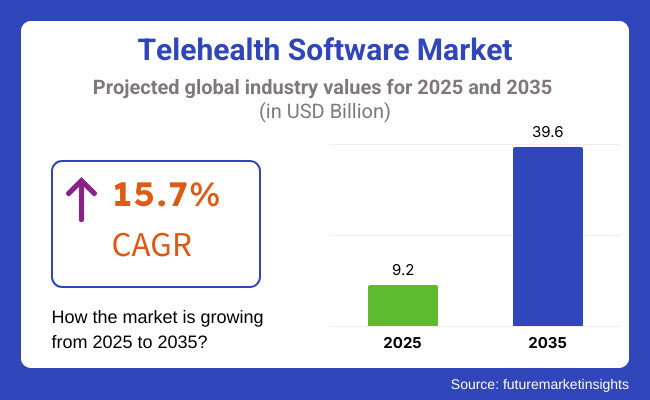

The telehealth software market is likely to witness a staggering growth during 2025 to 2035 led by the burgeoning availability of virtual healthcare services, AI-driven diagnostic capabilities, and remote patient monitoring activities. The market is estimated to grow from USD 9.2 billion in 2025 to around USD 39.6 billion in 2035, or a CAGR of 15.7%.

The rise in the demand for easy-to-reach medical services and the progress of portable health technologies, along with the combining of AI and machine learning in telemedicine platforms, are the major stimulants of this increase. Also, government policies, digital health infrastructure investments, and the shift to the value-based care models are the factors for penetration.

Though these are problems, adventurous innovations like 5G-enabled telehealth, Blockchain-based health records, and AI-enhanced virtual consultations are the types of vast opportunities. The healthcare realm is turning upside down as the providers and insurers are digitizing their operations telehealth is being transformed into a part of the modern healthcare system.

AI-assisted diagnostics and Chatbot-driven consultations are supporting clinician burnout besides increasing patient outcomes. Machine learning is elevating the workflow performance by the automation of admin functions, and AI-powered triage systems are boosting the patient assessments which in turn are resulting in more timely and effective virtual care.

Telehealth adoption is also being strengthened by the interoperability and electronic health records (EHR) & the integration. The real-time data exchange makes a significant contribution to the better quality clinical decision-making, and the standardized APIs are furthering care co-ordination across platforms.

The compliance with HL7 and FHIR standards is eliminating stresses and ensuring security while the regulatory issues are intact. In this way, the patients gain the benefits of smoother, connected and more reliable healthcare services.

The remote patient monitoring (RPM) is yet another extension, which boosts IoT-linked devices for health tracking purposes continuously. The wearable technologies are streaming patients' real-time vitals, which thereby let the physicians intervene i.e. change medications beforehand and lessen emergency admissions.

The AI-driven analytics discover health anomalies, and they are the ones which bring about the decisive timely reactions to medical worries. Patients and health care providers are becoming more willing to back up RPM, chronic disease management which is being transformed into more proactive, data-driven approaches.

The telehealth software market will become a major factor in the patient care, accessibility, and operational efficiency in the next decade. The evolution of digital health solutions throughout the coming decade should lead to continued dependence on telehealth as a means of solving health care problems. Hence, telehealth definitely will act as a bridge between places where there is not enough medical care and the digital South.

The telehealth software market evolved and matured between 2020 and 2024, mainly propelled by rising demand for online solutions. The swift uptake in telemedicine platforms for remote care and patient monitoring was primarily instigated by the onset of the COVID-19 pandemic.

Besides this, it was supported by favorable reimbursement policies and AI diagnostics. As the interoperability was enhanced with the electronic health records (EHR) and the wearable devices, patient care became more efficient and data-driven.

The industry is very likely to undergo transformation between 2025 and 2035 due to technological innovations pertaining to AI, Blockchain for secure data management, and telemedicine services powered through 5G. Also, progressive adoption of virtual health care for chronic disease management and mental health care, and additional adoption of on-demand health care services shall drive this trend.

The remaining two drivers that may enhance are improved digital infrastructure and consumer preference for remote health care services. Join ventures among technology firms and healthcare firms could also ensure optimized access, somewhere telehealth is a significant element of contemporary healthcare delivery.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The COVID-19 pandemic accelerated virtual consultations, e-prescriptions, and digital patient management. Governments revised policies, and investments surged in telehealth platforms. | Telehealth becomes a standard service integrated into hospital systems. Permanent reimbursement policies ensure virtual care remains an option. |

| Uncertainty arose in the needed long-term investments due to slightly relaxed regulations for remote consultations. The various reimbursement schemes further limited financial viability. | A uniform regulatory framework will ensure compliance, security, and quality care. Stable reimbursement policies will encourage long-term telehealth development. |

| Wearables and remote monitoring tools made progress, yet integration with telehealth platforms was still somewhat light. | Seamless integration of wearables and IoT devices enables real-time health monitoring. AI-driven mental health tools enhance digital therapy. |

| Cybersecurity and data privacy concerns intensified as rapid telehealth adoption increased cyber risks. | Stricter regulations have been set by the government in tandem with stricter encryption, biometric authentication, and blockchain technology compliance with international data protection standards. |

| The barriers to telehealth in rural communities were limited internet access and extremely expensive and ignorant people. Emerging hybrid models needed fine-tuning. | Most promising in scaling telehealth into underserved communities is investment by government and non-profit organizations. This would facilitate satellite-based internet, which will take hybrid models to mainstream. |

Telehealth faces a multifaceted regulatory framework, necessitating adherence to healthcare privacy regulations such as HIPAA and GDPR. Fines and reputational damage await those not complying. Licensure laws are adding barriers, particularly for telehealth across state lines in the USA, where pandemic waivers are expiring. If states reverse course with stringent licensure or in-person requirements, then telehealth adoption would fall off.

Insurers can also pose risks by shifting how they reimburse telehealth services or reducing payment rates, which can make revenue less stable. Telehealth providers need to wade through changing policies and push for permanent supportive laws.

Telehealth platforms are prime cyberattack targets due to sensitive health data. A data breach is damaging not only for one's reputation, but it can also come with legal consequences. Regulators are arbitrary about data use (like the FTC in 2024 suing Cerebral for violating people’s privacy). Liability risks stem from possible misdiagnoses or emergencies that can happen during virtual visits. Companies should provide secure platforms, train clinicians, and help patients understand limitations to alleviate risk.

Telehealth experienced massive pandemic-driven growth but has since stabilized. Smaller providers are threatened by utilization swings and competition from bigger players like Amazon and Walmart. There are cultural and regulatory headwinds; customer acquisition costs vary, and there are price pressures from insurers and big tech firms. Competitors that cannot separate their offer through technology, alliances or niche markets run the risk of losing share.

Telehealth solutions are commonly built on tiered SaaS pricing, with per-provider fees. For example, Doxy. me with a free tier and premium plans from USD 35/month. Freemium models bring users in and promote conversion to paid plans with advanced features, which leads to predictable revenue.

Some providers charge by the visit or per-member-per-month (PMPM) fees that are scalable. Teladoc, for example, charges employers an annual set PMPM fee, plus a per-visit fee. This model allows prices to be commensurate with usage, which helps insurers and companies trying to control health care costs.

Basic platforms are low-cost for solo providers, while enterprise solutions such as Amwell integrate with EHR systems and demand a higher price tag. Elevated pricing justified with advanced security, compliance, and AI-powered features

Innovative pricing strategies such as Freemium, which give users basic access with an option for paid upgrades. Some companies include telehealth as part of a remote monitoring device or integration with EHR, which makes it more valuable than just a software offering. It is common to employ penetration pricing - initial services are underpriced to substantiate adoption. A few value-based models, in which pricing is linked to healthcare outcomes, are emerging, but they remain few and far between. Competitive pricing strategies force telehealth companies to reconcile affordability and profit.

Telehealth software has become a prominent trend in the healthcare space, with a forecasted market share of 58.7% by 2025. This drives the demand for the telehealth software as the growing use of virtual healthcare systems such as patient monitoring, virtual consultations, and integrated health management systems.

AI-powered diagnostics, real-time patient data tracking, and remote health applications are accelerating software utilization as well. Moreover, healthcare professionals are utilizing cloud-derived and AI-incentivized mechanisms to increase efficiency, optimize patient effects, and minimize business expenditures.

Particularly with investment in digital transformation, both by governments and private healthcare facilities, telehealth software is a key pillar in the evolution of modern healthcare. Managed services and professional services are becoming increasingly popular in the telehealth software market as they facilitate better management of healthcare delivery.

Having managed services means support, security management, and system maintenance. Such services enable healthcare providers to concentrate on patient care while simultaneously minimizing IT-related complexities.

Conversely, professional services, such as consulting, implementation, and integration, come into play to help healthcare organizations adopt and customize telehealth solutions according to regulatory and operational requirements. Increased adoption of telehealth, with secure, compliant and scalable service offerings, is a key growth driver for both managed and professional service segments.

Cloud-based deployment is gaining huge popularity in telehealth software market owing to its scalability, cost-effective pricing, and remote accessibility and is estimated to grow at an exceptional rate. With more health care providers focusing on providing flexible and effective telehealth solutions, cloud-based platforms have rapidly become popular among small to medium-sized healthcare facilities, independent practitioners and large hospital networks.

Real-time data synchronization, interoperability with EHR systems, and seamless multi-device connectivity are the primary drivers of this segment. Cloud-based telehealth solutions enable healthcare professionals to remotely access patient data, perform virtual consultations, and securely manage health records from anywhere in the world, promoting greater patient engagement and more efficient workflows.

Cloud-based telehealth platforms are alleviating concerns over data security and privacy through improved cybersecurity, AI-driven analytics, and HIPAA and GDPR compliance. Moreover, increasing penetration of 5G, IoT, and AI–based healthcare automation also stimulates the growth of the market.

Healthcare providers will likely continue to embrace hybrid models that incorporate cloud and on-premise systems for flexibility, security and efficiency as telehealth deployment moves into the cloud. On-premises deployment will lead the telehealth software segment and hold a 57.6% share of the market share by 2035. The growing focus on data security, compliance, and complete control over patient information are the primary factors to drive the growth of this segment.

This is why healthcare providers prefer on-premise solutions due to more control of the data, enhanced cybersecurity, and easy integration with the existing IT system. In particular, large health systems need personalized and adaptive infrastructures to handle volume at the same time as meeting safety and quality within the confines of an equally burdensome regulatory framework.

Even though the usage of cloud-based telehealth solutions is on an upward trend, there are still many hospitals and healthcare organizations that prefer a telehealth solution as their on-premise solution for improved security, lower third-party risks, and long-term reliability. As telehealth capabilities continue on their growth path, hybrid use models providing ecosystem agility without sacrificing data security will come forward as leads.

| Countries | CAGR |

|---|---|

| China | 16.3% |

| India | 17.4% |

| UK | 15.1% |

Telehealth software in China is expanding at a whopping CAGR of 16.30% due to increasing government initiatives and demand for digital health services. Telemedicine has been given massive priority in the Healthy China 2030 policy of the Chinese government to establish digital health infrastructure.

Expansion of the 5G network, adoption of electronic medical records, and remote diagnostic solutions via artificial intelligence are the primary drivers. The huge population base in China with 1.4 billion people is a massive need for efficient delivery of health care and hence telehealth services.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Government Initiatives | The Healthy China 2030 policy puts immense focus on digitalization of the health care system. |

| 5G Infrastructure | Smooth telemedicine is facilitated by over 2.1 million 5G base stations. |

| AI Integration | The success of the deployment of AI-based diagnostics and remote consultations is enhanced. |

| Population Size | Population growth and an aging population are some of the determinants driving rising demand for telehealth. |

Telehealth development in India is leading today's times at a CAGR growth rate of 17.40%, driven by determinants like bulk internet penetration (932 million, 2023), government initiatives like Ayushman Bharat Digital Mission (ABDM), and telemedicine adoption increasing momentum in rural India.

Virtual care affordability, complemented by exceedingly high rates of chronic disease (e.g., 77 million diabetic patients), has fostered virtual healthcare. Public and private health service organizations are rolling out telemedicine solutions for India's 1.4 billion with a special push towards rural India.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Support | ABDM facilitates electronic health records and telemedicine. |

| Internet Penetration | Internet users of over 932 million fuel virtual care adoption. |

| Chronic Disease Burden | High rates of diabetes, hypertension, and cardiovascular diseases. |

| Affordable Healthcare | Telehealth processes offer affordable care, particularly in rural areas. |

The UK telehealth software industry is growing at 15.10% CAGR driven by strong NHS digital transformation program, AI-fostered health solutions, and increased reliance on hybrid healthcare in the post-COVID environment. It is assisted by the boom population (18.6% of 65+ in 2023) and government effort for digital wellness. AI-based virtual consultations, GP video consultation, and e-Patient records usage are converging healthcare ease and effectiveness in a more simplified manner

Growth Factors in The UK

| Key Drivers | Details |

|---|---|

| NHS Digital Transformation | Investment in telemedicine and remote care with the help of AI. |

| Aging Population | 18.6% of population aged over 65 years, hence increased demand for remote care. |

| Hybrid Healthcare Models | Move towards hybrid virtual and physical care models accelerated as a result of COVID-19. |

| AI-Powered Consultations | Triaging and diagnosis by primary care using AI. |

The USA telehealth software industry ranks as one of the most established, fueled by reimbursement from Medicare and Medicaid, expansion of private insurance, growing interest in AI-powered diagnostics, and behavioral telemedicine health. The industry has been growing progressively, fueled by funding for digital health startups as well as escalating chronic disease treatment interest. Regulation changes accelerated the impact of COVID-19 on regulatory reforms which today support extensive long-term expansion of virtual care.

Growth Factors in The USA

| Key Drivers | Details |

|---|---|

| Government Reimbursement | Medicare and Medicaid reimburse virtual visits. |

| Digital Health Startups | Over USD 15 billion invested in digital health start-ups in 2023. |

| Mental Health Telemedicine | Increased application of virtual sessions for psychotherapy and psychiatric sessions. |

| AI-Based Diagnostics | Increased usage of AI tools to diagnose disease at an earlier stage. |

Japan's telemedicine industry is changing more and more with its increasing population of elderly individuals (29% 65+ years), prevalence of chronic diseases, and government encouragement toward digital health adoption and expansion on the rise.

Telemedicine adoption was also hindered in the past by regulation and cultural challenges, but policy initiatives now are enabling remote consultations and artificial intelligence-driven healthcare solutions. Penetration of smartphones and the internet among elderly citizens has also driven digital health adoption.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Aging Population | Greater need for remote care. |

| Chronic Disease Burden | More diabetes, high blood pressure, and heart disease. |

| Government Policies | New laws make it possible to use telemedicine more. |

| Digital Literacy | Smartphone penetration among older populations eases adoption of telehealth. |

The telehealth software arena is rapidly narrowing competitive dynamics, with a few big names increasingly monopolizing the setting. The large healthcare technology companies continue the acquisition binge for the smaller start-ups to further the businesses' dominance in the industry.

The consolidation, therefore, strengthens pricing power against new entrants while creating high barriers to innovation, thus forcing many smaller firms to differentiate using niche solutions and specialized services.

The consolidation has not reduced demand for telehealth accelerates the requirement for it. Enterprise-oriented healthcare providers want scalable and integrated platforms tied into EHRs while being able to perform sophisticated analytics. Long-term contracts are assured due to huge networks and heavy expertise by established vendors, while industry access remains out of reach for new entrants without loading huge upfront investments or strategic partnerships.

Telehealth software Industry is cut-throat in competition in that well-established name in healthcare IT, major technology companies, and telemedicine-specialized firms are competing for a share. Key leaders are those companies investing in AI-integrated diagnostics, remote patient monitoring, and seamless EHR interoperability.

Integration of industry leaders with cloud computing, cybersecurity, and wearable technology further segregates them through the management of patient data, ensuring its security and efficiency. Moreover, regulatory compliance with HIPAA, GDPR, as well as regional healthcare laws is the major factor that holds the distinction for credibility and adoption. Established players manage through these complexities quite well, while newcomers grapple with regulatory and credibility challenges.

Strategizing mergers, supply, and alliances are some of the trends adopted by the players to widen their technological outreach and industry scope. Increased investments in virtual consultations, chronic disease management solutions, and AI-induced patient engagement are expected to spur development and innovation in the industry.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| Teladoc Inc. | 18-22% |

| Koninklijke Philips NV | 14-18% |

| Medtronic | 10-14% |

| American Well (Amwell) | 8-12% |

| Cerner Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Teladoc Inc. | A global leader in virtual healthcare, offering telehealth, mental health services, and AI-powered diagnostics solutions. |

| Koninklijke Philips NV | Provides advanced remote patient monitoring and AI-driven telemedicine solutions integrated with hospital systems. |

| Medtronic | Specializes in telehealth software for chronic disease management and remote patient monitoring via connected medical devices. |

| American Well (Amwell) | Focuses on cloud-based telemedicine platforms with real-time patient-doctor consultations and AI-powered diagnostics. |

| Cerner Corporation | Integrates telehealth with EHR systems, ensuring seamless hospital workflows and interoperability for healthcare providers. |

Key Company Insights

Teladoc Inc. (18-22%)

Teladoc Inc. is a leading player in virtual healthcare, offering comprehensive telehealth solutions, including remote consultations, mental health services, and AI-driven diagnostic tools. Its recent acquisitions and focus on chronic care management have further solidified its position as an industry leader.

Koninklijke Philips NV (14-18%)

Koninklijke Philips NV provides advanced remote patient monitoring solutions and AI-driven telemedicine platforms. The company emphasizes interoperability with hospital systems, ensuring effective patient management and high-quality virtual care experiences.

Medtronic (10-14%)

Medtronic has a strong presence in chronic disease management through telehealth platforms, integrating wearable medical devices with remote patient monitoring systems. The company is continuously innovating in AI-driven diagnostics and telemedicine applications.

American Well (Amwell) (8-12%)

Amwell specializes in cloud-based telemedicine platforms, enabling real-time virtual consultations for healthcare providers and patients. Its AI-powered patient engagement tools help optimize healthcare delivery and improve user experience.

Cerner Corporation (6-10%)

Cerner Corporation integrates telehealth with electronic health records (EHRs), allowing seamless hospital workflows and improved efficiency for healthcare professionals. The company is at the forefront of healthcare digital transformation.

Other Key Players (30-40% Combined)

Abridge

Specializing in AI-driven solutions, Abridge has built technology to transcribe patient/doctor visits and document them in the electronic health record to help reduce the administrative load on clinicians at this time of workforce challenges in healthcare. Abridge's growth strategy includes entering into strategic partnerships with the likes of Epic, a huge electronic health record vendor, to further extend its reach and service offerings within the healthcare ecosystem.

Amwell

Amwell has pursued growth through strategic partnerships and acquisitions. Recent collaborations with major organizations such as Cleveland Clinic and numerous alliances with tech companies like Google Cloud have helped expand the capabilities and reach of Amwell. On the other hand, acquisitions such as Silver Cloud and Conversa have diversified their services in behavioral health and patient engagement offerings. Thereby putting it firmly in the space of the full telehealth services provider.

By component, the market is segmented into software (real-time communication software, store-and-forward telehealth software, and remote patient monitoring telehealth software) and services (managed services and professional services).

By deployment, the market is categorized into cloud-based and on-premises.

By end user, the market is divided into healthcare providers, healthcare payers, and patients.

By region, the market is segmented into North America, Latin America, Europe, Japan, Asia Pacific, Middle East & Africa (MEA).

The market is expected to reach USD 9.1 billion in 2025.

The market is expected to garner a revenue of USD 39.6 billion by 2035.

The market is expected to grow at a CAGR of 15.7% from 2025 to 2035.

The rising adoption of remote patient monitoring, increasing demand for digital healthcare solutions, and advancements in AI-driven telemedicine platforms will propel the market growth.

The major players driving the telehealth software market include Aerotel Medical System, Koninklijke Philips NV, Teladoc Inc., American Well, and Chiron Health.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Deployment, 2023 to 2033

Figure 19: Global Market Attractiveness by End User , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Deployment, 2023 to 2033

Figure 39: North America Market Attractiveness by End User , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Deployment, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 77: Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Deployment, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 157: MEA Market Attractiveness by Component, 2023 to 2033

Figure 158: MEA Market Attractiveness by Deployment, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Telehealth Therapy Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Telehealth and Telemedicine Market Growth - Trends & Forecast 2025 to 2035

Telehealth Kiosk Market Analysis – Growth & Forecast 2024-2034

Global Veterinary Telehealth Market Analysis – Size, Share & Forecast 2024-2034

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA