This tablet packing machine market is rapidly expanding as more pharmaceutical, nutraceutical, and healthcare companies are demanding high-speed, precision-driven packaging solutions. Manufacturers today must focus on the growing needs of product safety, traceability, and shelf life to integrate automation, smart packaging, and even sustainable materials for better efficiency and compliance. Innovative in blister packaging, strip packaging, and high-speed filling technologies promote the industry: pharmaceutical tablets have to be blister-packaged; tamper-evident with a clear description of the active ingredients. An impetus of "green," or eco-friendly, packaging, has also included biodegradable films, recyclable, among other more eco-friendly materials down the path for reaching global targets on sustainability.

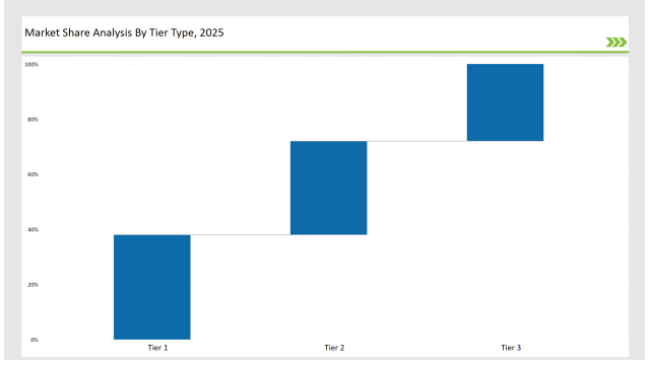

Tier 1 companies Bosch Packaging Technology, Uhlmann and Marchesini Group lead the market at 38% of market share, driven by their superiority in high-end automation, precision engineering, and robust regulatory compliance.

Tier 2 companies, including Romaco Group, IMA Pharma, and CAM Packaging, hold 34% of the market by offering cost-effective, flexible, and customized tablet packaging solutions for mid-sized pharmaceutical companies.

Tier 3 consists of regional and niche manufacturers specializing in compact, high-speed, and eco-friendly tablet packing machines, holding 28% of the market. These companies focus on localized production, advanced blister technology, and energy-efficient packaging solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Bosch Packaging, Uhlmann, Marchesini Group) | 19% |

| Rest of Top 5 (Romaco Group, IMA Pharma) | 12% |

| Next 5 of Top 10 (CAM Packaging, Mediseal, Körber, ACG Pampac, Hoonga) | 7% |

Market Concentration (2025E)

The tablet packing machine market caters to industries that demand precise, high-speed, and compliant packaging solutions. With the increasing stringency of pharmaceutical regulations, businesses are investing in advanced tablet packing technologies to ensure quality, safety, and efficiency.

Manufacturers are optimizing efficiency, safety, and sustainability in tablet packaging solutions.

The industry of tablet packing machines is undergoing changes through automation, sustainability, and compliance. Manufacturers are adopting AI-driven quality control, robotic-assisted filling, and high-speed inspection systems to increase accuracy while reducing waste. The progresses in recyclable and biodegradable packaging materials are helping pharmaceutical brands develop medications that support sustainability across the globe. Innovation in smart packaging includes track-and-trace technology, tamper-evident seals, and real-time monitoring to enhance regulatory compliance and provide transparency along the supply chain.

Technology suppliers should focus on automation, sustainable materials, and precision engineering to meet the growing demand for eco-friendly and compliant tablet packaging solutions. Collaborating with pharmaceutical, biotech, and nutraceutical companies will drive adoption and innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Bosch Packaging, Uhlmann, Marchesini Group |

| Tier 2 | Romaco Group, IMA Pharma |

| Tier 3 | CAM Packaging, Mediseal, Körber, ACG Pampac, Hoonga |

Leading manufacturers are improving efficiency, enhancing compliance, and integrating AI-driven automation to meet evolving pharmaceutical packaging demands.

| Manufacturer | Latest Developments |

|---|---|

| Bosch Packaging | Launched AI-driven blister packaging machines in March 2024. |

| Uhlmann | Developed fully automated strip packaging systems in April 2024. |

| Marchesini Group | Introduced robotic-assisted filling lines for high-speed tablet packing in June 2024. |

| Romaco Group | Strengthened its eco-friendly packaging line with recyclable films in July 2024. |

| IMA Pharma | Expanded its serialization and track-and-trace solutions in August 2024. |

| CAM Packaging | Released high-speed, compact blister packaging machines in May 2024. |

| Mediseal | Focused on tamper-proof tablet packing solutions in September 2024. |

| Körber | Innovated precision dosing and filling technology in October 2024. |

The competitive landscape in the tablet packing machine market is evolving as key players focus on automation, sustainability, and high-precision engineering to maintain strong market positions.

Manufacturers will implement AI-powered sensors for real-time defect detection and quality control. The industry will continue to move towards fully recyclable and biodegradable tablet packaging materials. Smart packaging features, such as anti-counterfeiting seals and digital tracking, will improve regulatory compliance and product safety. Automation will make production cycles faster and cheaper while ensuring precision. Personalized medicine and e-commerce-driven pharmaceuticals will continue to spur innovation in tablet packing technologies.

Leading players include Bosch Packaging Technology, Uhlmann , Marchesini Group, Romaco Group, IMA Pharma, and CAM Packaging.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 38%.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.