The market report for technical textile presents a comprehensive analysis of all the drivers and various business prospects that lead to the development of the technical textile market between the forecast periods of 2025 and 2035 due to increased demand for high-performance, innovative material across industries.

Mechanical textiles are any fabric produced using any type of man-made materials, synthetic fabrics, or improved functional characteristics such as strength, durability, and weather resistance. From markets it is popular everywhere as its usage is across construction automobile and medical as well as agriculture alone and the industry also masks clothes.

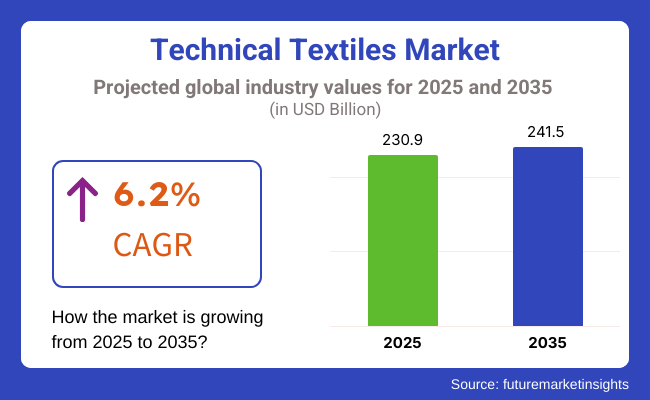

The market is expected to grow from approximately USD 230.9 Billion in 2025 to approximately USD 241.5 Billion by 2035, at a compound annual growth rate (CAGR) of 6.2% over the period of 2023 to 2035. The topmost potential growth drivers include the growing demand for high-performance technical textiles for producing advanced construction materials, rising consumption of personal protective equipment (PPE) across industrial and healthcare sectors, and augmented application of geotextiles for infrastructural development.

Material technology has advanced significantly leading to the development of smart textiles embedded with sensors, actuators, and intelligent fibres They not only increase the functionality but also help monitor data, as well as making the wearer safer. For instance, intelligent cloth is being employed in healthcare application for patient vital sign monitoring and sporting wear for body performance monitoring, generating new market growth opportunities.

The agricultural industry is more and more employing technical textiles for crop protection, soil stabilizing, and water retention in order to boost the yield and sustainability. Technical textiles in the automotive industry are being used for lighter composite materials to enable fuel efficiency as well as emissions reduction for global sustainability purposes.

Global regulatory measures and industrial practices are forcing producers to employ recyclable and green material, which are opportunistic and challenging. Producers are spending on research and development in order to develop biodegradable material and reduce their carbon footprint, thereby gaining competitiveness in an extremely volatile business. With so many variables involved, the technical textiles sector will surely witness growth on a daily basis, providing lucrative opportunities for manufacturers, suppliers, and inventors as well.

Explore FMI!

Book a free demo

North America continues to dominate the technical textile industry because of its strong infrastructure and highly developed industry base. Construction of buildings within the region is a heavy consumer of geotextiles and high-quality nonwovens, strengthening road, bridge, and drainage performance. Technical textiles find applications in the American and Canadian automotive sector as well for light components, upholstery, and sound absorption.

Within the healthcare sector, there is continuous demand for surgical gowns, masks, and other disposable medical textiles that continue to rise. High focus on safety standards and regulation in the area spurs high-quality production of personal protective gear. There is also high research and development investment in the North American market, leading to new fibre technology and smart textile development. With these drivers, North America is likely to continue on a stable growth path, driven by a combination of established and new applications.

Europe leads technically in technological innovation of textiles, and German, French, and Italian industries have made most of the big contributions. In the construction sector of buildings, technical textiles find more and more applications in green roofs, heat insulation, and smart reinforcement of concrete. Technological textiles contribute to the efficiency of energy with the use of light but strength-intensive materials as the automobile sector moves towards the use of electric vehicles.

Europe's sanitation and medical industry is also increasing the application of technical textiles, notably for the manufacture of antimicrobial fabric and biodegradable nonwovens. Environmental sustainability and compliance issues are among the top concerns, compelling manufacturers to meet green-friendly techniques and materials.

Europe's role as a center of technological innovation and sustainability efforts ensures its sustained dominance in the technical textiles industry.

The market in Asia-Pacific is anticipated to be the fastest growing technical textiles market. Fashion, interior design, and automotive textiles are offered by the demand-driven in China, India, Japan, and Southeast Asia, where industrialization, urbanization, and infrastructure development are key inequalities. In these countries, the construction industries are using technical textiles to the maximum, for applications such as soil reinforcement, erosion control, and drainage, while lightweight composite materials are more widely adopted in the automotive sector to meet fuel efficiency and emission reduction measures.

China and India are experiencing an increase in agricultural usage, as technical textiles are used in crop covers, shade nets and irrigation control fabrics. Demand has also been driven by rising disposable incomes in the region's middle class, which are now investing in higher-performance sports apparel, functional apparel, and home textiles. The Asia-Pacific region will be the dominant market for technical textiles in the years to come thanks to favourable government policies, research investments and developing manufacturing capacity.

Challenges

Opportunities

The technical textiles market grew between 2020 and 2024, aided by demand from healthcare, automotive, construction, defence, agriculture and industrial applications. The sector saw massive adoption of high-performance, durable, and intelligent textiles offering high strength, elasticity & functionality. The demand for stronger, more resilient and protective materials has led governments and businesses to look at new generations of fiber technology, composite textiles and multi-functional fabric solutions.

Incredibly flying fabrics were coming to the surface and were piling up at a mind boggling rate in the zeolic, milieu, medicine and equivalent enterprises. However, through heavy investments in R&D processes, advancements like synthetic fibers, nanotechnology-based advanced coatings, and biodegradable alternatives for textiles were developed which collectively resulted in extremely efficient and innovative textile solutions.

The market significantly, with a spike in demand for medical textiles, personal protective equipment (PPE), antiviral fabric, and filtration materials. The healthcare sector emerged as one of the largest consumers of Nonwoven composites, Antimicrobial Coatings & advanced textile technologies for infection control and medical-grade protection.

Furthermore, the growing apprehension regarding the indoor air quality and workplace safety provided a significant boost to the demand for high-performance filtration textiles, flame retardant cloth, and chemical-resistant textile across the industries. With public focus shifting increasingly towards hygienic and sustainable materials manufacturers were urged to emphasise bio-based, reusable and compostable textiles to reduce environmental impact. Similarly, the consumer market started demanding breathable, light weight and high durable fabrics, leading to significant change in production patterns as well.

In both the automotive and aerospace industries, the need to reduce weight in order to decrease fuel consumption and improve structural performance resulted in a growing dependence on lightweight technical textiles. Carbon fiber composites, aramid fabrics, and high-strength synthetic fibers were integrated into manufacturers for automobile interiors, aircraft components, and electric vehicle (EV) battery insulation materials. This transition was in line with the nationwide demand for lightweight, energy-saving and high-durability materials, to improve performance while saving the environment.

Due to the rise of electric vehicle (EV) production, heat-resistant advanced composite textiles that provide EMI-shielding and lightweight thermal insulation were extensively adopted for potent battery protection. Moreover, flame-retardant as well as noise-absorbing fabrics were key to enhancing the safety of vehicles and the comfort of passengers, which further drove demand for technical textiles.

The construction industry became an important market for technical textiles with the use of geo-textiles, waterproof membranes and high-tensile strength reinforcement fabrics to improve infrastructure lifespan, prevent soil erosion and enhance seismic resistance. This was further driven by urbanization, redevelopment of cities into smart cities, and initiatives for sustainable construction.

High-performance textile-reinforced concrete and flexible composite materials are changing the construction industry; these materials allow for the construction of eco-friendly and durable buildings and structures at a dose made on the cost-effective architectural design.

The growth of temperature-regulating, self-cleaning, and UV-resistant textiles for urban infrastructure projects also contributed to effective energy management, insulation, and environmental sustainability in response to the increasing urbanization. The rising concerns about green buildings and energy-efficient materials prompted manufacturers to develop building solutions using low-carbon footprint and recyclable textiles.

The European Chemicals Agency (ECHA), USA Environmental Protection Agency (EPA), International Organization for Standardization (ISO), and other governments and regulatory bodies imposed stringent compliance guidelines related to textile safety, product durability, and environmental impact. Such regulations forced manufacturers to create bio-based textiles, recyclable materials, and eco-friendly production processes. So companies began to develop biodegradable fibers, organic softeners and AI-powered textile innovation to meet the circular economy.

As brands brought increasing attention to sustainability certifications and carbon-neutral production processes, eco-friendly dyes, energy-efficient textile manufacturing, and waste reduction programs became the norm. Several companies have cooperated with research institutions and material scientists to develop the next generation of smart textiles that provide advanced mechanical, thermal and anti-microbial properties, while maintaining a low impact on the ecology.

That being said, the industry faced challenges like expensive production, disruption in the supply chain for raw materials, and recyclability issues. High costs of manufacturing advanced textile structures and combining smart textiles with electronic systems as well contributed to their less wide usage. But as industries shifted focus toward sustainability, digital transformation, and material innovation, the technical textiles market saw continued upward growth, presenting opportunity for next-generation textile solutions.

As the demand for high-performance, lightweight, and multifunctional textile solutions continued to grow, new doors were opened for automation-driven textile manufacturing, real-time quality monitoring, and AI-assisted fabric optimization. This allowed for increased scalability, production efficiency, and market stability in the long term.

The technical textiles landscape will change dramatically from 2025 to 2035, with smart textiles, nanotechnology, AI-driven textile production, and sustainable fiber technologies reshaping the industry. A paradigm shift will occur in the industry as we advance towards self-cleaning fabrics, adaptive and shape memory textiles, and embroidered and fabric-integrated systems that can provide real-time performance data and enhance functionality through embedded sensors.

The development of next-gen fiber, such as ultra-lightweight, heat-resistance, and self-repairing fibers that lasts longer will create more sustainable and long lasting textile solutions for all industries. Furthermore, this convergence yields applied research on composites including energy-harvesting textiles, leading to the creation of smart wearable electronics, self-powered clothing, smart medical textiles, and textiles communicating with the human organism and spatial environment.

Wearable smart textiles will revolutionize applications across healthcare, defense, and sportsmanship, with biometric sensors, AI diagnostics, and real-time health tracking capabilities directly woven into fabrics. These will form the base for continuous health monitoring, smart self-healing of wounds, and temperature-responsive clothes for extreme temperature environments.

Fashion, healthcare, and extreme industrial wear will merge as e-textiles with flexible circuits, self-powered fabrics and AI-integrated connectivity become widely adopted. Wearable textiles combined with artificial intelligence (AI) diagnostics will be integrated due to the uptick in telemedicine/remote patient monitoring, allowing for real-time health tracking, alerts and autonomous patient care. Last but not least, the defense industry will invest heavily in smart combat textiles, which will include fabrics that are bulletproof and have adaptive camouflage and exoskeleton integration for better soldier performance.

High-durability, self-repairing geo-textiles will be utilized in construction and civil engineering sectors in the reinforcement, waterproofing, and energy-saving structures. Increased use of AI for invention in material will directly help us develop carbon-neutral textiles, significantly reducing industrial carbon footprints and enhancing sustainability. Fire-, anti-microbial, and UV-protective textiles become the standard across construction and public infrastructure endeavours.

The heightened focus on infrastructure resilience and disaster-proof building materials will drive the adoption of earthquake-resistant textile-reinforced concrete, high-performance insulation fabrics, and self-healing geo-textiles. Moreover, the adoption of smart textiles is expected in the construction sector, including humidity-sensitive, light-adaptive, and noise-cancelling fabrics, generating energy-saving buildings and green cities.

The future of the technical textiles industry by 2035 will be characterized by biodegradable polymers, artificial intelligence (AI)-based fabric design, and 3D-printed textiles customized to meet industry requirements. This will enable block chain-based textile traceability to provide the market with ethical sourcing, transparency in supply chains, and the adoption of circular economy principles for more sustainable and efficient practices. Textiles with nanotechnology-boosted fibers will yield self-healing, featherweight, and durable materials that will be pioneering for automotive, aerospace, and defense applications.

Guide for Future Technologies - Hybrid materials will bridge these gaps between bio-composite textiles allowing stronger, lighter, and greener composite textiles to develop, altering the perception of textiles used in high-performance arenas. The zero-waste production and carbon-negative textile production challenge in the new paradigm will speak to the industry’s true commitment to environmental friendly practices, resource efficiency and next-gen textile solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Proven exacting safety, durability and VOC emission regulations. |

| Technological Advancements | AI-driven fabric testing, high-performance coatings, and nonwoven fabric innovation improved textile performance. |

| Industry Applications | Technical textiles were widely used in healthcare, construction, automotive, and industrial safety. |

| Adoption of Smart Equipment | AI-based quality control, robotic textile processing, and automated material testing improved efficiency. |

| Sustainability & Cost Efficiency | Move towards recyclable fibres, non-toxic materials and textile manufacturing. |

| Data Analytics & Predictive Modelling | AI-powered demand forecasting, defect detection, and performance analytics optimized production. |

| Production & Supply Chain Dynamics | The market faced supply chain disruptions, rising raw material costs, and textile waste challenges. |

| Market Growth Drivers | Growth was fuelled by urbanization, healthcare textile demand, and high-performance industrial applications. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments will enforce biodegradable fiber mandates, carbon-neutral textile production, and circular economy regulations. |

| Technological Advancements | Growth in smart textiles, AI-driven manufacturing, and self-healing nano-fiber technology. |

| Industry Applications | Expansion into wearable AI-integrated textiles, self-adaptive materials, and shape-memory fiber applications. |

| Adoption of Smart Equipment | Automated 3D textile weaving, AI powered live customizations, block chain based textile verification. |

| Sustainability & Cost Efficiency | Invest more to fully biodegradable textiles, energy-efficient fiber production as well as zero-waste textile processing. |

| Data Analytics & Predictive Modelling | Adoption of self-optimizing AI-driven textile manufacturing and predictive material behaviour modelling. |

| Production & Supply Chain Dynamics | Adoption of block chain-enabled textile traceability, decentralized fiber production, and AI-driven material sourcing optimization. |

| Market Growth Drivers | Market expansion will be driven by smart fabrics, AI-powered automation, and fully sustainable textile solutions. |

The United States Department of Defense (DOD) is a major buyer of technical textiles for fire-resistant apparel, military uniforms, high-performance parachutes, and ballistic protective apparel. Nanotechnology and lightweight armor fabric advancements are also creating demand.

Apart from that, medical textiles are growing significantly, and technical textiles are applied in big volumes by hospitals as well as pharma industries in the form of surgical gowns, wound dressing, and protective apparel.

USA automotive industry, led by the likes of General Motors, Ford, and Tesla, is one of the key drivers with increasing applications in technical textiles including interior restraint, seatbelts, airbags, and reinforcement of tires. Fire-resistant, recyclable, and lightweight textiles are gaining prominence in the areas of electric vehicles (EVs) and green vehicle usage.

As technology development in smart textiles continues, demand from defense & medicine is on the rise, and demand from the automotive sector remains robust, the USA technical textiles industry will expand moderately.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

United Kingdom technical textiles industry is posting a modest growth rate supported by sustainability campaigns, expansion of high-performance sport clothing, and increased application in the aerospace sector.

Focus of the UK government towards reducing textile waste and increasing circular economy adoption has boosted investment in recyclable and sustainable technical textiles. Companies are developing bio-based, biodegradable, and low-carbon textiles, particularly in construction, healthcare, and clothing industries.

The sportswear and outdoor industry is also leading the demand for performance textiles as the industry progresses with regard to moisture-wicking, temperature management, and impact absorption fabrics. Adidas, Reebok, and Under Armour are all making investments in smart textiles and sensor-embedded sportswear.

The British aerospace sector, comprising Rolls-Royce and BAE Systems, is employing lightweight, flame-resistant, and long-durability fabrics in aircraft interiors, seat covers, and insulation.

With strong government support on sustainability, adoption of high-performance textiles in sportswear & aerospace increasing, and greater focus on protective wear, the UK technical textiles industry will continue to expand steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

Europe's technical textile industry is expanding slowly with increased applications in industrial & medical applications, investment in geotextiles, and growth in smart textile manufacturing.

European Union green deal and circular economy action plan are pushing the application of sustainable technical textiles, especially for construction of buildings, geotextiles, and filtration. Germany, France, and Italy are leading high-performance textile innovations such as biodegradable, low-carbon, and high-strength materials.

The hygienic and healthcare textile market is growing, with the pharmaceutical sector, hospitals, and healthcare sector investing in breathable, antiviral, and antibacterial protective equipment for wound dressing, face masks, and PPE kits. Healthcare applications such as compression wear and orthopaedic supports are getting increasingly sought after because of the aging European population.

The automotive sector, covering Volkswagen, BMW, and Renault, is one of the main consumers of technical textiles to reinforce composite panels, seats, and airbags. Technical textiles that are resistant to heat, light, and hard are being utilized owing to electrification and the trend of making lightweight cars.

Due to proactive government policies towards R&D of intelligent textiles, growing demand in industry & healthcare applications and more investment in automotive & geotextiles, the European technical textiles sector will grow gradually.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.1% |

Japanese technical textile market is consistently on the rise with the help of sophisticated units of fabric manufacturing, enhanced use in electronics & automobile end-user sectors, and rising investment towards protective wear.

Japan has been a leading country in the technology of textiles, and Toray Industries, Teijin Limited, and Asahi Kasei pioneered high-strength synthetic fiber, conductive fabric, and nano-engineered fabric.

The electronics industry, like Sony, Panasonic, and Sharp, is more and more employing conductive fabrics in intelligent wearables and clothing, and flexible displays. The automotive industry, like Toyota, Honda, and Nissan, is employing technical textiles to make interior parts of electric vehicles, battery insulation, and light-weight reinforcement.

The market for protective clothing is expanding as well, and nuclear plants, laboratories, and hazardous working conditions need more and more radiation-resistant, chemical-resistant, and fire-resistant clothing.

As ongoing technical innovation continues to progress in the field of textile technology, more use in high-tech application, and more investment in smart textiles and protective textiles, are expected to spur the Japanese technical textile market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The South Korean technical textiles sector is also experiencing healthy growth due to a growth in smart textile application, rising demand for military & sport textiles, and rising emphasis on green & high-performance products.

South Korea's technology giant with Samsung, LG, and Hyundai leading the way is transforming wearable technology and e-textiles. Sensor-infused clothing with temperature-control and conductive fabric capabilities is becoming prominent for medical treatment, military clothing, and sportswear.

The defense industry is also one of the biggest consumers of technical textiles, and it has invested heavily in bullet-proof apparel, fireproof materials, and camouflage fabric. South Korea's growing military spending is also driving demand for advanced protective clothing.

The sportswear market, dominated by industry players Black Yak, Kolon Sport, and Fila, is embracing moisture-wicking, UV-blocking, and antimicrobial fibers to be used in its outdoor and performance wear.

With growing investment in smart & sustainable textiles, growing adoption in defense & sport uses, and growing emphasis on green manufacturing, the South Korean technical textiles market is likely to grow substantially.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Meditech and mobiltech industries are the major drivers of the technical textiles industry as companies rely more and more on high-performance, functional, and quality textile products for smooth operations. These technological advances in textiles are major drivers towards improving material efficiency, safety, and durability in the healthcare, transportation, and manufacturing industries.

Meditech Drives Market Demand for High-Performing Medical Textiles That Improve Healthcare Efficiency and Patient Safety

Meditech fabrics are the most important technical textile segment with improved properties such as antimicrobial resistance, biocompatibility, and improved absorbency of moisture to supply improved patient care, infection protection, and functionality of medical devices. Meditech items are different from standard fabrics with advanced fiber technology, nanocoatings, and intelligent textiles for improved performance in surgery, diagnosis, and therapy.

Growing demand for infection-proof top-grade meditech fabrics in home care, operating room facilities, and hospitals has propelled the adoption of meditech solutions because medical practitioners appreciate enhanced wound healing, enhanced patient comfort, and antimicrobial security. Studies have proven that meditech fabrics enhance significantly the effectiveness of healing, reduce the risk of cross-contamination, and provide enhanced comfort within the healthcare setup.

There is further growth in sustainable and bio-based medical textiles such as biodegradable yarns, antimicrobial finishes, and moisture-wicking yarns, and they have influenced demand within the market with hospitals and health institutions now looking in more directions for green options as a way of balancing out medical waste alongside environmental impact.

The incorporation of nanotechnology into meditech textiles has also enhanced performance such that medical textiles can be self-cleaning, resistant to antibacterial, and with enhanced drug-delivery capability. Innovations like nanofiber-based bandages, intelligent wound dressings, and temperature-control surgical fabrics have further fuelled market growth, providing improved functionality and improved patient outcomes.

The creation of wearable meditech fabrics, which have embedded smart sensors, biofeedback mechanisms, and real-time monitoring of medical conditions, has enabled remote patient monitoring, chronic disease management of chronic conditions, and post-surgical care to improve medical diagnosis and patient-centric healthcare solutions.

Usage of medical nonwoven products in surgical drapes, disposable gowns, and PPE ensembles has contributed to driving the market up because hospitals and emergency health care centers look for material that is lightweight, pervious, yet fluid-proof as material for use at work as well as preventing infections.

While it has continued to be popular in the medical sector, meditech textiles also possess drawbacks in terms of strict regulatory compliance, cost, and disruption of the supply of medical-grade raw materials. Nevertheless, emerging trends in AI-based textile production, biopolymer-based medical textiles, and antimicrobial surface treatment are improving cost-effectiveness, sustainability, and regulatory compliance, thereby guaranteeing ongoing market growth for meditech technical textiles.

Mobiltech fabrics have been accepted strongly in the marketplace, especially in the automobile, aerospace, and rail transport industries, with car manufacturers relying more on mobiltech fabrics, which are light, strong, and crash-worthy, to maximize vehicle performance, fuel efficiency, and passenger safety. Mobiltech fabrics have higher strength-to-weight ratio, insulation against heat, and resistance to fire compared to traditional auto materials, with outstanding structural strength and crashworthiness.

Mobiltech solution adoption has been driven by growing demand for high-performance textile materials used for the interiors of automobiles, airbags, and reinforced composites. Automotive manufacturers have prioritized advanced material engineering to boost the efficiency and level of safety in vehicles. Studies indicate that mobiltech textiles reduce vehicle weight, enhance acoustic insulation, and improve crash energy absorption, ensuring more durability and a safer environment for passengers.

The development of smart and self-healing textiles in the automotive industry, including temperature-sensitive fabric coatings, adaptive fiber morphologies, and bio-inspired reinforcement fabrics, has solidified market demand, as the fabrics improve driver comfort, reduce maintenance requirements, and enhance the vehicle's appearance.

Usage of mobiltech fabrics in electric cars (EVs) and eco-friendly transport has also accelerated market growth to a larger extent as fuel-efficient, recyclable, and eco-friendly material-based textiles support fuel efficiency, emission control, and sustainability in the process of next-generation automobile production.

Sophisticated textile composites for aeronautical and defense purposes, like carbon-fiber-strengthened textiles, Special textiles developed using sophisticated textile technology for military and aeronautical applications like carbon-fiber-reinforced textiles, impact-resistant textiles, and fire-resistant coatings have driven the safety, stability, and lightweight material building of airplanes to the limits of creating good aerodynamics and fuel economy.

The use of mobiltech textiles in rail transportation and commercial vehicle manufacturing has contributed to market expansion, with rail seat textiles, vibration-reducing textiles, and fireproof upholstery providing greater passenger safety, durability, and ride comfort. performance, mobiltech fabrics face the test of unpredictable raw material prices, fire safety regulatory approvals, and durability limitations in extreme operating conditions. However, advancing nanofiber-based car fabric technology, AI-optimized material design, and self-cleaning textile coatings are improving performance, life, and cost-effectiveness, with mobiltech technical textiles maintaining a continuous market growth.

The composite and nonwoven segments are two of the biggest market drivers since manufacturers continue to create sophisticated textile processing methods in order to maximize material strength, flexibility, and application-specific performance.

The production of nonwoven fabrics is today the most common production process of technical textiles that provides greater flexibility, light-weight construction, and economical mass production. Nonwoven fabrics are different from conventional woven fabrics and have better resistance to moisture, breathability, and mechanical properties for better performance in medical, automotive, and filtration uses.

The increasing need for disposable and resistant nonwoven fabrics in medical, hygiene, and industrial protective uses has spurred the application of nonwoven processes since the fabrics improve fluid resistance, antimicrobial action, and filtration capability. Research has shown that technical textiles made of nonwoven materials significantly lower contamination risk, enhance breathability, and increase the wearer's comfort in PPE kits, surgical drapes, and face masks.

The growth of automotive interior, insulation, and fire-blocking barrier uses of nonwoven fabrics has brought together market demand through automakers' greater use of lightweight, resilient, and sound-absorbing fabrics to enhance vehicle performance and passenger comfort.

Incorporation of green, biodegradable nonwoven materials, bio-based polymer fiber, environmentally friendly textile coatings, and recyclable material blends has maximized environmental sustainability and regulatory compliance, achieving maximum utilization in next-generation technical textiles.

While cost-effective in textile production, nonwoven fabrics are beset by the disadvantages of inferior mechanical strength, recyclability problems, and loss of properties at extreme temperatures. However, future directions in nanofiber-reinforced nonwovens, fiber alignment with AI, and innovative textile coating technologies are driving durability, efficiency, and versatility of application, guaranteeing continued growth in the nonwoven technical textiles market

Composite textile fabrication processes have firmly established themselves in the marketplace, especially in aerospace, construction building, and personal protective equipment applications, as industries increasingly leverage multi-layered, fiber-reinforced composite textiles to improve material toughness, structure durability, and impact resistance. Composite technical textiles, in contrast to traditional fabric materials, combine high-performance polymer matrices, advanced fiber reinforcements, and hybrid material structures to maximize mechanical strength and environmental responsivity.

Increased use of light-weight, high-strength composite textiles in the aerospace, defense, and industrial sectors has spurred the adoption of composite textile processing since composite materials possess higher fatigue strength, impact absorption, and thermal stability. It is seen through research that technical textiles comprising composites significantly minimize material weight, improve safety, and deliver extended life in stressful conditions.

Composite textiles in sportswear and performance apparel, such as impact pads, moisture-managing fabrics, and thermally responsive textile architecture, have intensified market demand because sportswear firms and athletes seek advanced textile technologies that enhance performance, protection against injury, and comfort.

Though it enjoys a superior position in material engineering, composite textiles must deal with expensive production, complex recycling processes, and limiting legislation. However, the latest developments in AI-assisted textile design, bio-composite textile reinforcements, and adaptive smart composite fabrics are improving manufacturing efficiency, sustainability, and affordability, guaranteeing continued market growth for composite technical textiles.

Technical textiles market is growing with high demand for high-performance fabrics in the automobile, healthcare, building, and defense industries. Companies are investing in smart textiles, nanotechnology-derived materials, and eco-friendly fiber solutions to add strength, fire resistance, thermal insulation, and bio-compatibility. Global textile companies and niche material science firms are part of the industry striving for advancements in geotextiles, medical textiles, and high-performance industrial fabrics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DuPont de Nemours, Inc. | 15-20% |

| Freudenberg Performance Materials | 12-16% |

| 3M Company | 10-14% |

| Ahlstrom-Munksjö Oyj | 8-12% |

| Kimberly-Clark Corporation | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| DuPont de Nemours, Inc. | Develops Kevlar® and Nomex® high-performance textiles for defense, industrial, and aerospace applications. |

| Freudenberg Performance Materials | Specializes in nonwoven technical textiles for automotive, medical, and geotextile applications. |

| 3M Company | Manufactures flame-retardant and thermal insulation textiles, smart fabric coatings, and industrial protective textiles. |

| Ahlstrom-Munksjö Oyj | Provides sustainable fiber-based solutions for filtration, healthcare, and industrial textiles. |

| Kimberly-Clark Corporation | Offers nonwoven hygiene and medical textiles, including protective apparel and antimicrobial fabrics. |

Key Company Insights

DuPont de Nemours, Inc. (15-20%)

DuPont dominates the technical textiles industry, providing high-strength aramid fibers (Kevlar®) and flame-resistant materials (Nomex®) for military, industrial safety, and automotive uses. DuPont is active in smart textiles and nanotechnology-based materials.

Freudenberg Performance Materials (12-16%)

Freudenberg is a specialist in nonwoven and multi-purpose textiles for car interiors, geotextiles, and medical use, incorporating biodegradable textile solutions.

3M Company (10-14%)

3M creates thermally insulating, electrically conductive, and fire-resistant textiles with an emphasis on industrial protection and smart fabric coatings.

Ahlstrom-Munksjö Oyj (8-12%)

Ahlstrom-Munksjö offers sustainable fiber-based technical textiles for filtration, construction, and protective clothing, providing environmentally friendly and high-performance material production.

Kimberly-Clark Corporation (5-9%)

Kimberly-Clark is a manufacturer of medical-grade nonwoven textiles and protective fabrics with expertise in hygiene, antimicrobial effects, and moisture-wicking abilities.

Other Key Players (40-50% Combined)

Several textile manufacturers and material science firms contribute to next-generation smart textiles, high-performance fiber innovations, and sustainable nonwoven materials. These include:

The technical textiles market size was USD 230.9 Billion in 2025.

As such, the technical textiles market is projected to have a value of USD 241.5 Billion by 2035.

Increasing demand in industrial applications, innovations in smart textiles, and rising demand in sectors such as healthcare, automotive, and construction will drive the demand for the technical textiles market. Government initiatives and sustainability trends, along with the latest innovations in high-performance materials, will only accelerate the growth.

There are top 5 countries which contributes to the growth of Technical Textiles Market are USA, UK, Europe Union, Japan and South Korea.

Medtech and Mobiltech drive market to coalesce to represent significant share during assessment period.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.