Promises are being made by manufacturers and businesses in tamper-evident packaging as they get pressurized by customers to ensure product safety, authenticity, and regulatory compliance. Growing incidences and rise in concerns regarding counterfeit products, contamination, and theft led many manufacturers toward the inclusion of modern security features such as breakable seals, induction-sealed liners, holograms, and RFID-enabled tracking.

The objective of these efforts is that products will reach customers in unbroken and untampered conditions, which will, in turn, convince the customer that he/she has received a safe product.

Sustainable investments made by companies in tamper-evident packaging include biodegradable security labels and breakaway caps, which can be included under global environmental initiatives. Digital security is no longer a far distance myth; digital authentication technologies such as QR code-enabled verification and blockchain-based tracking are the latest development trends as they provide real-time security updates.

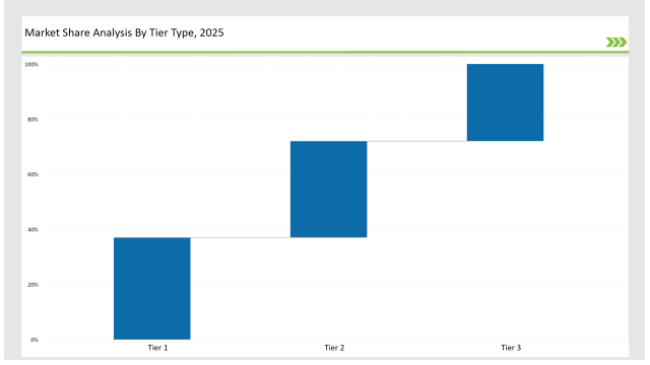

Tier 1 players - Amcor, Berry Global, and Sealed Air - together contribute 37% of the market, thanks to their leadership in high-barrier security packaging, innovative tamper-evident solutions, and widespread global distribution networks.

Tier 2 companies, like Avery Dennison, CCL Industries, and Coveris, add their 35% share in the market by providing affordable, versatile, and advanced security packaging, primarily focused on the pharmaceutical, food, and personal care applications for the end-use customers.

Regional and niche players engaged in the production of authentic security seals, forensic authentication features, and smart packaging solutions account just 28% of the market. Local production is the focus of the companies, the use of cutting-edge anti-counterfeit measures, and environmental responsibility tamper-evident technologies.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Berry Global, Sealed Air) | 17% |

| Rest of Top 5 (Avery Dennison, CCL Industries) | 12% |

| Next 5 of Top 10 (Coveris, WestRock, Denny Bros, Placon, UPM Raflatac) | 8% |

The tamper evident packaging industry serves multiple sectors where security, regulatory compliance, and product integrity are essential. Companies are developing advanced solutions to deter tampering and improve transparency.

Manufacturers are optimizing tamper evident packaging with high-performance materials, security enhancements, and sustainable alternatives.

Security and sustainability are changing the face of the tamper-evident packaging industry. Businesses look to integrate AI-based tracking, plant-based security films, and digital verification systems to increase their level of protection. To enhance recyclability without compromising security, businesses are in the process of developing strong but lightweight tamper-proof seals. Manufacturers are also developing forensically oriented authentication solutions to mitigate counterfeiting and establish product authenticity. In addition, companies are now fine-tuning their production with engineered security tapes and shrink bands that promote better packaging integrity.

Year-on-Year Leaders

Technology suppliers should focus on automation, secure digital tracking, and environmentally friendly materials to support the evolving tamper evident packaging market. Partnering with pharmaceutical, food, and retail brands will drive adoption and market expansion.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Berry Global, Sealed Air |

| Tier 2 | Avery Dennison, CCL Industries, Coveris |

| Tier 3 | WestRock, Denny Bros, Placon, UPM Raflatac |

Leading manufacturers are advancing tamper evident packaging technology with AI-driven automation, smart authentication features, and sustainable materials.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched biodegradable pharmaceutical security seals in March 2024. |

| Berry Global | Developed child-resistant breakaway caps in April 2024. |

| Sealed Air | Expanded RFID-enabled security tracking solutions in May 2024. |

| Avery Dennison | Released holographic security labels in June 2024. |

| CCL Industries | Strengthened forensic authentication for pharmaceuticals in July 2024. |

| Coveris | Introduced tamper evident tapes with blockchain in August 2024. |

| WestRock | Pioneered paper-based tamper proof packaging in September 2024. |

The continuous integration of AI-based security tracking, sustainable tamper-proof materials, and advanced anti-counterfeiting technologies will be undertaken by the industry. Manufacturers will be improving RFID and blockchain verification for enhanced authentication purposes. Companies will implement biodegradable alternatives to plastic tamper-evident seals in order to minimize plastic waste. Smart labels will be enhancing supply chain transparency. On the other hand, companies will develop high-performance lightweight security films for better recyclability and efficiency.

Leading players include Amcor, Berry Global, Sealed Air, Avery Dennison, CCL Industries, Coveris, and WestRock.

The top 3 players collectively control 17% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include security, sustainability, smart tracking, and regulatory compliance.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.