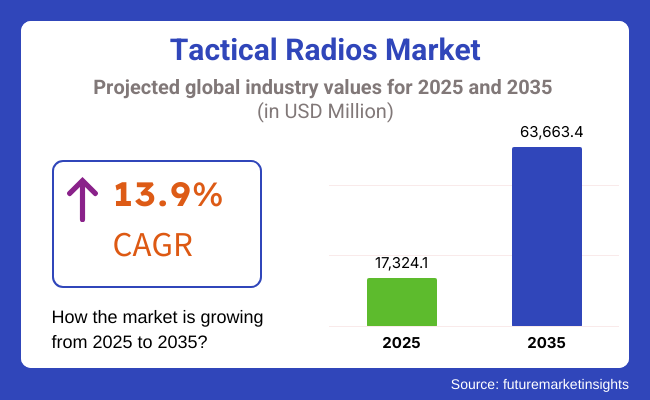

The sales of Tactical Radios Market are estimated to be worth USD 17,324.1 million in 2025 and are anticipated to reach a value of USD 63,663.4 million by 2035. Sales are projected to rise at a CAGR of 13.9% over the forecast period between 2025 and 2035. There is a growth in the industry as there is a need for secure and reliable communication systems in defense, law enforcement, and emergency response operations.

These devices effectively serve the purpose of voice and data communication in real-time, enabling coordination and situational awareness to be done without seams in critical missions. The increase in the need for advanced communication solutions on the battlefield and the military forces being able to work together are the driving forces behind the growth.

The primary force of growth is the modernization plans in the defense and security sectors. Almost all countries are putting their money into next-generation tactical communication systems to increase operational efficiency and battlefield effectiveness. Software-defined radios (SDRs), encryption technologies, and satellites are being utilized better by these devices through connectivity, which is the main reason for such improvement in performance and adaptability in challenging environments

Companies that deal with production are very much aware of the focus on network-centric warfare and secure communication solutions. Moreover, the military is giving priority to systems that are not only interoperable but also cyber-resilient. These systems can support the operation of multiple frequencies as well as encrypted communication. Also, the growing use of these devices in disaster management and emergency response activities is another factor contributing to development.

Innovation and technological advancement are the driving forces behind the introduction of new products. Lightweight, rugged, and long-range tactical radios that allow more motor mobility and operational flexibility for the defense and security force personnel have been developed. Furthermore, the integration of new AI-driven communication protocols has led to the emergence of cognitive radio technology and miniaturized radio systems, thus revolutionizing the industry.

Nonetheless, there are several difficulties, particularly acquisition costs, spectrum allocation challenges, and cybersecurity risks. Technical issues arise due to the complexity of modernizing the radio networks while integrating them with the legacy communication systems a lot of times. Along with these challenges, export restrictions on communication devices of military-grade quality play an important part in affecting growth.

Still, there are numerous opportunities for growth. Deployment of tactical communication networks in border surveillance, counterterrorism, and homeland security are mainly responsible for the rise in demand for new radio networks.

Moreover, the 5G technology-based tactical radios will be the key area of development apart from the AI-enabled signal processing technologies, which will, in turn, lead to an increase in communication abilities in the areas with high threats. As the defense and security agency continues to consider mission-critical communication as the top priority, the tactical radio sector will continue to grow in the years to come.

There was progressive growth from 2020 to 2024 as a result of increasing defense budgets and the increased demand for secure and stable communication networks by police and military organizations. These radios were key in providing situational awareness and ensuring real-time communication while conducting operations and responding to emergencies.

The implementation of Software-Defined Radios (SDRs) provided more operational flexibility by facilitating smooth interoperability between frequency bands and communication protocols. Improvements in encryption and anti-jamming technology enhanced the security of tactical communications networks.

Challenges like signal interference, spectrum scarcity, and expensive advanced systems hindered growth. Joint defense initiatives and military modernization programs in allied nations further accelerated the need for next-gen tactical radios.

During 2025 to 2035, the industry is anticipated to see remarkable growth through advances in satellite communications, 5G, and AI technologies. AI will support real-time signal processing, auto frequency adjustment, and adaptive response against threats. The combination of 5G and low-latency satellite networks will increase connectivity in far-flung and hostile environments with no interruption of communication.

More use of portable, ruggedized, and multi-band tactical radios will allow more flexibility and reliability in mission environments that are complicated. Cybersecurity will also be addressed, with new radios incorporating increased encryption and self-healing capabilities to address the evolving nature of cyber threats.

Self-sustaining communication networks powered by AI and blockchain technology will enable tamper-proof and decentralized data exchange. Defense contractors will focus on the use of lightweight materials and low-energy designs in order to promote mobility and reduce soldier fatigue in extended missions.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Greater adoption of software-defined radios (SDRs) for mission flexibility and interoperability enhancement. | Use of AI-driven communication protocols and cognitive radio techniques to dynamically optimize the spectrum in real time. |

| Secure communications protocols and encryption to deliver non-interception of signals. | Quantum-proof encryption standards and threat detection on an automated basis deliver better communications security. |

| The transition from analog to digital communications systems, increasing range and voice quality. | Mesh networking and multi-band frequency hopping are used for secure, reliable battlefield communications. |

| The first application of artificial intelligence is to more dynamically allocate frequencies and minimize signal interference. | AI-autonomous networks that can switch to react dynamically to combat situations. |

| Increased interoperability among allied forces through embedded communications protocols. | Smooth integration of land, sea, air, and space networks for multi-domain operations. |

| Police and military forces used these devices for mission-critical, secure communication. | Increased application in disaster response, emergency management, and critical infrastructure protection. |

The industry is expanding, mostly due to factors like the need for trustworthy and safe communication in defense, emergency services, and law enforcement. The radios are essential for real-time communication on the battlefield, coordinating responses to crises, and securing transmissions during mission operations.

For emergency response, like fire and medical response units, tactical radios with long battery life, real-time GPS location tracking, and clear audio transmission are essential. In the commercial world, too, some sectors, such as construction and private security, are now adopting them with an emphasis on security features like advanced encryption or military-grade ruggedness.

With the rise of 5G and software-defined radio (SDR) technology, the field is heading towards multi-band, network-based solutions equipped with AI-based communication functions, which will ensure quick response and better operational efficiency in demanding pressures.

The industry is penetrating every corner of the globe, primarily due to the ever-increasing defense modernization expenditures and the corresponding rise in the quest for secure communication solutions. Nevertheless, the very strict military-grade encryption regulations and spectrum allocation compliance cause operational hurdles.

Supply chain disruptions, such as the shortage of semiconductors, fluctuations in raw material prices, and geopolitical tensions, are the factors affecting the production and delivery timelines. The dependence on specific suppliers for important components will bottleneck the process. The companies are suggested to form multiple suppliers, a strategic sourcing approach, and a localized manufacturing plant to improve the supply chain resilience.

The quick technological evolution in secure communication systems, software-defined radios, and artificial intelligence (AI)-)-Driven networking causes the origin risks of obsolescence and interoperability problems. The integration of next-generation technologies requires the systems to be compatible with the legacy systems, which is a priority.

The increase in cyber threats and the growth of electronic warfare capabilities are significant risks to tactical radio networks. Jamming the signals, creating data breaches, and attempting to hack might lead to miscommunication of the communication channels that are critical for the test. Putting strong encryption, frequency-hopping technologies, and AI-based threat detection into place will be powerful for protective measures of the communication lines.

Financial limitations, the variations in the defense budgets, and the argument of procurement cycles are the reasons for instability in the industry. To be sure about growth in the long run, businesses are supposed to center their attention on innovations, partnerships with defense agencies, and flexible pricing strategies that will adapt to the various military and security needs.

The section contains information about the leading segments in the industry. Application: The Army segment will have a share of 27.4% in 2025. By Type, the Vehicle-Mounted segment is estimated to grow at a CAGR of 14.1% during the forecasted period.

| Application | Share (2025) |

|---|---|

| Army | 27.4% |

The industry is categorized by application, with the Army dominating at 27.4% share, followed by the Navy at 25.0% in 2025. The Army segment commands the tactical radio market because of the increasing need for secure and robust communication networks in contemporary warfare. There is a growing need for advanced, software-defined radios (SDRs) and multi-band frequency capabilities to ensure seamless communications in theater operations.

Ground troops are deploying tactical HF and VHF radios from major defense players like L3Harris Technologies, Thales Group, and Collins Aerospace to enable situational awareness and mission-critical communication. The growing use of network-centric warfare and digitized battle management systems is further adding to the growth of this segment.

In favor of operations at sea, the Navy segment is a high investment in cost-effective and secure naval communications systems. Both electronic warfare and anti-submarine warfare, as well as fleet coordination, become so critical, creating the demand for these high-performance ultra-high-frequency (UHF) and satellite-based tactical radios for use among naval forces.

BAE Systems and Northrop Grumman are developing technologies that are encrypted and employ fast-frequency hopping technologies to help counter cyber threats and electronic attacks. Modern naval ships and submarines are also incorporating software-defined communications to enhance interoperability within defense networks.

As militaries across the world shift their focus toward improving real-time communication, interoperability, and electronic warfare, the requirement for next-generation tactical radios within both land and naval forces is anticipated to increase gradually.

| Type | CAGR (2025 to 2035) |

|---|---|

| Vehicle-Mounted | 14.1% |

The industry is projected to expand considerably between 2025 and 2035 with the advancement in communication technologies and increased military modernization activities across the world. Categorization is done as Vehicle-Mounted and Handheld/Portable devices, which are both expected to have high compound annual growth rates (CAGR) in the forecast period.

The Vehicle-Mounted segment is expected to witness a growth rate of 14.1% CAGR. The increasing use of armed vehicles, combat support vehicles, and tactical command vehicles with the latest communication systems can drive the growth. These radios have better transmission capacity, increased range, and secure data transfer, which makes them vital for battlefield coordination in real-time and network-centric warfare.

The main players, L3Harris Technologies, Thales Group, and BAE Systems, are focusing on investing in software-defined radios (SDRs) for armored vehicles to bring about interoperability, frequency versatility, and jam-resistant capabilities. With the augmentation of defense expenditures around the globe and the development of next-gen tactical networks being incorporated, there will be tremendous growth in demand for vehicle-borne systems.

The Handheld/Portable segment is anticipated to grow at a CAGR of 12.5% with the growth in the need for lightweight, compact, and rugged communication devices for dismounted troops, special operation units, and emergency response teams. These radios offer secure voice and data communication, GPS location tracking, and real-time battlefield situational awareness.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.7% |

| UK | 10.2% |

| France | 10.8% |

| Germany | 11.5% |

| Italy | 10.3% |

| South Korea | 12.0% |

| Japan | 11.2% |

| China | 13.8% |

| Australia | 9.8% |

| New Zealand | 9.5% |

The USA is expected to grow at 12.7% CAGR during the years 2025 to 2035. The country has one of the biggest defense budgets in the world and continuously spends on future communications technology. Key defense industries like L3Harris Technologies and Raytheon are also drivers of innovation with Software-Defined Radios (SDRs) and next-gen communication technologies. USA military modernization, for example, through the Future Tactical Network program, is driving demand for these radios, as they provide greater security features and interoperability.

Apart from this, private defense firms collaborate with governmental agencies to develop satellite-based and AI-based communication products, offering end-to-end operations in air, land, and sea terrains. Increased focus on safeguarding tactical communications from cyber attacks is also fueling growth, and one of the most lucrative markets for these radios is in the USA

The UK is projected to expand at 10.2% CAGR during 2025 to 2035. The country prioritizes the enhancement of its military communication infrastructure to enable better connectivity on the battlefield. BAE Systems and Cobham, both established defense industry figures in the UK, hold a pivotal role in designing robust, secure communications systems for the armed forces.

Future soldier modernization programs focus on work to achieve improved interoperability with NATO allies and compel the integration of high-tech radios. The uptake of combined satellite communications by the UK that can enable a longer range of communications, even at longer ranges where the terrain is desert, further increases the need for advanced radio systems.

France's tactical radios market is expected to grow at a CAGR of 10.8% during 2025 to 2035. The country spends heavily on network-centric warfare, which is fueling the creation of advanced communication systems for its military. Thales Group, France's top defense producer, is leading the way in creating tactical radio solutions with cutting-edge encryption and AI capabilities.

SCORPION, the program aimed at more efficient battlefield coordination and networked warfighting capabilities, is driving growth. Interoperability through radios in defense alliances in Europe is another effort that France is giving priority to in order to facilitate ease of communication among friendly forces. Increased military deployment of digital communications and AI-enabled decision-making further helps the industry to grow.

Germany's tactical radio market is forecast to grow at a CAGR of 11.5% during 2025 to 2035. The country is eager to upgrade its military communication networks according to NATO standards. Rohde & Schwarz, a leading German defense contractor, designs highly secure tactical radio systems based on advanced encryption and interference protection.

Germany's commitment to trusted battlefield comms and net-centric warfare fuels next-gen radio demand. The country is also expanding its military presence in European defense unions, meaning interoperable radio capability for coalition warfare. Because of the rising threat of cybersecurity attacks, encrypted tactical comms systems are growing.

The Italian tactical radios market is anticipated to develop at a CAGR of 10.3% from 2025 to 2035. Italy's defense modernization policy and its participation in NATO and EU military operations are driving the demand for secure tactical communications. Leonardo S.p.A., one of the prominent Italian defense institutions, is engaged in developing tactical radio solutions with robust security features.

Italy's defense forces are deploying more SDRs and AI-enabled communications technology to increase connectivity on the battlefield. Their emphasis on naval and aerospace defense again contributes to the need for advanced radio systems with end-to-end integration between military services.

South Korea is also likely to observe a CAGR of 12.0% during 2025 to 2035. It is driven by the development of military communications within South Korea on account of geopolitical security concerns and propels spending on advanced radio technology. Top defense electronics vendor Hanwha Systems aggressively creates the most advanced next-generation devices with cyber resilience and real-time data-sharing features.

South Korea's adoption of 5G technology for its military communications and rising defense cooperation with the USA and NATO drive growth. Furthermore, AI-based communication increases demand for high-performance radios.

Japan's tactical radios market is predicted to expand at an 11.2% growth rate during 2025 to 2035. Japan has a defense policy of secure military communications as a nation. Some of the manufacturers of advanced high-frequency-resistant encrypted radio systems are Mitsubishi Electric and NEC Corporation.

Japan's increasing involvement in joint military exercises with the USA and other nations demands interoperable tactical communication systems. Increasing use of satellite-based communications and AI decision-making in combat missions also requires the deployment of next-generation tactical radios.

The Chinese industry for tactical radios will grow at 13.8% CAGR from 2025 to 2035. The country invests heavily in domestically developed defense technology, including high-end communication technologies. They are trailed by players like CETC (China Electronics Technology Group) in manufacturing high-capacity devices with AI-automatic operation and satellite features.

China's modernization of its military in electronic and cyber warfare is the major driving force behind the demand for secure tactical radio networks. Adding quantum encryption to communications from radios gives security and makes China a top supplier in the international market of these devices.

Australia's tactical radios market will grow at 9.8% CAGR between 2025 to 2035. The growth is driven by Australia's focus on the development of defense communication hardware and improving battlefield coordination. Codan Communications is an Australian defense technology company that specializes in developing secure, long-range tactical radio systems.

Australian Defense Force's investments in future networks and communications and war systems are driving the requirement for advanced radios. Australia's defense relationship with the USA and the UK is also creating avenues for cooperative technology development to secure communications.

New Zealand's tactical radio market will expand at 9.5% CAGR from 2025 to 2035. While the country may have a lower defense budget, it is keen on enhancing military communications for foreign peacekeeping missions. Tait Communications, a leading New Zealand company, manufactures these devices with enhanced security features and interoperability.

New Zealand's emphasis on defense interoperability of communication with allies and disaster relief drives market growth. Satellite radio system integration for military and emergency applications further boosts demand for next-generation tactical communication solutions.

The industry is booming as defense and security agencies seek secure, interoperable, and real-time communication solutions. Military modernization programs, steady increases in defense budgets, and demand for encrypted software-defined radios (SDRs) are propelling the growth of this market.

The market is primarily led by companies such as L3Harris Technologies, Thales Group, BAE Systems, Northrop Grumman, and Raytheon Technologies Corporation. These are providing advanced SDRs, networked communication solutions, and AI-enhanced radio systems. Niche defense-tech startups are also innovating in tactical radio solutions of mesh networking, satellite-integrated communication, and cybersecurity to bolster operational efficiency.

The market is rapidly evolving due to a rising demand for miniaturized, ruggedized, and multi-band radio systems used in defense, public safety, and border security applications. Increased investments in broadband tactical communication and AI-enabled spectrum management are intensifying competition in the sector.

Key strategic factors include securing government defense contracts, promoting cross-border military collaboration, and integrating systems with battlefield management solutions (BMS). Companies' long-term growth strategies also focus on expanding into export markets, strengthening cybersecurity measures, and enhancing the software upgradability of their products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| L3Harris Technologies, Inc. | 20-25% |

| Thales Group | 15-20% |

| BAE Systems | 12-16% |

| Northrop Grumman Corporation | 10-14% |

| Raytheon Technologies Corporation | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| L3Harris Technologies, Inc. | Specializes in multi-band, multi-mission devices with encrypted communication. It focuses on software-defined radios (SDRs). |

| Thales Group | Offers tactical communication solutions with an emphasis on interoperability and battlefield connectivity. |

| BAE Systems | Develops ruggedized devices optimized for electronic warfare resilience and secure communications. |

| Northrop Grumman Corporation | Focuses on next-gen devices with advanced signal processing for mission-critical applications. |

| Raytheon Technologies Corporation | Provides integrated communication systems with enhanced situational awareness and anti-jamming capabilities. |

Key Company Insights

L3Harris Technologies, Inc. (20-25%)

L3Harris asserts itself as the recognized leader in manufacturing these radios, supported by years of extensive expertise in the field of safe military communications. Its ardent concentration is on the development of multi-band and multi-mission radios, which will provide robust connectivity in tough operational conditions.

Thales Group (15 to 20%)

Thales has managed to capture the lion's share of the market through security-oriented, mission-critical communication solutions. The new SYNAPS family of radios promises cutting-edge technology that allows seamless integration into already existing communication infrastructure.

BAE Systems (12-16%)

BAE Systems struck a very good balance in developing highly secure and ruggedized devices that catered to extreme combat situations. Such radio solutions include encrypted voice and data transmission that secure communications channels from interception in electronic warfare environments.

Northrop Grumman Corporation (10-14%)

Northrop Grumman specializes in the creative development of radios that incorporate advanced signal processing and anti-jamming features. The firm is working towards next-generation waveforms that will probably usher in a fast and safe means of communication.

Raytheon Technologies Corporation (8-12%)

Raytheon has been fortifying itself by embedding these devices in broader communications suites supporting battlefield management systems. Emphasis has been directed toward situational awareness enhancement through real-time data sharing and secure mission communications.

Other Key Players (30-40% Combined)

These companies collectively push the market forward through innovations in encryption, waveforms, and interoperability, ensuring military and security forces have uninterrupted communication in diverse operational environments.

In terms of Type, the Tactical Radios Market is segmented into Vehicle-Mounted and Handheld/Portable.

In terms of application, the Tactical radio market is segmented into the Army, Navy, Air Force, and Special Operation Force (SOF).

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East and Africa (MEA) have been covered in the report.

The global Tactical Radios industry is projected to witness a CAGR of 13.9% between 2025 and 2035.

The global Tactical Radios industry stood at USD 17,324.1 million in 2025.

The global Tactical Radios industry is anticipated to reach USD 63,663.4 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 14.2% in the assessment period.

The key players operating in the global Tactical Radios industry include L3Harris Technologies, Inc., Thales Group, BAE Systems, Northrop Grumman Corporation, and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tactical Data Link Market Size and Share Forecast Outlook 2025 to 2035

Tactical Communications Market Size and Share Forecast Outlook 2025 to 2035

Tactical Boots Market Analysis - Growth & Industry Forecast to 2025 to 2035

Micro Tactical Ground Robot Market Size and Share Forecast Outlook 2025 to 2035

Radiosynthesis Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Radiosynthesis Modules Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA