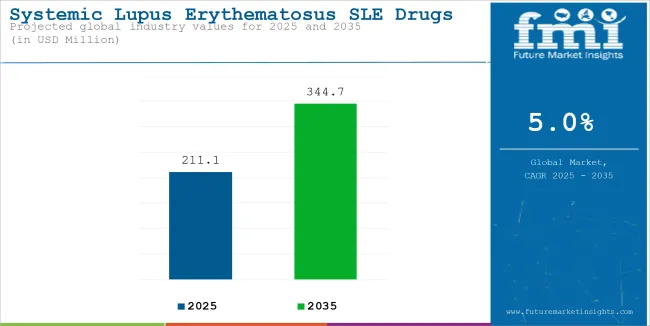

The global sales of systemic lupus erythematosus SLE drugs is estimated to be worth USD 211.1 million in 2025 and anticipated to reach a value of USD 344.7 million by 2035. Sales are projected to rise at a CAGR of 5.0% over the forecast period between 2025 and 2035. The revenue generated by systemic lupus erythematosus SLE drugs in 2024 was USD 203.6 million. The industry is anticipated to exhibit a Y-o-Y growth of 3.3% in 2024.

Systemic Lupus Erythematosus (SLE) is a chronic autoimmune disease that attacks body's tissues and cause inflammation and damage in organs. Major organs that are affected due to disease are skin, joints, kidneys, heart, and lungs. The symptoms caused due to disease includes fatigue, rashes, joint pain, and organ dysfunction.

Several factors, such as increasing awareness for SLE, an earlier diagnosis of the disease, along with improving accessibility of healthcare contribute to increase in demand for this drugs.

In addition, increase in investment of manufacturers on developing new treatment options fort the disease further propels its market growth. Moreover, growing older population that needs effective management and treatment for SLE surges its market growth.

Global Systemic Lupus Erythematosus SLE Drugs Industry Assessment

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 203.6 million |

| Estimated Size, 2025 | USD 211.1 million |

| Projected Size, 2035 | USD 344.7 million |

| Value-based CAGR (2025 to 2035) | 5.0% |

Systemic Lupus Erythematosus, or SLE, is a chronic autoimmune disease that attacks an individual’s immune system and damages its organ such as kidneys, heart, and skin.

The rising prevalence of SLE is owing to the increasing cases of genetic predisposition, and environmental triggering factors such as infections and UV exposure. The disease is very commonly observed among women’s which his majorly caused by hormonal influence.

Increase in investments made by pharmaceutical manufacturers for the development of new drug therapies that are more specific, and effective contribute to the market growth of SLE drugs.

In this, major focus of manufacturer is on development of biologics and monoclonal antibodies that boast of better outcomes of the patients with minimal side effects. Many of the companies are also emphasizing on accelerating the clinical trials of their drugs that are in R&D pipelines.

The major aim of this is to introduce this products to the market at the earliest. Other factors that contribute to the market's growth include aging population worldwide, increasing awareness among patients, favorable government policies for research into autoimmune diseases, and more people seeking advanced treatments.

Comparative analysis of fluctuations in compound annual growth rate (CAGR) for the global systemic lupus erythematosus SLE drugs market between 2024 and 2025 on six months basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market's growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table presents the expected CAGR for the global systemic lupus erythematosus SLE drugs market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.7%, followed by a slightly slower growth rate of 5.4% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.7% (2024 to 2034) |

| H2 | 5.4% (2024 to 2034) |

| H1 | 5.0% (2025 to 2035) |

| H2 | 4.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.0% in the first half and decrease moderately at 4.5% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

The Focus of Manufacturers on Accelerating their R&D Pipeline for Systemic Lupus Erythematosus is expected to Drive Market Growth

Growing demand for effective treatments options, especially among patients with moderate to severe forms of SLE disease, encourages pharmaceutical companies to prioritize innovation in their research and development efforts.

This acceleration in R&D promotes the introduction of advanced therapies that specifically target the underlying immune mechanisms of the disease, providing better disease control and fewer adverse reactions compared to traditional drugs. Therefore, as the clinical trials for novel treatments continues to grow, the potential for more FDA-approved therapies hitting the market is likely to grow.

This expands the availability of more treatment options and pushing up demand for the market. For instance, in March 2023, AbbVie Inc., announced results from its phase 2 study of Upadacitinib (RINVOQ) for patients with systemic lupus erythematosus. Based on results, company decided to advance its clinical program to phase 3.

In addition, fast-paced innovation is a big attraction for both public and private sectors in investment because the stakeholders understand the need to bridge unmet significant medical needs.

Competition is sparked as well as growth with the new drug development and treatment approach being pursued continuously. Therefore, R&D from the manufacturers plays an important role in determining the future of SLE treatment and general market expansion.

Growing Emphasis of Manufacturers on Introduction of Drugs to the New Markets Anticipate the Market Growth

The medical condition known as systemic lupus erythematosus is a complex, and unorganized disease. This disease basically affects different organ systems at once.

The pharmaceutical companies are constantly focusing on developing biologics, targeted therapies, and personalized medicine that have ability to treat patient population suffering from the disease.

The major aim of developing this kind of drugs is to promote disease control by improving its efficacy and safety. The introduction of new drugs like monoclonal antibodies, as well as pharmaceutical companies' focus on developing the next targeted treatments against specific pathways, is anticipated to foresee growth in the market.

Hence, increasing interest among the manufacturers, rising consciousness of the masses concerning SLE, along with the research investments made by manufacturers to mark availability of new drugs to the market significantly attribute to the growth of the market.

Therefore, the growing focus of manufacturers towards launch of new therapies that are less adversive, and have ability to efficiently control symptoms of the disease is projected to anticipate the growth of the systemic lupus erythematosus drugs market.

For example, in February 2022, AstraZeneca received a drug product for its Saphnelo anifrolumab in the European market. This drug is indicated for treating patients with moderate to severe systemic lupus erythematosus (SLE).

Emphasis on Developing Combination Therapies for Systemic Lupus Erythematosus Could Bring Business Opportunities to the Manufacturers

SLE is a disease often managed long-term with a combination of medications, as many patients do not have adequate control on monotherapies. Combination therapies are synergistic in their effects as they target several pathways involved in lupus, which improves overall treatment outcomes.

For example, combination of biologics with immunosuppressants or JAK inhibitors enhances efficacy of the medication, reducing flares, and side effects among patients.

This approach not only expands treatment options for physicians but also enables manufacturers to capture a broader market by addressing the diverse needs of patients with varying disease severities. In addition, combination products are more attractive to healthcare systems and payers because they may offer cost-efficiency and improved long-term outcomes, reducing hospitalizations and expensive complications.

The increasing focus on combination therapies provides an opportunity for regulatory incentives, such as orphan drug status or fast track approvals, especially for novel formulations.

As the demand for personalized and precision medicine continues to grow, combination therapies targeted to specific subsets of SLE patients further establish manufacturers as leaders in the autoimmune disease space, opening new business opportunities for SLE drug manufacturers to capture increased market share and patient adherence.

Availability of Alternative Treatment Option Hinder Systemic Lupus Erythematosus Drugs Market Growth

The introduction of alternative therapeutic options for systemic lupus erythematosus creates competition and therefore slows down growth in the market for SLE drugs. It also reduces their use through conventional pharmaceutical treatment.

The entry of new therapy modalities that include biologics, targeted therapies, and immunosuppressants presents greater options for treating the disease and brings more choices both to the patients and healthcare professionals. This diversification in treatment options can lead to the patient opting for alternatives that seem more effective, have fewer side effects, or are more convenient in terms of administration.

For instance, increasing demand for subcutaneous and oral lupus drugs, together with newer treatments, represents an example, since these latter treatments are always tailored to offer a more individually targeted treatment profile.

This trend restricts the ability of traditional drugs used in treating SLE such as corticosteroids, older immunosuppressives, which is often less efficient or associated with long-term side effects.

This factor puts on high pressure on pharmaceutical companies and results in growing adoption of alternative treatment options hinder the growth of drugs market for SLE.

The global systemic lupus erythematosus (SLE) drugs industry recorded a CAGR of 2.7% during the historical period between 2020 and 2024. The growth of systemic lupus erythematosus SLE drugs industry was positive as it reached a value of USD 203.6 million in 2024 from USD 183.3 million in 2020.

Systemic Lupus Erythematosus (SLE) is a chronic autoimmune disease in which the immune system of the body mistakenly attacks its own tissues and affects several organs of the individual. The better understanding of pathophysiology of the SLE disease have significantly contributed to the growing adoption SLE drugs in the market.

Earlier treatments for SLE were limited to immunosuppressants, such as corticosteroids, with some significant side effects. While recent SLE drug development has focused on targeted therapies affecting specific immune pathways, providing effective management with fewer side effects to patients.

In recent time, market has witness significant investment in R&D and launch of new drug treatment of SLE. Meanwhile, several medications have shown successful clinical trials using precision medicine.

A present trend that has continued in the development of drugs against SLE is personalized therapies by genetic and disease specificity, and the testing of combinations for a better achievement of efficacy with disease control.

The future prospects of SLE drugs demonstrates better future, considering a growing pipeline comprising biologics, JAK inhibitors, and other immune-modulating therapies. A global rise in the incidence of autoimmune diseases, and better safety and efficacy compared to traditional drugs, are the expected factors for enormous growth of the SLE drugs market.

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing significant market share of 54.6% in global market. These market leaders are characterized by high production capacity and a wide product portfolio.

These market leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within tier 1 include GSK plc, Merck KGaA, AstraZeneca.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 24.4% market share.

These are characterized by a strong presence overseas and strong market knowledge. These market players have good manufacturing technology and ensure regulatory compliance but may not have access to global reach. Prominent companies in tier 2 include UCB S.A., Amgen Inc., Sanofi.

Finally, Tier 3 companies, act as a suppliers to the established market players. They are essential for the market as they specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the systemic lupus erythematosus SLE drugs market remains dynamic and competitive.

The section below covers the industry analysis for the systemic lupus erythematosus SLE drugs market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

The United States is anticipated to remain at the forefront in North America, with a value share of 83.5% through 2035. In Asia Pacific, South Korea is projected to witness a CAGR of 5.7% by 2034.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

| China | 4.4% |

| Japan | 5.4% |

| South Korea | 5.7% |

| Germany | 4.3% |

| India | 3.8% |

| GCC Countries | 2.4% |

United States systemic lupus erythematosus SLE drugs market is poised to exhibit a CAGR of 6.6% between 2025 and 2035, reaching over USD 344.7 million by 2035. Currently, it holds the highest share in the North American market, and the trend is expected to continue during the forecast period.

Increasing concentration by manufacturers in the United States to develop safe and effective treatment options for Systemic Lupus Erythematosus significantly drives the market growth. Historically, treatments for SLE have been limited to broad immunosuppressants, many of which have serious side effects.

Developmental investment in the creation of targeted therapies-including biologics and precision medicines-that can effectively hit immune pathways implicated in disease is on the rise. The movement to more effective and safer treatments contributes to better patient outcomes not only by enhancing quality of life but also by reducing the risk of long-term complications.

Further, with improved biomarkers, treatments are becoming increasingly personalized, which in itself raises both patient adherence and overall efficacy. Since SLE affects a large pool of the population in the United States, the increasing demand for novel therapies will continue to attract several pharmaceutical companies to expand their research and development, thus driving further growth in the SLE drug market.

South Korea currently holds around 15.4% share of the global systemic lupus erythematosus (SLE) drugs market and is anticipated to grow at a substantial CAGR throughout the forecast period.

Early diagnosis rates due to improvements in diagnostic capabilities in South Korea and wider awareness have, in turn, resulted in interventions occurring sooner. This growing patient base boosts the need for a broader range of therapeutic options, including biologics, corticosteroids, and immunosuppressive drugs.

Further, the well-developed healthcare infrastructure in South Korea and support from the government for pharmaceutical innovation have resulted in an enabling environment for new SLE medication development and adoption.

This, in turn, also invites pharmaceutical firms to invest in the research and production of drugs suited for the South Korean market, securing newer treatments available to patients, therefore fueling market growth. The increased prevalence thus directly goes to increase the South Korean drug market.

Germany is expected to have a strong foothold when it comes to technology innovation. In 2024 the country is projected to account for substantial share of the systemic lupus erythematosus SLE drugs market.

The strategic collaboration of various manufacturers in conducting R&D for SLE drugs has become a vital driving force in accelerating the growth of the market. The sharing of expertise, resources, and technologies is made possible through such collaborations, where pharmaceutical companies leverage each other's strengths such as strong research capabilities, clinical trial expertise, and manufacturing capacity.

It accelerates the discovery and testing of new biologics, as companies share high costs and risks associated with drug development, allowing for faster innovation and more treatment options for patients. In most cases, partnerships also give companies access to a broader market in which to offer new therapies to patients around the world.

Other combinations are also facilitated through collaborative efforts, where it is possible to address multiple mechanisms of disease simultaneously, thereby enhancing the efficacy of treatment.

The more the firms enter the partnering agreement, the more inventions produced are put up for investment to compete within themselves, making the market grow larger for drugs with SLE treatment.

The section contains information about the leading segments in the industry. By drug class, immunosuppresants segment hold highest share of the market.

| Drug Class | Immunosuppresants |

|---|---|

| Value Share (2024) | 36.4% |

The systemic lupus erythematosus (SLE) drugs market is dominated by the immunosuppressants segment owing to several reasons such as, they directly target the overactive responses of the immune system, curbing flare-ups and managing inflammations that take center stage when SLE manifests.

Drugs such as corticosteroids, methotrexate, and biologics, (such as belimumab) are most prevalent in their effective control of the disease activity. Moreover, their use prevents most organ damage related to SLE. As it is a chronic and unpredictable disorder, long-term immunosuppressive therapy dictates the treatment over time, making the drugs have dominated the market.

| Distribution Channel | Hospitals Pharmacies |

|---|---|

| Value Share (2034) | 58.4% |

The hospital pharmacies segment is forecast to account for a share of 58.4% and is poised to expand at a substantial CAGR during the forecast period.

The systemic lupus erythematosus (SLE) drugs market is dominated by the hospital pharmacy segment primarily because of the nature of the disease and its treatment.

SLE is often complex, requiring highly specialized therapies, best managed in a hospital setting where professionals can monitor and modify treatment plans. Hospital pharmacies dispense critical drugs, such as biologics, immunosuppressants, and high-dose corticosteroids, typically required for severe cases.

Many SLE patients receive inpatient treatments for complications, thus increasing the dependence on hospital pharmacies. Moreover, hospitals are the main places for diagnosing and managing SLE, which means prescriptions are often produced from these settings. This combination of specialized care, monitoring, and high-cost therapies ensures that hospital pharmacies will maintain a strong market share.

Substantial investments and focus is seen in the systemic lupus erythematosus SLE drugs industry towards launch of new series of products to the market.

Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence. In addition, many of the key players are also emphasizing on making strategic investments for accelerating development of their pipeline products.

Recent Industry Developments in Systemic Lupus Erythematosus SLE Drugs Market

In terms of drug class, the industry is divided into NSAIDs, corticosteroids, antimalarials, immunosuppresants and biologics.

In terms of route of administration, the industry is segregated into oral, intravenous and subcutaneous.

The industry is classified by distribution channel as hospital pharmacies, retail pharmacies and online pharmacies.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa (MEA) have been covered in the report.

The global systemic lupus erythematosus SLE drugs industry is projected to witness CAGR of 5.0% between 2025 and 2035.

The global systemic lupus erythematosus SLE drugs industry stood at USD 203.6 million in 2024.

The global systemic lupus erythematosus SLE drugs industry is anticipated to reach USD 344.7 million by 2035 end.

South Korea is set to record the highest CAGR of 5.7% in the assessment period.

The key players operating in the global systemic lupus erythematosus SLE drugs industry include Anthera Pharmaceuticals BMS, GSK plc, ImmuPharma, Merck KGaA, UCB S.A., Amgen Inc., Gilead Sciences, Inc., Johnson & Johnson Services, Inc., AstraZeneca, Sanofi, Teva Pharmaceutical Industries Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Lupus Nephritis Treatment Market Trends, Analysis & Forecast by Drug Class, Route of Administration, Distribution Channel and Region through 2025 to 2035

Lupus Anticoagulant Testing Market

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Retinal Drugs And Biologics Market

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

Cytotoxic Drugs Market Analysis – Growth, Trends & Forecast 2025-2035

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

Depression Drugs Market

Parenteral Drugs Packaging Market

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Expectorant Drugs Market Trend Analysis Based on Drug, Dosage Form, Product, Distribution Channel, and Region 2025 to 2035

Cannabinoid Drugs Market

Clot Busting Drugs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA