The global tapioca maltodextrin market is projected to grow from USD 670.6 million in 2025 to USD 1,397.9 million by 2035, registering a CAGR of 7.6%. Market expansion is driven by rising demand for clean-label and non-GMO food ingredients, especially in functional foods, beverages, and sports nutrition. Manufacturers are leveraging tapioca maltodextrin’s superior solubility, neutral taste, and stabilizing properties to enhance product texture and shelf life.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 670.6 million |

| Projected Industry Value (2035F) | USD 1,397.9 million |

| CAGR (2025 to 2035) | 7.6% |

The market holds an approximately 5.0% share of the modified starch market, supported by its clean-label appeal, neutral taste, and superior bulking properties. Within specialty carbohydrates, it accounts for approximately 8.94% share, driven by its role in fat replacement, encapsulation, and energy-boosting applications in food and beverage formulations.

The market also contributes approximately 0.96% to the global food additives industry, aligning with the demand for natural, non-GMO, and allergen-free ingredients across processed foods, beverages, and nutritional supplements.

Government regulations impacting the market focus on food safety, labelling standards, and clean-label compliance. Regulations by bodies such as the US FDA, European Food Safety Authority (EFSA), and Food Safety and Standards Authority of India (FSSAI) ensure that tapioca maltodextrin meets stringent purity, safety, and non-GMO standards. These frameworks support the adoption of tapioca-based variants over conventional corn-based alternatives, ensuring transparent ingredient labelling and fostering consumer trust in natural and sustainable food ingredients.

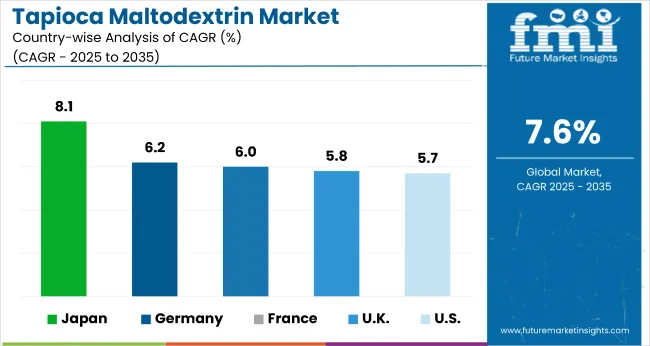

Japan is projected to be the fastest-growing market, expanding at a CAGR of 8.1% from 2025 to 2035. The medium DE segment will lead the dextrose equivalent category with a 41.2% share, while the pharmaceutical segment will hold 26.7% share by end-use. The UK and France markets are also expected to grow steadily, with CAGRs of 5.8% and 6%, respectively.

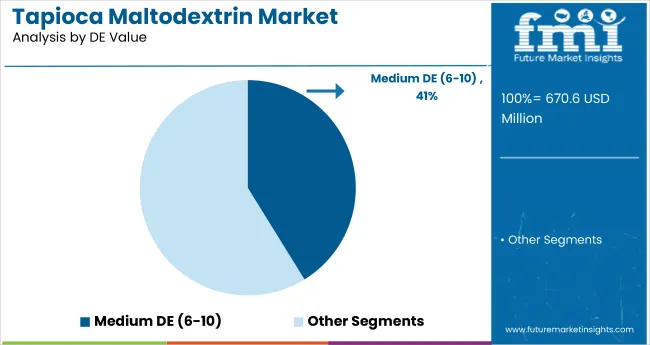

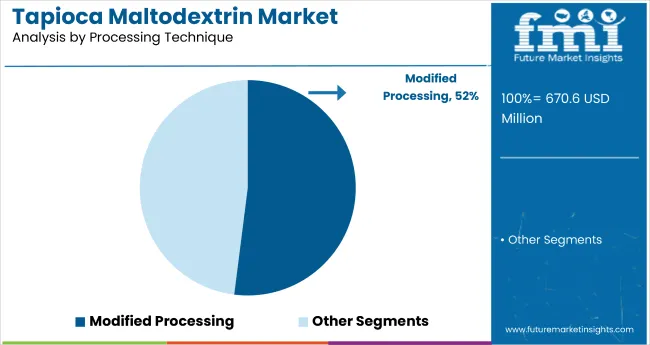

The tapioca maltodextrin market is segmented by dextrose equivalent (DE) value, processing technique, functionality, end-use industry, and region. By DE value, the market is divided into low DE (1-5), medium DE (6-10), and high DE (11-20). Based on processing technique, the market is classified into native processing, modified processing, and pregelatinized processing.

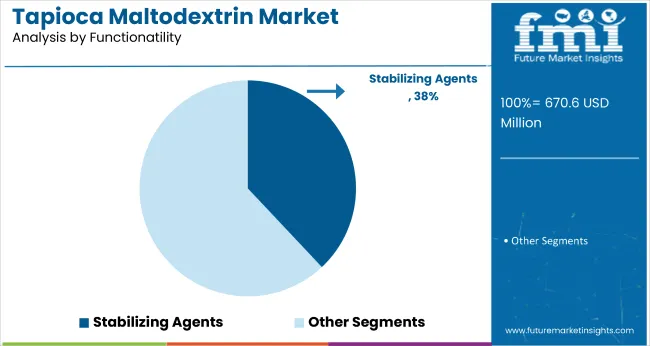

By functionality, the market is segmented into stabilizing agents, thickening agents, binding agents, and nutritional enhancers. Based on end-use industry, it is divided into food & beverage, pharmaceutical, nutritional supplements, and personal care & cosmetics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Medium DE is projected to lead the DE value segment, accounting for 41.2% of the global market share by 2025. This segment is widely used in food and beverage applications for its balance of sweetness and solubility.

Modified processing is expected to dominate the processing technique segment, accounting for 52% of the market share in 2025. This segment benefits from enhanced stability, improved solubility, and wider usability across multiple end-use sectors.

Stabilizing agents are expected to lead the functionality segment, accounting for 38% of the global market share by 2025. Its neutral taste and texturizing benefits drive widespread adoption.

Food & beverage is expected to dominate the end-use industry segment, accounting for 50% of the global market share by 2025. Its use improves mouthfeel, stability, and shelf life in products.

The global tapioca maltodextrin market is experiencing steady growth, driven by increasing demand for clean-label, natural, and non-GMO ingredients across food, beverage, pharmaceutical, and cosmetic industries. Tapioca maltodextrin plays a crucial role as a stabilizer, thickener, and bulking agent, enhancing product texture, shelf life, and formulation consistency without altering taste.

Recent Trends in the Tapioca Maltodextrin Market

Challenges in the Tapioca Maltodextrin Market

Japan leads the tapioca maltodextrin market due to strong demand in functional foods, beverages, and sports nutrition.

Germany and France, follow closely, supported by strict EU clean-label regulations and consumer preference for non-GMO and organic ingredients. While, the UK market is projected to grow at 5.8% CAGR and the USA market at 5.7% CAGR.

The report covers in-depth analysis of 40+ countries, with the five top-performing OECD nations highlighted below.

The Japan Tapioca Maltodextrin revenue is growing at a CAGR of 8.1% from 2025 to 2035. Growth is driven by increasing demand for clean-label stabilizers and thickeners in beverages, sauces, and confectionery products.

The sales of Tapioca Maltodextrin in Germany are expanding at 6.2% CAGR during the forecast period. Growth is driven by EU clean-label initiatives and rising demand for non-GMO and allergen-free ingredients.

The demand for tapioca maltodextrin market in France is projected to grow at a 6% CAGR during the forecast period. Demand is driven by national food safety standards and consumer inclination towards clean-label, gluten-free, and non-GMO products.

The USA tapioca maltodextrin market is projected to grow at 5.7% CAGR from 2025 to 2035. The growth is driven by sports nutrition, protein powders, and meal replacement products due to its rapid digestibility and energy-supplying properties.

The UK tapioca maltodextrin revenue is projected to grow at a CAGR of 5.8% from 2025 to 2035. Growth is driven by the demand for clean-label and plant-based ingredients.

The tapioca maltodextrin market is moderately consolidated, with leading players like Ingredion Incorporated, Cargill, Incorporated, Tate & Lyle PLC, ADM (Archer Daniels Midland Company), and Roquette Frères dominating the industry. These companies provide high-quality tapioca maltodextrin catering to applications in food and beverages, pharmaceuticals, and personal care sectors. Ingredion Incorporated focuses on clean-label, non-GMO, and organic variants, while Cargill specializes in high-purity maltodextrin with global distribution.

Tate & Lyle PLC delivers innovative texturizing solutions for low-fat and sugar-reduced products. ADM offers starch derivatives aligned with health and wellness trends, and Roquette Frères is known for its advanced processing technologies ensuring consistent quality. Other key players like Shafi Gluco Chem (Pvt) Limited, Tereos, Global Sweeteners Holdings Limited, AGRANA Beteiligungs-AG, and Grain Processing Corporation contribute by providing specialized, sustainably sourced, and high-performance tapioca maltodextrin for diverse industrial applications.

Recent Tapioca Maltodextrin Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 670.6 million |

| Projected Market Size (2035) | USD 1,397.9 million |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/Metric Tons |

| By Dextrose Equivalent (DE) Value | Low DE (1-5), Medium DE (6-10), and High DE (11-20) |

| By Processing Technique | Native Processing, Modified Processing, and Pregelatinized Processing |

| By Functionality | Stabilizing Agents, Thickening Agents, Binding Agents, and Nutritional Enhancers |

| By End-use Industry | Food & Beverage, Pharmaceutical, Nutritional Supplements, and Personal Care & Cosmetics |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Shafi Gluco Chem (Pvt) Limited, Ingredion Incorporated, Cargill, Incorporated, ADM (Archer Daniels Midland Company), Tate & Lyle PLC, Roquette Frères, Tereos, Global Sweeteners Holdings Limited, AGRANA Beteiligungs-AG, Grain Processing Corporation |

| Additional Attributes | Dollar sales by DE value, share by processing technique, regional demand growth, policy influence, clean-label trends, competitive benchmarking |

As per Dextrose Equivalent (DE) Value, the industry has been categorized into Low DE (1-5), Medium DE (6-10), and High DE (11-20).

This segment is further categorized into Native Processing, Modified Processing, and Pregelatinized Processing.

This segment is further categorized into Stabilizing Agents, Thickening Agents, Binding Agents, and Nutritional Enhancers.

This segment is further categorized into Food & Beverage, Pharmaceutical, Nutritional Supplements, and Personal Care & Cosmetics.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is valued at USD 670.6 million in 2025.

The market is forecasted to reach USD 1,397.9 million by 2035, reflecting a CAGR of 7.6%.

The food & beverage segment is expected to hold approximately 50% of the global market share in 2025.

Medium DE (6-10) will dominate the DE value segment with a 41.2% share in 2025.

Japan is anticipated to be the fastest-growing country with a CAGR of 8.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tapioca Pearls Market Analysis - Size, Share, and Forecast 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Granulated Tapioca Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Maltodextrin Business

Digestion Resistant Maltodextrin Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Digestion Resistant Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digestion-Resistant Maltodextrin Market in Japan - Growth & Demand from 2025 to 2035

Digestion-Resistant Maltodextrin Industry Analysis in Western Europe - Growth & Market Insights 2025 to 2035

Demand for Digestion Resistant Maltodextrin in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA