The tea packaging market has been witnessing significant growth with consumers demand for premium, sustainable and innovative packaging solutions. With the rise of special teas such as herbal infusions and organic variants, packaging plays a vital role in preserving freshness, extending shelf life and enhancing the brand identity of the product. Additionally, growing environmental concerns are also driving the adoption of biodegradable and recyclable tea packaging solutions.

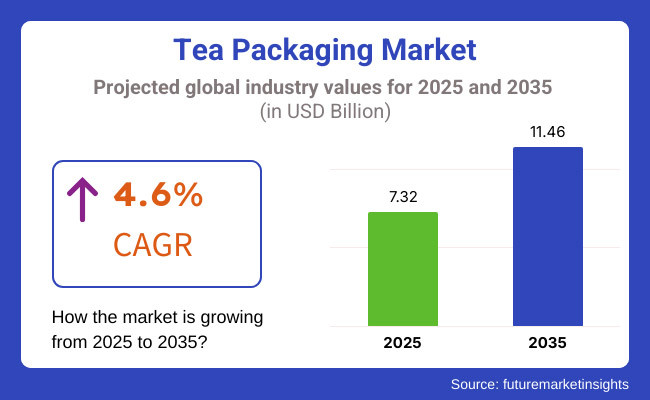

The size of the tea packaging market is anticipated to be valued at USD 7.32 billion in 2025 and is likely to expand at a 4.6% CAGR during 2025 to 2035 to reach USD 11.46 billion. The growth is driven by the growth of the global tea market, rising demand for convenience packaging, and changing consumer behaviour towards eco-friendly materials.

Further, developments in smart packaging and material science are also influencing market trends. Growth of the market is also facilitated by increasing demand for premium and specialty teas, whose high quality needs to be preserved by high-quality packaging to ensure fragrance, taste, and freshness.

Growth of e-commerce and direct-to-consumer tea companies further contributes to market growth, with novel packaging solutions enabling companies to differentiate themselves in a crowded market. Compostable tea bags, resealable pouches, and barrier-coated paper packaging innovations are anticipated to boost the functionality of tea packaging.

Explore FMI!

Book a free demo

During the period from 2020 to 2024, the tea packaging industry experienced steady growth due to increased health awareness among consumers, the popularity of herbal teas, and the demand for eco-friendly packaging. However, there were several challenges, including the prohibitive cost of biodegradable materials and meeting regulatory requirements, etc.

The industry also experienced growing investment in research to enhance biodegradable material and make the packaging more functional. Increased pressure regarding plastic waste led to regulatory agencies promoting compostable and recyclable packaging solutions. In addition, developments in packaging technology allowed for better moisture resistance and longer tea shelf life.

In the upcoming decade, the industry is expected to grow with technological advancements in recyclable films, eco-friendly printing methods and increased production efficiency.

Additionally, the increased use of AI and automation in packaging design and production processes will also continue to boost market competitiveness. The growing demand for convenient and single-serve tea packaging will also generate new growth opportunities. Businesses are also emphasizing making packages more durable and resealable to suit changing consumer needs. The trend of customized and interactive packaging solutions designed for niche markets is likely to pick up pace in the next few years.

Market Shifts: A Comparative Analysis (2020 to 2024 Vs 2025 to 2035)

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape: Initial bans on single-use plastic packaging. | Regulatory Landscape: Stricter global policies mandating compostable and recyclable tea packaging. |

| Material and Formulation Innovations: Development of biodegradable tea bags. | Material and Formulation Innovations: Expansion of high-performance, moisture-resistant, and eco-friendly packaging. |

| Industry Adoption: Widely used in loose-leaf and ready-to-drink teas. | Industry Adoption: Increased adoption in personalized, luxury, and organic tea segments. |

| Market Competition: Dominated by major tea brands and packaging firms. | Market Competition: Rise of eco-conscious packaging startups and collaborations with sustainability experts. |

| Market Growth Drivers: Growth driven by premiumization and health trends. | Market Growth Drivers: Market expansion fueled by AI-optimized packaging designs and smart packaging solutions. |

| Sustainability and Environmental Impact: Early-stage transition to recyclable materials. | Sustainability and Environmental Impact: Large-scale adoption of carbon-neutral and fully compostable packaging. |

| Integration of AI and Process Optimization: Limited use of AI in packaging design. | Integration of AI and Process Optimization: AI-driven predictive modeling and automated production enhancements. |

| Advancements in Packaging Technology: Focus on resealable pouches and airtight tins. | Advancements in Packaging Technology: Development of interactive and smart tea packaging with freshness indicators. |

| Key Drivers | Key Restraints |

|---|---|

|

Growing Demand for Sustainability: As consumers become more eco-conscious, there's a rising demand for sustainable, recyclable, and compostable packaging solutions. Brands are responding by innovating with eco-friendly materials, driving growth in the packaging market. |

High Cost of Sustainable Materials: Eco-friendly and biodegradable materials often come at a higher cost than traditional packaging. This increases production expenses, which may discourage smaller companies from adopting these solutions. |

| Health and Wellness Trends: The growing focus on health and wellness encourages consumers to opt for premium, organic, and health-focused tea products. This trend boosts demand for sustainable packaging that aligns with these values. | Limited Availability of Biodegradable Materials: Not all packaging materials are easily biodegradable, and the availability of high-quality, sustainable materials can be limited, slowing down the adoption rate. |

| Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, such as banning single-use plastics and encouraging the use of recyclable or compostable materials. This creates a need for innovative packaging solutions. | Lack of Recycling Infrastructure: In some regions, the lack of adequate recycling facilities and infrastructure poses a significant challenge to the widespread adoption of recyclable packaging. This can hinder the effectiveness of eco-friendly packaging. |

| Premiumization and Consumer Preferences: The increasing demand for premium, organic, and luxury tea products is pushing the market towards more sophisticated, eco-friendly packaging solutions that appeal to conscious consumers. | Resistance to Change: Traditional packaging methods, such as plastic, have been entrenched in the industry for a long time. The transition to eco-friendly alternatives may face resistance from companies that are reluctant to change established practices. |

| Technological Innovations: Advancements in packaging technologies, including smart packaging (e.g., freshness indicators) and AI-driven designs, are enhancing the functionality and appeal of tea packaging, driving market growth. | Environmental Impact of Manufacturing: While packaging materials may be sustainable, the processes required to produce these materials can still have a significant environmental impact, limiting the overall environmental benefits. |

| Consumer Awareness: Increasing awareness among consumers about the environmental impact of packaging has led to more demand for products that utilize sustainable and responsible packaging solutions. | Competition from Traditional Packaging: Established packaging methods and cheaper alternatives, like plastic and aluminum, remain highly competitive due to their lower cost and widespread availability. |

During the forecast period 2025 to 2035, tea bags are likely to witness a dramatic change with a move towards biodegradable, compostable and recyclable materials. Consumers will continue to demand sustainable alternatives, prompting manufacturers to adopt materials like plant-based fibers and papers that offer both functionality and sustainability.

Pouches will remain a favourite packaging option, especially for loose-leaf teas, as they are light, inexpensive, and facilitate greater retention of flavour. The industry will witness increased use of recyclable and biodegradable pouches due to consumers' heightened environmental awareness.

Also, tea pots will develop with an emphasis on sustainable materials such as glass and bamboo to suit the increasing demand for premium, eco-friendly tea products. The paper sub-segment is poised to emerge as a prominent sub-segment based on material type, with a value share of approx. 35% in 2025.

In the forecast period between 2025 and 2035, flexible tea packaging will lead the market. The demand for the industry will be boosted due to its convenience, lower price and ease of use. Businesses continue to use more flexible materials like compostable films and recyclable plastics in terms of their sustainability efforts. This packaging is commonly used for tea bags and loose-leaf teas, providing more convenience to consumers.

The rigid tea packaging will also gain traction, especially in luxury and premium tea categories. Consumers will be attracted to rigid pack formats such as glass containers or metal tins for their capability to offer superior protectives and enhanced shelf life and beautify the product.

Additionally, the rigid packs are also likely to gain traction due to their recyclable and reusable qualities. This sub-segment will capture a value share of nearly 25% in 2025 as they provide efficient and convenient packaging options, allowing for easy filling, transportation, and storage.

Asia-Pacific is poised to dominate the tea packaging market due to its robust tea manufacturing base in China, India, Japan and Sri Lanka. The tea packaging industry has been growing at a rapid pace, driven by the growing tea consumption, exports and demand for eco-friendly and innovative tea packaging solutions. Furthermore, high industrialization and increasing retail chains in the region are also boosting market growth.

The growth of the market in the region is driven by the growth of organic and specialty tea varieties, which demand high-end packaging for protecting freshness and promoting branding. Government campaigns for green packaging materials and restrictions on single-use plastics are also driving the use of biodegradable and recyclable tea packaging. In addition, investments in R&D for lightweight, eco-friendly, and airtight packaging materials are likely to generate new market opportunities in the region.

North America remains a prominent market for the tea packaging industry. Its demand is surging due to a rise in the population of specialty and herbal teas and demand for sustainable packaging solutions. Canada and the United States are the leading regions with technological advancements in biodegradable and compostable tea packaging. The growing preference for convenient and resealable packaging formats among consumers is further boosting the market demand.

The adoption of eco-friendly packaging materials is also gaining traction in the region, influenced by corporate sustainability commitments and government regulations in promoting recyclable and plastic-free solutions. The increasing investments in research and development for high-performance packaging film and paper-based alternatives are further propelling the market growth.

In addition to this, the rise in online tea sales and subscription-based tea services is also boosting demand for aesthetically appealing and durable packaging solutions. Many companies in North America are also focusing on enhancing the shelf-life properties of packaging materials through innovative barrier coatings and oxygen scavengers.

Europe is the leading market share holder in the tea packaging sector, supported by robust regulatory schemes favoring eco-friendly packaging solutions and growing demand among consumers for value-added tea offerings. The leading economies, including Germany, the UK and France, are at the forefront of eco-friendly tea packaging innovations. Rising investments in the circular economy concept and development work on compostable packaging materials further consolidate the position of the region as the global leader in the market.

Tough green legislation encouraging plastic cutting and reusable packing alternatives are boosting the trend of paper-based and biodegradable tea packs. Furthermore, the high demand for special and organic tea will support long-term growth in the sector. The sector is also experiencing a growing level of cooperation among packaging companies and high-end tea brands to offer high-quality, environmentally friendly solutions.

In addition to this, European research centres are putting money into future generation barrier films and moisture-proof packaging to boost tea preservation. These innovations will likely improve the overall efficiency and use of green tea packaging across different industries.

The United States will lead the tea packaging market, driven by its growing demand for sustainable, premium, and innovative packaging in the food & beverage industry. High-barrier, moisture-resistant, and biodegradable packaging has spurred manufacturers to create sophisticated tea packaging materials with improved freshness and shelf life. Government policies are urging the use of eco-friendly and recyclable materials.

Companies are also adopting the use of compostable tea bags, paperboard cartoons and bio-based flexible packaging. Additionally, the resealable closure, airtight packaging and smart labelling technologies are also enhancing consumer efficiency and product traceability.

Companies are also testing premium tea packaging designs with elaborate branding and specialty materials to attract health-conscious and luxury tea drinkers. In addition, the increasing use of tea sachets, stand-up pouches, and pyramid tea bags in e-commerce and retail packaging is fueling innovation in sustainable tea packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

Japan's tea packaging market is rising consistently as there is a heightened need for superior-quality, functional, and well-designed packaging for the green tea, matcha, and specialty tea markets. There is packaging with advanced technology features such as UV protection, oxygen barrier, and resealable zipper designed to protect the aroma and freshness.

With stringent food safety regulations and eco-friendly packaging, companies are shifting towards biodegradable tea bags, plastic-free pouches, and FSC-approved paperboard boxes. Additionally, the progress in vacuum-sealed and nitrogen-flushed packaging is propelling demand in applications necessitating a longer shelf life.

Companies are also spending money on automation-friendly tera packaging units to enhance the efficiency of their product and decrease material waste. In addition to this, the growth of high-end, artisanal and ceremonial tea packaging is also boosting in Japan due to its innovative packaging with elaborate designs and upscale materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The tea packaging industry of the United Kingdom is growing significantly, with larger companies focusing on sustainability, regulatory requirements and consumer-led innovation. The surging need for plastic-free, compostable and high-barrier packaging solutions has resulted in higher uptake across various product segments, such as loose-leaf tea, herbal infusions ad specialty blends.

Government policies encouraging waste reduction and sustainable packaging regulations are also driving companies to incorporate recyclable and biodegradable materials into their offerings. Moreover, technologies in foil-lined pouches, kraft paper bags, and reusable tins are rendering these packaging options more appealing to premium tea brand companies. Organizations are also opting digital branding strategies, QR-code packaging, and interactive labels to increase customer interaction.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

The South Korea tea packaging market is anticipated to show lucrative growth due to the rising demand for sustainable, high-barrier and attractive packaging in herbal, functional and ready to drink tea. Manufacturers are becoming increasingly focused on creating compostable tea bags, pouches without aluminum and paper-based packages with enhanced moisture and aroma barriers to meet the requirements for sustainable and cost-effective packaging.

Additionally, the industry’s expansion is also supported by government regulations that mandate the use of biodegradable and food-safe materials. Further, businesses introduce digital tracking technologies, such as QR codes and smart labels, in tea packaging for traceability and to enhance consumer engagement.

Additionally, the rising popularity of luxury and gift-ready tea packaging with embossed cartons and decorative tins is also driving adoption. In addition, ongoing research on active packaging technologies like oxygen scavengers and antimicrobial coatings are enabling companies to create new and innovative tea packaging that is targeted towards the freshness-sensitive and premium tea industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The tea packaging market is growing substantially, driven by its rising demand in retail, e-commerce and specialty tea segments. The market is witnessing innovation through new material formulations, involving plant-based packaging, moisture resistant packaging and resealable eco-friendly pouches, addressing concerns about performance, sustainability and efficiency.

Additionally, the developments in the automated sector and AI packaging are also further shaping the industrial trends. Another factor driving market growth includes the increasing preference towards plastic-free and reusable tea packing solutions. Furthermore, increased investments in branding-focused packaging technologies are improving product marketability and expanding market opportunities.

Companies are also expanding hybrid tea packaging solutions that integrate smart and biodegradable components to enhance user engagement and environmental impact. Additionally, the collaborations between tea brands and sustainable packaging manufacturers are also driving development in the sector.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor plc | 12-16% |

| WestRock Company | 8-12% |

| Sonoco Products Company | 6-10% |

| Huhtamaki Oyj | 4-8% |

| Aero-pack Industries Inc. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor plc | Develops high-barrier, recyclable tea packaging solutions with enhanced shelf-life properties. |

| WestRock Company | Specializes in sustainable paperboard packaging for tea brands, focusing on premium branding. |

| Sonoco Products Company | Produces resealable, eco-friendly tea packaging solutions with moisture-resistant features. |

| Huhtamaki Oyj | Expands its product line with compostable tea pouches and bio-based tea bag materials. |

| Mondi Group | Specializes in flexible, compostable tea packaging solutions with a focus on sustainability. |

Key Company Insights

Amcor plc (12-16%)

Leading provider of sustainable tea packaging solutions, focusing on recyclability and product protection.

WestRock Company (8-12%)

Strong presence in paperboard tea packaging, offering innovative branding solutions.

Sonoco Products Company (6-10%)

Innovates with resealable, moisture-resistant tea packaging for improved shelf-life.

Huhtamaki Oyj (4-8%)

Develops biodegradable tea pouches and compostable packaging materials for sustainable tea packaging.

Aero-pack Industries Inc. (4-8%)

Develops flexible, compostable tea packaging solutions with a focus on sustainability.

Other Key Players (45-55% Combined)

Various specialty packaging companies contribute to market growth, including:

The overall market size for the Tea Packaging Market was USD 7.32 Billion in 2025.

The Tea Packaging Market is expected to reach USD 11.46 Billion in 2035.

The market will be driven by increasing demand from retail, e-commerce, and premium tea brands. Sustainability trends, innovations in eco-friendly packaging materials, and improvements in branding technologies will further propel market expansion.

Key challenges include the high cost of sustainable packaging materials, strict regulatory compliance requirements, and the complexity of maintaining freshness while using eco-friendly solutions. However, continuous advancements in biodegradable films and smart packaging technologies are mitigating these issues.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.