Between 2025 and 2035, the worldwide teeth desensitizer industry is predicted to grow at an exponential rate due to the increasing prevalence of tooth sensitivity, rising consumer awareness of oral health, and advancements in dental care products.

Tooth sensitization, which is due to enamel erosion, gumline recession, and brushing habits, is also becoming common among people of ages. As a result the demand of teeth desensitizers, which block nerve pathways to alleviate discomfort, is steadily increasing in the industry.

As new technologies for desensitizing agents arise, such as bioactive glass, nano-hydroxyapatite, and potassium nitrate-based formulations, more options for effective long-term pain relief become available. Additionally, this segment is flourishing because of the availability of OTC solutions and the rising recognition of in-office desensitizing treatments.

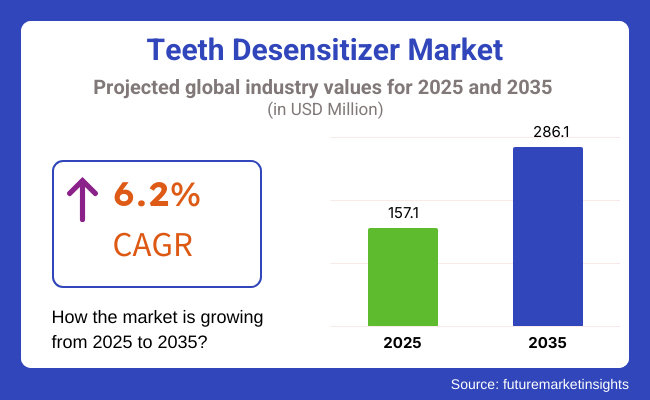

However, lack of proper knowledge in some areas, heightened cost on medications and doubts about its efficiency may present as challenges slowing down the pace of sector growth. Despite this, by the end of 2035, the teeth desensitizer sector is expected to be worth around USD 286.1 million, expanding at an 6.2% CAGR.

Explore FMI!

Book a free demo

North America is expected to hold the largest share in the teeth desensitizer industry owing to high consumer awareness, sophisticated dental establishments, and presence of the prominent players in the industry. The increased prevalence of diets that cause wear of the enamel and the increasing demand for cosmetic dentistry further fuels the adoption of these desensitizing products.

Liason between dental professional, manufacturers result in innovations aiding esthetic solutions. In addition, the availability of established dental care networks, along with government initiatives to promote oral health awareness, is also driving the growth of the industry.

With the invaluable growth in direct-to-consumer (DTC) brands and subscription-based oral care products that teeth desensitizers are gaining a broad recognition and are now easily accessible as well. However, the availability of opting home cures alternatives and expensive professional treatments might obstruct the growth of the industry.

The European industry will facilitate a stable growth as the region is experience an increased rate of exposure to oral hygiene, initiatives taken by administration in regarding to dental care, and the rising demand for preventive dentistry. In the notable nations including Germany, France, and the UK the fluoride-based segments represent some of the most valuable industries.

Where rigorous regulatory framework vows to provide premium-quality standards in dental care products for strengthening consumer base, it may also be proves to be an obstacle for the newcomers entering the domain. In many European countries, the enhanced and easy access to desensitizing treatments and insurance coverage for dental procedures has also contributed in expanding the industrial landscape.

Additionally, with the inclusion of eco-friendly and sustainable dental hygiene products, consumers are making more intentional buying decisions, and choosing organic products that are fluoride-free as well

Asia-Pacific predictive to be rise at rapidly because of the increasing middle-class population, disposable money and increasing knowledge about dental health in the region. Transforming dietary habits, greater use of acidic foods and rising access to dental care in countries like China, India and Japan have resulted in increased demand for desensitizing products.

Accelerated urbanization and increased proliferation of dental care chains are also propelling the adoption of products. The overall shift of the government towards oral hygiene education and preventive dental care is driving the market expansion.

But widespread adoption may be limited in rural areas by affordability and consumer lack of awareness. To add to that, certain cultures and regions may prefer traditional home remedies, making it difficult for modern desensitizing solutions to gain popularity. The growth of e-commerce platforms and direct-to-consumer sales channels also improves product availability, pushing more penetration in the sectors.

The lack of awareness about treatment of tooth sensitivity is a key challenge in the teeth desensitizer industry, particularly in underdeveloped regions. Many people ignore sensitivity problems until they are serious, postponing treatment. Moreover, skepticism regarding desensitizing product effectiveness, in addition to the availability of lower-cost alternative relief options, may restrict industry penetration.

Regulatory hurdles around the ingredients used and claims made in products present a sizable challenge for manufacturing looking to expand across industries. Unfortunately, the expense involved in professional in-office treatments may deter patients from seeking dental treatment entirely, while OTC products can be largely competing with general oral care items that seem to provide comparable results.

In addition, multiple brands in the industry with similar formulations would lead to price competition, leading to lower profit margins for the companies.

Increasing inclination towards preventive dental care and minimally invasive treatment options are projected to provide opportunities for industry growth. Emergence of advanced desensitizing formulations with prolonged action along with biomimetic and free fluoride formulations would lead a wider consumer base.

Further adding, the rising collaboration between dental professionals and manufacturers are driving the way of innovative efforts in premium quality, in-office therapies. With the support of e-commerce and DTC sales channels, these products have become easily available on every platform, further enriching the industry growth.

Furthermore, the rising partnerships between dental professionals and manufacturers are leading innovations in professional-quality in-office therapies. Growth of e-commerce and direct to consumer sales channels is also making these products more accessible to a larger audience, which is further stimulating sector growth.

AI-powered diagnostics combined with personalized dental care is opening the door to focused treatment options that increase overall product efficacy and strive for higher patient happiness. Additionally, the marketing of dental care brands by influencers and partners is raising product awareness, which in turn is increasing industrial penetration and customer engagement.

Surge of Direct-to-Consumer (DTC) Brands: The online retail landscape and subscription-based approaches in oral care are enhancing consumer access to novel desensitizing solutions, facilitating growth in the industry. Direct to consumer (DTC) brands marketing through digital ad strategies and social media brand engagement are creating ongoing brand loyalty by marketing subscription-based delivery of desensitizing toothpaste and treatments to consumers, resulting in better long-term retention.

From 2020 to 2024, the teeth desensitizer industry experienced moderate growth in which factors such as increasing dental hypersensitivity awareness, rising acidic and sugary food consumption, and formulator innovation in dental care would contribute to the industry.

The growing rates of adoption of the potassium nitrate and fluoride based desensitizers, are among the various factors credited with the upsurge in the industry. In addition, enhanced access to both OTC and professional dental treatment made it easier for consumers. Although players in the industry faced challenges in terms of regulatory hurdles and long term efficacy concerns.

Comparison Table

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tougher worldwide rules on ingredient transparency, efficacy claims and product labeling. |

| Technological Advancements | The goal here is to develop formulations based on nanotechnology and bioactives with improved extended effects. |

| Consumer Demand | Increased demand for natural, organic, and long-lasting sensitivity relief options. |

| Market Growth Drivers | Developments in available dental biomaterials, digital education, and more dental clinic adoption. |

| Sustainability | Increased focus on biodegradable formulations, recyclable packaging and green manufacturing. |

| Supply Chain Dynamics | Localized manufacturing and sustainable sourcing enhanced supply chain resilience. |

Market Outlook

The USA teeth desensitizer landscape is growing at a steady pace owing to the growing awareness about dental health and increasing prevalence of tooth sensitivity among individuals. Dentin hypersensitivity is more effectively managed due to evolving dental care technologies, resulting in better (more comfort and compliance) desensitizing products.

Gels, liquids and pastes are just a few of the formulations available on the market catering to a wide range of consumers. Nevertheless, the high cost of products and lack of awareness in certain demographics could hinder industry growth.

Market Growth Factors

Market Outlook

The industry for teeth desensitizer in Germany is supported by a robust healthcare infrastructure and strong awareness about dental health among the general populace. The growing occurrence of dentin hypersensitivity, mainly in the aging population, surges the requirement for efficient desensitizing agents. Industry Analysis and Opportunity Aspects.

The industry is segmented into fluoride and fluoride-free, with distribution channels in dental clinics, pharmacies, general medical stores, e The post Top Mouthwash companies in India 2023 appeared first on loophole.in. But the strict regulations and professional approval processes may also affect the industry.

Market Growth Factors

Market Outlook

The China teeth desensitizer industry is proliferating, owing to increasing urbanization accompanied by rising disposable income and growing oral health awareness. Tooth sensitivity continues to increase due to altered dietary habits and greater intake of acidic foodstuffs and drinks.

Desensitizers are an essential part of the dental industry, and this industry is expected to grow due to the increasing preference for both innovative formulations and convenient delivery methods of these products. Qualities such as regional disparities in access to healthcare and differing degrees of consumer consciousness could however hinder it.

Market Growth Factors

Market Outlook

India's teeth desensitizer landscape is anticipated to witness a robust CAGR during the forecast period owing to a large population base, growing awareness of dental health, and rising incidence of tooth sensitivity. The marketplace provides such desensitizing agents in the form of gels, liquids and pastes that can be found in dental clinics, pharmacies and retail outlets.

Furthermore, the expansion of the middle-class population and government efforts to enhance oral healthcare are expected to drive the further development of the landscape. But the industry penetration can be impacted by challenges like limited access to dental care in rural sectors and price sensitivity amongst consumers.

Market Growth Factors

Market Outlook

The Japan teeth desensitizer industry is expected to grow with the rising concern of aesthetics in the dental sector. The high incidence of tooth sensitivity, together with a societal focus on the aesthetics of teeth, leads to high demand for desensitizing products.

Offering fluoride based and herbal based formulations, the industry serves to a range of consumer requirements. Increase in the fitness rate of courses and expansion of dental clinics and pharmacies in urban and semi-urban regions boosts product accessibility. However, economic disparities and concerns over affordability may prevent widespread adoption.

Market Growth Factors

Fluoride-containing dental desensitizers are already leading the industry owing to the wide studies around their effectiveness and dentinal hypersensitivity. It reinforces enamel, encourages remineralization and creates a protective barrier over exposed dentin, which is less provocative to the nerves.

These desensitizers are commonly used by dental professionals and consumers alike for sensitivity due to tooth erosion, whitening treatments, and gum recession. Growing awareness about oral health, along with an upsurge in incidence of dental sensitivity, will continue to spur demand for fluoride-based solutions in the marketplace. Chemical mouthwashes often find use in different formulations of fluoride, calcium phosphate, or bioactive glass.

Fluoride Free Dental Desensitizer: Growth soars with Natural and Non-Toxic Alternatives. Fluoride free dental desensitizers are growing at a fast pace with consumers looking for non toxic and natural alternatives to traditional fluoride treatments. These desensitizers typically comprise activating ingredients like potassium nitrate, arginine, and hydroxyapatite, all of which serve to block nerve signals and induce tubule occlusion within the dentin.

Rising instance cases of fluoride sensitivity are also boosting the industry growth for fluoride-free dental products especially among health-conscious consumers. Combined with regulatory concerns surrounding excess fluoride exposure, there has been a move toward alternative desensitizing agents which make fluoride-free products appealing to both patients and dentists alike.

Fluoride-free dental desensitizers are anticipated to observe steady growth in the coming period, as holistically organic oral care continues to gain popularity among consumers.

Gel

The go-to for Long-lasting Protection & Ease of Application Gel based teeth desensitizers are dominant in the market place as they are easy to apply, allow for prolonged contact time on the areas and adhere better to the enamel and dentin surfaces. On the contrary, they create a long-lasting coating that provides prolonged protection against external stimulants.

For professional in-office treatments, gel-based desensitizers are also offered to patients to provide effective and immediate relief, and are available to patients in their at-home care routines. This segment is being driven by the increased desire for simple and rapid-acting dental solutions. Moreover, the development of novel gel formulations, including slow-release and bioactive products, is increasing the effectiveness and duration of desensitization therapy.

Liquid

Fast Absorption and High Adoption in PracticesLiquid-based desensitizers are becoming increasingly popular among dental professionals because of their fast absorption and easy use in the office. High controversy is present in dental treatment material for dentifrice and chemical dentin adhesives. A combination of liquid desensitizers is often used alongside restorative and cosmetic dental practices, including bonding and whiteners, to enhance the post procedural sensitivity.

Liquid-based products are seeing demand due to the increasing adoption of minimally invasive dentistry as well as growing preference for fast-acting desensitization solutions. The continued research done on both nano-hydroxyapatite and bioactive liquid formulation and the improvement of each are anticipated to impact their strength in the industry.

Driven by growing consumer awareness, advancing desensitizing technologies, and the rising prevalence of dentinal hypersensitivity across the globe, the teeth desensitizer industry is projected to witness robust growth in the years to come.

Several factors such as the growing prevalence of dentin hypersensitivity, rising awareness regarding oral health among consumers, and the introduction of new formulations for dental care are driving the growth of the teeth desensitizer industry.

Companies are targeting the launch of innovative products and establishing clinical potential, while also expanding their distribution network to bolster their industry position. The industry for desensitizing solutions is intensely competitive, with long-standing oral care brands and new entrants to the space introducing targeted solutions for these issues.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Colgate-Palmolive Company | 18-22% |

| GlaxoSmithKline (GSK) | 15-18% |

| 3M Company | 10-12% |

| Ivoclar Vivadent | 6-8% |

| Other Companies (combined) | 40-51% |

| Company Name | Key Offerings/Activities |

|---|---|

| Colgate-Palmolive Company | Offers a range of desensitizing toothpastes and in-office treatments. |

| GlaxoSmithKline (GSK) | Specializes in Sensodyne products, the leading brand in teeth desensitization. |

| 3M Company | Develops fluoride-based and resin desensitizing agents for professional use. |

| Ivoclar Vivadent | Provides innovative dental materials and in-office desensitizing treatments. |

Key Company Insights

Colgate-Palmolive Company (18-22%)

The desensitizer segment is dominated by Colgate, which represents a wide range of OTC and professional desensitizing products. Who works in clinical research and consumer education to build these brands through trust and acceptance.

GSK (GlaxoSmithKline) (15-18%)

Specialty toothpaste and rapid-relief solutions dominate the GSK portfolio across its Sensodyne brand, which is globally recognized, leading to its significant market share. It remains focused on R&D and marketing strategies to reach a broader customer base.

3M Company (10-12%)

3M 3M is a professional dental solutions provider focusing on fluoride varnishes and resin-based desensitizers. This competitive positioning is further extended with its innovative materials and dental coatings.

Ivoclar Vivadent (6-8%)

Ivoclar Vivadent Dental Materials and Chairside Treatments for Desensitization ProviderProvides dental professionals and patients with high-performance dental material and chairside treatment for desensitization to provide long-term relief from sensitivity.

Several other companies contribute significantly to the teeth desensitizer market by offering a diverse range of formulations and expanding accessibility. Notable players include:

As demand for teeth desensitizers continues to rise, companies are prioritizing innovation, clinical validation, and global market expansion to maintain their competitive edge and improve patient outcomes.

A teeth desensitizer is a dental product designed to reduce tooth sensitivity by blocking nerve pathways or sealing exposed dentin tubules. It helps alleviate discomfort caused by hot, cold, or acidic foods and drinks.

The market is growing due to increasing cases of tooth sensitivity, rising consumer awareness about oral health, advancements in dental care technology, and the availability of over-the-counter and professional treatment options.

North America is expected to hold the largest market share due to high consumer awareness, advanced dental care facilities, and the presence of major market players. However, Asia-Pacific is anticipated to grow at the fastest rate due to increasing disposable income and improving dental care access.

Key challenges include a lack of awareness in underdeveloped regions, skepticism about product effectiveness, high costs of professional treatments, regulatory hurdles, and competition from alternative oral care products.

The market is categorized into gel and liquid.

The market is divided into hospital pharmacies, dental clinics, retail pharmacies, and online pharmacies.

The market is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.