Technical films are widely used across diversified sectors such as packaging, electronics, automotive and construction, etc. These are high-performance materials that provide enhanced mechanical, thermal and chemical properties tailored to specialized applications. The growing demand for advanced packaging solutions, protective coatings and energy-efficient materials are expected to drive industry growth in the upcoming decade.

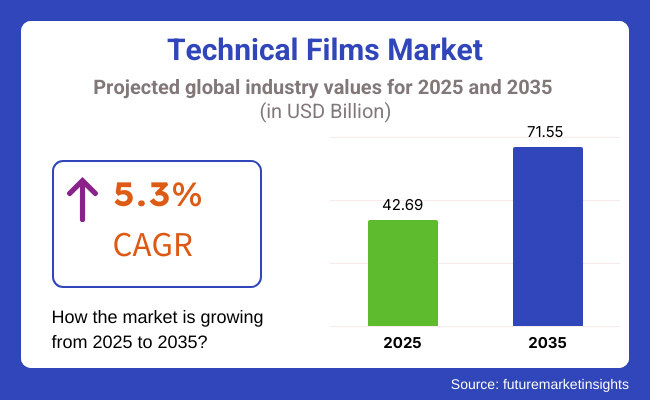

The technical film industry size is anticipated to grow up to an estimated value of USD 42.69 billion by 2025 and is further anticipated to progress at a CAGR of 5.3% during 2025 and reach USD 71.55 billion by 2035. The growth is driven by rising technological developments, growing industrial use, and standardization policies fostering sustainable and high-performance materials. Moreover, the R&D activities in biodegradable and recyclable technical films are expanding the sustainability of the industry.

The development of the sector is driven by the growth of smart electronics and electronic vehicles, with technical films possessing a crucial role in component protection and performance enhancement. The technological growth in the film-making technology, including multi-layered and nano-engineered films, which are expected to enhance the efficiency of technical films.

Explore FMI!

Book a free demo

Asia-Pacific will lead the technical films industry, fueled by fast industrialization, growing electronics production, and robust demand for flexible packaging solutions. China, India, and Japan are major contributors, with robust demand for high-performance films in the automotive, electronics, and construction sectors. Moreover, fast urbanization and growing manufacturing capabilities in the region are further fueling industry growth.

The growth in the region is boosted by increasing investment in sustainable film materials and polymer technology innovations. Besides, government initiatives to encourage eco-friendly packaging and energy-efficient solar films will also fuel innovation in the industry. Also, the rising presence of international technical filmmakers in the Asia-Pacific region is enhancing local capacities. Also, high-barrier and biodegradable film research and development are expected to contribute to new sources of growth in the region.

North America is a major industry for technical films due to its high demand in the healthcare, food packaging, and automotive sectors. The United States and Canada are spearheading the region with technological innovation in smart films, protective coatings, and energy-saving materials. Increasing demand for lightweight, high-durability films in automotive and aerospace applications is also driving the industry further.

The use of sophisticated technical films is increasing, driven by government policies and corporate sustainability programs. Growing investments in research and development of high-performance and recyclable film technology are also fueling industry expansion.

The growth in electric vehicle manufacturing and next-generation flexible electronics is also increasing the demand for protective and insulating films. Most of the companies in North America are also focusing on enhancing the recyclability and durability of technical films to increase product performance. Advances in self-healing and antimicrobial films will continue to define the industry in the future years.

Europe is a major player in the technical films industry, supported by robust regulatory environments that encourage sustainable and high-performance materials. Top economies like Germany, France, and the UK are leaders in polymer engineering and advanced film technologies. The rising investments in circular economy programs and research on bio-based films are further consolidating the region's leadership in the industry.

Stringent green regulations favoring low-carbon, recyclable, and biodegradable packaging material are driving growth towards sustainable technical films.

Increasing consumer knowledge and demand for environment-friendly products also are likely to support long-term industry growth. The region also is seeing growing numbers of collaborations between film manufacturers and industries for creating new high-performance formulations.

In addition, research organizations in Europe are investing in the next-generation technical films with better barrier performance and energy efficiency. These developments are likely to contribute to better efficiency and utilization of technical films across industries.

Key Challenges

Key Opportunities

During the period between 2020 and 2024, the technical films industry witnessed a moderate growth due to rising industrial demand, sustainability commitments and increasing applications in smart packaging and flexible electronics. However, there are several challenges such as high production cost, material disposal concerns and key issues for manufacturers.

Additionally, the industry experienced greater investment in research for enhanced film strength, transparency, and recyclability. There were mounting concerns over plastic waste that led regulatory authorities to promote biodegradable alternatives. Also, development in nanotechnology led to enhanced film properties and application efficiency.

In the upcoming decade, the growth of the industry will be led by innovation in smart films, self-healing coatings and ultra-thin barrier films. The use of AI and automation in the film manufacturing processes will surge the market competition. Further, the rising demand for technical films in high-performance industries like aerospace, EV batteries and wearable electronics will generate new opportunities.

Companies are emphasising improving the function and longevity of technical films as per industrial applications. The development of personalised firm solutions designed for specific niches will continue to gain momentum in the forecasted period.

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Initial focus on reducing single-use plastics. | Stricter global policies mandating biodegradable and recyclable technical films. |

| Development of basic multi-layered films. | Expansion of smart films, high-barrier, and self-healing technical films. |

| Widely used in packaging and automotive industries. | Increased adoption of renewable energy, medical devices, and flexible electronics. |

| Dominated by major film manufacturers. | Rise of sustainable material startups and collaborations with tech industries. |

| Growth driven by food packaging and industrial applications. | industry expansion fueled by AI-optimized film manufacturing and sustainable solutions. |

| Early-stage transition to eco-friendly film materials. | Large-scale adoption of bio-based and fully recyclable technical films. |

| Limited use of AI in production processes. | AI-driven predictive modeling and automated film production enhancements. |

| Focus on high-barrier and lightweight films. | Development of multi-functional, smart, and temperature-resistant technical films. |

The United States has been leading the technical film industry due to its surging demand for high-performance, durable and multifunctional films across various industries, including packaging, automotive and construction.

The demand for high-barrier, UV-resistant, and flexible films has forced manufacturers to develop advanced technical films that provide enhanced protection and performance to products. Further, the demand for high-barrier, UV-protected and flexible films has encouraged the manufacturers to develop advanced films that provide protection and performance to products.

Further, government regulations favouring sustainable and recycled materials insist that companies adopt environmentally friendly and biodegradable film solutions. Further, technological advancements in nanocoatings, multi-layer structures and self-healing film technologies are enhancing functionality and longevity of technical films.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

In Japan, the technical films industry continues to grow steadily due to the rising demand for precision-engineered and high-performance films in the electronics and semiconductor and display panel segments. Brands are innovating technical films with ultra-thin layers, scratch-resistant coatings and optical clarity to improve durability and performance.

As electronic waste and sustainable materials become ever more tightly regulated, companies are migrating toward recyclable and bio-based technical films. Similarly, growth in flexible display films and EMI shielding coatings is provided to applications that require conductivity and electromagnetic protection.

For the same reason, businesses are investing in automation-friendly film manufacturing technologies. Moreover, the growth of high-tech consumer electronics and wearable devices in Japan is driving demand for specialized high-quality technical films in different industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The rising demand for flexible, lightweight, and high-barrier films for the automotive, electronics, and packing industries is driving the growth of technical films in South Korea. This has encouraged manufacturers to work on creating multi-functional solutions with better thermal stability, anti-glare and chemical resistance properties for low-emissivity films in which they have sensors/devices incorporated as part of the structure.

Additionally, the introduction of new government regulations promoting sustainable materials further strengthened industry growth. Furthermore, companies are incorporating nanotechnology and AI-enabled material design in technical films to enhance functionality and recyclability.

Increased adoption is also driven by rising demand for photographic window films (energy-efficient window films), protective coatings for smartphones and electronic devices, and flexible printed electronics. In addition, research in self-cleaning and anti-fingerprint coatings is helping businesses to find new technical film solutions for high-tech and consumer-oriented marketplaces.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The technical films industry in the United Kingdom is growing steadily, with companies focusing more on sustainability, regulatory compliance, and superior performance in industrial and consumer applications. Broad adoption across end-use industries, such as food packaging, aerospace, and renewable energy, has been bolstered by robust demand for heat-resistant, anti-fog, and high-strength films.

Government efforts to promote green materials, including recyclable and compostable technical films, are thus urging companies to integrate more such eco-friendly products. Innovations in lightweight and high-barrier films bring more attractiveness in high-performance applications.

Some companies are investing in printed electronic films and intelligent coatings that can improve product functionality. Moreover, the UK industry is expected to see a growing demand for technical films as protection films and smart surfaces are becoming popular in automotive and construction.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

Technological films will continue to evolve during the forecast period of 2025 to 2035 due to their surging demand across various industries. Stretch films are a key factor for the flexible packaging industry in both the logistics and retail sectors due to their high flexibility and load stability.

With the growing demand for effective product packaging solutions, shrink films will have increased usage in various segments, particularly in food packaging and product bundling, as these end-use segments are used for their need for strong product protection and aesthetic appeal.

In food packaging, specifically, barrier films will see improvements, such as the more efficient configurations of multi-layer constructions offering optimum protection against moisture, oxygen, and UV light. In the field of electronics, conductive films will be important and will enable flexible and wearable devices.

In automotive and construction sectors, safety & security films will gain ground due to increased concern regarding vandalism and security. In addition, in automotive and medical applications, where visibility is of utmost importance, anti-fog films will see increasing demand. Expansion will also occur in other technical films for applications such as smart packaging or medical.

Polyethylene (PE) will remain the leading product in the film industry due to its versatility and cost efficiency, especially for packaging materials. Low-density polyethene (LDPE) and Linear Low-Density Polyethylene (LLDPE) will continue to be widely used for flexible films, providing good tensile strength and elasticity. Polyethylene Terephthalate (PET) will further gain traction, especially in food packaging and the medical sector, due to its high-barrier properties and durability.

Polyamide (PA) films will see increasing use in applications requiring high thermal resistance and strength. It is also applicable to the automotive and aerospace industries. Polypropylene (PP) will remain preferred due to its resistance to chemicals and moisture, making it ideal in the pharmaceutical and chemical industries. PVC are used in applications that require rigidity and chemical resistance, such as construction.

The demand for Ethylene Vinyl Alcohol (EVOH) will increase due to its excellent barrier properties in food packaging applications, whereas polyurethane (PU) films will ensure that their use is growing because of their unique flexibility and durability. Aluminum films (for barrier and safety applications) will continue to play an essential role, and PC will find niche applications in high-impact and optical applications.

For lightweight and flexible packaging, especially food and beverage packaging, films with thicknesses of up to 25 microns will dominate. The thin films offer articulate performance along with significant material savings, making them highly suitable for companies focused on sustainability.

Films in the range of 25-50 microns will have very general use, particularly in applications where some extra strength and barrier properties are desired, including, for example, cosmetic and personal care. 50-100 micron films will gain popularity in pharmaceutical and chemical sectors where strength, puncture resistance and protection of the product are of utmost importance.

In the 100-150 microns, films are targeted in automotive and construction applications, where more robust films are required to resist harsher environments. Heavy-duty industries and applications, such as agriculture, building and construction, will require films in more thicknesses-greater than 150 microns-as these films offer better protection against circumstances faced in extreme conditions.

The food and beverage industry will continue to be a strong driver for technical films due to the growing need for increasing the shelf life of commodities along with protection and convenience via packaging. Packaging will change to meet consumer demand for sustainability and environmental friendliness, with bio-based and recyclable films growing faster.

The growing demand for appealing, functional, and sustainable packaging will lead to a high adoption of technical film in this segment of the personal care and cosmetics industry as well. Packaging will also be more sophisticated than ever before, driving higher demand for chemical-resistant and durable films, among other features in the chemical sector.

Films for protective and insulating applications will continue to be required across the construction and building industries, with a growing demand for energy-efficient solutions. At the same time, from the pharmaceutical sector, the demand for high-performance barrier films that protect sensitive drugs will increase.

The electrical and electronic industry requires films that protect against moisture, dust, and electromagnetic interference. While, the automotive sector will use technical films more widely for safety, security, and styling purposes. Growing adoption of specialty films would be observed across the other industries, such as textiles and medical devices, as new solutions and applications are developed.

The technical films industry is driven by growing demand in electronics, automotive, healthcare, and packaging applications. The industry is being driven by innovation through new formulations of materials, including bio-based polymers, ultra-thin laminates, and high-barrier films, which are tackling issues related to performance, sustainability, and efficiency. Automated manufacturing and artificial intelligence-optimized supply chains are also affecting industry trends.

Increased demand for sustainable and high-performance film alternatives is also propelling industry growth. Furthermore, increased investments in green film production technologies improve product efficiency. Companies are also exploring hybrid technical film solutions that incorporate strength, flexibility, and recyclability for enhanced durability. Furthermore, collaborations between corporate players and video suppliers are driving tailored technical video improvement for certain trade construction.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Toray Industries | 12-16% |

| DuPont | 8-12% |

| Covestro AG | 6-10% |

| 3M Company | 4-8% |

| Amcor Limited | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Toray Industries | Develops high-performance polymer-based technical films for electronics and industrial applications. |

| DuPont | Specializes in multi-layered, moisture-resistant technical films for medical and packaging industries. |

| Covestro AG | Produces durable, lightweight technical films with advanced mechanical properties. |

| 3M Company | Expands its product line with high-barrier and self-healing technical films for specialized applications. |

| Amcor Limited | Develops sustainable and high-performance technical films with advanced barrier properties for multiple industries. |

Key Company Insights

Toray Industries (12-16%)

Leading provider of high-performance technical films, focusing on innovation and durability.

DuPont (8-12%)

Strong presence in medical and food packaging sectors, offering moisture-resistant and tamper-proof films.

Covestro AG (6-10%)

Innovates with ultra-thin, high-strength films catering to electronics and automotive industries.

3M Company (4-8%)

Develops advanced multi-layered technical films with enhanced mechanical and optical properties.

Amcor Limited (4-8%)

Develops sustainable and high-performance technical films with advanced barrier properties for multiple industries.

Other Key Players (45-55% Combined)

Various specialty film manufacturers contribute to industry growth, including:

The overall industry size for the Technical Films industry was USD 42.69 Billion in 2025.

The Technical Films industry is expected to reach USD 71.55 Billion in 2035.

The industry will be driven by increasing demand from electronics, automotive, and packaging industries. Sustainability trends, innovations in high-barrier films, and improvements in material durability will further propel industry expansion.

Key challenges include high production costs, environmental concerns related to plastic waste, and regulatory compliance issues. However, advancements in recyclable materials and biodegradable films are helping to mitigate these challenges.

Packaging Inserts Market Insights - Growth & Forecast 2025 to 2035

Needlecraft Patterns Market Analysis - Growth & Demand 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Plastic Shrink Wrap Market Report - Key Trends & Forecast 2025 to 2035

Multiwall Bags Market Trends - Growth & Demand 2025 to 2035

Pharmaceutical Printed Cartons Market Trends – Demand & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.