The market for the tea packaging machine globally is currently booming, given that the world needs efficient and high-speed customisable packaging in the tea sector. The industry will reach USD 1998.94 million with a CAGR of 3.4% by 2035. It is projected that the following drivers will further lead to significant growth: an upsurge in the tea consumption sectors, the advance of automation technologies, and also more preference in the sustainable as well as innovative ways of packaging.

Manufacturers are focusing on developing cutting-edge tea packaging machines that offer enhanced efficiency, flexibility, and eco-friendly options. Partnerships with tea manufacturers and packaging firms are further accelerating the adoption of advanced tea packaging technologies globally.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 1998.94 million |

| CAGR during the period 2025 to 2035 | 3.4% |

Explore FMI!

Book a free demo

Summary

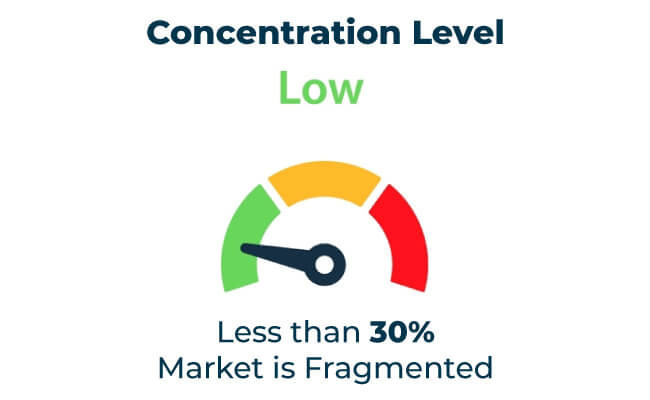

The following analysis identifies the positioning of the key players in the market for tea packaging machines. IMA Group takes the lead by offering innovative and automated tea packaging solutions, though with the weakness of high production costs. Bosch Packaging Technology offers highly versatile and efficient packaging machines but struggles to scale in emerging markets.

Fusetea Machinery has focused on offering customizable and sustainable packaging solutions, but regional players challenge its success. Opportunities are in riding on the trends of sustainability and further applications of automated tea packaging machines, while threats include raw material price volatility and regulatory changes.

IMA Group

IMA Group demonstrates strengths in its high-speed and efficient tea packaging machines. However, weaknesses include high production costs and reliance on advanced technology. Opportunities exist in expanding partnerships with global tea producers. Threats arise from increasing competition and evolving packaging standards.

Bosch Packaging Technology

Bosch Packaging Technology excels in versatile and durable tea packaging machines. However, the company faces challenges in scaling its operations to meet the growing demand in developing regions. Opportunities lie in innovating with energy-efficient packaging machines. Threats include competition from emerging players offering low-cost solutions.

Fusetea Machinery

Fusetea Machinery specializes in customizable and sustainable tea packaging solutions. However, weaknesses include limited market penetration in certain industries. Opportunities exist in developing machines for biodegradable and recyclable packaging materials. Threats stem from regulatory changes and market competition from established brands.

| Category | Market Share (%) |

|---|---|

| Top 3 Players (IMA Group, Bosch Packaging Technology, Fusetea Machinery) | 12% |

| Rest of Top 5 Players | 4% |

| Next 5 of Top 10 Players | 10% |

Type of Player & Industry Share (%)

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 26% |

| Next 20 Players | 43% |

| Remaining Players | 31% |

Year-on-Year Leaders

Governments globally are implementing regulations to promote sustainable packaging practices in the tea industry. Compliance with EU sustainability directives and other international standards ensures the adoption of eco-friendly materials and technologies.

Emerging markets in Asia-Pacific, Africa, and South America offer significant growth potential for tea packaging machine manufacturers. Demand for efficient and sustainable tea packaging solutions is increasing globally to meet evolving consumer preferences and regulatory expectations.

In-House vs. Contract Manufacturing

The tea packaging machine market is shaped by regional dynamics, with Europe and Asia-Pacific leading due to technological advancements and rising tea consumption. North America is emerging as a key growth area driven by demand for premium and sustainable packaging solutions.

| Region | North America |

|---|---|

| Market Share (%) | 40% |

| Key Drivers | Regulatory mandates and advanced technologies. |

| Region | Europe |

|---|---|

| Market Share (%) | 35% |

| Key Drivers | High tea consumption and increasing automation. |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 20% |

| Key Drivers | Demand for premium and eco-friendly packaging. |

| Region | Other Regions |

|---|---|

| Market Share (%) | 5% |

| Key Drivers | Emerging opportunities in specialty tea packaging. |

The tea packaging machine market will expand through innovations in automation, sustainability, and smart packaging technologies. Companies prioritizing efficiency, customization, and eco-friendliness will gain a competitive edge. Investments in emerging markets and partnerships with key stakeholders will further drive growth.

| Tier | Key Companies |

|---|---|

| Tier 1 | IMA Group, Bosch Packaging Technology, Fusetea Machinery |

| Tier 2 | Viking Masek, Nichrome Packaging Solutions |

| Tier 3 | TEEPACK Spezialmaschinen, Sanko Machinery |

The tea packaging machine market is well set for stable growth, thanks to the steady increase in the consumption of tea, demand for sustainable solutions in packaging, and the developments in automation technology. Companies will be those innovating, following compliance, and being eco-friendly.

Key Definitions

Abbreviations

Research Methodology

This report is based on primary research, secondary data analysis, and market modeling. Insights were validated through industry expert consultations.

Market Definition

The tea packaging machine market includes automated and semi-automated machines designed for efficient packaging of tea into bags, sachets, and other formats, with a focus on sustainability and innovation.

Rising demand for automated and sustainable tea packaging solutions and increasing global tea consumption.

The market is projected to reach USD 1998.94 million, growing at a compound annual growth rate (CAGR) of 4.4%.

Leading players include IMA Group, Bosch Packaging Technology, and Fusetea Machinery.

Key challenges include high initial investment costs and regulatory complexities.

Opportunities lie in automation, sustainability initiatives, and partnerships with key industries.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.