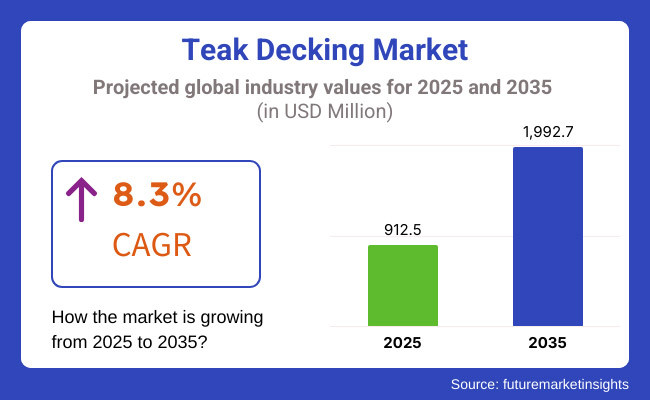

The global teak decking Market size is projected to reach USD 912.5 million in 2025 and USD 1,992.7 million by 2035. The CAGR from the period 2025 to 2035 is anticipated to be 8.3%. The qualities of Teakwood including durability, water resistance and aesthetics make it a most popular option in the marine sector.

The sector is expected to surge due to its growing demand for luxury yachts and boats. However, Sustainable sourcing and synthetic teak alternatives have also been increasing due to environmental concerns. Technological advancements enable the customization of teak decking designs based on the unique design preferences of consumers. Innovative maintenance solutions are also extending the lifespan of teak decks. The growth of the leisure boating industry positively influences the demand for teak decks. Hence, these factors are anticipated to boost the global teak decking Market during the forecast period.

The key drivers for the teak decking Market include increasing demand from the luxury marine sector, growing sustainability sourcing interest as well as the technological development of customisation and maintenance solutions. Teak is a common choice for yacht and boat decking materials due to its natural resistance to water, excellent durability and attractive appearance. The evolving trend of luxury tourism and luxurious outdoor living space construction are the driving forces for Market growth. Teak decking is also commonly used in luxury resorts, hotels, and cruise ships to improve the aesthetic and luxury of exterior spaces.

However, there are some restraints to the Market like the environmental issues driving a move towards synthetic alternatives and regulations on using teak wood sources. The availability of synthetic teak alternatives that require less maintenance and have a lower environmental impact is a significant challenge for the traditional teak decking Market.

Explore FMI!

Book a free demo

During the period between 2020 to 2024, the teak decking Market witnessed a steady demand, primarily due to the luxurious marine construction sector’s preference for this high-quality, aesthetically pleasing material. In addition, an increasing focus on sustainable sourcing practices also contributed to Market growth. Advances in technology during this period led to more decorating options for teak decking, as well as new maintenance options.

From 2025 to 2035, the Market in the luxury tourism and hospitality segments will be heading for massive expansion. The timber-generated process which utilizes prefabricated teak decking panels combined with digital design tools will help provide customers with a decking solution that is less only likely to be more in line with their decorative intentions.

It will also help increase awareness of the eco-consciousness of consumers and will create more stringent demands for sustainable sourcing techniques and efficient forest management practices. A move to green alternatives will also evolve the Market with options friendly to the environment taking the forefront. Technological advancement, luxury sector demand, and environmental sustainability are expected to propel the teak decking Market.

| Key Drivers | Restraints |

|---|---|

| Increasing demand from the luxury marine sector: The luxury marine sector, particularly yachts and boats, continues to drive the demand for teak decking. Teak wood's exceptional durability, water resistance, and appealing aesthetics make it the preferred choice for decking materials in this Market. The growth of luxury tourism and the trend of creating opulent outdoor living spaces further boost the demand for teak decking in the marine sector. | Environmental concerns leading to a shift towards synthetic alternatives: Environmental concerns about deforestation and the sustainability of teak wood have led to a shift towards synthetic teak alternatives. These alternatives offer lower maintenance requirements and a reduced environmental impact, making them an attractive option for eco-conscious consumers. This shift poses a challenge to the traditional teak decking. |

| Growing interest in sustainable sourcing: As consumers become more eco-conscious, there is a growing interest in sustainable sourcing and responsible forest management practices for teak wood. Teak sourced from well-managed plantations appeals to environmentally aware consumers, driving the demand for sustainably sourced teak decking. | Stringent regulations on teak wood sourcing: Stringent regulations on teak wood sourcing, including restrictions on logging and export, can limit the availability of high-quality teak wood in the sector. These regulations aim to protect forests and promote sustainable practices, but they can also pose challenges for manufacturers and suppliers. |

| Technological advancements in customization and maintenance solutions: Advances in technology have enabled greater customization and innovative maintenance solutions for teak decking. Digital design tools allow customers to visualize and customize their teak decking layouts before making a purchase decision, enhancing the customer experience. Innovative maintenance solutions address issues such as fading, discolouration, and wear, prolonging the life of teak decks. | Higher cost of teak wood compared to other decking materials: Teak wood is more expensive than other decking materials, such as composites and other hardwoods. The higher cost can be a deterrent for some consumers, particularly in industry where cost is a significant factor in purchasing decisions. |

| Rising popularity of luxury tourism and outdoor living spaces: The rising popularity of luxury tourism and the trend of creating luxurious outdoor living spaces have contributed to the growth of the teak decking Market. Upscale resorts, hotels, and cruise ships use teak decking to enhance the visual appeal and luxury experience of outdoor areas, driving demand for teak decking in these sectors. | Limited availability of high-quality teak wood: The limited availability of high-quality teak wood can be a restraint for the Market. Teak trees take many years to mature, and the demand for high-quality teak wood often exceeds the supply. This limitation can impact the availability and pricing of teak decking. |

| Innovations in prefabricated teak decking panels and digital design tools: Innovations in prefabricated teak decking panels and digital design tools have further enhanced the consumer experience. Prefabricated panels allow for easier installation and greater customization, while digital design tools enable customers to visualize their decking layouts and make informed decisions. These advancements drive the growth of the teak decking. | Competition from alternative decking materials: The teak decking faces competition from alternative decking materials, such as composites and other hardwoods. These alternatives offer various benefits, including lower costs, reduced maintenance requirements, and environmental advantages. The competition from these materials can impact the Market share of teak decking |

Impact of Key Drivers

| Key Drivers | Impact |

|---|---|

| Increasing demand from the luxury marine sector | High |

| Growing interest in sustainable sourcing | High |

| Technological advancements in customization and maintenance solutions | Medium |

| The rising popularity of luxury tourism and outdoor living spaces | High |

| Innovations in prefabricated teak decking panels and digital design tools | Medium |

Impact of Key Restraints

| Key Restraints | Impact |

|---|---|

| Environmental concerns leading to a shift towards synthetic alternatives | High |

| Stringent regulations on teak wood sourcing | Medium |

| Higher cost of teak wood compared to other decking materials | High |

| Limited availability of high-quality teak wood | Medium |

| Competition from alternative decking materials | Medium |

The teak decking Market has been segmented into three primary categories by grade, including FEQ (First European Quality), MEQ (Middle East Quality) and FAS (Free Along Side). FEQ refers to the high-quality teak. It is characterised due to its high durability and aesthetic appeal. This quality makes it the preferred choice for luxury applications. MEQ is a less refined version of FEQ, but still good for all types of teak decking. FAS teak is the most widely found grade of teak and it has good quality with a price tag lower than the other F grade that makes it suitable for widespread applications.

The Application-based segmentation of the Market describes the wide spectrum of applications. Teak wood is highly sought after for these purposes because of its natural water-resistant and durable qualities. In the hospitality and tourism sector, teak decking is commonly used for pool decks, walkways, seating areas, and recreational areas to enhance the aesthetic appeal and make these spaces more comfortable.

Living quarters, boardwalks, garden paths and outdoor decking are all examples of building and construction applications where teak's strength and durability make it a popular choice. This breadth of applications approaches the very wide range of industries where teak is in great demand based on its unique properties.

The demand for the teak decking Market in the United States is driven by the growing demand for quality outdoor spaces. Teak's resistance to weathering, rot, and decay is an ideal choice for the consumers across US. They have been drawn to durable and aesthetically pleasing materials.

The demand is also driven by a growing trend of home improvement and outdoor living. However, increasing environmental concerns about deforestation have made certified sustainable teak sources more desirable. The teak's price comes with a price tag that can be hard for some buyers to digest when compared to cheaper substitutes like pressure-treated wood and composite materials. The rising eco-consciousness is leading to sustainable sourcing practices.

Teak decking is naturally seen in high-end residential and luxury commercial applications in Canada, due to its premium grade. The demand is also furled as teak is known for its durability in extreme weather conditions, with colder climates due to harsh winters. Canadian Market embraces sustainability, thus FSC-certified or sustainably sourced teak is preferred.

One of its finest woods is teak, which is best known for longevity, and is maintenance-free compared to other woods but is expensive. Growing disposable incomes and the prevalence of outdoor entertainment activities are also helping the demand. But more affordable and widely available options like cedar and composite decking remain popular.

The UK teak decking Market is fairly niche, again mainly residential and luxury projects. Teak is in demand due to its aesthetic quality, longevity and level of endurance for the country’s varying climate. This is one of the reasons why garden decks and patios are often made from teak, as the wood is naturally able to withstand the UK’s rainy and wet environment. Environmental awareness is nudging consumers to certified sustainable sources of teak, which has implications for pricing.

Increased awareness in the direction of eco-friendly construction and rising home renovation activities also work in favour of teak decking’s popularity. Timber and composite decking, on the other hand, can sometimes be cheaper solutions.

In France, you will find teak decking mainly used in luxury home and commercial applications, mainly in high-end and outdoor living settings. The French appreciate teak for its sleek appearance, longevity and resilience to the humid, coastal climate. This demand is underpinned by a growing trend towards high-end outdoor spaces, where teak continues to be the material of choice for decking, furniture, and landscaping.

Although the Market for weather-resistant products is niche, the growing trend toward sustainability has led to the push for FSC-certified teak. That said, price is a limitation for some, as lower-cost materials, such as composites, could be more affordable for wider Market segments.

Germany's Teak Decking Market has been growing due to its high quality and sustainability. The demand for teak is on surge, causing consumers to opt for eco-friendly building materials. Its demand in the nation is also driven due to low-maintenance options that is environmentally friendly in the region.

That is why FSC-certified teak always sells at a high price in the country as the Market is lined up with well-defined standards for certification and sustainability. Teak is particularly popular for outdoor living areas and high-end projects, although composite decking is a major competitor. Growth in the Market is progressively driven by the encouragement of contemporary architecture and encourages in-outward living.

The teak decking Market in South Korea is growing steadily owing to increasing preference for outdoor areas and high-end home interiors. The resilience and scenic value of teak are well-liked by consumers, especially among high-end residential properties. Teak is a well-suited timber for South Korea's variable climate, with humid summers and its withstanding of extreme weather also makes this wood a desired decking option.

But teak's popularity has come at a cost - the lumber pile prices are often more than the average homeowner can shell out. Additionally, Climatic conditions are ineffectively grasped in the country, resulting the growing industrial preference for teak that is sustainably harvested. Locally sourced materials compete with imported teak, and there is a strong demand for quality.

Teak decking is also becoming increasingly popular in Japan, especially for luxury residential and commercial projects. This is due to its natural beauty, durability, and ability to withstand the humid conditions in the region. In Japan, teak is preferred for its low-maintenance attributes such as outdoor decking, patio, and garden area.

Due to Japan's increasing sustainability orientation, the trend towards FSC-certified teak in the country is rising to match eco-conscious demand. Teak also has a high cost per linear foot, thus limiting its use on large industry products, where competing materials (or even composite decking) are typically favoured.

The Market for teak decking is also growing in China because of increased urbanization, luxury real estate, and outdoor living. Teak is considered an upscale material for both residential and commercial developments, appreciated for its resistance to moisture, decay and insects making it arguably appropriate for China’s varied climate. However, the steep price of teak hinders its widespread usage, especially in cost-conscious Markets.

However, the sector is moving towards more sustainable practices, and an increasing number of retailers now offer FSC-certified teak as an alternative. With incomes on the rise, so will the appetite for high-end sustainable materials like teak.

The Indian teak decking is expanding due to increasing luxury housing, hotels, resorts, and outdoor spaces. Especially in tropical climates, Indian consumers prefer teak for its classic look, strength and resistance to termites and weather, making it truly ideal for decking. But the high cost, especially in the price-sensitivity is also some of the major drawbacks in this Market. In India, Urban areas are the leading consumers, with a trend to modern outdoor living, driving demand for teak.

The teak decking is heavily consolidated, with Tier 1 players accounting for approximately 90% of the overall Market share. With such control over the supply chain and distribution networks, the dominant players can influence prices and key trends.

These factors indicate that teak decking space is still very fragmented, primarily due to the presence of small to medium-sized businesses focused on niche, regional, or eco-friendly products. However, competition is fierce among the top players, who continuously work to improve quality, gain sustainability certification and examine customer service. The very high demand for premium materials such as teak and global environmental concerns have established the position of leading companies.

The leading players operating in the teak decking are Bender Lumber Co, Teak Master, Mathews & Fields and Greenheart Teak. These companies provide top-quality and eco-friendly teak that is sourced from certified plantations. This move was crucial to becoming a leading eco-responsible supplier of sustainable products. Bender Lumber Co. introduced a new line of green teak decking solutions with a focus on shrinking carbon footprints and extending product life. Key takeaways from these trends show the Market's shift towards XR and eco-friendliness.

Demand is driven by teak's durability, beauty, and suitability for luxury outdoor spaces.

Challenges include high costs and concerns over sustainable sourcing.

Key players include Bender Lumber Co., Teak Master, and Greenheart Teak.

Sustainability drives demand for FSC-certified teak to ensure responsible sourcing.

Drag Reducing Agent Market Growth 2025 to 2035

Electronic Board Level Underfill Material Market Analysis - Size, Share & Forecast 2025 to 2035

Condensing Unit Market Trends-Growth, Demand & Forecast 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Electroplating Market Growth - Trends & Forecast 2025 to 2035

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.