rising investments in sustainable fiber alternatives like organic cotton and recycled polyester. |

| Market Growth Drivers | Increased consumer awareness about sustainability and fashion brands shifting towards eco-friendly materials. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulations mandating the use of recycled materials and biodegradable textile staples. |

| Technological Advancements | AI-driven production optimization, enhanced biofiber development, and increased automation in fiber processing. |

| Industry-Specific Demand | Growth in smart textiles, medical textiles, and high-performance fibers for technical applications. |

| Sustainability & Circular Economy | Large-scale adoption of bio-based fibers, closed-loop recycling systems, and waste-free production processes. |

| Market Growth Drivers | Government incentives for green textiles, advancements in sustainable fiber production, and growth in ethical fashion movements. |

The steady growth of the USA textile staples market can be attributed to tech advancements, eco-sustainability, and reshoring. The manufacturers are now pouring in investments into automation and smart textiles to the realization of better productivity and efficiency.

Fearing strict environmental laws and wanting to absorb consumers' sustainable brands, manufacturers are now looking for environmentally friendly and sustainably sourced raw materials. Proponents of these incentives are also motivating reshoring, which in turn is boosting domestic production and lowering dependency on textile fabric exports.

The automotive and home furnishing sectors are continually on the rise, demanding high-quality fibers. Getting rid of the fiber-blending problem and creating new types of performance textiles are both innovative moves. However, labor costs and the competition from Asian markets can be obstacles. Although there are these, the USA is still a significant country in the global textile market which it focuses mainly on premium and technical textiles.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The transformation of the UK textile staples industry shines notably with the prominent themes of sustainability, textile recycling, and the advent of high-value specialty fibers. A regression to the circular economy paradigm prompts the use of materials that are biodegradable and made from recycling. Domestic companies are engaging in the production of cutting-edge fibers to adhere to the comprehensive environmental rules.

The indispensable fashion and home textile industries are delivering the major part of the growth, with the demand for high-grade textiles increasing. Trade re-alignments due to Brexit are changing the supply chain and influencing the import of raw materials.

Support from the government for the textile sustainability project is the engine of a large-scale transformation of the industry. The challenges of labor and energy costs aside, the UK counter push for the ethical and sustainable textile production is a factor of a long-term industry sustainability and competitiveness against European and world markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

Garment industry, cost-effective production, and government incentives are the most crucial things that have made Bangladesh a strong global textile hub. Besides, the country is a big supplier of cotton and synthetic staple fibers, thus, it can meet the demand for international fashion brands.

The investments in eco-friendly textile production are rising due to social pressure for taking sustainable and ethical manufacturing practices. The growth of exports is supported by trade agreements and through the provision of duty-free access to the European Union and the United States markets.

The incorporation of advanced textile production technologies is aimed at efficiency and quality improvements. Nevertheless, the growth is hindered by the lack of infrastructure and unstable prices of raw materials. The conformity with environmental and labor standards has to be fulfilled to make Bangladesh competitive in the worldwide textile market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Bangladesh | 6.8% |

The Indian textile staples market is on the fast track to expansion, given the strong domestic demand, the robust production capabilities, and the backing from the government. India has become a preeminent player in the cotton and synthetic fiber industry, not only lifting the entire trade with the support of a strong textile ecosystem, but also with the aid of exports.

The Production-Linked Incentive (PLI) scheme is facilitating investments in the modern textile manufacturing process. The ever-increasing numbers of full-fledged middle classes in India are the ones driving the demand for fashion and home textiles besides boosting the fiber usage.

On top of this, the country also has been experiencing increased need for technical textiles in sectors like automotive and industrial. Sustainability measures are gaining momentum with a concentration on production of organic cotton and recycled polyester. Furthermore, largely unstable raw material pricing and defective supply chain factors are creating problems for this sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

The textile staples market of Indonesia is on a steady path of growth driven by the expansive textile industry, export-driven demand, and government support. The country is a well-known supplier of polyester and synthetic fibers, which are used by famous global brands.

The advancements of production efficiency are backed with investments in the latest techniques of textile manufacturing such as automation and digital textile printing. The pursuit of sustainability is a hot topic nowadays as the initiatives are being pushed through the application of reclaimed fibers in the manufacturing process. The geographical location of Indonesia right near the textile-consuming markets gives it a competitive edge.

Basically, the government also takes initiative to the promotion of the modernization of industry through various incentives and projects aimed at improving infrastructure. On the other hand, an ongoing dependency on imported raw materials and erratic currency exchange rates are among the biggest impacts for cost structures and profitability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Indonesia | 6.0% |

Natural Fiber Dominates the Market Due to Sustainability Trends

The reasons that natural fibers reign in the textile staples market are their being biodegradable and eco-friendly, including cotton, wool, and flax. Organic and sustainable fabric consumer tastes mostly dictate the search for natural fiber textiles, mostly in apparel company manufacturing. Cotton still is the most favored staple, due to its soft texture and good air permeability with good demand in The states, Europe, and some countries in Asia.

Favorable regulations for a sustainable textile market, such as the EU's Green Deal and global programs that promote organic farming, mainly, add to the growth of the natural fiber market. Nonetheless, factors like changing raw material costs and climate change having an effect on crop yields make it hard to keep up growth.

Fleece Synthetic Fiber for Durability and Economy

Synthetic fibers made of polyester, nylon, and acrylic are still quite a lot in the market share because of their durability, affordability as well as versatility. Polyethylene terephthalate, which is the top synthesized fiber inside the staple category, is utilized for both clothing and home textiles. Innovations such as the recycled polyester and bio-based synthetizes have helped the market growth by mitigating the environmental concerns that they create.

The unfavorable image of synthetic fibers is due to the environmental degradation they cause but, however, the adoption of sustainable production methods such as closed-loop recycling and biodegradable synthetics are improving their image in the market. Asia-Pacific, particularly China and India, still remains a key producer and primary consumer of synthetic staple fibers due to efficient manufacturing processes and demand for relatively cheap textiles.

Apparel Ensures Dominance Over All Other Applications

The staple textile market is led by the apparel sector driven by the increasing demand for both natural and synthetic fibers. Fast fashion, athleisure trends, and the growing concern of the consumer about sars clothing, that it is ecological make them one of the most important factors of market growth. Cotton and polyester continually attempted to be the most used staple fabrics in the segment.

North America and Europe have begun to see a growth trend in consumers wanting organic and recycled textile goods, while Asian economies continue to drive the mass apparel production. Policies such as the Sustainable Apparel Coalition's initiatives and the circular economy are the primary causes of material choice and production methods changes in the industry.

Interior Flooring Has Grown Despite the Sustainability Obstacles

The interior flooring market, with carpets and rugs included, is a major user of textile staples. Wool and synthetic fibers like polypropylene and polyester occupy the majority share here. Even if the synthetic ones are the first choice for stain resistance and durability the ecological consideration of the clients has been a major factor in getting the specifications to shift to natural fiber carpets in housing projects.

The demand that comes from the commercial sector plays a big part, especially in hospitality and office space and the major regions are the USA and Europe. Environmental considerations are pushing manufacturers in this direction, and they have taken steps by introducing things like bio-synthetics and recycled fiber carpets as sustainable alternatives.

The Textile Staples Market is a critical segment within the textile industry, encompassing natural and synthetic staple fibers used in yarn production, nonwovens, and various textile applications. The market is driven by increasing demand for sustainable fibers, advancements in fiber blending technologies, and the growing influence of the circular economy. Key players dominate the global market, while regional manufacturers cater to localized demand and niche segments.

The Textile Staples Market is evolving with a strong emphasis on sustainability, innovation, and supply chain optimization. While established players drive technological advancements and market consolidation, emerging entrants are leveraging recycled and specialty fibers to carve out niche segments. The competitive landscape will continue to be shaped by eco-conscious consumer preferences and regulatory shifts favoring sustainable production practices.

Technological advancements in the textile staples market are driving innovation in fiber processing, improving durability, and enabling eco-friendly treatments to meet consumer demand for high-performance and sustainable materials. There is also a strong focus on sustainability efforts, with an increasing shift toward biodegradable and recycled fibers to comply with global environmental regulations.

Market consolidation trends, such as mergers and acquisitions, are reshaping competitive dynamics, allowing companies to enhance their global supply chains, streamline operations, and gain access to new markets. These factors are collectively accelerating growth and shaping the future of the textile industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lenzing AG | 10-15% |

| Toray Industries | 8-12% |

| Indorama Ventures | 7-11% |

| Reliance Industries | 6-10% |

| Far Eastern New Century | 5-9% |

| Other Companies (Combined) | 55-65% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lenzing AG | Specializes in sustainable cellulosic staple fibers (TENCEL, LENZING ECOVERO). Focus on circular economy solutions. |

| Toray Industries | Produces synthetic polyester and nylon staple fibers with advanced functionality and durability. |

| Indorama Ventures | Major producer of polyester staple fiber (PSF), investing in recycling technologies for sustainability. |

| Reliance Industries | Supplies PET-based staple fibers and synthetic yarns, integrating backward with petrochemical operations. |

| Far Eastern New Century | Focuses on innovative synthetic fiber solutions, including recycled PET fibers for eco-friendly applications. |

Key Company Insights

Lenzing AG

Lenzing AG is a world number one in the production of cellulosic staple fibers, especially TENCEL and LENZING ECOVERO. The objective of the company is to provide sustainable, biodegradable fiber solutions for the textile industry. Lenzing has made capital investments in the closed-loop manufacturing process by which water and other resources are used much more efficiently than before.

Besides, the brand makes the extra effort to remove wastes and to save resources. The company is showing its remarkable growth by operating multiple premium brands in the areas of fashion, home textiles, and industrial applications, which is made possible through strategic partnerships and capacity expansions.

Lenzing’s innovative technology for fiber blending not only extends the textile's lifespan but also improves its quality, and thus it meets the demand of eco-conscious consumers. Lenzing has established a production process that is both ecologically mindful of the surroundings and cutting-edge in the fiber field.

Toray Industries

Toray Industries is a well-known manufacturer of polyester and nylon staple fibers for both textiles and industrial sectors. The firm has already taken huge steps in the production of functional fibers by blending them with properties like moisture-wicking, anti-bacterial protection, and thermal regulation.

Toray is actively participating in high-tech sectors, including the production of advanced materials that are sold in Japan, China, the USA, and other places.

With the goal of providing high-performance and environmentally friendly fiber solutions, Toray invests heavily in R&D to move beyond the limits of textile technologies. Out of their commitment to environmentally friendly fiber production and their recycling initiatives, Toray grows its competitive position as a key supplier for high-performance and eco-conscious textiles.

Indorama Ventures

Indorama Ventures is a leading polyester staple fiber (PSF) manufacturer globally and is firmly committed to a sustainable production process and recycling technologies. The company is a significant player in the nonwoven textile segment that is mainly used for hygiene, automotive, and medical applications.

Indorama is a pioneer having developed chemical recycling and circularity initiatives that are directed at green textiles. The company, with its broad global reach, still pursues growth through acquisitions and partnerships. They are focused on maintaining their market leadership by employing cost-effective and high-volume production methods alongside a commitment to sustainability.

Reliance Industries

Reliance Industries is a prominent global player in the fashion business of PET-based staple fibers and synthetic yarns. The entity which has been carrying out fiber production integrated with the petrochemical industry experiences both cost efficiency as well as secured supply chains.

Reliance Industries focuses on mass production which continues to be a driving force behind the company's growth and enables it to cater to worldwide markets efficiently. In line with the sustainability theme in the apparel sector, the company has also expanded its investment in recycled PET fibers over the past few years. The brand is making its mark in the market through its cutting-edge technology application and its partnership strategies.

Far Eastern New Century

Far Eastern New Century (FENC) is a leading company operating in synthetic fiber solutions, where the focus is on sustainability and performance-enhanced applications. The firm has a footprint in the re-processor business of PET fibers and is also supplying to the textile and nonwoven markets around the globe.

FENC is actively engaged in R&D to introduce fiber technologies of the future, like moisture-wicking and flame-retardant fibers. The company runs a vertical integration strategy which is more cost-saving and ensures uninterrupted raw material supply. FENC has its presence in major global markets and is committed to promoting eco-friendly and high-performance textile solutions, thus solidifying its position as a major supplier of synthetic staple fibers.

The global Textile Staples Market is projected to reach USD 189,329.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.5% over the assessment period.

By 2035, the Textile Staples Market is expected to reach USD 323,402.2 million.

Synthetic Fiber to Account for Mammoth's Share in Global Market.

Major companies operating in the Textile Staples Market Huvis Corporation, Teijin Limited, Toyobo Co., Ltd., China National Petroleum Corporation (CNPC), Alpek Polyester, Sinopec Yizheng Chemical Fibre Company.

In terms of Fiber Type: the industry is divided into Natural Fiber, Synthetic Fiber

In terms of Application: the industry is divided into Apparel, (General and Leisure, Sportswear), Interior Flooring, Medical, Upholster, Automotive, Construction, Filtration

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.