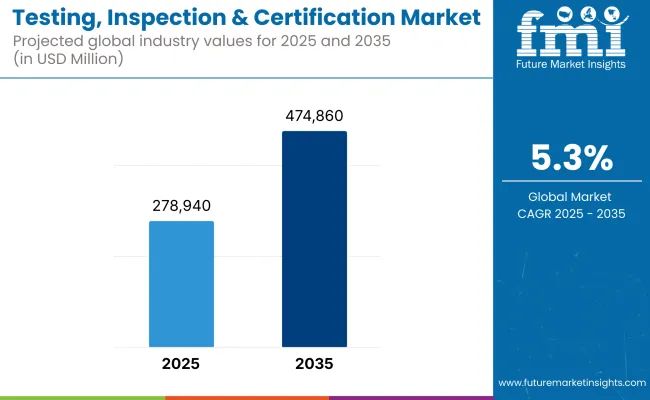

The testing, inspection & certification (TIC) market is expected to witness steady growth between 2025 and 2035, driven by increasing regulatory compliance requirements, the globalization of trade, and rising consumer awareness regarding product safety and quality. The market was valued at USD 278,940 million in 2025 and is projected to reach USD 474,860 million by 2035, expanding at a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The demand for quality assurance, risk management, and certification services is growing across industries such as automotive, healthcare, food & beverage, energy, and manufacturing. The implementation of stringent regulations and industry standards worldwide, along with the rapid expansion of e-commerce, has further fuelled the need for TIC services. Additionally, technological advancements such as artificial intelligence, automation, and block chain are enhancing the efficiency and accuracy of testing and inspection processes.

The rise in outsourced TIC services, particularly in developing economies, is creating new market opportunities. Companies are increasingly relying on third-party TIC providers to ensure compliance with global standards while optimizing operational costs.

The testing, inspection & certification market poised for steady growth as a result of growing product safety, regulatory compliance and risk mitigation across industries. Over the next decade, the implementation of digital TIC solutions and the uptake of smart technologies will usher in continued market growth.

Based on the region, it is estimated that North America will hold the largest share of the testing, inspection & certification market due to strict regulations, rising consumer awareness and demand for quality assurance across industries. The existing industry standards, sophisticated tech ecosystems, and stringent government edicts that ensure compliance and safety, the United States and Canada are leading the pack.

They are also finding increased demand across sectors such as healthcare, food & beverages, automotive, and manufacturing (among many others). Moreover, modern technologies like digital inspection tools, AI quality control mechanisms and Block chain for traceability are migrating in to sectors, making them more efficient. Nonetheless, factors such as high compliance costs and complex state-specific regulatory variations could limit market players.

Europe holds a very prominent market for testing, inspection & certification, primarily due to the stringent regulations enforced by the EU, increasing demand for environmental & safety testing, and growing sustainable manufacturing practices. Germany, France, the UK and Italy lead the way here to strong industrial and auto sectors requiring constant quality assurance and compliance.

Availability of international certification bodies supported by increase in cybersecurity test as well as green certification is driving the market growth. Because of standardisation across the EU, trade and compliance becomes more straight-forward. On the negative side, differing national regulatory frameworks and high service costs could hinder industry players.

Asia-Pacific is the fastest growing region in the testing, inspection & certification market owing to rapid industrialization, rising exports, and government initiatives aimed at improving the quality and safety of products. In nations like China, India, Japan, and South Korea, where manufacturing establishments are surging, the demand for certification services to meet international standards is on the rise.

The increasing significance of e-commerce, cross-border trade, and stringent safety regulations in the Gulf region's major export markets are pushing companies to invest in testing and certification. Moreover, the adoption of digital and AI-based inspection solutions is gaining traction to enhance efficiency and accuracy. But inconsistent regulatory enforcement and the price-sensitive nature of small enterprises could restrict market growth.

Challenges - Stringent Regulatory Compliance and Evolving Standards

One of the key challenges in the testing, inspection & certification (TIC) space is the continuous evolution of regulatory standards across various sectors. Since the requirements for compliance differ in industries like automotive, healthcare, aerospace, food safety, etc., thus the TIC have vast testing protocols and inspection criteria to adopt as per the evolving local and international regulatory legislations. The need to adapt to changing government policies, environmental safety regulations, and industry-specific mandates adds complexity and cost to operations.

Opportunities - Integration of AI, Automation, and Digital Technologies

AI-powered inspection systems, block chain-based certification, and remote auditing solutions are just a few of the technologies transforming the TIC industry. These technologies in the form of automated NDT, continuous monitoring with IoT sensors, and risk assessment with predictive analytics are being adopted to improve efficiency and decrease human error. This segment far outweighs the traditional means of verification and has the means to successfully grow the TIC sector through investment in smart testing platforms, digital reports, and AI-powered quality assurance frameworks.

From 2020 to 2024, the TIC market experienced significant growth as there was a growing regulatory supervision in manufacturing, pharmaceutical and energy sectors. The need for cybersecurity testing, supply chain transparency, and ESG (Environment, Social, and Governance) certifications also increased as companies focused on sustainability by meeting ethical standards. However, high operational costs, a fragmented regulatory landscape, and workforce shortages hindered market entry.

Following this, during the period from 2025 to 2035, AI-enabled automated test and inspections, digital certification, and robotics-led inspection will be at the centre of the TIC industry. Block chain-based traceability solutions will help protect data integrity, compliance validation, while remote and virtual auditing technologies will help to manage global compliance remotely. Businesses that meld together cloud-based compliance workbenches and artificial intelligence-supported decision-making frameworks will achieve a leading edge.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter compliance across industries |

| Technological Advancements | IoT-enabled inspection and remote auditing tools |

| Industry Adoption | Rise in cybersecurity and ESG certifications |

| Supply Chain and Sourcing | Growing demand for supply chain transparency |

| Market Competition | Dominance of traditional TIC firms |

| Market Growth Drivers | Increased regulatory oversight and consumer safety concerns |

| Sustainability and Energy Efficiency | Growing demand for ESG compliance |

| Consumer Preferences | Focus on ethical sourcing and transparency |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Automated AI-driven compliance monitoring and reporting |

| Technological Advancements | Widespread adoption of AI, block chain, and robotics-based TIC solutions |

| Industry Adoption | Integration of AI-driven quality assurance and predictive analytics |

| Supply Chain and Sourcing | Block chain-based product traceability and automated audits |

| Market Competition | Entry of tech-driven TIC start-ups and AI-powered compliance platforms |

| Market Growth Drivers | Advancements in digital testing and smart certification solutions |

| Sustainability and Energy Efficiency | AI-powered sustainability audits and carbon footprint tracking |

| Consumer Preferences | Preference for AI-driven, real-time compliance monitoring |

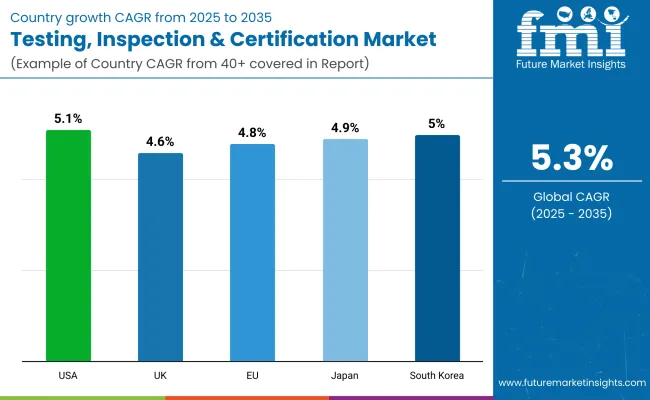

The TIC market is predominantly driven by the United States owing to strict regulatory standards across multiple sectors such as automotive, aerospace, healthcare, and food safety. The presence of international certification agencies and the growing focus on product quality and safety are driving the market growth. Additionally, the increasing demand for digital testing solutions and AI health inspection techniques in the region have greatly improved the efficacy of TIC services in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

The TIC market is growing at a steady rate in the United Kingdom due to regulatory compliance and growing complexities of supply chains across the pharmaceuticals, food, and construction industries. Brexit-driven regulatory changes and the need for third-party testing services has also been driving the demand. Furthermore, sustainability testing for the products that will contribute to the net-zero targets of the UK are an emerging factor that will supplement the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

Strong in industry regulation (like automotive, food safety and medical devices), the European Union has a mature TIC market. Germany, France and Italy are the leading countries. The robust industrial base and the presence of key certification agencies. Moreover, further growth is encouraged in the region as its focus on testing for cybersecurity purposes and environmental compliance certifications increases.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

Driven by its sophisticated manufacturing industry and the increasing demand for safety compliance in sectors such as electronics, automotive, and healthcare, Japan’s TIC market is growing. The demand for international certifications continues to grow, ensuring that the market will develop steadily and confirming the country’s commitment to high-quality standards. The surge in demand for automated testing solutions and Internet of Things (IoT) integrated inspections are propelling the market significantly.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

Moreover, the TIC market in South Korea is gaining significant growth owing to its industrial sector and government-funded quality assurance programs. The market is fuelled by rapidly increasing exports in the country, particularly in electronics, automotive and pharmaceutical sectors, which require stringent certification procedures to comply with international standards. Furthermore, the market is being driven by the development of AI-based inspection techniques and the increasing penetration of digital testing service.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The TIC market is driven by several factors, including increasing regulatory compliance requirements, rising global expansion, and a growing demand for high-quality products. TIC services are being used by businesses across a wide range of industries, from healthcare and manufacturing to food and beverage and automotive, to help maintain strict compliance with tough international standards for quality and safety. As trade and supply chains expand, demand for their services will likely grow even faster, driving market growth over the coming years.

The TIC market also sees firms taking advantage of automation, artificial intelligence (AI), and data analytics that improve efficiency and accuracy in the delivery of services as technology develops. These subsequent advancements assist businesses in reducing process times and increasing efficiency while remaining compliant with the ever-evolving industry regulations.

Testing Services are an essential credential for demonstrating product compliance with international regulations, industry testing standards and customer expectations. Testing services are widely used across various sectors, including pharmaceuticals, electronics, and consumer goods, to ensure the safety and reliability of products. The growing trends of digitalization and smart technologies in the testing laboratories. The improvement of quality testing in terms of accuracy and speed. Furthermore, tight environmental legislation and safety regulations in various industries, including energy, construction, and chemicals, are fueling the need for specialized testing solutions.

Another area to create an impact on the market is Inspection Services, providing certainty that the processes followed, as well as the equipment and final products, comply with safety and performance standards. Various tech-driven structural inspection companies are putting together real-time monitoring & remote inspection technologies to improve efficiency & accuracy. The automotive and aerospace industries, in particular, depend heavily on stringent inspection protocols to keep up with safety and operational efficiency.

Certification Services are growing due to the product standardisation applicability emphasis by regulatory entities, and free trade agreements. Certification also gives businesses credibility, enabling them to build trust with customers and access new markets. As concerns grow about cybersecurity, sustainability, and food safety, the demand for internationally recognized certification programs only increases.

Outsourced TIC Services allow organizations to tap into specialized testing and certification expertise without the need for substantial in-house development cost. In sectors including consumer electronics, medical devices, and food production, many companies are seeking to collaborate with third-party TIC service providers in order to efficiently comply with regulatory requirements. As intra-regional trade between member states continues to proliferate and global supply chains further complicate the playing field, the need for impartial third parties to carry out independent assessments of compliance with international standards becomes altogether self-evident.

In contrast, In-house TIC Services are still the best choice for companies that need ongoing quality assurance and want to keep an eye on their manufacturing operations. They include large enterprises, such as pharmaceutical and aerospace companies, who keep internal TIC teams for regular inspections and testing. Although in-house services improve control over compliance measures, high operational costs related to the maintenance of specialized testing facilities often drive companies towards outsourcing of TIC functions.

The global testing, inspection & certification market will keep experiencing growth owing to factors such as increasing regulatory scrutiny, development of digitized testing technologies, and rising demand for quality assurance in global trade. With many industries focusing heavily on safety, efficiency, and compliance, this has led to an increased demand for TIC services, which will provide business with enhanced credibility and risk mitigation in a competitive market.

Regulatory compliance, globalization, and growth in consumer demand are driving the growth of the testing, inspection & certification (TIC) market. Technological advancements in automated testing, as well as digital inspection solutions and AI-based certification services are making it easy for the market to generate growth. To stay in line with the new standards of the industry, organizations are working on getting accredited for it & are also focusing on cyber security related compliance & sustainability certifications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SGS Group | 20-24% |

| Bureau Veritas | 15-19% |

| Intertek Group | 12-16% |

| TÜV SÜD | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| SGS Group | Leading provider of inspection, verification, testing, and certification services across industries such as food, healthcare, and automotive. |

| Bureau Veritas | Specializes in quality control, risk management, and regulatory compliance for industries including marine, construction, and consumer goods. |

| Intertek Group | Offers product testing, safety assessments, and regulatory certifications with a strong focus on supply chain resilience and sustainability. |

| TÜV SÜD | Provides technical inspection, certification, and risk assessment services, particularly in automotive, industrial equipment, and renewable energy. |

Key Company Insights

SGS Group (20-24%)

SGS Group - The significant player in the TIC Market, SGS offers global expertise in testing, auditing and compliance verification. Its investments in digital transformation and AI-powered testing solutions solidify its position as a leader.

Bureau Veritas (15-19%)

Bureau Veritas, which primarily handles certification and regulatory compliance, is also a titan in marine, construction and sustainability-related inspections. The market growth is driven by its expansion into digital risk management solutions.

Intertek Group (12-16%)

Intertek Group, which is centred on product safety, performance testing, and supply chain assurance for the automotive, chemicals, and consumer electronics sectors. The incorporation of AI and IoT in its guide by test processes improves its upper hand.

TÜV SÜD (10-14%)

TÜV SÜD is known for engineering-based technical inspections and certifications (notably for automotive, manufacturing, and industrial safety). That emphasis on green energy and regulatory testing expands its footprint.

Other Major Players (30-40% Combined)

The competitive landscape for TIC Market is present, supported by the ongoing technological advancements across sectors, which reduce human labour and error, while increasing the timeframe and accuracy of the process. Key players include:

The overall market size for the testing, inspection & certification (TIC) market was USD 278,940 million in 2025.

The testing, inspection & certification (TIC) market is expected to reach USD 474,860 million in 2035.

The demand for TIC services is expected to rise due to increasing regulatory compliance requirements, the globalization of trade, rising consumer awareness regarding product safety and quality, and advancements in digital TIC solutions.

The top five countries driving the development of the testing, inspection & certification (TIC) market are the USA, Germany, China, Japan, and the UK.

Inspection services and third-party certification services are expected to command a significant share over the forecast period due to increasing regulatory enforcement across industries such as healthcare, automotive, and consumer goods.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soil Testing, Inspection, and Certification Market Growth – Forecast 2017-2027

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Environment Testing, Inspection and Certification Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Inspection Lighting Fixture Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Inspection and Inventory Labels

Inspection Machines Market Growth – Trends & Forecast 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

PCB Inspection Microscope Market Size and Share Forecast Outlook 2025 to 2035

Bar Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Tire Inspection System Market - Outlook 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cargo Inspection Market Size and Share Forecast Outlook 2025 to 2035

Wafer Inspection Market Size and Share Forecast Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA