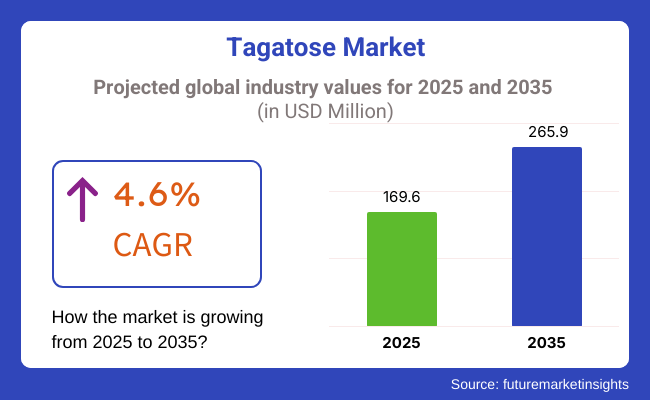

The tagatose market is projected to grow from USD 169.6 million in 2025 to USD 265.9 million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.6% over the forecast period. The growth is mainly due to the rising need for low-calorie as well as natural sugar substitutes across the food and beverage sector. Tagatose, a naturally occurring monosaccharide, provides about 92% of the sweetness of sucrose but contains much fewer calories, making it an appealing choice for health-conscious consumers.

The increasing incidence of diabetes and obesity has increased the need for healthier sweetening options. The low glycemic index of tagatose has led top food manufacturers to use it for diabetic-friendly products, which is increasing its consumption in food application segments such as beverages, dairy products, and confectioneries. Furthermore, there is an increasing trend toward the use of clean-label and natural ingredients in food products that has fostered the application of tagatose as a sweetener of choice.

However, the high production cost and non-availability of raw materials may hamper the marginal growth of the market. The tagatose molecule cannot be made up from scratch like glucose or fructose; it has to be extracted from lactose, a laborious process that involves fermentation and is often too expensive to be used on a wide scale. Additionally, limiting the potential growth of the market is the threat from competing low-calorie sweeteners.

Regionally, North America and Europe are anticipated to hold a large share of the tagatose market as there is significant awareness among consumers of health and wellness, along with the presence of key industry players. The Asia-Pacific region is expected to register essential growth during the forecast period, owing to the increasing health consciousness and growing disposable incomes.

Research and Development (R&D) are key focus areas for major end-market players due to the constant need for new & improved products, as few manufacturers have established built-in costs for modifications due to aftermarket service costs. Companies are also focusing on research and development activities to optimize extraction technologies and minimize the cost of production, ensuring wider availability of tagatose among different consumer bases.

The purchase criteria across various segments differ for the global tagatose market, among which are food and beverage manufacturers, which are significant buyers. These companies are looking for tagatose sweeteners because of their taste, stability, and low glycemic index, making them one of the perfect sweeteners for baked goods, beverages, and confectionery products.

In supply chains, cost-effectiveness and scalability are high priorities, leading manufacturers to opt for tagatose only if they can be incorporated at an industrial scale. Preference is given to suppliers with a competitive pricing structure, reliable sourcing, and innovative product formulation.

Tagatose is particularly sought after in diabetic and weight-management formulations by pharmaceutical and nutraceutical companies. When choosing suppliers, stability in different conditions and bioavailability are key. Purchasing decisions in this segment are influenced by scientific validation of health benefits along with safety certifications and regulatory approvals.

Retailers and end consumers, however, have been told that clean-label positioning, sustainability, and affordability matter. Consumers prefer natural, low-calorie options with transparency in the ingredient sourcing and limited processing.

The rise in demand for sugar alternatives to keep up with health-conscious trends should grow for the tagatose market. Firms focused on innovative manufacturing methods, regulations, and supply chains will be in a good position in this shifting economy.

Between 2020 and 2024, demand for tagatose grew as people searched for low-calorie, low-glycemic index sweeteners. Tagatose, a naturally occurring sugar, was quickly noticed because it is second only to sucrose in taste and function, making it a perfect ingredient for many food applications. Its low glycemic effect and prebiotic characteristics also catered to the growing demand for healthier food alternatives for consumers and the needs of patients living with diabetes.

Its use in the industry of diabetic-friendly products and as a prebiotic ingredient drives the demand. Market penetration will depend on regulatory approvals and consumer awareness. Moreover, due to the increasing trend towards using natural and functional ingredients, the use of tagatose may widen its scope to be included in the food and beverage industry, among other functional foods and nutraceuticals. Technology developments, sustainability efforts, and changing consumer preferences toward health and environmental consciousness will propel these markets from 2025 to 2035.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The tagatose market experienced steady growth, driven by increasing consumer demand for low-calorie and natural sweeteners. | The market is projected to continue its expansion, with advancements in production technologies and broader applications across various food and beverage sectors. |

| Applications were primarily in food and beverage products as a low-calorie sweetener, especially in dairy products, beverages, and confectionery. | Applications are expected to diversify into pharmaceuticals, nutraceuticals, and personal care products, leveraging the functional properties of tagatose beyond its sweetening capabilities. |

| North America and Europe were key markets, with significant consumption driven by health-conscious consumers seeking sugar alternatives. | Asia-Pacific is anticipated to witness significant growth, with increasing health awareness and demand for low-calorie sweeteners in emerging economies. |

| Challenges included high production costs and limited availability, which hindered widespread adoption. | Technological advancements in production methods are expected to reduce costs and improve scalability, facilitating broader market penetration. |

| Research focused on optimizing extraction processes and exploring health benefits associated with tagatose consumption. | Innovations in biotechnology and sustainable production practices are projected to enhance product offerings and application development. |

| Consumer awareness of health risks associated with high sugar consumption contributed to market demand. | Growing consumer preference for natural and healthier sugar substitutes is likely to drive further market expansion. |

| Investments in research and development increased, reflecting a trend toward improved production efficiency and product quality. | Continued investments in sustainable practices and regulatory support are expected to bolster market growth. |

The industry is growing, but it has considerable risks. High production costs are still a key hurdle. Tagatose is expensive because its manufacturing is complex, and therefore, tagatose is expensive to produce. This might lead a company to invest in the development of more scalable production methods, for example, by using enzymatic conversion or microbial fermentation.

Challenges from the supply chain also complicate market stability. This leads to supply bottlenecks and price volatility due to limited raw material availability and inefficient production processes. Establishing alternative production routes can ensure a stable supply chain. Regulatory challenges are also a drag on growth.

Tagatose’s status as a novel food ingredient in many parts of the world adds to this problem, as does the fact that some 250 novel food applications are already under review in the European Union, which can extend delays in reaching the market. A key ingredient to global expansion is regulatory compliance and easy-to-obtain approvals.

An example of a major risk is consumer awareness. Tagatose is far less known to consumers than more widely marketed sugar substitutes such as stevia and erythritol. It can be improved with an effective marketing strategy and collaboration with food manufacturers. To reduce these risks, companies need to innovate in production, seek regulatory approval, educate consumers, and cut costs. Enhancing supply chain resilience and building further awareness will be essential to maintaining market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.90% |

| UK | 6.50% |

| France | 6.60% |

| Germany | 6.80% |

| Italy | 6.30% |

| South Korea | 7.10% |

| Japan | 7.00% |

| China | 7.20% |

| Australia | 6.20% |

| New Zealand | 6.10% |

The United States tagatose market is witnessing growth on the back of rising demand for natural, low-calorie sugar substitutes in beverages, dairy, and confectionery products. Food makers are adding tagatose in sugar-free and reduced-calorie foods in the wake of rising diabetes and obesity rates.

Tagatose's wider adoption is due to FDA approval as a Generally Recognized as Safe (GRAS) ingredient. Companies such as Bonumose and Nutrilab are working on enzymatic production methods that will be more affordable than those used with tagatose today.

Sports nutrition and functional food industries are also increasing growth by using tagatose in their products for its prebiotic properties. In addition, the government-supported health programs that encourage cutting sugar intake are motivating manufacturers to replace traditional sweeteners with tagatose-based ones.

The tagatose market in the United Kingdom is expanding steadily, driven by growing awareness of the health risks associated with sugar and a shift toward natural sugar alternatives. Adoption has been boosted by the UK government's sugar tax policies and public health campaigns promoting low-sugar diets.

Tagatose finds its application in low-calorie baked products, beverages, and dairy products satisfying the health-thinking customer segment. The growing population of diabetes drives the functional sweetener market market, as well as the increasing adoption of plant-based diets. In fact, clean-label, non-GMO ingredients are a priority for food manufacturers in the UK, which should make tagatose even more appealing. Enable market penetration through the retail expansion of specialty health food products.

The industry is rising due to growing interest in more natural sweeteners in premium bakery, confectionery, and dairy products. Tagatose, with its clean-label and organic options, aligns well with this trend toward healthy eating among French consumers. French government efforts to reduce sugar consumption in processed foods have spurred food manufacturers to explore alternative sweeteners.

The booming organic food market also includes tagatose among sugar-free and reduced-calorie foods. French beverage firms are also using tagatose in sugar-free sodas and flavored waters in response to the increased health-conscious trend among consumers. Strong export markets for premium food products in the country have further accelerated demand.

The industry is growing as the country is focused on functional food innovations and sugar reduction programs. Tagatose isn't usually added to chocolate, protein bars, or drinks, but the need for these diabetic-friendly varieties is so high it pushes producers to increase their, thus, potential usage in these products.

This is being further pushed by the sports nutrition and weight management industry, where tagatose finds application in use as a functional sweetener in meal replacements and energy supplements. Government support for clean-label and natural sweeteners is pushing companies to develop plant-based and non-artificial sugar alternatives.

The German biotechnology companies are aiming to enhance the fermentation-based tagatose production process. Moreover, tagatose is catching on as a choice over high-GI sweeteners to complement the growing trends toward vegan and keto diets.

The tagatose market is rising because of the growing consumption of natural and plant-based sweetening agents [in traditional desserts, gelato, and baked products in Italy]. With the increase of organic and functional food products, manufacturers have incorporated low-calorie sweeteners in sugar-free dairy products and beverages.

Low-GI confectionery also targeting diabetic consumers using tagatose has been used by targeting diabetic consumers (Italian Food Brands). The growing adoption of alternative sweeteners aligns with the government's push to reduce sugar in processed foods.

Moreover, the increasing health of the specialty food business in Italy is contributing to the demand for tagatose-based goods. However, there are still challenges to widespread adoption due to the high production costs and regulatory hurdles involved.

The industry is anticipated to witness significant growth over the forecast period, owing to the increased consumer inclination for sugar substitutes in functional foods, beverages, and dietary supplements. In food manufacturing, the government's focus on health-oriented policies has resulted in a move towards low-calorie, natural sweeteners.

The oral health and skincare space in the beauty and wellness industry is also considering tagatose. As pandemic-related concerns about obesity and diabetes mount, Korean food brands are featuring tagatose in sugar-free tea, coffee drinks, and baked goods. A South Korean company is developing inexpensive production methods for tagatose to bring products based on tagatose both in the domestic and export markets.

Rising health awareness and growing demand for functional and sugar-free foods are driving the growth of Japan's tagatose market. Japanese food companies are incorporating tagatose into traditional sweets, products based on green tea, and other low-sugar snacks.

The government has actively focused on reducing sugar intake, which has influenced the use of natural sugar substitutes in beverages, confectionery & dairy products. To scale up the availability of tagatose, Japanese biotech companies have been working on fermentation methods of production. Tagatose applications from the functional food industry, specifically in anti-aging and gut health, are another area of growth to watch. Japan's export market for high-value, sugar-free products is also generating demand.

The demand for tagatose in China is growing steadily as the demand for sugar substitutes in functional foods, energy beverages, and drugs increases. Government regulations in favor of sugar cuts in processed foods are driving manufacturers to adopt food uses of natural sweeteners like tagatose.

The growth of the diabetic population in China has prompted more interest in low-GI and diabetic-friendly products. Tagatose can now be produced at a lower cost and on a wider scale thanks to investments in inexpensive production methods by Chinese biotech firms. The adoption of tagatose is also driven by the expansion of China's nutraceutical and health food industry, where it is commonly used in dietary supplements and weight management products.

Increasing consumer demand for clean-label and natural sweeteners has been driving the Australian tagatose market. The food and beverage industry is utilizing tagatose in sugar-free chocolates, meal replacement drinks, and energy bars.

The residential sector is another major driver in the growth of tagatose, which is used in protein powders and functional snacks. The support by the Australian government for sugar reduction policies is putting pressure on food manufacturers to turn to low-calorie sweeteners.

Studies show tagatose can be used as an alternative carbohydrate in the ketogenic diet; it does not interfere with carbohydrate metabolism while also having an anti-obese property tethered to its hypolipidemic properties; therefore, dieters on cell metabolism with decreased energy status may try tagatose safely, and supplementation may indeed support cell function and health, leading to building lean body mass. Similarly, increased awareness of gut health and prebiotics is expected to stimulate the demand for functional-based food tagatose as well.

Growing demand for natural sweeteners for functional food, beverages, and organic food products, because of which New Zealand's tagatose market is growing. Tagatose is being added to sports nutrition products, foods for diabetics, and meal replacements in the country's food industry.

The New Zealand government's focus on sugar reduction in processed food is also catalyzing adoption. Scientific research establishments are looking into the gutsy benefits of tagatose, too, promoting it as a microbiome-friendly sweetener.

Tagatose is classified into synthetic and naturally derived Tagatose. For clean-label, health-conscious consumers, the naturally derived version of the sweetener found in dairy and fruit, Tagatose, is the product of choice. It is a naturally occurring sugar called rare sugar with prebiotic properties, which means it promotes gut health.

Although effectively the same chemical, Synthetic Tagatose is rapidly becoming the form of Tagatose used in high-volume production at low cost, making it a much lower investment avenue for manufacturing on an industrial scale. Tagatose is progressively being favored over sucrose and high-fructose corn syrup primarily due to its functional benefits, improvement in glycemic control, and weight management, which can be witnessed by increased research on this ingredient.

Food & beverages are the most opportunistic in demand; Tagatose is used as a sugar substitute in baked goods, drinks, and dairy products. This makes it ideal for diabetic blues products that still want the taste and texture of sugar but want fewer calories and lower glycemic index.

The pharmaceutical industry has extended its application as well, especially in managing diabetes by controlling blood sugar without increasing insulin levels. Furthermore, Tagatose is being utilized in oral care and skin care formulations in the cosmetics industry. Due to its humectant properties, it is also used as an important ingredient in moisturizers, toothpaste, etc., and prevents dehydration in the body.

Rapid growth in the tagatose industry is being driven by the demand for low-calorie, natural sweeteners as consumers move away from sugar and artificial substitutes. Tagatose (in terms of sweetness, is 92% as sweet as sucrose while the use of only 38% calories) is a rare sugar attracting more and more attention in the food, beverage, and pharmaceutical industries due to its low glycemic index (GI) and its prebiotic benefits.

It has important applications in dietary foods, diabetic foods, functional beverages, and pharmaceuticals. Increasing health awareness, regulatory approvals, and development in enzymatic manufacturing technologies for improved cost-effectiveness and scalability draw the market upward. The FDA approval of tagatose as a safe sweetener, as well as EFSA's approval, has also contributed to its increasing use in international markets.

While it has significant potential, market expansion is hindered by high production costs, limited availability of raw materials (i.e., lactose-based sources), and competition from alternative sweeteners, allulose, stevia, etc. Nonetheless, the market is anticipated to move forward on the back of strategic partnerships, innovative fermentation-based production technologies, and growing investment in R&D. Manufacturers capable of minimizing production costs without compromising high-purity tagatose preparations will gain a decisive advantage in the market.

Market Share for Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Bonumose, Inc. | 20-25% |

| Nutrilab NV | 14-18% |

| CJ CheilJedang | 12-16% |

| Südzucker AG (BENEO) | 10-14% |

| Ingredion Incorporated | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bonumose, Inc. | Pioneering low-cost enzymatic tagatose production for mass adoption. |

| Nutrilab NV | Specializes in high-purity tagatose for food and beverage applications. |

| CJ CheilJedang | Developing fermentation-based tagatose production for enhanced sustainability. |

| Südzucker AG (BENEO) | Focuses on functional tagatose for diabetic-friendly and prebiotic foods. |

| Ingredion Incorporated | Invests in alternative sugar solutions, including tagatose-based blends. |

Key Company Insights

Bonumose, Inc. (20-25%)

A leader in enzymatic tagatose production, Bonumose is reducing manufacturing costs to enable wider market adoption.

Nutrilab NV (14-18%)

Specializes in high-purity tagatose, serving premium food and beverage brands.

CJ CheilJedang (12-16%)

Focuses on fermentation-based tagatose, offering a more sustainable production approach.

Südzucker AG (BENEO) (10-14%)

Targets functional foods, integrating tagatose into prebiotic and diabetic-friendly formulations.

Ingredion Incorporated (6-10%)

Investing in tagatose-based sweetener solutions, expanding global market reach.

Other Key Players (30-40% Combined)

Food-grade and pharmaceutical-grade.

Food & beverages, pharmaceuticals, dietary supplements, and others.

North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA)

The industry is expected to generate USD 169.6 million in revenue by 2025.

The market is projected to reach USD 265.9 million by 2035, growing at a CAGR of 4.6%.

Key players include Damhert Nutrition NV, CJ Cheiljedang Corporation, Bonumose LLC, Arla Foods, and Tokyo Chemical Industry Co., Ltd. (TCI).

North America and Europe, driven by increasing demand for natural sugar alternatives, clean-label ingredients, and diabetic-friendly sweeteners.

Food-grade tagatose dominates due to its applications in sugar-free and reduced-calorie food products, including confectionery, dairy, and functional beverages.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 23: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 35: South Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: Oceania Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 46: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Form, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 20: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Form, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 38: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 56: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 66: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Form, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 74: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 75: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 84: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 92: South Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 93: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 102: South Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 110: Oceania Market Value (US$ million) by Application, 2023 to 2033

Figure 111: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 120: Oceania Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA