Tackifiers, also known as tackifying agents, are natural or synthetic resins that are used to improve tack, peel, and shear strengths in various applications, such as adhesives, sealants, coatings, rubber, and others.

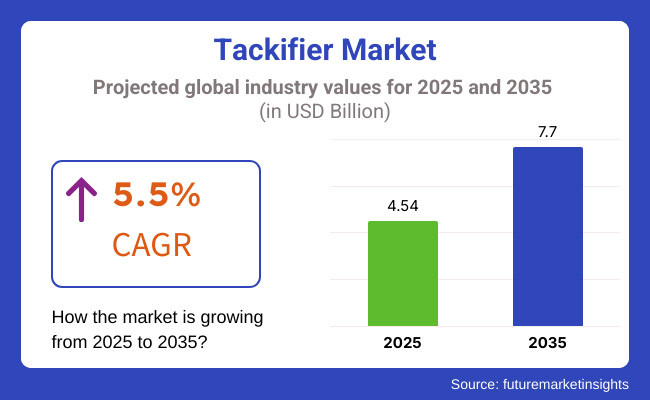

The market is estimated to grow with a compound annual growth rate (CAGR) of 5.5% to reach USD 4.54 billion in 2025. By 2035, the industry is projected to reach more than USD 7.7 billion if the same trend continues.

The use of tackifiers in pressure-sensitive adhesives, rubber-based products, and hot-melt adhesives is driving the industry’s growth. Additionally, the increasing usage of packaging, automotive, and construction applications is contributing to the growth of the industry. Asia-Pacific continues to be a leading region on account of rapid industrialization and increasing infrastructure projects.

However, sustainability issues and the volatility of raw material prices are inhibiting development. However, innovations in bio-based tackifiers and adhesion technology are predicted to open new growth avenues. Over the forecast period, we expect the global tackifier market to witness prominent development due to changing industrial requirements and advancing technologies.

Explore FMI!

Book a free demo

From 2020 to 2024, the tackifiers landscape gained significant development owing to the growing demand from adhesives, packaging, and automotive industries. The tackifiers industry remained conventional rosin or hydrocarbon, which were the industry's typical standards, but suppliers were looking for improvements in thermal stability, compatibility, and performance.

This trend toward low-VOC and eco-friendly formulations started to accelerate as new bio-based tackifiers made from renewable resources (such as pine resins and vegetable oils) started gaining traction. High-performance tackifiers are also in higher demand because more hot-melt adhesives and pressure-sensitive adhesives (PSAs) are being used in eco-friendly packaging and hygiene products.

Nevertheless, variable input prices and supply chain disruptions created challenges, leading to a shift toward localized and diversified production.

From 2025 to 2035, the tackifier industry is poised for major transformation-the result of sustainability, nanotechnology, and AI-driven material innovation. The development of biodegradable and bio-based tackifiers can help the world reach carbon neutrality by reducing the need for petrochemical derivatives.

Higher-grade synthetic resins and hybrid mixes will offer improved adhesion, durability, and responsiveness. Moreover, temperature-adaptive tackifiers and self-healing smart adhesives will bring design innovation to industrial applications.

Tackifiers will play a role in the future of next-generation adhesives due to increasing investment in recycling technologies and circular economy initiatives, which pave the way for increased efficiency with a lower emissions profile and can also facilitate recycling potential.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand for adhesives in packaging, automotive, and construction industries. | Fluctuating raw material prices affect production costs. |

| The Rise of bio-based and sustainable tackifiers due to environmental regulations. | Regulatory challenges related to VOC emissions and environmental concerns |

| Increased use of hot-melt and pressure-sensitive adhesives (PSAs) in hygiene, labeling, and medical applications. | Supply chain disruptions and raw material shortages impact production. |

| Advancements in polymer science improving tackifier performance and thermal stability. | High production and R&D costs for developing advanced and bio-based tackifiers. |

| Growth in e-commerce and flexible packaging driving adhesive consumption. | Limited adoption of new technologies in developing regions due to cost constraints. |

| Rising demand for high-performance adhesives in aerospace and electronics. | Competition from alternative bonding technologies, such as mechanical fasteners and welding. |

Impact Assessment of Key Drivers

| Key Drivers | Impact Level |

|---|---|

| Growing demand for adhesives in packaging, automotive, and construction industries. | High |

| The Rise of bio-based and sustainable tackifiers due to environmental regulations. | High |

| Increased use of hot-melt and pressure-sensitive adhesives (PSAs) in hygiene, labeling, and medical applications. | High |

| Advancements in polymer science improving tackifier performance and thermal stability. | Medium |

| Growth in e-commerce and flexible packaging driving adhesive consumption. | High |

| Rising demand for high-performance adhesives in aerospace and electronics. | Medium |

| Key Restraints | Impact Level |

|---|---|

| Fluctuating raw material prices affect production costs. | High |

| Regulatory challenges related to VOC emissions and environmental concerns. | Medium |

| Supply chain disruptions and raw material shortages impact production. | High |

| High production and R&D costs for developing advanced and bio-based tackifiers. | Medium |

| Limited adoption of new technologies in developing regions due to cost constraints. | Medium |

| Competition from alternative bonding technologies, such as mechanical fasteners and welding. | Low |

Hydrocarbon resins, rosin resins, and terpene resins make up the global tackifier industry. A very widely used type of adhesive due to its good adhesion, heat stability, and compatibility with different adhesives. Petroleum-based feedstocks ultimately yield these resins, which find common use in hot-melt adhesives, pressure-sensitive adhesives (PSAs), and rubber-based applications.

Rosin resins come from pine trees and are prized for their natural tackiness. They are widely used in packaging, woodworking, and rubber compounding. It is known that terpene resins made from natural terpenes are very good at not dissolving and resisting oxidation. This is why they are used in specialty adhesives and high-performance coatings.

From a feedstock standpoint, tackifiers can be grouped into synthetic and natural/biobased categories. Demand for synthetic tackifiers, most of which are derived from petroleum-related sources, dominates the industry as they offer consistent quality, high durability, and stable performance. However, regulatory challenges and environmental concerns are pushing it toward natural/biobased tackifiers.

Resins made from rosin, terpenes, and other renewable ingredients are increasingly critical to sustainable packaging, medical adhesives, and green coatings. With industries steadily moving to eco-friendly alternatives, the natural tackifiers are foreseen to witness strong growth in the following ten years, propelled by innovations like biodegradable and low-VOC tackifiers.

The United States is one of the largest tackifier markets globally, driven by its massive adhesives industry. North America as a whole generated about USD 1.3 billion in tackifier revenue in 2023, with the USA accounting for the majority share. Tackifier demand in the USA is growing at a healthy pace, fueled by the extensive use of adhesives in packaging, construction, and automotive manufacturing.

Robust e-commerce packaging needs and the shift toward lightweight automotive assembly (using structural adhesives in place of welds) are key contributors to USA tackifier consumption. However, the USA market also faces cost challenges from volatile hydrocarbon feedstock prices and stringent VOC regulations, prompting innovation in tackifier formulations.

Canada’s tackifier market is smaller than the USA but exhibits steady growth alongside the North American trend. The demand is largely tied to Canada’s packaging industry (for food and consumer goods) and the construction sector, which utilizes adhesives for sealing and bonding. Canadian adhesive manufacturers increasingly require high-performance tackifiers for packaging tapes, labels, and building materials, mirroring USA industry dynamics.

Growth is moderate and supported by imports as well as regional production, with Canadian demand benefiting from the overall North American push for more sustainable, low-VOC adhesives. As a result, Canada is expected to maintain a stable growth trajectory in tackifier consumption.

The UK is a significant tackifier market in Europe, supported by its large consumer goods and e-commerce packaging sectors. As part of the European region, the UK contributes to the continent's overall share in global tackifier revenues. Key drivers include demand for pressure-sensitive adhesives in labels and tapes for packaging, as well as specialty adhesives used in the UK’s automotive and construction industries.

The growth rate in the UK is moderate, with a focus on sustainable adhesives. The UK’s commitment to sustainability and strict EU/UK regulations on chemicals are pushing adhesive formulators to adopt bio-based tackifiers and low-VOC products, gradually influencing market composition.

France represents another important European tackifier market, with strong ties to the adhesives and pine chemicals industry. France hosts notable tackifier producers and suppliers, indicating a solid domestic supply chain. The French market’s demand is driven by packaging adhesives (for cosmetics, luxury goods, and food packaging) and industrial applications like bookbinding and footwear, where tackifiers are used for bonding.

Growth is steady in line with Europe’s overall trajectory. Additionally, France’s adherence to EU sustainability initiatives means a growing share of tackifiers used are rosin-based or bio-based to reduce environmental impact, and local companies have been innovating in light-colored, more stable tackifier resins for high-end applications.

Germany is the largest tackifier market in Europe, owing to its expansive manufacturing base. German demand is bolstered by the automotive industry (Germany is Europe’s automotive hub) using advanced adhesives, as well as a high volume of packaging and construction activities. Germany constitutes a substantial portion of Europe's tackifier consumption, outpacing other EU countries.

Analysts note that Germany is expected to witness the highest growth in Europe’s tackifiers market, supported by its strong industrial output. Tackifiers in Germany are critical for automotive assembly adhesives, appliance manufacturing, and durable packaging.

The market is growing moderately, with a shift toward high-performance synthetic tackifiers and increasing interest in eco-friendly resins to comply with EU regulations. Major chemical companies in Germany are actively supplying or developing tackifier materials, helping maintain Germany’s leadership in this segment.

South Korea’s tackifier market is robust relative to its size, anchored by the country’s strong electronics, automotive, and packaging industries. As part of the Asia-Pacific region, which holds the largest share of global tackifier demand, South Korea contributes significantly, with local producers serving both domestic and export markets.

Tackifier demand in South Korea is driven by pressure-sensitive adhesives for electronics (e.g., adhesives used in displays and semiconductor packaging) and the automotive sector (for interior tapes, labels, and assembly adhesives). Growth is steady, roughly in line with global averages, as the country’s packaging and consumer goods sectors continue to expand.

South Korea also benefits from having integrated supply chains, ensuring local availability of high-quality tackifiers. The market is gradually incorporating bio-based tackifiers in response to global sustainability trends, though synthetic petroleum-based resins remain prevalent due to their performance.

Japan’s tackifier market is mature and characterized by high-quality, specialized products. With a well-established adhesives industry, Japan’s demand for tackifiers comes from its automotive manufacturing, electronics assembly, and bookbinding sectors, among others.

Japanese tackifier consumption is stable and growing modestly, supported by domestic producers who supply rosin esters, terpene phenolic resins, and synthetic tackifiers. These companies give Japan a degree of self-sufficiency in tackifier supply and drive innovation, particularly in terpene-based tackifiers used in high-performance pressure-sensitive adhesives.

Market growth is moderate, reflecting a balance of new opportunities (e.g., adhesives for emerging electronics and electric vehicles) and a relatively saturated traditional market. Japanese manufacturers are also early adopters of technological advancements in tackifiers - emphasizing products with excellent thermal stability and clarity to meet the stringent requirements of electronics and automotive applications.

Sustainability is a growing focus in Japan, aligning with global moves toward low-VOC, environmentally friendly adhesives.

China is the world’s largest tackifier market by volume and value, underpinned by its massive manufacturing and packaging industries. In 2024, China’s tackifier market was valued at over USD 1.6 billion, representing a substantial portion of global demand. It is expected to grow steadily, supported by China’s strong base in packaging (thanks to a booming e-commerce sector) and automotive production.

China’s construction boom and expanding electronics manufacturing also contribute heavily to adhesive and tackifier consumption. Notably, China is not only a top consumer but also a leading producer of raw materials for tackifiers - it is a major source of gum rosin (from pine trees) and petroleum-based resins.

This vertical integration offers Chinese tackifier producers cost advantages and supply security. The market trend in China is toward higher-quality tackifiers to meet advanced application needs, and there is rising interest in bio-based tackifiers domestically as sustainability becomes important. Still, synthetic tackifiers dominate due to cost-effectiveness and performance, aligning with China’s focus on durable, high-volume manufacturing.

India’s tackifier market is fast-growing, propelled by rapid industrialization, urbanization, and infrastructure development. While smaller in absolute size compared to China or the USA, India’s demand for adhesives (and thus tackifiers) is climbing quickly in sectors like packaging (especially flexible packaging for food and consumer goods), construction, and textiles.

Recognizing this growth, companies are investing in India to increase local production capacity. Such investments point to robust local demand and a positive outlook. India’s market expansion is tied to the rise of e-commerce (driving packaging needs), government infrastructure projects (requiring construction adhesives), and a growing automotive assembly sector.

Tackifiers in India are used in hot-melt adhesives for packaging and tapes, as well as in rubber adhesives for footwear and tire applications. Market growth through 2025 is expected to outpace many developed countries, making India an attractive market for global tackifier suppliers.

The country is also gradually adopting eco-friendly tackifiers as global brands with operations in India seek adhesives that meet international sustainability standards. However, cost remains a deciding factor in this price-sensitive market.

The tackifier industry is moderately consolidated, with a mix of global chemical companies and specialized resin manufacturers competing. Major players include Eastman Chemical Company, ExxonMobil Chemical, Kraton Corporation, Arkema, BASF SE, along with others like Henkel, H.B. Fuller, Kolon Industries, SI Group, Arakawa Chemical, Zeon Corporation, and more. Each of these companies has distinct strategies and recent developments:

The tackifier market also features several regional and specialized companies:

Competition in the tackifier market is characterized by both innovation and consolidation. M&A activity, such as Eastman’s divestiture and Kraton’s acquisition, is reshaping the industry while companies race to introduce new products (bio-based, specialty tackifiers) to differentiate themselves.

Market leaders are also expanding geographically, with many setting up production in Asia or partnering with local firms to secure raw materials and strengthen their market presence.

Overall, major tackifier suppliers compete on factors such as product performance, consistency, pricing, and sustainability. With increasing demand for environmentally friendly adhesives, companies that prioritize sustainability and regulatory compliance have a competitive advantage.

Innovations such as bio-based tackifiers, high-performance resins, and tackifier dispersions for water-based adhesives are key differentiators in this evolving market.

Key industries such as packaging, automotive, construction, adhesives & sealants, as well as rubber and coatings, utilize tackifiers. The demand for tackifiers is driven by multiple industries, including packaging, automotive, construction, and hygiene products, with significant contributions from hot-melt and pressure-sensitive adhesives (PSAs) used in flexible packaging, labeling, and hygiene applications.

The trends at this stage are toward bio-based and sustainable tackifiers, advanced synthetic resin technology, and the increasing use of high-performance adhesives in electronics and medical applications. Moreover, the growing regulations concerning VOC emissions are catalyzing manufacturers to innovate for green solutions.

Some of the key players include Eastman Chemical Company, ExxonMobil Chemical, Kraton Corporation, Arkema, DRT, Guangdong KOMO, Yasuhara Chemical, and Neville Chemical. This is heavily consists of Tier 1 players claiming nearly 90% share.

Some of the major challenges with polymer-based products include changing raw material prices, strict regulations on Volatile Organic Compound (VOC) emissions, and supply chain disruptions that affect production and distribution. High bio-based tackifier costs are anticipated to hamper the growth, along with competition from different bonding technologies, such as mechanical fasteners, welding, and others.

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Malonic Acid Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Neopentyl Glycol (NPG) Market Report - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.