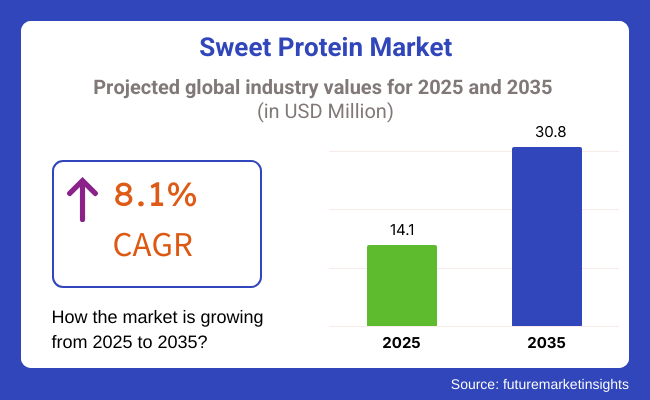

The sweet protein market is estimated to generate USD 14.1 million by 2025 and grow beyond USD 30.8 million by 2035 at an 8.1% CAGR. The growing consumer demand for natural and low-calorie sweeteners is boosting market growth. Sweet proteins from natural plant origins replace artificial sweeteners, suitable with greater health awareness and clean-label trends. Furthermore, technological improvements in biotechnology and fermentation methods are increasing production efficiency and scalability.

Growing concerns about diabetes and obesity have fuelled the call for sugar reduction in food and beverages and driven the uptake of sweet protein solutions. Sweet proteins like thaumatin, brazzein, and monellin deliver a potent sweetness without raising blood sugar, making these proteins appealing to health-conscious consumers. Moreover, such proteins also exhibit functional advantages like improved flavor masking and enhanced stability in diverse formulations.

Sweet protein uses cover not only food and beverages but also confectionery, dairy alternatives, and functional beverages. The pharmaceutical industry is also looking at sweet proteins for their ability to improve the taste of medicinal syrups and supplements.

The North American and European regions dominate the market primarily due to the stringent regulations on artificial sweeteners in these regions and the strong effect of natural ingredients. On the other hand, Asia-Pacific is growing more rapidly with increasing investment in plant-based & alternative sweeteners.

Players invest in precision fermentation and sustainable extraction processes to improve yield and reduce production costs. Other companies are also targeting regulatory approvals and partnerships with food manufacturers to drive adoption. However, obstacles like high production costs and consumer awareness persist. However, as researchers learn more and companies increase production, sweet proteins are getting closer to providing a direct alternative to conventional sweeteners.

The competition is divided among ingredient manufacturers, food-tech start-ups, and biotechnology companies that are developing new methods for sugar protein extraction and synthesis. Mergers, acquisitions, and collaborations are the norm, with companies trying to deliver the widest product range into the largest markets. The sweet protein market is well-positioned for robust growth, with the demand for sugar alternatives continuing to increase and innovations in protein-based sweeteners continuing to emerge.

Explore FMI!

Book a free demo

Sweet proteins are of interest to food and beverage manufacturers in terms of taste profile, stability, and formulation compatibility. Given the clean-label trend, which favors naturally derived, non-GMO, and allergen-free sweeteners, sweet proteins are thus preferred over artificial solutions.

They are also necessary tools when it comes to sugar reduction since they are particularly essential to corporations targeting health-conscious consumers who want a low-calorie, naturally-derived sugar substitute. Manufacturers also make sure that supplier selection for cost-effectiveness and the scalability of production.

Functional, low-calorie sweet proteins are the focus for pharmaceutical and nutraceutical companies, especially for diabetic-friendly and weight-management products-two important factors to consider when purchasing are stability under different processing conditions and bioavailability.

The health benefits and safety of sweet proteins need to be supported by company suppliers-to this end. These companies are looking for proof and good experiences backed by scientific studies/comparisons. Meanwhile, it is noted that retailers and consumers aren't just looking for sweet proteins; they are also asking for transparency regarding ingredient sourcing, sustainability credentials, and the overall health implications of sweet proteins. Growing demand for clean-label and plant-based options also drives interest in sweet proteins.

With a growing competitive landscape for sweet proteins, advancements in production technology, cost-effective strategies, and sustainable practices will help achieve market dominance. High-quality, naturally derived sweet proteins that can meet regulatory guidance will take the lion's share of the future market in sugar alternatives.

The sweet protein market expanded thanks to the growing demand for natural juice and low-calorie sweeteners. Sweet proteins extracted from exotic fruits, these natural sugar replacers matched up with consumers' health trends and the pressing need for reduced-added sugar in food and beverage applications. In addition, the rising instances of health disorders like obesity, diabetes, etc., increased the demand for a healthier sweetening option among consumers as well, which served as another factor bolstering the growth of the market.

The industry is likely to further expand from 2025 to 2035. With developments in biotechnological fermentation processes, production is expected to become more efficient, widespread, and cheaper. The data on diabetes-friendly and weight-management products shows the potential to impact the growth of the market. Moreover, consumers will continue to embrace natural and clean-label ingredients, which leave sweet proteins with wider applications in other food and beverage categories.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The sweet protein market experienced steady growth driven by increasing demand for natural and low-calorie sweeteners. | Market expansion will be fueled by advancements in production technology and wider application across food and beverage industries. |

| Sweet proteins gained popularity as sugar alternatives in confectionery, dairy, and beverages. | Adoption will extend into bakery products, sweet spreads, sauces, and carbonated drinks. |

| Key markets included North America and Europe, with growing interest in Asia. | Asia-Pacific is expected to witness significant growth alongside continued demand in established markets. |

| High production costs and scalability challenges limited widespread use. | Improved manufacturing processes and regulatory support will facilitate broader market penetration. |

| Research efforts focused on extraction methods and small-scale production. | Innovations in large-scale fermentation and cost-efficient production will enhance commercial viability. |

| Sustainability concerns led to initial interest in sweet proteins as an alternative to artificial sweeteners. | Increased adoption will contribute to reducing sugar dependence and support global sustainability initiatives. |

| Consumer awareness of sugar-related health issues drove market demand. | Growing emphasis on clean-label products and natural ingredients will strengthen market position. |

The growing demand for natural, low-calorie sweeteners among consumers is stimulating the growth of the sweet protein market. However, a number of risks could slow its expansion. High production costs are one of the major challenges.

Sweet proteins are expensive and complex to extract and ferment, making them less competitive than the likes of synthetic sweeteners such as aspartame or stevia. To scale these production techniques further, companies must adopt cost-effective alternatives to current technology, such as microbial fermentation.

The risk posed by regulatory barriers is fairly high as well. In addition, approval processes for new food ingredients differ by region, and delays in getting regulatory approval may stall market entry. Companies looking to expand globally must also navigate changing food safety requirements and achieve the right certifications.

Another potential issue is a lack of consumer awareness. However, still not widely recognized, they find it hard to compete against older sugar substitutes. Public education campaigns and production partnerships with food manufacturers may aid adoption.

Production consistency could potentially be affected by supply chain instability, such as dependence on certain plant or microbial sources. Diversified sourcing and synthetic biology approaches also reduce these risks. It is, therefore, imperative that cost reduction, regulatory compliance, and consumer education are deployed to help address these challenges for continued growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.20% |

| UK | 6.80% |

| France | 6.90% |

| Germany | 7.00% |

| Italy | 6.50% |

| South Korea | 7.30% |

| Japan | 7.10% |

| China | 7.40% |

| Australia | 6.40% |

| New Zealand | 6.30% |

The USA sweet protein market is experiencing steady growth, driven by rising consumer preference for natural sugar alternatives in food and beverage products. With growing concerns about diabetes, obesity, and artificial sweeteners, demand for sweet proteins such as thaumatin, brazzein, and monellin is increasing. \

Food manufacturers are actively integrating low-calorie, plant-based sweeteners into dairy, confectionery, and beverage formulations to meet clean-label demands. The FDA's regulatory approvals for natural sweeteners support industry expansion, with companies focusing on precision fermentation and enzymatic production techniques to improve scalability and cost efficiency. Additionally, the USA functional food industry is driving innovation in nutraceutical and sports nutrition products that incorporate sweet proteins.

In the UK, the sweet protein market is expanding due to government-backed sugar reduction policies and health awareness campaigns. With consumers shifting towards low-calorie sweeteners, demand for natural sugar alternatives in beverages, bakery products, and dairy alternatives is rising.

The UK 's food industry is leveraging sweet proteins derived from natural sources, especially in functional beverages and sugar-free confectionery. Research institutions and food tech startups are working on improving sweet protein extraction and formulation techniques to enhance taste compatibility and scalability. While regulatory challenges regarding novel food approvals remain, the growing trend of plant-based diets is accelerating the adoption of sweet proteins in the market.

The French sweet protein market is being driven by the country's strong culinary and food innovation culture. French consumers are increasingly looking for natural, non-GMO, and clean-label sweeteners that provide an authentic taste experience while supporting health-conscious choices.

Major food and beverage manufacturers are testing sweet protein formulations in premium confectionery, pastries, and functional foods. The French government is also encouraging sugar reduction policies, which is pushing companies to explore sweet proteins as sugar substitutes. Research on sustainable fermentation technologies for cost-effective sweet protein production is gaining traction, with companies aiming to improve affordability and accessibility for mass-market adoption.

Germany's sweet protein market is expanding due to the country's emphasis on health and wellness, as well as functional food innovations. German food manufacturers are integrating plant-based and non-artificial sweeteners in response to increasing consumer demand for low-calorie and diabetic-friendly products.

The functional beverage and nutraceutical sectors are key growth drivers, with sports drinks, protein bars, and dietary supplements incorporating sweet proteins for natural sweetness without added sugar. Germany's strong biotechnology sector also supports research on precision fermentation and bioengineering techniques to enhance sweet protein production efficiency. Regulatory approvals for novel sweeteners are expected to accelerate market penetration further.

Italy's sweet protein market is growing as consumers prioritize healthy and natural food ingredients. Traditional Italian desserts, baked goods, and dairy products are being reformulated with low-calorie sweeteners, including sweet proteins, to meet changing dietary preferences.

The Italian government's focus on sugar reduction in processed foods is pushing manufacturers to explore alternative sweeteners that provide a better sensory experience than artificial options. Research institutions in Milan and Rome are studying fermentation-based production methods to enhance the scalability of sweet proteins. The premium food and beverage industry in Italy is also showing interest in high-intensity sweet proteins for use in low-sugar luxury products.

South Korea's sweet protein market is growing rapidly, supported by government investments in food technology and biotechnology research. The country's functional beverage and dietary supplement industries are adopting sweet proteins as part of their clean-label and low-calorie product innovations.

South Korean food manufacturers are developing fermentation-based production techniques to increase the availability of cost-effective sweet proteins. The demand for sugar substitutes in K-beauty and health products is also driving innovation, with sweet proteins being tested for use in oral health formulations. The country's rising diabetic population and the trend toward healthy eating are boosting the adoption of beverages, snacks, and processed foods.

Japan's sweet protein market is expanding due to the country's deep-rooted interest in functional foods and nutraceuticals. Japanese consumers are increasingly opting for low-calorie, non-artificial sweeteners as part of their health-conscious diets. Major beverage and confectionery companies in Japan are incorporating sweet proteins into sugar-free and reduced-sugar product lines, particularly in green tea, mochi, and traditional sweets.

The country's strong biotech sector is also researching advanced enzymatic processing methods to make sweet proteins more affordable and scalable. Regulatory approvals for novel sugar alternatives are expected to drive market expansion further, positioning Japan as a key innovator in sweet protein technology.

China is one of the fastest-growing markets for sweet proteins, with major food manufacturers investing in domestic production and export capabilities. The rising middle-class population is driving demand for low-calorie and natural sweeteners, especially in beverages, dairy, and confectionery.

China's biotechnology sector is focusing on precision fermentation techniques to scale up sweet protein production, making it more cost-effective. Additionally, government initiatives supporting sugar reduction and healthier food choices are creating a strong market for plant-based sweeteners. Local brands are also investing in functional snacks and drinks, incorporating sweet proteins for their clean-label appeal and health benefits.

Australia's sweet protein market is benefiting from the country's increasing focus on health and wellness trends. Consumers are actively seeking sugar alternatives, and sweet proteins are emerging as a preferred option in plant-based and functional food categories.

The Australian beverage industry is leading the adoption of sweet proteins in sugar-free drinks, while sports nutrition brands are exploring natural sweeteners for protein powders and meal replacements. Government support for sugar reduction initiatives and clean-label food production is fostering research into cost-effective sweet protein manufacturing methods. The demand for diabetic-friendly and weight-management products is also contributing to market growth.

New Zealand's sweet protein market is expanding due to increasing demand for natural, non-GMO sugar substitutes. Dairy and functional food manufacturers are exploring sweet proteins for their clean-label benefits and low-calorie attributes. The rising interest in organic and sustainable food solutions is driving research into fermentation-based sweet protein production.

Additionally, New Zealand's strong agricultural sector is investing in plant-derived sugar alternatives for premium food exports. The country's health-conscious consumer base and regulatory support for natural sweeteners are expected to propel market growth in the coming years.

Sweet protein products are separated into Monellin, Thaumatin, Brazzein, and Curculin. Based on its best sweetness profile followed by IQP and excellent solubility, FDA approval as a widely accepted natural sweetener, Thaumatin dominates the natural sweeteners market. Its flavor-enhancing properties make it a common ingredient in the food and beverage industry.

Brazzein is becoming popular for its stability to heat, making it desirable for baking and for industrial food processing industries where high temperatures, as well as other environmental extremes, are used. Monellin, however, is very sensitive to heat, which means it cannot be used in many products. Curculin is interesting because it can change the perception of taste; sour foods taste sweet. It is growing in use in functional foods and in the development of novel formulations for products.

Sweet proteins have many applications in food & beverage, pharmaceuticals, and personal care. Food and beverage companies continue to see significant growth potential for low-calorie sweeteners, especially in products such as dairy, confectionery, and beverages. As consumers look for healthier sugar alternatives, food manufacturers are adding sweet proteins to yogurt, protein bars, and functional drinks.

Pharmaceutical applications are on the rise, especially in sugar-free medicinal syrups or supplements for diabetic patients, where natural and non-glycemic sweeteners are needed. Personal care is a niche market with sweet proteins used in oral care and skincare formulations. Toothpaste brands are using them as natural sweetening agents, and skincare companies are looking to incorporate them into moisturizing products because they can bind to water and improve hydration.

The industry is reshaping the landscape of alternative sweeteners as consumer awareness of health and wellness issues continues to grow, along with regulatory restrictions on sugar and increasing demand for natural, low-calorie substitutes. Sweet plant-based proteins, such as monellin, thaumatin, brazzein, and miraculin, have developed an increased interest in the industry due to their respectful sweetness and significant functional potential.

A series of advances in precision fermentation, new extraction methods, and growing regulatory acceptance drive the competition in this market. For instance, key players are entering into strategic collaborations with leading food and beverage companies to strengthen their market existence.

The firms that are able to scale production efficiently, maintain the product’s stability, and exploit its clean-label appeal will assume a leading position in the new market. Market leadership will be determined by innovation and cheap production methods as consumers move toward healthier diets.

Market Share of Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Amyris, Inc. | 20-25% |

| Joywell Foods | 12-17% |

| Conagen, Inc. | 10-15% |

| Sweegen | 8-12% |

| Senomyx (acquired by Firmenich) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amyris, Inc. | Pioneering precision fermentation to produce brazzein and other sweet proteins at scale. |

| Joywell Foods | Specializing in monellin- and miraculin-based sweeteners for beverages and desserts. |

| Conagen, Inc. | Develops biosynthetic sweet proteins, focusing on cost-effective production. |

| Sweegen | Offers natural sweet proteins and stevia-alternative solutions for food manufacturers. |

| Senomyx (Firmenich) | Works on flavor modulation technologies, integrating sweet proteins into formulations. |

Key Company Insights

Amyris, Inc. (20-25%)

A leader in synthetic biology, Amyris has developed scalable fermentation-based sweet proteins, positioning itself as a key supplier for sugar reduction solutions.

Joywell Foods (12-17%)

This biotech startup focuses on fruit-derived sweet proteins, especially monellin and miraculin, targeting the functional beverage and dessert market.

Conagen, Inc. (10-15%)

Conagen specializes in biotech-driven production, aiming to create cost-effective sweet proteins that mimic sugar's taste profile.

Sweegen (8-12%)

Well-known for plant-derived and biosynthetic sweeteners, Sweegen integrates sweet proteins into natural sugar substitutes.

Senomyx (Firmenich) (6-10%)

Acquired by Firmenich, Senomyx uses flavor modulation technologies to enhance sweetness perception using minimal sugar content.

Other Key Players (30-40% Combined)

The industry is expected to generate USD 14.1 million in revenue by 2025.

The market is projected to reach USD 30.8 million by 2035, growing at a CAGR of 8.1%.

Key players include Sweegen, Joywell Foods, Oobli, Amai Protein, Tate & Lyle, and Miraburst.

North America and Europe, driven by increasing demand for low-calorie natural sweeteners and advancements in precision fermentation.

Plant-based sweet proteins dominate due to their clean-label appeal, intense sweetness, and growing use in sugar reduction strategies across food industries.

Plant-based and microbial-based sweet proteins

Food & beverages, pharmaceuticals, and dietary supplements

North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA)

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Customized Premix Market Analysis – Size, Share & Trends 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.