The temperature management packaging solution market is growing, with the pharma, food, and logistics sectors all needing advanced service to preserve product integrity. Businesses are investing in insulation with high performance, phase change material (PCM), and IoT-based monitoring in order to keep up with strict temperature standards.

Therefore, low-cost and low-energy consumption packaging has an emerging demand, prompted by the increased demand for cold chain logistics, vaccine delivery, and perishable goods transportation.

Firms are developing reusable thermal packaging with vacuum-insulated panels and intelligent tracking systems to improve performance and sustainability. Industry trends are moving towards sustainable thermal insulation, compostable cooling, and real-time temperature monitoring to comply with regulations and reduce carbon footprints.

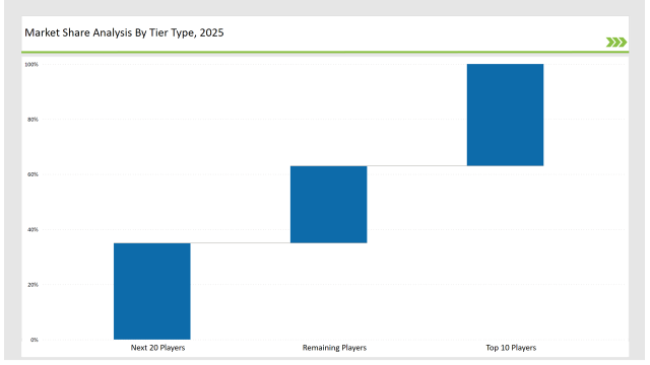

Tier 1 players like Sonoco ThermoSafe, Pelican BioThermal, and Cold Chain Technologies hold 37% market share because they possess expertise in sophisticated temperature-control solutions, interconnectivity to the global supply chain, and regulatory compliant processes.

Tier 2 players like Sofrigam, va-Q-tec, and Tempack hold 35% of the market by having cost-effective, high-performance thermal packaging committed to the pharmaceutical and perishable shipping industry.

Tier 3 consists of local and specialty players with expertise in biodegradable cold pack solutions, active cooling technologies, and thermal packaging solutions tailored to individual clients, capturing 28% of the market. These players concentrate on localized manufacturing, expert insulation methods, and computerized temperature monitoring solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players 2025

| Category | Market Share (%) |

|---|---|

| Top 3 (Sonoco ThermoSafe, Pelican BioThermal, Cold Chain Technologies) | 18% |

| Rest of Top 5 (Sofrigam, va-Q-tec) | 11% |

| Next 5 of Top 10 (Tempack, Cryopak, Softbox Systems, Intelsius, Envirotainer) | 8% |

The temperature-controlled packaging solution industry serves multiple sectors where maintaining precise temperatures, efficiency, and sustainability is crucial. Companies are designing packaging solutions to enhance cold chain logistics and ensure regulatory compliance.

Manufacturers are optimizing temperature-controlled packaging with high-efficiency insulation, digital monitoring, and sustainable alternatives.

The temperature-controlled packaging solution industry is now undergoing transformation through sustainability and precision control. Companies have now incorporated AI-powered analytics, cloud-based shipment tracking, technology of the vacuum-insulated panel for better performance.

Businesses are also working on recyclable insulation materials to substitute expanded polystyrene (EPS). Manufacturers have begun introducing lighter and even more powerful thermal packaging materials that can optimize costs and minimize waste. They are also enhancing active cooling solutions through intelligent temperature control to support the cold chain logistics on a global scale.

Year-on-Year Leaders

Technology suppliers should focus on automation, sustainable insulation, and AI-driven monitoring to support the evolving temperature-controlled packaging market. Partnering with pharmaceutical, food, and logistics companies will drive industry adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Sonoco ThermoSafe, Pelican BioThermal, Cold Chain Technologies |

| Tier 2 | Sofrigam, va-Q-tec, Tempack |

| Tier 3 | Cryopak, Softbox Systems, Intelsius, Envirotainer |

Leading manufacturers are advancing temperature-controlled packaging technology with high-performance insulation, smart monitoring, and sustainability-driven materials.

| Manufacturerh | Latest Developments |

|---|---|

| Sonoco ThermoSafe | Launched fully recyclable thermal packaging in March 2024. |

| Pelican BioThermal | Developed AI-powered cold chain monitoring in April 2024. |

| Cold Chain Technologies | Expanded PCM-based reusable containers in May 2024. |

| Sofrigam | Released cost-efficient last-mile delivery thermal packaging in June 2024. |

| va-Q-tec | Strengthened vacuum-insulated panel production in July 2024. |

| Tempack | Introduced biodegradable cold packs in August 2024. |

| Envirotainer | Pioneered IoT-enabled active cooling systems in September 2024. |

The temperature-controlled packaging market is evolving as companies invest in high-efficiency thermal packaging, real-time tracking, and eco-friendly materials.

The industries shall incorporate AI-based monitoring, intelligent cooling, and environment-friendly materials in their operations. The manufacturers shall continue to improve the insulation's lightweight, high-barrier insulation cost-wise optimization. The businesses shall continue working on reusable and closed-loop cold chain solutions.

The companies will adopt blockchain-based tracking of their shipments for better security. Using digital monitoring will make the supply chain considerably efficient. Companies will then adopt large quantities of biodegradable thermal packaging for mainstream commercial purposes.

Leading players include Sonoco ThermoSafe, Pelican BioThermal, Cold Chain Technologies, Sofrigam, va-Q-tec, Tempack, and Envirotainer.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include sustainability, AI monitoring, reusable solutions, and regulatory compliance.

In terms of product type, the market for temperature controlled packaging solutions is divided into active system and passive system. Active system include refrigerated containers, refrigerated trucks and vans and electrically powered units. Passive systems include, insulated shippers, and insulated boxes, phase-change material (PCM)-based system and vacuum insulated panels (VIPs).

In terms of capacity, the market for temperature controlled packaging solutions is segmented into small (<20 liters), medium (20 - 150 liters), large (>150 liters).

Multiple materials used for making temperature controlled packaging solutions includes polymer based, glass, metal, others. The polymer based materials include expanded polystyrene (EPS), polyurethane (PU), polypropylene (PP) and polyethylene (PE).

Temperature ranges in the temperature controlled packaging solutions include frozen (-20°c and below), chilled (2°c to 8°c) and ambient (15°c to 25°c).

End users of temperature controlled packaging solutions include healthcare, food and beverages, chemicals and others. Healthcare includes pharmaceuticals, vaccines and biological samples. Food and beverages include fresh produce, meat, poultry, seafood, dairy products and processed foods. Chemicals consist specialty chemicals and industrial chemicals. Others include cosmetics, flower and plants.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

Cutter Box Films Market Growth – Demand & Trends Forecast 2025-2035

Disposable Tea Flask Market Trends – Growth & Forecast 2025 to 2035

Disposable Lids Market Analysis – Growth & Forecast 2025 to 2035

Cup Carriers Market Insights - Growth & Forecast 2025 to 2035

Custom Boxes Market Trends – Growth & Forecast 2025-2035

Degassing Valves Market Analysis - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.