The teeth whitening pens market is valued at USD 574.63 million in 2025. As per FMI's analysis, the industry will grow at a CAGR of 4.8% and reach USD 912.26 million by 2035. In 2024, the industry experienced steady growth, supported by increased consumer interest in at-home dental care and cosmetic enhancement products.

A closer look at the year reveals that product launches with improved whitening formulas, including peroxide-free and sensitivity-friendly options, gained significant traction. Brands focused heavily on digital advertisement, utilizing platforms like Instagram and TikTok to promote before-and-after results, leading to higher engagement among younger audiences.

E-commerce emerged as a strong distribution channel, with many consumers preferring the convenience of online purchases. Subscription models for recurring deliveries became popular, especially in North America. In contrast, in regions like Asia-Pacific, local brands introduced budget-friendly whitening pens that appealed to price-sensitive consumers, accelerating regional industry penetration.

In 2025 and beyond, the industry is likely to witness growth from further innovations, such as LED-activated pens and products with smart tracking for usage and results. Increasing awareness about dental hygiene, coupled with growing demand for aesthetic improvement across both urban and semi-urban populations, is expected to shape the future of this industry and open up new opportunities for brands globally.

Market Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 574.63 million |

| Industry Value (2035F) | USD 912.26 million |

| CAGR (2025 to 2035) | 4.8% |

Explore FMI!

Book a free demo

The Teeth Whitening Pens Industry is on a steady upward trajectory, driven by growing consumer demand for convenient, affordable, and non-invasive cosmetic dental solutions. Rising awareness of dental aesthetics, especially among younger demographics, is pushing both innovation and competition. Brands offering safe, easy-to-use, and fast-acting products stand to gain, while traditional, clinic-based whitening treatments may see reduced demand.

Innovate with Sensitivity-Safe and Fast-Acting Formulas

Invest in R&D to develop peroxide-free, enamel-safe whitening pens that deliver quick results, addressing a key consumer pain pointteeth sensitivitywhile differentiating the product in a crowded industry.

Leverage Digital-First Marketing and Personalization

Align with shifting consumer behaviours by prioritizing influencer-led campaigns, social commerce strategies, and personalized product recommendations through AI-driven platforms to enhance engagement and conversion.

Expand E-Commerce and Strategic Retail Partnerships

Strengthen distribution through partnerships with leading online marketplaces, beauty retailers, and subscription services, while exploring M&A opportunities to acquire niche players with strong D2C models or innovative technology.

| Risk | Probability - Impact |

|---|---|

| Regulatory scrutiny on ingredient safety | Medium - High |

| Consumer skepticism due to exaggerated product claims | High - Medium |

| Supply chain disruptions affecting raw materials | Medium - Medium |

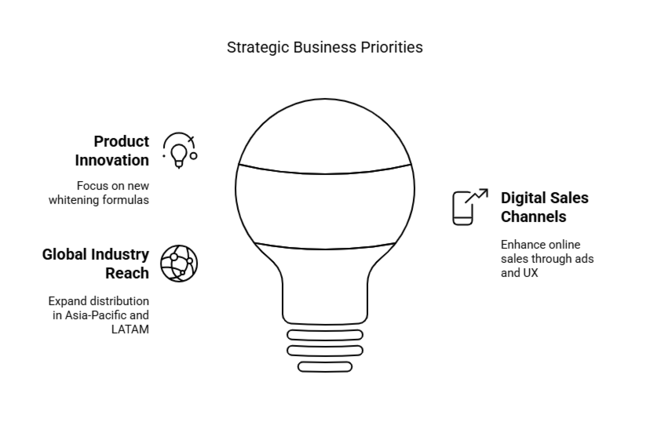

| Priority | Immediate Action |

|---|---|

| Expand Product Innovation | Conduct consumer testing on new peroxide-free whitening formulas |

| Strengthen Digital Sales Channels | Launch targeted ad campaigns and optimize D2C website UX |

| Broaden Global Industry Reach | Identify regional distributors in Asia-Pacific and LATAM |

To stay ahead, companies must double down on innovation that prioritizes safety, speed, and ease of usekey drivers in the teeth whitening pens industry. This intelligence underscores the shift toward at-home, tech-enabled oral care, signaling a need to reallocate resources toward R&D, influencer-led digital advertising, and strategic e-commerce expansion.

Forward-looking brands should explore peroxide alternatives, LED-enhanced pens, and AI-based personalization to differentiate in a crowded space. Additionally, securing agile supply chains and forming regional retail alliancesespecially in high-growth industries like Asia-Pacificwill be critical to sustaining momentum and capturing long-term industry share.

(Surveyed Q4 2024, n=450 stakeholder participants across manufacturers, retailers, dentists, and consumers in North America, Western Europe, Japan, and South Korea)

Regional Variance

Adoption of Smart and Clean Technologies

Converging View

Regional Differences

Manufacturers

Retailers

End Users (Consumers)

Consensus

Regional Trends

Variance vs. Consensus

Key Variances

Strategic Insight

| Countries | Regulations and Certifications |

|---|---|

| USA | Whitening products are regulated by the FDA. Most products are considered cosmetics and do not require approval unless they are classified as drugs. |

| UK | Up to 0.1% hydrogen peroxide is allowed for consumer use, while products containing between 0.1% and 6% hydrogen peroxide may only be used by dentists. |

| France | Follows EU regulations. Products with less than 0.1% hydrogen peroxide are allowed for consumer use, while those containing 0.1% to 6% hydrogen peroxide can only be used by dentists. |

| Germany | Follows EU regulations, similar to France. Products with less than 0.1% hydrogen peroxide are allowed for consumer use, while higher concentrations can only be used by dentists. |

| Italy | Follows EU regulations. The same rules apply as in France and Germany. |

| South Korea | Regulated by the Ministry of Food and Drug Safety (MFDS). Whitening products may require approval depending on the ingredients used, including hydrogen peroxide. |

| Japan | Whitening products are often classified as quasi-drugs and require approval from the Ministry of Health, Labour and Welfare (MHLW) if they contain hydrogen peroxide. |

| China | If hydrogen peroxide is used in whitening products, they are classified as "special cosmetics" and require pre-approval from the National Medical Products Administration (NMPA). |

| Australia and New Zealand | The Therapeutic Goods Administration (TGA) regulates whitening products. Products containing over 6% hydrogen peroxide require a dentist’s supervision, while lower concentrations are allowed for consumer use with safety labeling . In New Zealand, Products with high peroxide content are restricted. The regulations follow Medsafe and the Medicines Act for approval, ensuring consumer safety and appropriate use. |

Hydrogen peroxide-based pens are expected to dominate the industry with a CAGR of 5.2%, owing to their rapid whitening action and strong consumer trust in their efficacy. They work by releasing oxygen molecules that break down stains on the teeth, delivering faster results compared to carbamide peroxide alternatives. Additionally, growing consumer preference for quick, visible improvements in smile aesthetics aligns with the product benefits of this bleach type.

Dental professionals also recommend hydrogen peroxide for patients looking for short-duration treatments. Increasing shelf presence in pharmacies and online platforms, combined with aggressive product marketing, is boosting adoption. Hence, this segment offers high return potential for manufacturers and retailers alike.

The on-the-go whitening segment is seeing strong traction, driven by fast-paced urban lifestyles and demand for convenience. It is projected to grow at 5.4%. Consumers today prioritize portable solutions that fit into their daily routines commuting, travel, or office use. On-the-go pens offer ease of use without requiring rinsing or additional accessories, making them ideal for younger, active demographics.

Social media-driven cosmetic trends and the rise of travel-size dental kits are also fueling interest in this category. Major brands are introducing compact designs and quick-dry formulas that enhance usability. With consistent innovation and a growing direct-to-consumer approach, this segment is poised to outperform traditional whitening methods over the coming decade.

With increased awareness of oral health, many consumers are seeking effective whitening products that do not aggravate gum or enamel issues. This has led manufacturers to develop specialized formulations with lower peroxide concentrations and soothing ingredients like potassium nitrate or aloe vera.

Furthermore, as consumers move away from abrasive strips and LED kits, gentle alternatives like these pens are finding Favor, especially among middle-aged and elderly users. Supported by clinical endorsements and positioned as safe for daily use, this segment is expected to sustain above-average growth.

However, the sensitive teeth whitening segment is gaining momentum in this category with an expected CAGR of 5.3% during the forecast period. This is mainly due to a growing population suffering from dentin hypersensitivity.

Consumers are increasingly turning to online platforms for better price comparisons, user reviews, and access to niche or international brands. E-commerce segment is emerging as the most dynamic and profitable channel in the teeth whitening pens industry. It is projected to show a CAGR of 5.7% during the evaluation term.

Subscription-based whitening kits and influencer-driven product launches are common online, attracting a younger, tech-savvy customer base. Moreover, direct-to-consumer strategies allow manufacturers to improve margins and maintain control over branding.

Convenience, fast delivery, and targeted digital marketing further enhance this channel’s appeal. As trust in online health and beauty retail continues to grow, e-commerce will likely surpass traditional retail in revenue contribution, offering unmatched scalability and profitability.

The industry in the USA are anticipated to grow at a CAGR of 5.2% between 2025 and 2035. This growth is driven by increasing consumer focus on cosmetic dental care, widespread e-commerce penetration, and a growing number of products launches that target both convenience and instant results.

The presence of strong D2C brands and influencer-backed marketing has rapidly boosted demand. Additionally, a culture that prioritizes aesthetics, combined with relatively high disposable income, supports premium purchases in this segment. The country’s large base of millennials and Gen Z consumers who value quick, affordable oral care solutions is also expected to drive strong year-over-year growth.

Sales in the UK are expected to grow at a CAGR of 4.5% during the forecast period. Rising awareness of personal grooming and oral aesthetics has made teeth whitening pens increasingly popular among young professionals. Online retail channels and beauty subscription services have created new distribution avenues for domestic and international brands.

Furthermore, a growing emphasis on non-invasive beauty enhancements has positioned teeth whitening pens as a convenient, low-cost alternative to professional dental procedures. Regulatory clarity in the UK around cosmetic dental products has also encouraged innovation and new product formulations tailored to sensitive teeth and natural ingredients.

France’s beauty-conscious population is gradually embracing dental aesthetics, with a growing preference for quick, at-home whitening solutions. While traditional dental treatments remain popular, consumer shift toward minimalistic and portable products-like teeth whitening pens-is evident.

Rising demand is especially concentrated in urban centres such as Paris and Lyon. Clean beauty trends also influence this industry, prompting manufacturers to introduce peroxide-free and vegan-friendly options.

Retail pharmacies and beauty stores are important sales channels in France, and digital marketing by beauty influencers is helping increase product visibility and consumer trust. The industry in France is expected to grow at a CAGR of 4.3% during the evaluation period.

The German industry shows moderate but stable adoption of cosmetic oral care products. Consumers there tend to prefer function over flash, and so efficacy, safety, and value-for-money dominate purchasing decisions.Sales in Germany is projected to rise at a CAGR of 4.1% during the assessment term. Whitening pens with clinically-backed claims and those endorsed by dental professionals are likely to see more traction.

Additionally, sustainability is a growing priority, and eco-conscious packaging or natural ingredients can offer brands a competitive edge. Online platforms and drugstores like DM and Rossmann play a key role in industry access and product discovery across age groups.

Italian consumers, known for their strong inclination toward beauty and fashion, are increasingly adopting oral aesthetics. Teeth whitening pens are gaining popularity due to their affordability and ease of use, especially among working professionals and students. Italy’s teeth whitening pens industry is forecasted to grow at a CAGR of 4.0% between 2025 and 2035.

The growth is further supported by social media exposure and the country’s thriving beauty and wellness culture. However, limited awareness of product differentiation and a fragmented retail industry could pose challenges. Successful brands are expected to invest in targeted marketing and education campaigns to build consumer familiarity and trust.

The industry in South Koreais estimated to grow at a CAGR of 5.0% during the forecast period. South Korea’s hyper-competitive beauty and personal care landscape fosters rapid acceptance of innovation. With a strong culture of skincare and grooming, consumers are receptive to aesthetic dental solutions, especially those offering instant, portable results.

Whitening pens that incorporate Korean beauty principles-such as gentle ingredients, sleek packaging, and multifunctionality-are likely to thrive. Local celebrities and beauty influencers significantly impact buying behaviour. Additionally, online shopping festivals and cross-border e-commerce further accelerate industry penetration for both domestic and international brands targeting younger demographics.

Despite being one of the most mature oral care industries, Japan shows relatively slower adoption of cosmetic dental products due to cultural preferences and cost sensitivity. Japan’s sales is projected to grow at a CAGR of 3.7%. Consumers prioritize safety, subtlety, and functionality in whitening solutions.

Products that promote gentle care for sensitive teeth and include fluoride or remineralizing properties tend to perform better. Convenience stores, drugstores, and online marketplaces remain primary retail outlets. Regulatory conservatism and consumer scepticism toward aggressive whitening chemicals continue to limit product diversity, though slow but steady adoption is underway.

China is one of the most dynamic and fastest-growing industries for teeth whitening pens. The rise of aesthetic consciousness, particularly among urban youth, is driving explosive demand for on-the-go, affordable solutions. Livestreaming e-commerce, social media challenges, and celebrity-endorsed products heavily influence buying decisions.

Domestic brands compete aggressively with global entrants, and product innovation is rapid-often integrating herbal ingredients, LED light compatibility, or dual-function pens. With beauty and health convergence becoming mainstream, China's growth is also fueled by rising oral health awareness in tier-2 and tier-3 cities.Sales in China are expected to expand at a CAGR of 5.8% between 2025 and 2035.

The industries in Australia and New Zealand are witnessing growing interest in teeth whitening pens due to increased awareness around oral hygiene and a preference for minimally invasive cosmetic treatments. Consumers value convenience and results without dental appointments, making these pens an attractive option.

Clean beauty and cruelty-free product trends are strong in this region, influencing product selection. The revenue of these industries is forecasted to grow at a CAGR of 4.6% during 2025 to 2035. Local brands with organic or natural positioning are well-received, though imported USA and Korean brands continue to gain industry share through online retail and wellness-focused influencer marketing.

In August 2024, Ultradent Products, Inc., a prominent developer and manufacturer of dental materials, acquired a majority stake in i-dental, a renowned dental product manufacturer based in Šiauliai, Lithuania. This strategic acquisition aims to enhance Ultradent's product portfolio and expand its global presence, particularly in Europe and other international industrys. The collaboration is expected to drive innovation in dental materials and products, including teeth whitening solutions.

Conversely, in July 2024, Gold Coast-based teeth whitening company HiSmile faced multiple multimillion-dollar lawsuits in the United States. Customers accused the company of false advertising and deceptive social media marketing strategies, including allegations of fake discounts and misleading celebrity endorsements. HiSmile's general counsel, Steve Mahoney, described these lawsuits as frivolous and committed to defending them vigorously.

These developments highlight significant movements within the teeth whitening pens industry in 2024, reflecting both expansion efforts and legal challenges faced by key industry players.

Procter & Gamble (Crest Whitestrips, Oral-B)Estimated Share: ~20-25%

Dominates with strong brand recognition and distribution. Crest Whitestrips remains aindustry leader, supported by aggressive digital marketing.

Colgate-Palmolive Company (Colgate Optic White)Estimated Share: ~15-20%

Competes closely with P&G, leveraging its oral care dominance. Expanded its whitening pen offerings in 2024 with new formulations.

Koninklijke Philips N.V. (Philips Zoom)Estimated Share: ~10-15%

Focuses on premium at-home whitening solutions, integrating teeth whitening pens with its electric toothbrush ecosystem.

SmileDirectClub Inc.Estimated Share: ~5-10%

Struggled post-bankruptcy but retained some industry presence through partnerships with retailers.

BleachBrightEstimated Share: ~5-8%

Gained traction in 2024 with influencer-driven advertising and vegan-friendly formulations.

White GloEstimated Share: ~5-8%

Strong in Australia and expanding in Asia, with new charcoal-based whitening pens.

Dr. Fresh LLC (Dr. Brite, Snow)Estimated Share: ~4-7%

Focused on natural ingredients, launching an upgraded peroxide-free formula in early 2024.

Beaming White, LLC.Estimated Share: ~3-6%

Popular among dental professionals, offering professional-grade whitening pens.

GO SMILE & AuraglowEstimated Share: ~3-5%

each DTC-focused brands scaling through Amazon and Shopify, with subscription models.

Smaller Players (Keeko, Moon Oral Care, Perfora, etc.)Combined Share: ~10-15%

Niche brands focusing on sustainability, luxury positioning, or regional industrys.

The industry is valued at USD 574.63 million in 2025.

The industry is expected to grow at a CAGR of 4.8% between 2025 and 2035.

E-commerce is emerging as the preferred channel due to convenience and personalized offerings.

Consumers increasingly prefer peroxide-free, sensitivity-safe, and fast-acting formulations.

North America and Asia-Pacific are key growth regions driven by innovation and affordability.

the industry is divided into hydrogen peroxide-based pens and carbamideperoxide-based pens.

the landscape is bifurcated into On-the-go whitening and slow whitening.

the industry is bifurcated into sensitive teeth whitening and general teeth whitening.

the market is segmented into hospitals, dental clinics, hypermarkets/supermarkets, retail pharmacy sales, e-commerce.

the industry is studied across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, and the Middle East & Africa.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.