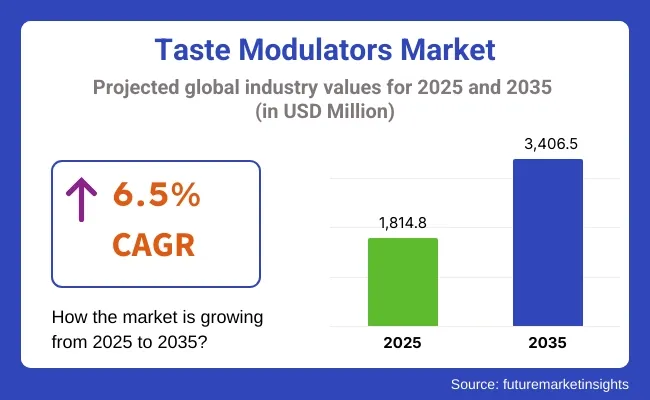

The Taste Modulators Market is expected to witness substantial growth between 2025 and 2035, driven by the rising demand for healthier food alternatives without compromising taste. The market is projected to be valued at USD 1,814.8 million in 2025 and is expected to reach USD 3,406.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% during the forecast period.

One major driver of market growth is the growing consumer preference for sugar and salt reduction in processed foods. As health concerns regarding obesity, diabetes, and cardiovascular diseases continue to rise, food manufacturers are actively incorporating taste modulators to maintain flavor while reducing sugar, salt, and fat content. Regulatory bodies are also imposing stringent guidelines on excessive sodium and sugar intake, further accelerating the adoption of taste modulators in various food and beverage applications.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,814.8 million |

| Industry Value (2035F) | USD 3,406.5 million |

| CAGR (2025 to 2035) | 6.5% |

The market is segmented by Product Type and Application. The key product types include Sweet Modulators, Salt Modulators, and Fat Modulators, while the applications cover Dairy Products, Bakery Products, Confectionery Products, Meat Products, Snacks, Savory, Alcoholic Beverages, and Non-Alcoholic Beverages.

Among these, Sweet Modulators command the market as they are widely used as ingredient in none alcoholic beverages, dairy products and candy. The rising health consciousness among people drives food producers to replace with sweet, modulators while artificial sweeteners and high-calorie sugars do not reduce the overall sweetness of the product.

High usage of sweet modulators has been witnessed in the beverages segment (carbonated soft drinks, flavored water, and energy drinks), although companies are focused on the launch of sugar-free and low-calorie drink variants to cater to changing consumer trends.

One of the fastest growing segment in the taste modulator market are sweet modulators which is helping quality food and beverage applications as they reduce sugar levels without sacrificing sweetness level. Unlike traditional sweeteners, sweet modulators optimize the perception of natural sweetness, allowing manufacturers to create low-calorie, sugar-free, or reduced sugar versions of products that resonate with health-focused consumers.The increasing demand for low sugar content in soft drinks, processed food, and dairy products from consumers has resulted in demand for sweet modulators, as there are rising consumer preferences for healthier food options.

This market demand is already being consolidated with the growth of natural sweet modulators, which are plant-based ingredients that include monk fruit extracts and stevia derivatives, coupled with polyphenol-based flavor enhancers, ensuring both market needs and clean-label strategies for consumer needs for natural alternatives.

The implementation of AI-enabled taste optimization followed, which uses machine learning-based flavor analysis, personalized sweetness profiling, and AI-enabled sugar reduction strategies to accommodate varying regional taste needs, further encouraging uptake.

Backend-List hams with equitable return sweetness modulator along with functional drinks such as sugar free energy drink, flavored water and low calorie fruit juices maximize Body growth and fraction application beyond traditional food. The use of sustainable sourcing practices, including ethically sourced natural sweeteners, eco-friendly processing methods, and open supply chain practices, has further supported market expansion, ensuring global sustainability standards compliance.

In spite of its sugar reduction, calorie control, and health benefit gains for consumers, the sweet modulators market is challenged by such regulatory hurdles as artificial sweetener bans, variations in perception of taste, and production expenses of natural alternative sugars.

That said, newer developments in enzyme-based sweetness stimulants, fermentation-based modulator manufacturing, and block chain-verifiable ingredient authenticity are enhancing efficiency, cost-effectiveness, and regulatory acceptability, bringing sustained growth to sweet modulators in global food and beverage applications.

Fat modulators have gained meaningful traction in the marketplace particularly amongst food manufacturers seeking to develop lower-fat variations of recipes that maintain mouth-feel, richness and flavor. Unlike traditional fat replacers, fat modulators alter lipids while retaining the desired sensory properties of full fat food.

These factors, along with the increasing trend towards healthier food products such as low-fat dairy, baked products, and snack foods, have been another factor behind the increasing use of fat modulators with consumers moving to balanced diets and higher consumption of healthy fats. The increasing production of algal lipids, along with protein-derived fat enhancers and emulsion-based mouthfeel enhancers, has driven growth for the global plant-based fat modulators market by offering a clean-label, natural approach to fat reduction.

The advent of creations like microencapsulation technology, which encompasses encapsulated fat modulator substances that release flavor-enhancing compounds at key intervals- have bolstered consumer adoption even further, expanding shelf-life, stability, and consistency in low-fat food(s).

Maximized the market growth market penetration and consumer acceptance, the development of fat modulator-enriched snack foods, lower-fat chips, low-calorie dips, and healthier nut-based spreads has guaranteed the wider market expansion and consumer acceptance.

Market expansion is supported by new lipid chemistry, in which lipid-mimicking molecules, structured emulsions, and even plant-derived lipid compounds are used to ensure that reduced fat foods have all the creamy, rich, and satisfying texture.While fat modulators offer benefits for fat reduction, calorie control, and sensory enhancement, they also contend with complexities in taste optimization, regulatory scrutiny over fat substitutes, and consumer skepticism toward fat reduction technologies.

Nevertheless, the advent of new technologies encompassing AI-assisted lipid profiling, nanotechnology-mediated fat modulation, and sustainable lipid extraction methods are enhancing the consistency of taste, acting as a mediator for regulatory approval and building consumer trust, thereby ensuring sustained growth for fat modulators for food and beverage applications across the globe.

The dairy products business unit has emerged as one of the most widely employed applications of taste modulators, offering rich flavor solutions in low-sugar and low-fat dairy-based drinks, yoghurts and cheese items. Unlike conventional flavoring techniques, which we can produce, taste modulators in dairy products also ensure that low sugar, low fat versions keep the same flavor profile, texture and mouthfeel as the original.

Growing demand for healthier dairy products such as lactose-free, sugar-free, and plant-based dairy has encouraged the adoption of taste modulators as health benefits coupled with a satisfying taste experience remains a paramount consideration for consumers.

While being recommended for taste enhancement and sugar format reduction, as well as fat replacement, the dairy products category faces up to formulation complexity, clean label compliance regulation and skepticism among consumers about synthetic taste modulators.

However, more recent innovations regarding AI-powered dairy formulation, enzyme-driven sugar modulations and precision fermentation for fat replacement are boosting efficiency, compliance, and consumer confidence, unlocking future potential for growth within the dairy application global taste modulators market.

Bakery items category has seen a strong market acceptance over the forecasted period across all manufacturers' low-calorie, sugarless, and a lower-fat baked item. Unlike artificial flavor enhancers, taste modulators in bakery products provide balanced freshness and enhance sweetness, richness, and mouthfeel naturally without imposing unwanted aftertastes or synthetic elements.

The growing demand for healthier baked foods such as sugar-free cakes, protein cookies, and low-fat pastries over the past few years has driven the demand for taste modulators, as customers wanted guilt-free enjoyment without sacrificing taste or texture.

The bakery products category, while being a specific strength for the enhancement of sweetness, the maintenance of texture, and the substitution of sugar, poses its own challenges in formulations in the long run, shelf-life maximization, and consumer disbelief of sugar-free replacements.

However, the wave of future scenario with advancements in AI formulation optimized baking, molecular gastronomy enabled texture modification and block chain verified clean-label ingredients is certainly taking the reliability, authenticity and trust of consumers to the next level, ensuring a bright future ahead for taste modulators in bakery applications across the globe.

Challenge

Regulatory Hurdles and Clean-Label Demand

Increasing focus on clean-label products along with complex regulatory compliance is one of the major challenge to the growth of taste modulators market. Each country has different regulations for taste modulation ingredients, thus presenting a challenge for manufacturers to comply with varying regions.

Consumers are also looking askance at artificial additives and synthetic taste enhancers, and that is pushing companies to reformulate products with natural alternatives. A top challenge for development players in the market is creating inexpensive, plant-based taste modulators that do not sacrifice taste and stability.

Opportunity

Rising Demand for Sugar and Sodium Reduction Solutions

Rising global health awareness coupled with regulatory drives such as sugar tax and sodium reduction initiatives are high opportunity market aspects for taste modulators. Food and drinks firms are stepping up investments in novel taste modulation technologies that allow them to slash sugar, salt, and fat with no loss of flavor.

The demand for taste modulators is also driven by the increasing popularity of functional foods & beverages including the plant-based dairy products and protein fortified snacks. Companies focusing on innovative formulation techniques such as enzyme-based & fermentation-based flavor modulators are perfectly positioned to capitalize on this expanding sector.

In the United States, the market for steroid-free nasal sprays is growing steadily due to the increasing prevalence of allergy, sinus infections and respiratory ailments. Growing awareness of the long-term effects of steroid-based therapies has encouraged rising demand for safer, non-steroidal alternatives.

Other factors boosting market growth include availability of over-the-counter (OTC) nasal sprays and rising consumer awareness about drug-free cures. Moreover, pharmaceutical innovation and introduction of new formulations such as saline-based and antihistamine sprays are driving product uptake. The market is further benefitting from an increase in pediatric and geriatric patients seeking non-steroidal alternatives for long term use.

| Country | CAGR (2025 to 2035) |

|---|---|

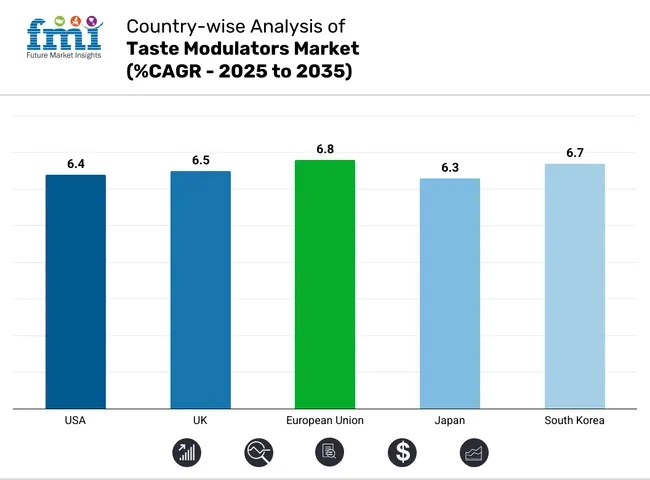

| USA | 6.4% |

Steroid-free Nasal Sprays Market in UK Increasing Factors: The UK steroid-free nasal sprays market is driven by increasing awareness of allergic rhinitis, respiratory problems due to air pollution, and inclination toward non-steroidal drugs in medicines.

Local National Health Service (NHS) and regulatory bodies are endorsing the use of over-the-counter nasal sprays as first-line treatment for mild to moderate symptoms. The growing demand for saline-based and natural nasal sprays is also being driven by health-conscious consumers, who are ever more seeking drug-free treatments. Additionally, the rising base of pediatrics and geriatrics in the UK is expanding the consumer base for steroid free products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The European Union steroid-free nasal sprays market is being driven due to the stringent rules regarding usage of steroid based drugs, increasing air pollution resulting in respiratory ailments and preference of individuals for natural and drug free medicines. The market in Germany, France, and Italy is growing, boosted by their respective advanced pharmaceutical industries and high demand for OTC nasal care products.

The rising demand for steroid-free options in pediatric and elderly healthcare are also contributing to the expected increase in demand for this type of treatment with lower risks of side effects. Furthermore, ongoing developments in the formulation of nasal sprays, such as xylitol-based and saline nasal solutions, are further contributing to regional market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.8% |

Japan's market for non-steroidal nasal sprays is expanding consistently amid the growing rate of seasonal allergies, particularly hay fever (pollinosis), affecting a high proportion of the population. The increased use (and high culture) for self-medication and over-the-counter drugs have encouraged the use of drug-free nasal sprays.

Japanese pharmaceutical companies are investing in innovative products, such as seawater-based and probiotic nasal sprays, to cater to health-conscious consumers. And the country’s growing, aging population, which is more susceptible to chronic nasal congestion, represents a large driver of demand for steroid-free alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

The market for steroid-free nasal sprays is growing rapidly. Rising cases of respiratory diseases, including allergic rhinitis, associated with air pollution are driving this growth in South Korea. Demand is being driven by the government's promotion of non-steroidal medications through public health programs.

The food and beverage market in South Korea is expanding due to the presence of domestic pharmaceutical industries that are introducing innovative and eco-friendly formulations. In addition, the rising utilization of saline-based sprays by parents for pediatric applications is also expected to propel the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

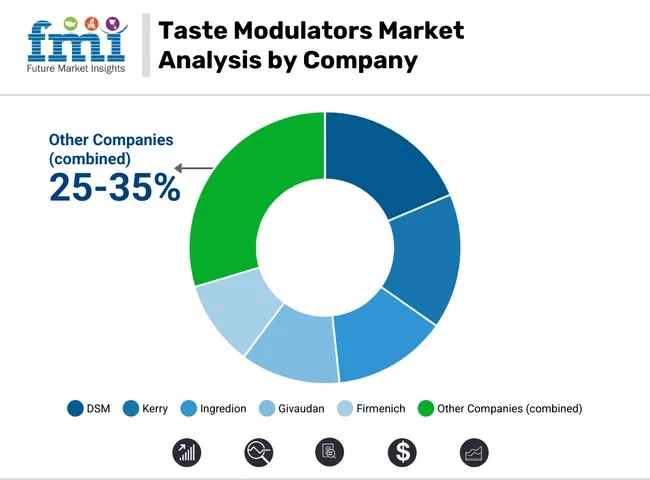

The Taste Modulators market is experiencing significant growth, driven by increasing consumer demand for healthier food and beverage options with reduced sugar, salt, and fat content. Taste modulators are essential ingredients that help maintain or enhance the flavor profile of products while achieving desired nutritional improvements. Key players in this market are focusing on innovative solutions, strategic acquisitions, and partnerships to strengthen their market positions and address evolving consumer preferences.

DSM (18-22%)

A leader in nutritional solutions, DSM focuses on developing innovative taste modulation ingredients. In 2025, the company launched Delvo®Plant Go, an enzyme solution designed to enhance the taste and texture of plant-based dairy alternatives, addressing the growing demand for plant-based products.

Kerry (15-19%)

Kerry has been actively expanding its taste modulation capabilities. In December 2024, the company acquired the lactase enzyme business from Chr. Hansen and Novozymes for €150 million, strengthening its position in the enzyme market and enhancing its portfolio of taste modulation solutions.

Ingredion (12-16%)

Ingredion is committed to providing innovative sweetening solutions. In November 2024, the company introduced PureCircle™ NSF-13, a next-generation stevia sweetener that enables significant sugar reduction without compromising taste, catering to the health-conscious consumer segment.

Givaudan (10-14%)

Givaudan is leveraging digital platforms to enhance consumer engagement. In March 2024, the company announced a partnership with e-retailer TMall to support the growing local demand for fragrance products, demonstrating its commitment to meeting evolving consumer preferences through innovative channels.

Firmenich (8-12%)

In 2023, Firmenich merged with DSM to form dsm-firmenich, combining their expertise in nutrition, health, and beauty. This strategic merger aims to drive innovation in taste modulation and expand their global market presence.

Other Key Players (25-35% Combined)

The taste modulators market is also supported by regional and emerging companies that are contributing to market growth through innovation and strategic partnerships:

The overall market size for taste modulators market was USD 1,814.8 Million in 2025.

The taste modulators market is expected to reach USD 3,406.5 Million in 2035.

The rising demand for healthier food alternatives without compromising taste fuels Taste Modulators Market during the forecast period.

The top 5 countries which drives the development of Taste Modulators Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product type, sweet modulators to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Metric Tons) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 6: Global Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: North America Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 10: North America Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 12: North America Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Latin America Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 16: Latin America Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 18: Latin America Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Europe Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 22: Europe Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 24: Europe Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: East Asia Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 28: East Asia Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 30: East Asia Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 31: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: South Asia & Pacific Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 33: South Asia & Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 34: South Asia & Pacific Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 35: South Asia & Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 36: South Asia & Pacific Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 38: Middle East and Africa Market Volume (Metric Tons) Forecast by Country, 2017 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 40: Middle East and Africa Market Volume (Metric Tons) Forecast by Product Type, 2017 to 2033

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 42: Middle East and Africa Market Volume (Metric Tons) Forecast by Application, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 5: Global Market Volume (Metric Tons) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 9: Global Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 13: Global Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 23: North America Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 27: North America Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 31: North America Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 41: Latin America Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 45: Latin America Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 49: Latin America Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 59: Europe Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 63: Europe Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 67: Europe Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 77: East Asia Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 81: East Asia Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 85: East Asia Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia & Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia & Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia & Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 95: South Asia & Pacific Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 96: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia & Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 99: South Asia & Pacific Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 100: South Asia & Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia & Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 103: South Asia & Pacific Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 104: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia & Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia & Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia & Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 113: Middle East and Africa Market Volume (Metric Tons) Analysis by Country, 2017 to 2033

Figure 114: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 117: Middle East and Africa Market Volume (Metric Tons) Analysis by Product Type, 2017 to 2033

Figure 118: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 121: Middle East and Africa Market Volume (Metric Tons) Analysis by Application, 2017 to 2033

Figure 122: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 125: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 126: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Taste Enhancers and Modifiers Market

Demand for Taste-maskers for Plant Protein Bars and Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Flavor Modulators Market Size and Share Forecast Outlook 2025 to 2035

Optical Modulators Market Analysis and Forecast by Type, Application, and Region through 2025 to 2035

Food Immunomodulators Market – Growth, Demand & Functional Nutrition

Global Veterinary Immunomodulators Market Analysis – Size, Share & Forecast 2024-2034

Oncology Apoptosis Modulators Market Insights – Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA