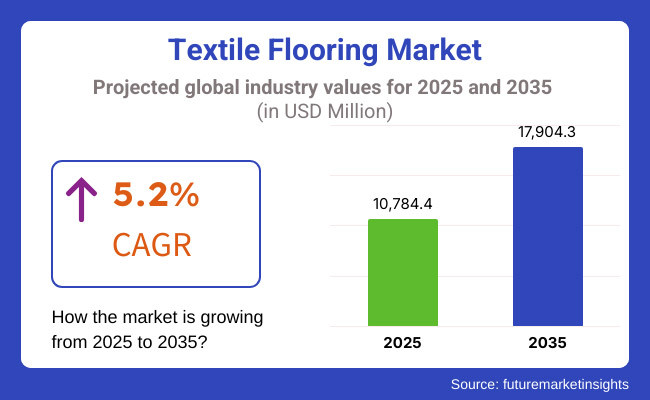

The global textile flooring market is expected to witness steady growth, driven by rising urbanization, increasing demand for aesthetic interior solutions, and the expansion of the construction sector. The market is projected to reach USD 10,784.4 million in 2025 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.2%, reaching USD 17,904.3 million by 2035.

The expansion of the sector is primarily driven by innovations in textile flooring materials, sustainability initiatives, and the increasing popularity of modular carpet tiles.

Increasing demand for modern and decorative design in the flooring market for residential, commercial and hospitality establishments is expected to drive the textile flooring market. Manufacturing process innovation has made textile flooring products more durable, stain resistant and sustainable than ever. Further, increasing investments for development of infrastructure projects and real estate are also contributing to the growth of the market.

Moreover, increased acceptance of sustainable and recycled textile materials creates lucrative opportunities for the manufacturers. One such important factor that has gained traction, subsequently fueling the overall textile flooring application over the period is growing trend of implementation of eco-friendly flooring materials for different type of constructions such as residential, commercial and industrial facility. Rising penetration of anti-microbial and water repellent textiles also present opportunities for textile flooring in healthcare facilities and educational institutions.

Explore FMI!

Book a free demo

Sustainability along with the demand for luxury flooring is driving North America textile flooring market. Eco-friendly carpets and rugs are becoming popular in the USA and Canada, with the push provided by strict environmental regulations. Modular carpet tiles are becoming more and more popular amongst the commercial sector such as offices and hospitality spaces as they offer versatility features, cost-effectiveness and ease of maintenance.

The consumer demand in textile flooring is further driven by innovations in stain-resistant, hypoallergenic textile materials. Less post-consumer waste in eco-conscious flooring solutions links to increasing the market within the area with sustainability once it remains a priority.

The market for textile flooring is strong across Europe due to high awareness of sustainability among consumers and strict regulations regarding building materials. As the region has doubled down on sustainable construction, this translates to growing demand for eco-friendly and recycled flooring materials.

Inclusion of premium carpet tiles in a commercial sector, including office and hotels, has been the trend in Germany, UK, and France among others. Adding to this, government initiatives in the country to promote green building initiatives also further aids the demand for eco-friendly flooring solutions, establishing the region as a small yet potent market in the textile flooring market.

With rapid urbanization, infrastructure development, and growing consumer spending on interior design, the Asia Pacific region accounts for the fastest growing market for textile flooring. Countries such as China, India, and Japan are investing heavily in commercial real estate, which subsequently increases the demand for high quality textile flooring solutions.

As the hospitality sector in the region continues to grow, demand for fashion-forward, long-lasting carpets and rugs is increasing. The growth potential is available but external factors like raw material price cycle and competition from other flooring solutions may slow the market growth. However, the dynamic growth trajectory of the region still drives the textile flooring demand.

The rise in construction activities along with growing disposable income in emerging economies has led to the expansion of the textile flooring market in Latin America, the Middle East, and Africa (LAMEA). Countries in Latin America and the Caribbean are increasingly interested in affordable, decorative flooring products for residential and commercial applications. The Middle East luxury real estate market is adding to the demand for premium carpets, while Africa’s infrastructural development is creating new growth avenues for textile flooring.

However, some regions may be predicted to grow less than the rest of the world is, due to economic uncertainties and limited production facilities. The same challenges that lie ahead create meaningful opportunities for textile flooring manufacturers with growing construction and real estate market sectors.

Challenges

High Cost of Premium Textile Flooring

One of the major challenges is the high costs of these premium textile flooring, particularly in price-sensitive markets. While luxury carpets and rugs provide superior aesthetics and durability, consumers in developing economies find them unaffordable. Consequently, these markets tend to be more-trend driven towards cheaper flooring options, while limiting the overall market penetration of high-end textile flooring products.

The price difference between premium and budget-friendly options makes it harder for consumers to adopt these products, particularly in price-sensitive segments of the residential and commercial markets. The challenge is that manufacturers need to identify ways to cut down production prices or offer cheaper substitutes.

Environmental Concerns and Recycling Issues

Although sustainability is a growing trend in the textile flooring market, many products still rely on synthetic fibers, chemical treatments, and non-biodegradable materials. recycling carpets has proven difficult the materials used in textile flooring can be hard to process and can leave waste in the environment. Carpeting is another huge contributor to our landfills due to its disposal and recycling.

Manufacturers need to invest in more sustainable production processes, biodegradable materials, and improved recycling technologies to overcome this challenge. Significant pressure is mounting to design closed-loop systems that decrease waste and the overall environmental impact of textile flooring products.

Opportunities

Rising Demand for Sustainable Flooring Solutions:

As awareness of environmental sustainability grows, there is an increasing demand for eco-friendly flooring options, such as recyclable and bio-based textile flooring. Fuelled by regulations and the need to cut their carbon footprints, consumers and companies have elevated sustainable products. Additionally, to manufacturers, creating environment-friendly, low-emission flooring may prove to be a very competitive product in the growing natural building market.

Governments are cracking down more and more on environmental abuses, while the green building movement continues to make LEED certifications more common and more desirable, and the customer demand for environmentally friendly flooring products is likely to boom, providing excellent growth for eco-friendly flooring.

Technological Advancements in Textile Flooring

Technological innovation in textile flooring is creating new opportunities, particularly in specialized sectors like healthcare, education, and high-traffic commercial spaces. The new generation of antimicrobial, waterproof, and stain-resistant textiles will appeal to beyond just beauty for flooring where cleanliness and durability are top concerned.

Innovations in 3D printing and smart textiles could also lead to more customized and flexible flooring options. These breakthroughs allow manufacturers to improve the style and functionality of textile flooring, resulting in improved marketability and new product ideas. However, this is an ever-evolving field, and such technologies could pave the way for the future of the textile flooring.

Between 2020 and 2024, the textile flooring market saw steady growth due to its growing adoption due to consumer preference for visually pleasing and comfortable flooring. Increasing urbanization, infrastructure expansion, and the expanding hospitality and commercial sector have driven demand. The trend towards eco-friendly and sustainable materials also plays a key role in determining market trends. Products have been further improved thanks to technological advances in stain resistance, durability and recyclability.

Looking ahead to 2025 to 2035, the market will witness the emergence of many changes like the adoption of smart textiles and biodegradable materials, and AI-driven manufacturing processes. Enhanced customization, digital printing techniques, and antimicrobial textile flooring solutions will define the next phase of growth.

The future of the textile flooring market looks promising, with several trends and developments expected to shape its growth. From 2020 to 2024, the emphasis was placed on making them more durable, stain-resistant and environmentally friendly. As far as innovations, the upcoming 10 years will see the introduction of smart textiles, AI (Artificial Intelligence)-driven design capabilities, fully circular production models and more to create a sustainable and efficient flooring ecosystem.

Organizations that focus on sustainable production, deploy advanced technologies, as well as provide multifunctional functionalities will have an upper hand. Businesses that innovate with high lettered items will develop the floor covering of the future, in methods that are socially responsible.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on green manufacturing and lower VOC emissions. |

| Technological Advancements | Research and development on stain resistant and durable textile flooring. |

| Industry-Specific Demand | High demand from residential, hospitality, and office spaces. |

| Sustainability & Circular Economy | Increasing use of recycled materials and low-impact dyes. |

| Production & Supply Chain | Global shortage of raw materials leading to shortages in supply. |

| Market Growth Drivers | Urbanization, demand for soft flooring, and green building initiatives. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent sustainability regulation driving circular economy initiatives. |

| Technological Advancements | Smart textiles, AI-integrated manufacturing, and self-cleaning surfaces. |

| Industry-Specific Demand | Growth in sectors like higher education, health care and green commercial projects. |

| Sustainability & Circular Economy | Full-scale adoption of biodegradable and upcycled textile flooring solutions. |

| Production & Supply Chain | Localized manufacturing, AI-powered stock portfolio management, and sustainable sourcing. |

| Market Growth Drivers | Greater investment in sustainable designs, smart flooring solutions, and improved functionality. |

Demand for new residential construction, rising demand for luxury flooring, commercial projects, etc. are expected to drive the USA textile flooring market. Hotels and resorts are among the biggest buyers of plush carpets and top-end rugs. There has also been an increase in demand for modular carpet tiles due to their design flexibility and easy maintenance, propelled by the growing corporate office spaces.

Moreover, sustainability trends are compelling manufacturers to design and build recyclable textile floor coverings wicker. But competition from hard flooring solutions such as vinyl and laminate is a threat. The market is expected to maintain growth, owing to an increase in home renovations and remodeling activities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The UK textile flooring market is expanding due to rising urban housing projects, increasing demand for soft flooring, and sustainability trends. Carpet flooring is still popular for residential use, with consumers showing preference for wool-based and recycled textile materials.

Hospitality and office sectors are significantly demanding durable and stylish carpets, while anti-bacterial and slip resistant flooring is required in healthcare institutions. Brexit-related trade challenges caused volatility in raw material prices, hitting local manufacturers. The trend towards circular economy practices are encouraging recyclable and sustainable textile flooring solutions in the commercial and residential markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

The demand for high-quality carpets, sustainability trends, and smart flooring innovations drive Germany’s textile flooring market. Textile flooring is consumed predominantly in the commercial sector, with office buildings, schools, and hotels representing major use categories. A strong emphasis on environmentally friendly materials in the country has resulted in the growing production of bio-based and recycled carpets.

The increasing technological developments in the field of acoustic and thermal insulation flooring are also enhancing the demand in this market. Nevertheless, the costs to produce and floor covering alternatives presented by durable floor covering sensor-based functionalities is expected to create new opportunities in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.5% |

Growth in urbanization, demand for comfort-oriented flooring systems, and innovations in modular carpet tiles are key propellers of the textile flooring market in Japan. The country’s hospitality industry is a significant driver, with luxury hotels and ryokans choosing premium carpets.

Combining a stylish and functional aesthetic with modern textile flooring solutions for your home, tatami is making a return, albeit a contemporary one. Moisture-resistant and anti-bacterial flooring are the technological developments that are stimulating growth in the healthcare and commercial fields.

But in urban apartments where living space is limited, demand for wall-to-wall carpeting has faded, with preference for small and modular flooring options. Japan’s emphasis on recyclable and biodegradable materials is spurring innovation in the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The South Korea carpet tile market is directly growing because of the increasing amount of real estate projects, growing inclination towards soft flooring and rising technological advancements. Durable yet elegant carpets are strong consumers in the corporate and hospitality markets, fueled by a rise in demand for stain-resistant and easy-to-maintain textile flooring. Interest in customizable and sensor-integrated flooring solutions is being propelled by the country’s smart home industry.

But the presence of vinyl and laminate flooring products restricts the growth of this market. The sustainability drive of the South Korean government encourages manufacturers to develop low-emission and recyclable textile flooring materials for environmentally conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Synthetic fibres such as nylon, polyester, polypropylene is the most commonly used market for textile flooring owing to their affordability, stain resistance and durability. These materials are popular in residential, commercial, and hospitality, and come in a myriad of textures and designs. Innovations in synthetic fiber technology like stain repellents coating, and softness are increasingly contributing to their demand.

Falling within the realm of sustainability, recycled and eco-friendly synthetic flooring has also also come to market. Demand continues to surge around the Asia-Pacific, especially in China and India, driven by rapid urbanization and growing disposable incomes.

Textile floorings containing animal sourced materials such as wool, leather and felt are steadily growing in the premium sector. Wool carpets and rugs can provide superior comfort, insulation, and natural stain resistance and are becoming the preferred choice of both luxury and eco-conscious consumers. In spite of higher prices relative to synthetic fibers, the demand for animal textiles continues to be fueled by their natural and biodegradable properties.

Europe and North America are currently the key markets for premium wool-based carpet applications, but there is increasing interest in respectably sourced, natural-dyed materials. The revival of hand-knotted wool rugs and carpets supplement the growth of this segment.

Rugs are still the most popular part of the textile flooring market thanks to their versatility, adaptability, and design options. In residential and commercial settings, rugs are used to improve interior aesthetics as well as providing comfort. Customizable and artisanal rugs are also a hot trend in both the high-end and trendier rug markets, and the rug industry is innovating.

Washable and stain-resistant rugs are also on the rise (as Minnesota) especially in high-traffic areas like hotels and offices. Rug sales continue to be driven by regional demand Asia-Pacific and North America, in particular while online platforms are helping brands to reach consumers far and wide.

Carpets are a major share of textile flooring due to its warmth, soundproofing, and comfort. Although carpets are still predominantly used in residential applications, many commercial and hospitality segments, particularly in hotels, offices, and educational sectors, are driving the growth.

Demand in environmentally conscious markets is fueled by the introduction of eco-friendly carpet materials including recycled fibers and natural wool. Also trending are modular carpet tiles, which create a lot of flexibility and are easier to install. Bangladesh and India being prime manufacturers; Car-pets are key markets for North America and Europe with increasing adoption in sustainable buildings.

The textile flooring market is one of the segments of the flooring market which provides carpet and textile-based flooring solutions for residential, commercial, and industrial applications. The properties of softness and sound absorption offered by textile flooring make it a preferred choice among various end-users.

Technological advancements, rising demand for sustainable flooring solutions, and growing commercial infrastructure are propelling the market. The industry is dominated by global players, but regional manufacturers partner local and niche markets.

The Textile Flooring Market is undergoing changes with advancements being made in design, sustainability, and performance. The industry is dominated by established players that are cutting their teeth with sustainable and innovative flooring solutions, while challengers target niche applications and low-cost products.

The market is anticipated to grow further with rising commercial infrastructure projects along with the upsurge in the demand for sustainable interiors. The industry's future is one of competition, driven by global players, and will be shaped by key trends like recyclable materials, energy-efficient production, and smart flooring technologies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Interface Inc. | 14-18% |

| Shaw Industries | 12-16% |

| Tarkett S.A. | 10-14% |

| Mohawk Industries | 8-12% |

| Milliken & Company | 6-10% |

| Other Companies (Combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Interface Inc. | Leading manufacturer of modular carpet tile manufacturer specializing in sustainable and carbon-neutral products |

| Shaw Industries | Offers high-quality textile flooring solutions comprising broadloom carpets and carpet tiles. |

| Tarkett S.A. | Focused on advanced textile flooring solutions for various applications, such as recyclability and sustainable materials. |

| Mohawk Industries | Wide range of textile flooring products with modern designs and sustainable manufacturing processes. |

| Milliken & Company | Develops high-quality carpet tiles and broadloom carpets with a focus on durability and aesthetics. |

Key Company Insights

Interface Inc.

Interface Inc. is a global leader in modular carpet tiles, providing sustainable and carbon-neutral flooring solutions. The company specializes in closed-loop recycling and makes products from recycled materials.

For example, Interface's Mission Zero program seeks to have zero negative impact on the environment, making it a leader in sustainable flooring applications. Interface's competitive advantage in the textile flooring market has been driven by its focus on innovation and sustainability.

Shaw Industries

Shaw Industries is a major manufacturer that produces broadloom carpets and carpet tiles, and it produces a variety of designs and high-performance designs. The company involves sustainable practices, including recycling programs and use of eco-friendly raw materials.

Shaw invests a lot in research and development to ensure that its flooring solutions are better than ever year after year in terms of performance and sustainability. Utilization of the company's vast global distribution channel allows it to cater to residential, commercial, and industrial customers across all continents.

Tarkett S.A.

Tarkett S.A. focuses on high-performance textile flooring, featuring high recyclability and low embodied energy materials. The company has created circular economy initiatives that minimize waste and support green building certifications.

Tarkett provides customizable flooring solutions for commercial space and hospitality sectors, and used by offices. Energy-efficient materials and low-VOC carpeting improve its competitive positioning in regard to sustainable flooring.

Mohawk Industries

Mohawk Industries is a multifaceted supplier of textile flooring products, from broadloom carpets to carpet tiles to woven flooring, as well as ceramic, laminate, wood and vinyl products. They utilize cutting-edge fiber technology to create stain-repelling, enduring flooring products.

Mohawk is dedicated to lower the carbon footprint, and continues to invest in renewable energy and closed loop recycling systems. Its wide-based products are for the residential, commercial, and institutional international markets.

Milliken & Company

Milliken & Company is known for its high-quality carpet tiles and broadloom carpets, offering superior design aesthetics and durability. They combine cutting-edge fiber technologies, and dyeing processes to manufacture brilliant and long lasting textile flooring options.

Milliken prides itself on eco-conscious manufacturing, using recycled inputs and less toxic production processes. With a strong focus on performance, comfort and sustainability, it has established itself as a leading brand in the textile flooring market.

The global Textile Flooring Market is projected to reach USD 10,784.4 2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.2% over the assessment period.

By 2035, the Textile Flooring Market is expected to reach USD 17,904.3 million.

Synthetic Textiles Holding the Lead.

Major companies operating in the Textile Flooring Market Beaulieu International Group, Bentley Mills Inc., Forbo Flooring Systems, Balta Group, Victoria PLC, Mannington Mills.

In terms of Material Type the industry is divided into Synthetic Textiles, (Polypropylene, PET, Acrylic, Nylon), Animal Textiles, Plant Textiles.

In terms of Product Type the industry is divided into Rugs, Carpets.

In terms of Technology the industry is divided into Tufting, Woven, Needlefelt.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.