The sustainable footwear market is gaining steady traction as consumers, brands, and regulatory bodies increasingly prioritize environmentally responsible production and consumption. Industry reports and corporate sustainability disclosures have emphasized the rising adoption of renewable materials, circular economy models, and carbon-neutral manufacturing in the footwear sector. Major players have committed to reducing their carbon footprint by using recycled plastics, natural rubber, and plant-based textiles, aligning product development with global sustainability targets.

Additionally, growing consumer awareness regarding the environmental impact of fast fashion has shifted preferences toward long-lasting and eco-conscious footwear. Retail innovations, such as product traceability tools and repair-reuse programs, have further elevated the visibility and appeal of sustainable options. E-commerce platforms and sustainable fashion campaigns have amplified access and awareness, especially among urban and millennial consumers.

Looking forward, market expansion is expected to be driven by product performance improvements, design innovation in eco-materials, and gender-specific collections tailored to sustainability-conscious buyers. The market is poised to be led by Athletic footwear and Men’s categories due to their alignment with function-driven fashion and high-volume purchasing behavior.

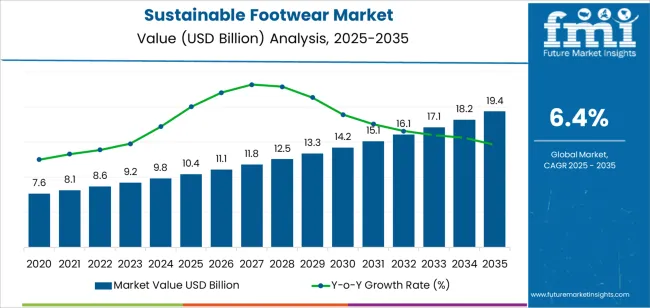

| Metric | Value |

|---|---|

| Sustainable Footwear Market Estimated Value in (2025 E) | USD 10.4 billion |

| Sustainable Footwear Market Forecast Value in (2035 F) | USD 19.4 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

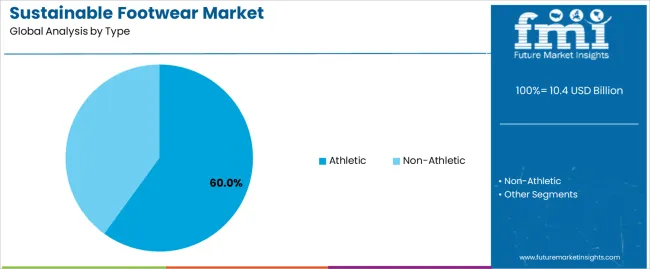

The market is segmented by Type and End User and region. By Type, the market is divided into Athletic and Non‑Athletic. In terms of End User, the market is classified into Men, Women, and Children. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Athletic segment is projected to contribute 60.0% of the sustainable footwear market revenue in 2025, holding its position as the leading type category. This dominance has been attributed to the surge in demand for sustainable activewear and performance-driven footwear that aligns with eco-conscious lifestyles. Sportswear brands have expanded their offerings by integrating recycled materials, bio-based foams, and low-impact dyes into athletic shoe production, reflecting a commitment to sustainability without compromising on functionality.

Athletes and fitness-focused consumers have shown increasing interest in high-performance products that also support climate and environmental goals. Industry initiatives such as product take-back schemes and footwear recycling programs have been primarily launched within the athletic category, accelerating consumer adoption.

The crossover appeal of athletic footwear for both sports and casual wear has expanded its usage frequency, reinforcing its share in the sustainable segment. As global demand for athleisure continues to rise, the Athletic segment is expected to remain the primary contributor to the sustainable footwear market.

The Men segment is projected to account for 54.0% of the sustainable footwear market revenue in 2025, establishing itself as the leading end-user category. Growth of this segment has been driven by increasing male participation in sustainability-oriented purchasing, particularly within the active and lifestyle footwear categories. Product portfolios designed specifically for men have incorporated durable and minimalistic designs using recycled rubber, organic cotton, and water-based adhesives, meeting both functional and environmental expectations.

Retail analysis has indicated that men’s footwear purchases are often value- and longevity-driven, aligning well with the durability-focused messaging of sustainable brands. Brand communications and influencer campaigns targeting male demographics have effectively positioned eco-friendly footwear as a socially responsible and performance-equivalent alternative to conventional shoes.

Moreover, expansion of direct-to-consumer and online retail channels has improved accessibility to sustainably manufactured men's footwear, strengthening adoption. As sustainable living becomes a more integral part of male consumer behavior, the Men segment is anticipated to continue leading in end-user contribution.

Industry faces significant restraints due to high production costs. Environmentally friendly materials such as organic cotton, recycled plastics, and ethically sourced leather often come with higher price tags compared to traditional materials. This increase in costs can result in higher retail prices, making sustainable footwear less accessible to price-sensitive consumers and limiting market penetration.

Consumer awareness and demand also pose a challenge. While there is growing interest in sustainable products, a significant portion of the market remains unaware or unconvinced of the benefits of sustainable footwear. This can be attributed to a lack of effective marketing and educational efforts by brands, which hampers the shift towards sustainable purchasing behaviors. Additionally, there is often skepticism regarding the authenticity of sustainability claims, leading to consumer hesitation.

Finally, the sustainable footwear market is constrained by limited supply chain infrastructure. Sourcing sustainable materials and ensuring ethical manufacturing practices require robust and transparent supply chains, which are still developing. The complexity and cost of building such supply chains can deter new entrants and limit the scalability of existing sustainable footwear brands. This infrastructure gap slows down the overall growth of the market by restricting the availability and variety of sustainable footwear options.

One key trend shaping the sustainable footwear market is the increasing use of innovative materials. Companies are investing in research and development to create alternatives to traditional materials, such as biodegradable plastics, mushroom leather, and algae-based foams. These materials not only reduce the environmental impact of footwear production but also cater to the growing consumer demand for eco-friendly products. Innovations like these are becoming a major selling point and differentiator in the competitive footwear industry.

Another significant trend is the rise of circular economy practices. Brands are adopting models that promote recycling and upcycling, aiming to create closed-loop systems where shoes can be easily disassembled and repurposed at the end of their lifecycle. This includes take-back programs, where consumers can return old shoes for recycling, and the use of modular designs that facilitate repair and reuse. These practices are gaining traction as consumers become more environmentally conscious and seek sustainable consumption patterns.

Lastly, digital transformation is playing a pivotal role in the sustainable footwear market. Companies are leveraging technology to enhance transparency and traceability in their supply chains, using blockchain and other digital tools to verify the sustainability credentials of their products. Additionally, e-commerce platforms and social media are being utilized to educate consumers and promote sustainable footwear. This digital shift not only helps in building consumer trust but also broadens the reach and impact of sustainability initiatives, driving market growth.

Investors in the sustainable footwear market have strategic opportunities in advancing eco-friendly materials. By funding research and development in innovative materials like biodegradable fabrics and plant-based leathers, investors can capitalize on the growing consumer demand for sustainable products. This investment can drive down costs and improve the scalability of sustainable footwear production.

Another opportunity lies in supporting brands with strong sustainability narratives. Consumers are increasingly valuing transparency and ethical practices, so backing companies with clear and credible sustainability commitments can lead to brand loyalty and premium pricing power. Strategic marketing and branding can further enhance consumer engagement and market share.

Finally, investing in supply chain optimization offers significant potential. By developing and enhancing sustainable supply chain infrastructure, investors can streamline the sourcing and manufacturing processes. This not only reduces costs but also ensures consistent product quality and availability, providing a competitive edge in the sustainable footwear market. Such improvements can facilitate wider adoption and market growth.

Indian government's initiatives promoting sustainability and eco-consciousness are further driving the growth of the sustainable footwear market. With campaigns like 'Make in India' emphasizing local manufacturing and sustainable practices, more Indian consumers are inclined towards supporting brands that align with these values. As a result, the sustainable footwear market in India continues to expand, offering eco-friendly options to a growing base of environmentally conscious consumers.

Indian consumers are showing a growing preference for brands that prioritize sustainability and ethical sourcing. This shift is evident in the rise of brands like Paaduks, which produces footwear made from upcycled rubber tires and natural fibers.

Rise of direct-to-consumer (DTC) models has revolutionized the sustainable footwear market in the United States. Prominent brands bypass traditional retail channels, allowing them to maintain control over their supply chains and reduce environmental impact. By selling directly to consumers online, companies like Everlane offer transparency into their manufacturing processes and use of sustainable materials like recycled polyester and leather alternatives.

This approach not only appeals to environmentally conscious consumers but also aligns with the growing preference for ethically sourced and transparently produced products.

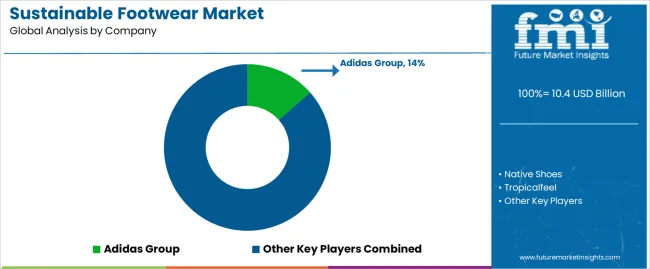

Moreover, sustainability has become a key differentiator for established footwear brands seeking to remain competitive in the United States market. Industry giants like Nike and Adidas have responded to consumer demand by integrating sustainable practices into their operations.

Sustainable footwear market has witnessed significant growth in response to rising consumer consciousness about environmental issues. Brands like Po-Zu, founded in 2006, have been instrumental in driving this movement by offering eco-friendly shoes made from sustainable materials such as organic cotton, cork, and natural rubber.

Moreover, the UK's emphasis on sustainability and innovation has paved the way for emerging brands like Vivobarefoot, which specializes in minimalist footwear designed for maximum comfort and sustainability. Vivobarefoot's shoes are made from recycled materials and feature innovative designs that prioritize both foot health and environmental impact. These brands cater to a growing segment of British consumers who prioritize sustainability without compromising on style or performance.

The athletic segment leads in the sustainable footwear market due to high consumer demand for eco-friendly, performance-oriented products. Innovations in sustainable materials and designs cater to athletes' needs for durability, comfort, and functionality, driving growth and market adoption in this niche.

Men dominate the end-user segment of the sustainable footwear market due to growing awareness and preference for eco-friendly lifestyle choices. Brands are increasingly targeting men with durable, stylish, and sustainable options, aligning with the rising demand for responsible consumption in men's fashion and footwear.

Manufacturers and major companies are expanding globally by adopting sustainable practices, investing in eco-friendly materials, and enhancing supply chain transparency. They are also forming strategic partnerships, leveraging digital marketing, and entering new markets with targeted products to meet the increasing global demand for sustainable footwear.

Industry Updates

Based on product type, the market is bifurcated into athletic and non-athletic sustainable footwear.

Men, women, and children are three categorized segments of the sustainable footwear industry.

A regional analysis has been conducted across key countries of North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The global sustainable footwear market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the sustainable footwear market is projected to reach USD 19.4 billion by 2035.

The sustainable footwear market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in sustainable footwear market are athletic and non‑athletic.

In terms of end user, men segment to command 54.0% share in the sustainable footwear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sustainable Label Market Forecast Outlook 2025 to 2035

Sustainable Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Packaging Market Size, Share & Forecast 2025 to 2035

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Market Share Distribution Among Sustainable Packaging Providers

UAE Sustainable Tourism Market Analysis - Growth & Forecast 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Italy Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Mexico Sustainable Tourism Market Trends – Growth & Forecast 2025 to 2035

New Zealand Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Sustainable Tourism Market Trends - Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Footwear Adhesives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA