The sustainable aviation fuel (SAF) market globally is larger by the day, fueled by the aviation industry's commitment to emissions reductions through the use of cleaner energy. The growing implementation of strict environmental regulations and growing investments in alternative fuel technologies are driving the need for SAF.

Airlines around the world are pledging to reach net-zero carbon targets, facilitating the widespread use of bio-based and synthetic fuels for aviation. Market growth is further aided by technological advances in feedstock processing, governmental incentives, and a growth in the global aviation sector.

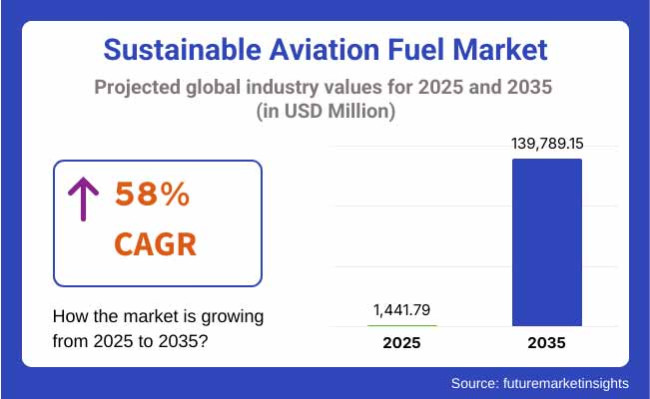

In 2025, the sustainable aviation fuel market was valued at approximately USD 1,441.79 million. By 2035, it is expected to reach USD 139,789.15 million, expanding at a compound annual growth rate (CAGR) of 58%. This exponential growth is attributed to the increasing availability of feedstocks such as used cooking oil, algae-based biofuels, and municipal solid waste, alongside advancements in fuel conversion technologies.

Additionally, collaborations between fuel producers and airlines are enhancing fuel adoption, while regulatory support from organizations like the International Civil Aviation Organization (ICAO) and the European Union is streamlining commercialization.

The SAF market in North America is the largest looming due to numerous government policies, financial incentives and joint ventures between fuel producers and aviation participants. The USA is at the forefront of production and consumption thanks to efforts such as the Sustainable Aviation Fuel Grand Challenge and tax credits in the Inflation Reduction Act.

United Airlines, Delta and other airlines are aggressively bringing SAF into their operations. Rising investments in biofuel facilities, along with examinations of new fuels, are supporting regional growth of the biofuels market even more.

Europe is the key market for sustainable aviation fuel driven by tough carbon reduction policies and airline purchasing commitments. The EU’s “Fit for 55” legislation gradually increases where SAF must be used, which also increases demand.

To reduce carbon emissions, the UK, Germany and France are investing in new biorefineries, and airlines such as Lufthansa and British Airways are showing leadership in large-scale SAF adoption. Government funding and public-private partnerships are driving the commercial viability of SAF.

Worldwide, the Asia-Pacific market is expected to experience became growth in the short to medium term as campaigns for SAF adoption intensify and as demand for carbon footprint reduction persists in the aviation industry. Countries like China, Japan and Australia are investing in SAF production and infrastructure, while airlines including Singapore Airlines and Qantas are combining SAF into their supply chains.

Regional Market Dynamics Supportive policies and shifts towards alternative feedstocks such as microalgae define the regional market landscape

The sustainable aviation fuel market has the potential for exponential growth as global aviation players are focused on decarbonization and no net-zero goals. With growing regulatory frameworks, improvements in fuel production technology and increasing commitments by airlines, SAF is emerging as the central solution for aviation emissions reduction.

Looking forward, strategic partnerships, increased production capacity, and feedstock diversification will play a crucial role in determining the market’s trajectory. As SAF adoption grows, the industry is poised to reimagine the future of aviation by offering greener and more sustainable fuel alternatives.

Challenges

High Production Costs and Infrastructure Limitations

Sustainable aviation fuel production continues to be costly, with high feedstock costs, refining technologies, and certification requirements. Finally, the absence of infrastructure to produce and distribute large volumes of SAF hinders market development and prevents widespread usage by the airlines.

Regulatory Hurdles and Standardization Issues

SAF producers face the intricacies of regulatory frameworks and getting the green light from aviation governing bodies like the International Civil Aviation Organization (ICAO) and Federal Aviation Administration (FAA). There are also added complexity in standardization, as every region has distinct mandates and blending requirements, making it difficult for global adoption.

Opportunities

Government Incentives and Net-Zero Carbon Initiatives

Governments are offering incentives like tax credits, subsidies and carbon pricing mechanisms to support both the production and use of SAF. With the aviation sector setting ambitious targets for net-zero emissions by 2050, investment into SAF technologies is only expected to accelerate, providing lucrative growth opportunities for players in the market.

Advancements in Feedstock and Production Technologies

Research continues into alternative feedstocks, such as algae, waste oils and biomass, to improve efficiency of SAF production. Longer-term viability for SAF is improving due to advances in refining processes (e.g., hydro processed esters and fatty acids (HEFA), Fischer-Tropsch synthesis) which lower costs and increase scalability.

The SAF market grew significantly between 2020 and 2024, following an airline sustainability push and growing government requirements. The biggest aviation companies teamed up with fuel manufacturers to increase the use of SAF, and investment poured into bio-refineries. Cost challenges as well as feedstock limitations, on the other hand, hampered ideas for mass deployment.

A boost in funding for renewable energy projects and stricter emission regulations will push SAF market to be more mainstream with significant expansion of the market, post 2025 to 2035 . With the introduction of synthetic e-fuels and continuous improvements in biofuel conversion technologies, production is becoming increasingly efficient. Indeed, due to international partnerships and policy harmonization attempts, the global SAF market is expected to become more coherent.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial SAF blending mandates and carbon offset programs |

| Technological Advancements | Expansion of HEFA-based SAF production |

| Industry Adoption | Increased airline partnerships with SAF producers |

| Supply Chain and Sourcing | Limited feedstock availability |

| Market Competition | Dominated by a few biofuel producers |

| Market Growth Drivers | Airline sustainability goals and regulatory pressures |

| Sustainability and Energy Efficiency | Initial carbon reduction initiatives |

| Integration of Smart Monitoring | Limited real-time emissions tracking |

| Advancements in Product Innovation | SAF limited to bio-based pathways |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter emission reduction policies and SAF quotas |

| Technological Advancements | Commercialization of e-fuels and advanced biofuels |

| Industry Adoption | Mainstream adoption driven by cost reductions and mandates |

| Supply Chain and Sourcing | Diversification into synthetic and waste-based feedstocks |

| Market Competition | Rise of new entrants leveraging emerging technologies |

| Market Growth Drivers | Cost reductions, global policy harmonization, and tech innovations |

| Sustainability and Energy Efficiency | Large-scale deployment of carbon-negative SAF processes |

| Integration of Smart Monitoring | AI-powered fuel efficiency optimization and blockchain -based SAF certification |

| Advancements in Product Innovation | Expansion of power-to-liquid (PtL) and waste-to-fuel technologies |

The sustainable aviation fuel (SAF) market is driven largely by the USA, incentives offered by the government, carbon reduction policies and airlines’ commitments to net-zero emissions.

The sustainable aviation fuel grand challenge and inflation reduction act tax credits have driven investments in SAF production facilities. Major airlines such as Delta, American Airlines and United have also entered into long-term contracts with biofuel producers. The increased use of SAF from both commercial and military aviation helps ensure that the USA will continue to lead in this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 60% |

The UK has a government-backed SAF sector with no shortage of clear decarbonization path. Renewable Transport Fuel Obligation (RTFO) and proposed blending targets will support domestic SAF production.

Major players, such as British airways, are working with renewable energy providers to increase production capacity. Moreover, the development of waste-to-fuel technologies and sustainable feedstocks, including used cooking oil and forestry residues are also propelling growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 57.5% |

The EU is leading the charge on SAF, with heavy climate action and policy like the Fit for 55 and RefuelEU aviation leading the charge. Nations such as France, Germany, and the Netherlands are flooding investments into bio-refineries and synthetic fuel technologies.

Lufthansa, Air France-KLM and other major airlines are already incorporating SAF into their fuel supply chains. On top of all that, cross-border collaborations and cash from the European Green Deal are spurring technological innovation and growing production capacity.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 58.1% |

Japan is making a push to invest in SAF production, as part of its pathway to carbon neutrality by 2050. Airlines like Japan Airlines (JAL) and All Nippon Airways (ANA) have pledged to use more SAF in their operations.

They are encouraging bio launches using domestic wastage algae and municipal solid waste through government subsidies. Japan's SAF supply chain and production capacity is being enhanced through strategic collaborations with international SAF producers and research institutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 56% |

In South Korea, both the government and the plans of power producers and airlines are pushing in the same direction towards SAF, making it an important market. Ministry of Environment, along with major refiners such as SK Innovation, is working on bio-refineries and renewable fuel production.

Korean Air is working to establish agreements for the procurement of SAF in its endeavor to meet the global reduction target of carbon emissions. Long-term market growth is anticipated from the ramp-up of SAF-related R&D and partnerships with foreign fuels producers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 59% |

| Platform | Market Share (2025) |

|---|---|

| Commercial Aviation | 62% |

Due to its tremendous fuel consumption and decarbonization mandates, along with commitments to sustainability from airlines, the largest end-use sector of the sustainable aviation fuel (SAF) market is the commercial aviation sector. Using strategic biofuel partnerships, government-backed incentives, and construction of dedicated refueling infrastructure, major carriers are moving forward and integrating SAF into operations to try to scale adoption.

Sustainable aviation fuel (SAF) integration is also being advanced by military and business aviation, while defense agencies look into biofuel blends for operational and energy security. Meantime, private jet operators are adding SAF to their fleets to access low-emission flight goals, serve environmentally conscious customers, and to match changing regulation standards.

With the aviation sector stepping up its decarbonisation efforts, the adoption of SAF across all segments is expected to ramp up, underpinned by the evolving technological developments and market incentives driven by developments in policy.

| Biofuel Blending Capacity | Market Share (2025) |

|---|---|

| Below 30% | 68% |

Below 30% SAF blending is still the industry standard, allowing for compatibility with existing aircraft engines as well as compliance with existing aviation fuel regulations. Lower blends are mainly used by airlines and fuel suppliers to blend SAF into existing fuel infrastructure without requiring changes to either aircraft or infrastructure.

Yet, blends with levels between 30% and 50% are starting to have a market as new engine technology and certification procedures continue to advance. An increased use of SAF in commercial flights would expand markets for SAF used in sustainable aviation research initiatives and the adoption of higher-blend SAF options as both are being evaluated by regulatory bodies and industry leaders.

Varying fractions above 50% are also being investigated, especially for next-gen aircraft and hybrid propulsion technologies. Increasing concentrations of SAF will be critical to long-term aviation decarbonization strategies, alongside evolving fuel certification and engine adaptations as developments continue.

The sustainable aviation fuel (SAF) market is experiencing rapid growth due to increasing regulatory mandates, rising airline commitments to net-zero emissions, and advancements in biofuel technology. SAF is emerging as a key solution to reducing aviation-related carbon emissions, with feedstocks such as waste oils, agricultural residues, and synthetic fuels gaining traction.

Governments worldwide are offering incentives and subsidies to promote SAF adoption, while major airlines are committing to long-term SAF procurement agreements. The push for carbon-neutral aviation by 2050 is further accelerating investment in biorefineries, supply chain infrastructure, and advanced fuel conversion technologies.

Additionally, private and public partnerships are fostering innovation in SAF production, ensuring that new pathways, such as Power-to-Liquid (PtL) and Hydrogen-based SAF, enter commercial viability. With a Compound Annual Growth Rate (CAGR) of X% from 2025 to 2035, the SAF market is set to expand as fuel production capacity increases and blending mandates become stricter worldwide.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Neste Corporation | 20-25% |

| World Energy | 15-20% |

| TotalEnergies | 12-18% |

| LanzaJet | 10-15% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Neste Corporation | In 2025, Neste expanded its SAF production capacity in Singapore , reinforcing its position as the largest global SAF producer . The company has also partnered with leading airlines, airports, and logistics providers to enhance SAF supply chains and distribution networks . Neste is also investing in advanced feedstocks , such as algae-based biofuels , to improve SAF sustainability. |

| World Energy | In 2024, World Energy announced a $2 billion investment in new SAF production facilities , increasing its annual output to meet rising airline demand . The company is focusing on waste-to-fuel technology to produce low-carbon SAF from municipal and agricultural waste , ensuring long-term scalability. |

| TotalEnergies | TotalEnergies launched a new SAF refinery in France in 2025 , supporting the European Union's SAF blending mandates . The company is investing in Power-to-Liquid (PtL) technology , aiming to produce synthetic aviation fuel from captured CO₂ and renewable hydrogen , reducing dependency on traditional bio-based feedstocks . |

| LanzaJet | In 2024, LanzaJet secured strategic funding from major airlines and energy firms , accelerating the commercialization of its alcohol-to-jet (ATJ) technology . The company is developing pilot SAF plants in North America and Asia , ensuring scalable and cost-effective production for global markets. |

Key Company Insights

Neste Corporation (20-25%)

Neste dominates the SAF market due to its strong production capacity, sustainable feedstock sourcing, and extensive airline partnerships. The company is continuously expanding its refining operations in Asia, Europe, and North America, ensuring reliable SAF supply for major aviation hubs. Neste’s investment in next-generation biofuels and synthetic SAF development further solidifies its leadership position.

World Energy (15-20%)

World Energy is a key SAF producer in North America, focusing on waste-based and low-carbon biofuels. The company’s investment in advanced biorefineries and municipal waste-to-fuel conversion technology allows it to meet growing airline sustainability commitments. Its strategic partnerships with major USA carriers and government agencies ensure steady SAF demand and policy support.

TotalEnergies (12-18%)

TotalEnergies is leveraging its expertise in refining and renewable energy production to expand its SAF portfolio. The company is focusing on Power-to-Liquid (PtL) and synthetic fuel production, addressing concerns about feedstock limitations for traditional bio-based SAF. TotalEnergies is also collaborating with the EU on SAF policy frameworks, ensuring long-term industry growth and regulatory alignment.

LanzaJet (10-15%)

LanzaJet is pioneering alcohol-to-jet (ATJ) technology, offering a cost-effective and scalable SAF alternative. The company’s partnerships with airlines, energy firms, and sustainability investors are accelerating commercial production. LanzaJet’s expansion into emerging markets and new production facilities positions it as a key player in SAF innovation and distribution.

Other Key Players (25-30% Combined)

The overall market size for sustainable aviation fuel market was USD 1,441.79 million in 2025.

The sustainable aviation fuel market expected to reach USD 139,789.15 million in 2035.

Stringent carbon emission regulations, rising airline commitments to sustainability, technological advancements in biofuel production, and government incentives will drive the demand for the sustainable aviation fuel market during the forecast period.

The top 5 countries which drives the development of sustainable aviation fuel market are USA, UK, Europe Union, Japan and South Korea.

Below 30% blending segment driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Platform, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 8: Global Market Volume (Litre) Forecast by Fuel Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 10: Global Market Volume (Litre) Forecast by Technology, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 14: North America Market Volume (Litre) Forecast by Platform, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 16: North America Market Volume (Litre) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 18: North America Market Volume (Litre) Forecast by Fuel Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 20: North America Market Volume (Litre) Forecast by Technology, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 24: Latin America Market Volume (Litre) Forecast by Platform, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 26: Latin America Market Volume (Litre) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 28: Latin America Market Volume (Litre) Forecast by Fuel Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Latin America Market Volume (Litre) Forecast by Technology, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 34: Europe Market Volume (Litre) Forecast by Platform, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 36: Europe Market Volume (Litre) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 38: Europe Market Volume (Litre) Forecast by Fuel Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 40: Europe Market Volume (Litre) Forecast by Technology, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 44: Asia Pacific Market Volume (Litre) Forecast by Platform, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 46: Asia Pacific Market Volume (Litre) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Litre) Forecast by Fuel Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 50: Asia Pacific Market Volume (Litre) Forecast by Technology, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 54: MEA Market Volume (Litre) Forecast by Platform, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 56: MEA Market Volume (Litre) Forecast by Biofuel Blending Capacity, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 58: MEA Market Volume (Litre) Forecast by Fuel Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 60: MEA Market Volume (Litre) Forecast by Technology, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Platform, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Biofuel Blending Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 11: Global Market Volume (Litre) Analysis by Platform, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 15: Global Market Volume (Litre) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Biofuel Blending Capacity, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Biofuel Blending Capacity, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 19: Global Market Volume (Litre) Analysis by Fuel Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 23: Global Market Volume (Litre) Analysis by Technology, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 26: Global Market Attractiveness by Platform, 2023 to 2033

Figure 27: Global Market Attractiveness by Biofuel Blending Capacity, 2023 to 2033

Figure 28: Global Market Attractiveness by Fuel Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Technology, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Biofuel Blending Capacity, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 41: North America Market Volume (Litre) Analysis by Platform, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 45: North America Market Volume (Litre) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Biofuel Blending Capacity, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Biofuel Blending Capacity, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 49: North America Market Volume (Litre) Analysis by Fuel Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 53: North America Market Volume (Litre) Analysis by Technology, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 56: North America Market Attractiveness by Platform, 2023 to 2033

Figure 57: North America Market Attractiveness by Biofuel Blending Capacity, 2023 to 2033

Figure 58: North America Market Attractiveness by Fuel Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Technology, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Biofuel Blending Capacity, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 71: Latin America Market Volume (Litre) Analysis by Platform, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 75: Latin America Market Volume (Litre) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Biofuel Blending Capacity, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Biofuel Blending Capacity, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 79: Latin America Market Volume (Litre) Analysis by Fuel Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 83: Latin America Market Volume (Litre) Analysis by Technology, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Platform, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Biofuel Blending Capacity, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Fuel Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Platform, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Biofuel Blending Capacity, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 101: Europe Market Volume (Litre) Analysis by Platform, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 105: Europe Market Volume (Litre) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Biofuel Blending Capacity, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Biofuel Blending Capacity, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 109: Europe Market Volume (Litre) Analysis by Fuel Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 113: Europe Market Volume (Litre) Analysis by Technology, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 116: Europe Market Attractiveness by Platform, 2023 to 2033

Figure 117: Europe Market Attractiveness by Biofuel Blending Capacity, 2023 to 2033

Figure 118: Europe Market Attractiveness by Fuel Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Platform, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Biofuel Blending Capacity, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Litre) Analysis by Platform, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Litre) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Biofuel Blending Capacity, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Biofuel Blending Capacity, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Litre) Analysis by Fuel Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Litre) Analysis by Technology, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Platform, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Biofuel Blending Capacity, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Fuel Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Platform, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Biofuel Blending Capacity, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 161: MEA Market Volume (Litre) Analysis by Platform, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 165: MEA Market Volume (Litre) Analysis by Biofuel Blending Capacity, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Biofuel Blending Capacity, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Biofuel Blending Capacity, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 169: MEA Market Volume (Litre) Analysis by Fuel Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 173: MEA Market Volume (Litre) Analysis by Technology, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 176: MEA Market Attractiveness by Platform, 2023 to 2033

Figure 177: MEA Market Attractiveness by Biofuel Blending Capacity, 2023 to 2033

Figure 178: MEA Market Attractiveness by Fuel Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sustainable Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Packaging Market Size, Share & Forecast 2025 to 2035

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Sustainable Packaging Providers

Sustainable Label Market Report - Key Trends & Forecast 2024 to 2034

Sustainable Footwear Market Trends – Demand & Forecast 2024-2034

UAE Sustainable Tourism Market Analysis - Growth & Forecast 2025 to 2035

Italy Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Analysis – Trends & Forecast 2024 to 2034

Mexico Sustainable Tourism Market Trends – Growth & Forecast 2025 to 2035

New Zealand Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Sustainable Tourism Market Trends - Growth & Forecast 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Thailand Sustainable Tourism Market Trends – Growth & Forecast 2024-2034

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA