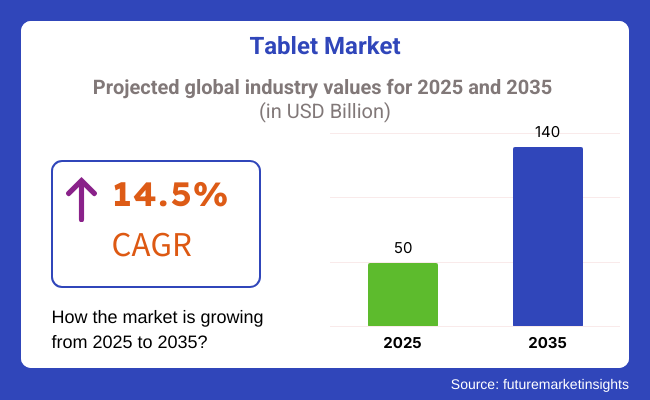

The market will reach USD 50 billion in 2025 and stretch to USD 140 billion in 2035, reflecting a CAGR of 14.5% over the period of the forecast. Factories are increasingly adopting AI-driven tablet technologies, cloud-based computing systems, and real-time processing information with the aim of initiating productivity to its full potential and creating an even finer digital experience. Spending on foldable screens, powerful chipsets, and 5G connectivity will fuel growth.

Consumers and businesses employ tablets to provide hassle-free work and entertainment experiences, further enhancing mobility, communication, and productivity in industries like IT, healthcare, education, and retail. Tablet functionality and real-time processing ability will be augmented further with AI-driven apps, sophisticated biometric security, and IoT connectivity.

Furthermore, the convergence of 5G-enabled tablets, cloud computing, and AI is revolutionizing user experiences with more productivity, seamless multitasking, and interactive digital experiences. With increasing reliance on tablets for remote work, online education, and media consumption by consumers and businesses alike, the demand for power-efficient, high-performance, and lightweight devices continues to rise.

Explore FMI!

Book a free demo

The tablet market is undergoing a dynamic phase of development through the factors of technological progress, soaring consumer needs, and widespread use in different sectors. Customers are the ones who regard the highest performance, battery long-standing, and portability, where the main focus goes to games, social networking, and light productivity activities.

On the contrary, businesses want the highest possible level of confidentiality, computational abilities, and software compatibility when using tablets when it comes to business operations, remote work, and collaboration.

The educational sector is bringing the cost factor to the forefront by focusing on the software support available and the lifespan above while the tablets used are providing the basic for digital-oriented teaching methods. The Health sector is looking for such devices that would be not only secure and lightweight but also extremely long-lasting so that they can be implemented in the fields of patient monitoring, data entry, and telehealth.

In the retail and hospitality sectors, companies like cost-efficient, robust tablet PCs are used for point-of-sale (POS) systems, stock management, and customer service. The combination of new technologies, such as 5G, Artificial Intelligence, and flexible display touchscreens, allows the industry to proliferate while providing solutions to multifarious end-user requirements.

| Company | Contract Value (USD Billion) |

|---|---|

| Apple Inc. | Approximately USD 45 - 50 |

| Samsung Electronics Co., Ltd. | Approximately USD 18 - 22 |

| Huawei Technologies Co., Ltd. | Approximately USD 8 - 10 |

| Lenovo Group Limited | Approximately USD 7 - 9 |

| Xiaomi Corporation | Approximately USD 6 - 8 |

In 2024, the global market for tablets experienced a resurgence, with total shipments reaching 147.6 million units, a 9.2% increase from the previous year. This growth was observed across all regions except North America. Apple maintained its leading position, while Samsung, Huawei, Lenovo, and Xiaomi also performed strongly.

The industry's expansion is attributed to increased demand in sectors such as education, healthcare, and enterprise, as well as technological advancements and government initiatives promoting digital adoption.

Looking ahead, the industry is projected to continue its growth trajectory, with forecasts estimating a size of USD 155 - 160 billion by 2029, driven by ongoing digital transformation and the integration of advanced technologies. The renewal periods across manufacturers range between 3 - 7 years, indicating continuous investment in new tablet models, software updates, and hardware innovations to keep up with evolving consumer needs.

Between 2020 and 2024, the industry expanded as remote work, online education, and digital entertainment fueled demand for portable, high-performance devices. Consumers and businesses embraced tablets for their versatility, while the COVID-19 pandemic accelerated adoption among students, professionals, and content creators.

Manufacturers integrated AI-driven productivity tools, high-refresh-rate displays, and 5G connectivity, enhancing user experience. Hybrid tablet-laptop models, stylus-enabled designs, and gaming tablets gained traction, catering to diverse needs. However, supply chain disruptions, rising component costs, and competition from large-screen smartphones and ultrabooks posed challenges.

Companies focused on improving battery life, security, and cloud-based synchronization. Between 2025 and 2035, AI-powered computing, foldable displays, and quantum-enhanced processing will transform the industry. AI-driven interfaces, predictive workflow automation, and real-time collaboration tools will boost productivity. Foldable and rollable screens will enhance portability, while quantum computing will enable ultra-fast processing. Blockchain-based security will ensure encrypted data transactions.

AR and VR integration will expand applications in education, gaming, and remote collaboration. Sustainability will shape future tablet designs with eco-friendly materials, energy-efficient processors, and modular components promoting longevity and reducing electronic waste.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter data privacy laws (GDPR, CCPA) required tablet manufacturers to enhance security features such as encrypted storage, biometric authentication, and AI-driven privacy settings. | AI-powered, quantum-secure tablets provide real-time, decentralized data protection, blockchain-based identity verification, and AI-driven anomaly detection for next-gen cybersecurity. |

| AI-powered tablets improved productivity, enhanced handwriting recognition, and enabled real-time translation and voice assistance. | AI-native, self-learning tablets autonomously optimize user experiences, predict workflow patterns, and offer real-time AI-driven contextual assistance for enhanced personalization. |

| The rise of remote work and digital transformation drove demand for enterprise-grade tablets with cloud connectivity and enhanced multitasking. | AI-enhanced, ultra-secure enterprise tablets provide real-time AI-driven collaboration, edge-native processing, and seamless multi-device integration for hybrid and decentralized work environments. |

| Innovations in flexible OLED and mini-LED displays enabled the rise of foldable and dual-screen tablets for enhanced multitasking. | AI-powered, adaptive screen technology enables dynamic content optimization, predictive split-screen management, and real-time, user-driven interface adjustments for immersive experiences. |

| AR-enabled tablets became essential for education, retail, and industrial applications, enhancing interactive experiences. | AI-driven, real-time AR/VR-integrated tablets provide holographic collaboration, AI-powered immersive training, and predictive augmented reality applications for next-gen digital experiences. |

| The adoption of 5G-enabled tablets improved cloud-based gaming, real-time collaboration, and high-speed data processing. | AI-powered, 6G-integrated tablets leverage ultra-fast cloud synchronization, real-time edge computing, and AI-driven, predictive workload distribution for seamless computing. |

| AI-enhanced security frameworks ensured encrypted communications, biometric authentication, and secure VPN integration for business and personal users. | AI-native, quantum-resistant tablet security autonomously detects cyber threats, enables blockchain-powered authentication, and ensures tamper-proof, AI-driven real-time data security. |

| Companies focused on sustainable tablet production, incorporating recyclable materials and energy-efficient processors to reduce environmental impact. | AI-driven, carbon-conscious tablets integrate renewable materials, AI-powered smart battery management, and ultra-efficient, AI-optimized power consumption for eco-friendly computing. |

| Tablets became essential for e-learning, telehealth, and industrial applications, supporting touch-based workflows and remote diagnostics. | AI-enhanced, sector-specific tablets provide real-time AI-driven learning assistance, predictive healthcare analytics, and adaptive industrial automation through AI-powered tablet ecosystems. |

| Businesses explored blockchain-based tablet security for secure transactions, identity verification, and digital asset management. | AI-integrated, decentralized tablet ecosystems enable real-time trustless transactions, AI-driven data ownership models, and smart contract-based access control for enterprise and consumer applications. |

The industry experiences a variety of risks, such as technology obsolescence, supply chain windfall, saturation in the industry, regulatory compliance issues, and cybersecurity threats.

An instance of rapid technological advancements triggering obsolescence for existing models is one of the major difficulties. The accustomed customers demand frequent updates, which include quicker processors, longer-lasting batteries, and better display quality. Manufacturers are supposed to make huge investments in research and development to be competitive.

The supply chain risks are still a major problem, especially when it comes to chip shortage, raw materials, and geopolitical trade issues. The failure of the supply that is related to semiconductors, lithium-ion batteries, and display components can cause production delays and a rise in expenditure.

The industry has become a land-grab for numerous companies such as Apple, Samsung, and Microsoft, as well as newcomers from China. Distributors have to concentrate on their product variation, be it joining software ecosystems, or improving user experience, to keep hold of their share.

Furthermore, the rise in cyber security dangers in the realm of race, which has seen a multiplication of active tablets in business, education, and home use are another reason. The possibilities of data breaches, malware attacks, and unauthorized access are some of the driving forces that have led the manufacturers to put in place crime prevention measures, such as biometric identification, data encipherment, and the release of security updates repeatedly.

By coping with these challenges, corporations are able to not only augment product longevity but also ensure a reliable supply chain and ultimately gain consumer trust in the changing industrial scenario.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| UK | 8.2% |

| European Union (EU) | 8.3% |

| Japan | 8.4% |

| South Korea | 8.6% |

It indicated an expected wide-scale industry adoption of tablets in the USA by connected device manufacturers, particularly for the upcoming year, as high-performance tablets move into consumers, business, and academic users' hands for work, entertainment, and learning.

Corporations can hand out tablets that come with AI-embedded software, 5G connectivity, and brilliant screens to mesmerize users and keep things running. The growing adoption of remote work, telemedicine, and e-learning solutions drove increased expansion.

Enterprise-grade tablets have additional security features that are very important to the USA government and the private sector, where cloud-based applications and data security are number one. Healthcare organizations use tablets to monitor patients and hold telehealth visits and schools to enable digital learning.

Companies such as Apple, Microsoft, and Samsung are relentless in their innovation. At the same time, several digital tablets provide even long-lasting battery life along with software packages that are compatible with each one's system. While tablet sales across the USA are projected to rise at 8.5% CAGR from 2023 to 2033, FMI believes.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI and 5G Integration | Advancements in 5G connectivity and AI-powered productivity tools help improve processes in business and education on tablets. |

| The Rise of Telemedicine and Health Care Adoption | In the medical field, tablets are used in telehealth, patient records, and telemedicine. |

The UK definitely offers opportunities for both businesses and consumers. As user needs change, brands are providing AI-optimised features, high-refresh-rate displays , and better battery life. The hybrid work phenomenon boosts the demand for high-performance tablets that support advanced multitasking.

The rising government initiatives for advocating digital literacy and smart classrooms help propel the penetration of tablets in schools and colleges. Retailers and content creators employ tablets for inventory management, customer interactions, and digital design. The premium and budget segments are driven by innovative brands such as Apple, Lenovo, and Amazon Fire. According to FMI, the UK is expected to expand at a CAGR of 8.2% throughout the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Hybrid Work and Productivity | Tablets are used for cloud collaboration, video conferencing, and digital documentation in companies. |

| Digital Literacy Initiatives | The Government-sponsored initiatives help encourage tablet use in the skill and education sectors. |

Enterprise and educational adoption of tablets through remote connectivity and industry-specific applications contributes to the tablet marketplace within the European Union. AI-based tablets and cloud business solutions have made countries like Germany, France, and Italy the key leaders. EU's GDPR drives greener, compliant tablet innovations from manufacturers.

Multi-purpose tablets with longer battery life and robust security frameworks are at the forefront of business and educational reforms. The proliferation of 5G, AI, and cloud computing is driving tablet adoption and improving the digital experience for enterprises and users around the world. The EU tablet industry is expected to witness a growth at the rate of 8.3% CAGR during the period under consideration.

Growth Factors in the EU

| Key Drivers | Details |

|---|---|

| AI-Powered Business Solutions | Ai Deserted Tablets for Businesses and Automating Business Processes, Collaborating as well as Digital Transformation |

| E-Learning and Smart Classrooms | Governments spend more and more on digital education and fold tablets into school syllabuses. |

High-performance tablets are gaining in popularity in Japan, with corporate and personal daily life uses. Tablets are used as business tools by retailers, and gamers want the latest in graphic technology, while doctors need them for efficiency. Japan's efforts to implement digital transformation initiatives for smart cities and automation will also help boost the growth.

Tablets are used by retailers and service providers for sales point transactions and direct communication with customers, while hospitals use them for patient monitoring and medical consultations. Companies such as Sony, Panasonic, and Fujitsu are pioneering foldable tablets, stylus inputs, and AI personal assistants. According to FMI, the Japanese tablet market is expected to register a high CAGR of 8.4% during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI and AR Integration | The productivity experience on these tablets is augmented with innovative AI-powered automation and AR apps. |

| Retail and Payment Solutions | Retailers employ tablets for everything from digital payments to inventory management to customer engagement. |

Businesses and individuals are embracing AI-powered, 5G-enabled, and foldable tablets in different sectors in South Korea, making the tablet industry booming. Investments in government-led digital transformation initiatives, such as smart cities, high-speed internet in urban and rural areas, and enterprise mobility solutions, are driving government digital transformation industries.

Businesses build tablets with OLED displays, stylus compatibility, and AI-augmented productivity features. Further demand is generated by gaming and entertainment, with users seeking high-refresh-rate displays and immersive audio experiences. Samsung and LG beget innovation but also have budget tablets. FMI holds an optimistic outlook for tablet sales in South Korea, which is expected to experience comprehensive growth at a CAGR of 8.6% during the course of the study.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI and 5G-Enabled Devices | These are tablet devices with AI integration IT professionals and researchers often code those devices. |

| Enterprise Mobility Solutions | Businesses utilize tablets to enable field operations, improve workforce management, and provide cloud-based collaboration. |

The slate tablet remained in the lead in terms of sales, though its share grew to 66.3% by 2025. Its low price, lightweight, and ease of use make it popular with consumers, schools, and businesses. In addition, government initiatives for e-learning programs in countries such as India and China have also contributed to the demand for such programs, fuelling demand.

Apple's iPad series of tablets and the Samsung line of Galaxy Tab A models are some of the better-known alternatives, making a strong case based on their existing ecosystem and price, especially for education. In 2025, the detachable tablet segment held about 33.7% of the share, driven by this need for hybrid work environments, business productivity, and the widespread adoption of 2-in-1 devices.

A 2-in-1 tab hybrid gives the flexibility of being a tab or a laptop. Hence, it is highly sought after by professionals and students. Surface Pro and Yoga Duet and its ilk are driving this market, as well as external devices for those who want a perfect workplace with high-performance computing and high portability.

However, the growing prevalence of 5 G-connected devices, cloud computing, and AI-based applications will probably cause detachable tablets to be adopted with increasing frequency across enterprise and creative vertical markets.

The Windows segment leads the tablet market with a commanding 39.4% share in 2025 due to its strong position in the enterprise and productivity-centric use case scenarios. PCs, like Windows Tablets, naturally cater to enterprise customers and professionals, with out-of-box support for enterprise software, Microsoft 365, and cloud-based productivity tools.

The growth of hybrid work models, as well as the increasing demand for detachable like the Microsoft Surface Pro and the Lenovo ThinkPad X12, have helped spur adoption. Windows tablets have also become preferred across more specialized sectors such as education, healthcare, and financial services, where security, multitasking ability, and compatibility with desktop applications are a high priority.

By 2025, the Android tablet market share will be 36.8%, thanks to its lower price point, the fact that multiple manufacturers make all shapes and sizes of devices, and the fact that it works seamlessly with Google services.

Samsung is far from the only name in the tablet space of wire-free computing - Lenovo and Huawei can also be seen as competitors, to a lesser extent, Smart devices, all offering models that vastly differ in price, from affordable entry-level models all the way through to premium offerings such as the Samsung Galaxy Tab S9.

Due to Android's nature as an operating system that can be adapted to a variety of form factors and its openness to developers, it has also become a favored operating system in the developing world and educational systems. Android tried to break into the furious tablet market seasoned in the smartphone segment, but that didn't really go well due to the competition from the Apple iPad, which still dominates this segment today.

The Tablet Market enlarges itself with increasing demand for portable, high-performance computing devices at the consumer, enterprise, and educational levels. Along with hybrid work trends and the adoption of digital learning and entertainment consumption, these trends push manufacturers to improve display technology, battery efficiency, and functionality in the cloud, which eventually spurs market growth.

Market leaders like Apple, Samsung, Amazon, Lenovo, and Microsoft dominate the competitive landscape, offering premium, productivity-focused, and budget-friendly tablets. Still, several startups and niche providers have developed specialized rugged gaming, as well as creative tablets, contributing to a competitive landscape.

AI-powered productivity tools, foldable and dual-screen innovations, and operating systems becoming cloud-native will shape the future of the market. Moreover, the development of such products keeps being influenced by themes such as 5G connectivity, styluses, and more extensive ecosystem compatibility for smart devices.

Competition around strategic factors encompasses performance optimization, OS ecosystem integration, and differentiated user experiences. Flexibility in form factors, enhanced security features, and seamless cross-device functionality will put companies in a better position to grab further market share.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Apple (iPad) | 30-35% |

| Samsung | 18-22% |

| Amazon (Fire Tablets) | 10-14% |

| Lenovo | 8-12% |

| Microsoft (Surface) | 5-9% |

| Other Companies (combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Apple (iPad) | Delivers state-of-the-art tablets with cutting-edge, AI-powered features integrated into the iOS ecosystem and outstanding display technology. |

| Samsung | Designed high-performance tablets, primarily use Android operating system and most high-display-resolution coupled with powerful processors with S Pen support. |

| Amazon (Fire) | Manufactures affordable tablets designed especially with specifications for streaming online videos and integrated for smart households powered by Alexa. |

| Lenovo | Manufactures highly productive tablet types and hybrid models with 2 in 1' capabilities, with specialized features for enterprise-grade security. |

| Microsoft (Surface) | Offers Windows tablet devices with detachable keyboards, accompanied by high computing performance and well-versed professional software support. |

Key Company Insights

Apple (iPad) (30-35%)

Apple leads the tablet race with its AI-enhanced user experience, integration with iOS, and the latest display technology.

Samsung (18-22%)

Samsung enhances its tablets with OLED displays having a high resolution, S Pen functionality, and Android features that boost productivity.

Amazon (Fire Tablets) (10-14%)

Amazon designs its economic tablets with media consumption, Alexa integration, and family-friendly usage in mind.

Lenovo (8-12%)

Lenovo delivers flexible tablets with strong productivity features, hybrid 2-in-1 capabilities, and enterprise-grade security.

Microsoft (Surface) (5-9%)

Microsoft grants a high-performance Surface tablet with seamless integration with Windows for business and creative professionals.

Other Key Players (15-25% Combined)

The industry is slated to reach USD 50 billion in 2025.

The industry is predicted to reach a size of USD 140 billion by 2035.

Key companies include Apple (iPad), Samsung, Amazon (fire tablets), Lenovo, Microsoft (surface), Huawei, Google (pixel tablets), Asus, Xiaomi, and TCL.

South Korea, driven by strong demand for premium tablets and technological advancements, is expected to record the highest CAGR of 8.6% during the forecast period.

Slate tablets remain widely used due to their affordability, ease of use, and strong adoption in both consumer and commercial segments.

The market includes detachable tablets and slate tablets.

The market covers consumer and commercial applications.

The market comprises Android, iOS, and Windows.

The market spans North America, Latin America, Europe, East Asia, South Asia, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.