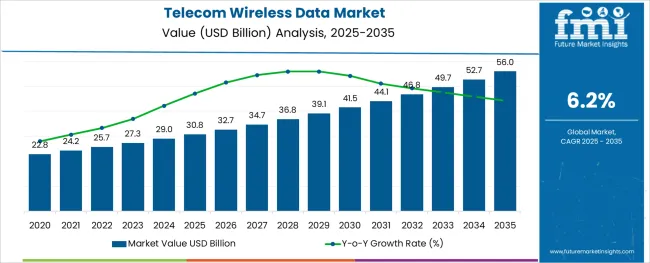

The Telecom Wireless Data Market is estimated to be valued at USD 30.8 billion in 2025 and is projected to reach USD 56.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

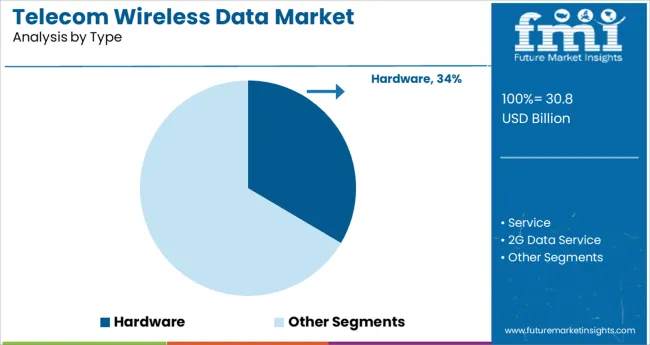

The market is segmented by Type and End User and region. By Type, the market is divided into Hardware, Service, 2G Data Service, 3G Data Service, and 4G Data Service. In terms of End User, the market is classified into Individual, Corporate, Small, Medium Enterprises, and Large Enterprises. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by type, the hardware is projected to hold 33.6% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

Increasing spending on the construction of 5G infrastructure as a result of a shift in customer preference for smartphone devices and next-generation technologies is one of the key reasons driving this industry.

The worldwide communication network has undoubtedly been one of the most significant areas for ongoing technological improvements over the past few decades. The future of the telecom sector is now being shaped by 5G, NFV/SDN, the expanding mobile ecosystem, artificial intelligence and machine learning, and value-added managed services.

The industry needs to enhance its business strategies due to increased competition from Over-The-Top (OTT) competitors, expensive network infrastructure costs, a decline in core sales, and market restructuring.

Brands like Netflix, Instagram, YouTube, Skype, Amazon, and Facebook have grown and provide digital media and online stores to millions of customers worldwide. With the advent of digital websites from retailers and banks, customers may now conduct a number of counter transactions from the comfort of their homes. All these are positive signals for market growth.

Organizations are using IoT to make their operations more efficient and accessible as the usage of advanced technology-based solutions and services increases. Infrastructure development, including smart houses and other modifications to hotels, shows promise for using wireless telecommunication services.

Other factors that are anticipated to fuel the expansion of the global wireless telecommunication services market include businesses installing digital solutions and looking for services that are more precise and cost-effective. During the projected period, innovation through collaborations amongst various industries is anticipated to drive the growth of the worldwide wireless telecommunication services market.

One of the trends in the worldwide wireless telecommunications market is consumers choosing wireless connections over landlines. Affordable wireless connections with increased speed continue to promote widespread use of cellular telecommunication services.

The emphasis is shifting to personalized and customized services, a completely new category of mobile services, in order to accommodate the most recent insights that are expected to drive mobile operators' future enterprises.

A few key market variables, such as the development of mobile technology, which makes it simple to transport massive amounts of data via mobile networks, are responsible for the growth of customized mobile services.

The immense potential of the digital services market is not only being monitored by mobile operators. Companies with a strong market position in this industry are coming up with increasingly innovative and aggressive marketing plans to expand their market share in both traditional and emergent services.

Asia-Pacific held the largest market share in 2024, accounting for more than 32.0%, and is anticipated to have strong growth between 2024 and 2035. By 2035, the region will probably draw more than half of all new mobile customers. Platforms for e-commerce and retailer buy-in, the widespread use of smartphones, and investments in 5G networks are the main factors driving the regional market.

The rise of the regional market has seen notable contributions from China, Japan, and India. China and India were among the countries with the highest numbers of internet users worldwide in 2024, with more than 854 million and 560 million users, respectively, according to statistics released by the International Telecommunication Union (ITU).

Furthermore, it is projected that the expansion of the APAC market will be fueled by increased government initiatives on digital integration through Information Communication Technologies (ICT). For instance, the Indian government invested more than USD 600 million in 100 smart city projects, where IoT is essential to the designation of such cities as "smart cities."

Due to strong consumer mobile phone expenditure and early adoption of digital technology, North America accounted for a sizeable portion of global sales in 2024.

The market is expected to be driven by the present rollout of 5G in South-Korea, Australia, Germany, the United Kingdom, and the United States. By 2035, 5G networks are expected to be used by more than 20.0% of communication connections globally, with a significant presence in North America and Europe.

The vast majority of novel wireless subscriptions over the last few years have originated from emerging markets, particularly those of China, India and Africa.

In contrast, subscriber growth rate remains pale in markets of developed economies where saturation is reached, thwarting wireless network operators in these markets from attaining the subscriber growth rates of their peers in emerging economies and instead leading them to lay emphasis on enhancing per-user revenue.

Asia Pacific excluding Japan regional market is anticipated to grow at the highest rate among all regional markets.

Customers across the globe are switching to cellular wireless data, which in turn, fortifies the primacy of wireless as the favored method of communication and is significantly boosting wireless revenue share as a proportion of worldwide total telecom revenue.

Additionally, network equipment players are altering themselves into information and communication technology (ICT) vendors in order to benefit from the mobile operator digital transformation journey.

Number of smartphone adopters is skyrocketing and mobile video consumption is witnessing highest growth amongst cellular data service usage. On the other hand, complexity of deploying telecom infrastructure in remote areas and compatibility requirements is hindering the growth of telecom wireless data market.

The global wireless telecom carriers industry is extremely capital intensive, reflecting the excessive level of capital resources tied up in cellular infrastructure and telecommunication networks.

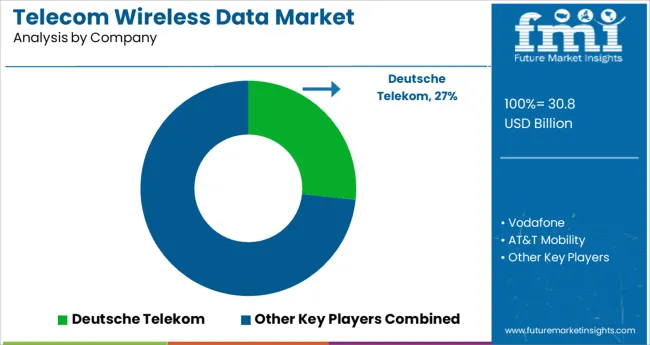

The major players in the telecom wireless data market include Deutsche Telekom, Vodafone, AT&T Mobility, Verizon Wireless, Bharti Airtel, VimpelCom, T-Mobile, Orange Mobile, SingTel, Telefonica and China Mobile.

Major players in the telecom wireless data market try to gain competitive advantage by offering additional ancillary services, such as subcontracted solutions from industry-leading vendors and cellular mobile device management (MDM) software.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global telecom wireless data market is estimated to be valued at USD 30.8 billion in 2025.

It is projected to reach USD 56.0 billion by 2035.

The market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types are hardware, service, 2g data service, 3g data service and 4g data service.

individual segment is expected to dominate with a 41.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Telecom Millimeter Wave Technology Market Size and Share Forecast Outlook 2025 to 2035

telecom-expense-management-market-market-value-analysis

Telecom Order Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Cloud Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Systems Market Size and Share Forecast Outlook 2025 to 2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Telecommunications Services Market - Growth & Forecast 2025 to 2035

Telecom Enterprise Services Market Analysis - Growth & Forecast through 2034

Telecom Service Assurance Market Trends – Size, Demand & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA