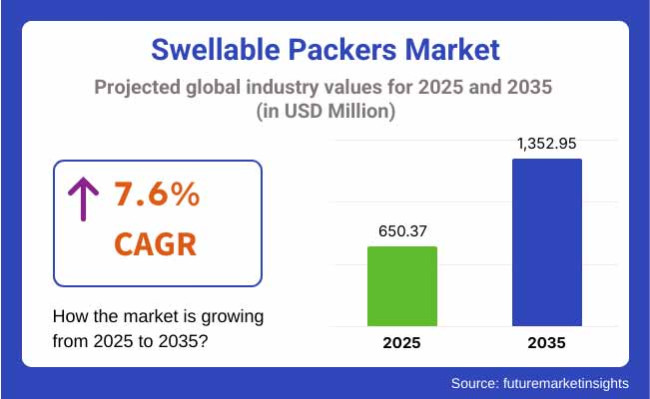

The global swellable packers market is estimated at USD 650.37 million in 2025, and is projected to reach USD 1,352.95 million by 2035, reflecting a compound annual growth rate (CAGR) of 7.6% during that period. Growth is being driven by increased adoption of zonal isolation technologies in drilling and completion operations particularly across horizontal wells and reservoir-specific applications.

Technology advances have recently been made by key suppliers. In February 2025, Vipo opened a new swellable packer manufacturing facility in Monclova, Ohio, aiming to improve production capacity and supply chain responsiveness in the Americas.

As stated by Thor Hegg Eriksen, Managing Director, “The cooperation between the Norwegian and USA team has successfully set up a complex production line within a tight deadline. This new facility enhances our operational capabilities and service offerings in a key market.” Production was initiated in Q3 2025, with first shipments scheduled earlier in the year.

Alaskan Energy Resources (AER) offers advanced swellable packer designs, featuring patented end-ring technology. This solution integrates drill-bit-inspired structures into packer heads, enabling smoother runs and reliable zonal isolation. The design was reportedly adopted in Bakken shale wells in 2023 to 2024, with multiple swellable packers per well being installed as standard to support complex lateral completions.

Competitive dynamics in the market have been influenced by increased drilling in deep horizontal wells. Swellable packers are being favored over mechanical set packers for applications involving long laterals, high-pressure differentials, and corrosive formations. Their ability to activate downhole without mechanical setting tools has supported simpler well designs and reduced completion costs.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 650.37 Million |

| Projected Market Size in 2035 | USD 1,352.95 Million |

| CAGR (2025 to 2035) | 7.6% |

Regional deployment has shown North America as the leading market. The growth led to expanded USA production by key global suppliers. Asia-Pacific and Middle Eastern markets have also been adopting swellable packers, particularly in unconventional and high-temperature reservoir plays, but at a slower pace due to logistics and on-site support limitations.

Service providers have enhanced support frameworks by offering technical guidance, reservoir diagnostics, and integrated completion planning services. Quality certifications and field reliability assurances have been built into sales processes to address operator requirements.

Research and development continues. Suppliers are working on fluid-selective elastomers and polymer compounds to fine-tune swelling times and ensure sealing performance in harsh chemical environments. Trials of multi-zone swellable packers and embedded sensor monitoring are expected in 2025 to 2026.

Water-swelling packers are estimated to account for approximately 46% of the global swellable packer market share in 2025 and are projected to grow at a CAGR of 7.8% through 2035. These packers absorb water from the surrounding formation or completion fluid, expanding to create an effective seal for zonal isolation in low-pressure and water-prone reservoirs.

Their deployment is preferred in environments where chemical compatibility, cost-efficiency, and long-term reliability are essential. Operators across North America, the Middle East, and Asia-Pacific increasingly adopt water-swelling packers in horizontal and vertical wellbores for their ease of installation and activation without requiring external mechanical or hydraulic systems. Manufacturers continue to improve elastomer formulations to enhance swelling rate, resistance to saline water, and structural integrity under elevated downhole temperatures.

Zone isolation is projected to account for approximately 52% of the global swellable packer market share in 2025 and is expected to grow at a CAGR of 7.7% through 2035. This application is vital for isolating production zones, managing water or gas breakthrough, and enabling selective stimulation across complex reservoirs.

In both open-hole and cased-hole configurations, swellable packers offer a reliable, cost-effective solution for ensuring seal integrity without requiring mechanical setting tools. The growing use of multistage hydraulic fracturing, particularly in unconventional oil and gas plays across the USA, Canada, and China, continues to drive demand for high-performance zonal isolation tools.

Enhanced packer technologies with rapid swelling response, increased differential pressure ratings, and compatibility with challenging fluid environments are key focus areas for service providers and equipment manufacturers.

High Manufacturing Costs and Material Constraints

High raw material cost and complex manufacturing process are few of the challenges faced by the Swellable packers market. High performance, reliable packers cannot be produced without proper elastomer technology, making the packer expensive. Moreover, that overall production efficiency and profitability is affected by rate variations of materials availability and pricing.

Overcoming these financial challenges will require companies to consider supply chain optimization, research into lower cost elastomer formulations, and sustainable sourcing.

Operational Limitations in Harsh Environments

Swellable packers are frequently used in oil and gas applications, where harsh downhole conditions present serious operational challenges. Conditions like temperature fluctuations, high-pressure scenarios, and extended exposure to corrosive fluids all have an impact on packer performance and life. To tackle these challenges, the development of next generation elastomers that exhibit advanced resistance to extreme circumstances and the enhancement of design adaptability will be essential.

Rising Demand in Unconventional Oil and Gas Exploration

Rising interest of unconventional oil and gas extraction methods such as hydraulic fracturing and enhanced oil recovery (EOR) is accelerating demand for swellable packers. It provides effective zonal isolation greatly improving efficiency in multi-stage well completions. With increasing investment in shale gas and tight oil product innovations, companies have the potential to capitalize demand and develop their position in the marketplace.

Technological Advancements in Smart Packers

Smart technologies like real-time monitoring and adaptive swelling mechanisms are progressively integrating into the swellable packers industry. To improve efficiency and reliability, materials that can swell at controlled rates and selfheal are under development. It is expected that companies that invest in intelligent packer solutions with IoT-based monitoring and remote operation capabilities will possess a competitive advantage in the market.

The swelling packers market in the USA is expected to grow as oil and gas exploration activities increase, particularly in shale formations. Increasing spending on well completion technologies and the demand for effective zonal isolation are expected to fuel the growth of advanced packers.

Demand for key oilfield service providers and new technologies in swelling elastomers is stimulating additional market growth. Introducing high-performance packers due to regulatory policies encouraging cost-effective natural resource extraction.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.8% |

The UK market is on a growth trajectory, fueled by oil and gas offshore projects in the North Sea. The trend of maximizing hydrocarbon recovery from old developed fields has resulted in more use of swellable packers for zonal isolation as well as for well integrity purpose.

The market growth is by the introduction of government incentives, which promote enhanced oil recovery (EOR) technologies, and the move towards cost-effective well intervention solutions. This trend is also extended with the implementation of smart well technologies once again impacting the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

Ongoing exploration activities of deepwater and unconventional resources in Norway and the Netherlands are driving growth of the EU swellable packers market. Environmental regulations are stringent and motivating oilfield service companies to create environmentally safe and long-lasting packer materials.

The polymer-based swellable packer’s technologies for long-term deployment are emerging. Moreover, there are growing opportunities in the field of geothermal energy as investments pour into projects all over Europe, where swellable packers are no longer limited to conventional oil and gas exploration.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.6% |

The market is growing due to Japan's increasing interest in deep-sea oil and gas exploration and well completion technology development. In the purpose of ensuring drilling operation in the complex HTHP host environment, the country is developing HTHP resistant packers.

Increasing government expenditure and support for renewable energy sources is gaining traction demand. International players combine with Japanese oilfield service providers to develop technological advancement in swellable packer solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

The market looks strong in South Korea where they feel a strong need for offshore exploration and well intervention technologies. Oilfield service giants are investing in advanced elastomer swellable packers to find oil economically.

The increase in geothermal drilling initiatives is also helping to drive the market. Global technology providers, in partnership with South Korean energy companies, are expected to lead the acceleration of adoption of high-performance packers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

Rising oil and gas exploration activities and the implementation of elastomers-bases sealing technologies have resulted in the swellable packer market witnessing significant growth. They improve the well's efficiency and minimize operational risks, as to be expected, swell packers are extensively used in zonal isolation, water shutoff, and cement assurance applications. Various geologies are becoming prevalent in the need for improved well completion solutions, which, in turn, is driving the growth of hydrophilic and oleophilic swell packers.

Moreover, the increasing number of deepwater and ultra-deepwater projects for drilling is also driving the growth of the market. The risk of downhole leaks and the cost of hydrocarbon loss is high, which is why many companies are now using smart well technologies and digital monitoring solutions to optimize packer performance to improve long-term sealing and hydrocarbon recovery.

The market is anticipated to increase at a CAGR of 7.6% for the forecast years of 2025 to 2035, as energy producer seeks for cost-effective and long-lasting well integrity solutions to maximizing field output and minimize costs related well intervention.

The overall market size for swellable packers market was USD 650.37 million in 2025.

The swellable packers market expected to reach USD 1,352.95 million in 2035.

Increasing oil and gas exploration, rising demand for well integrity solutions, advancements in packer technology, and growing deepwater drilling activities will drive the demand for the swellable packers market during the forecast period.

The top 5 countries which drives the development of swellable packers market are USA, UK, Europe Union, Japan and South Korea.

Retrievable packers segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wraparound Case Packers Market Size and Share Forecast Outlook 2025 to 2035

Pick and Place Carton Packers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA